City of boulder admission tax: Boulder county, co sales tax rate.

Should Boulder Do Away With Sales Tax On Groceries - Boulder Beat

Try it now & grow your business!

Boulder co sales tax rate 2020. As of july 1, 2020, tobacco retailers must collect and remit the 40% sales tax on electronic smoking devices including any refill, cartridge or any other esd components. 2.055% lower than the maximum sales tax in co. The 2020 boulder county sales and use tax rate is 0.985%.

This tax is charged for admission to an event such as concerts, nightclubs and theatres. Depending on the zipcode, the sales tax rate of boulder may vary from 2.9% to 8.845% depending on the zipcode, the sales tax rate of boulder may vary from 2.9% to 8.845% Payments postmarked on or before the 20th of the month will be considered timely and will not be assessed penalties and interest.

You can print a 8.845% sales tax table here. University of colorado 0.8% all other boulder. This is the total of state, county and city sales tax rates.

The colorado sales tax rate is currently %. , co sales tax rate. The combined rate used in this calculator (8.845%) is the result of the colorado state rate (2.9%), the 80303's county rate (0.985%), the boulder tax rate (3.86%), and in some case, special rate (1.1%).

Create your own online store and start selling today. The boulder sales tax rate is %. Cu boulder charges an administrative fee for all purchases through the university system.

Rate variation the 80303's tax rate may change depending of the type of purchase. Create your own online store and start selling today. The boulder, colorado, general sales tax rate is 2.9%.

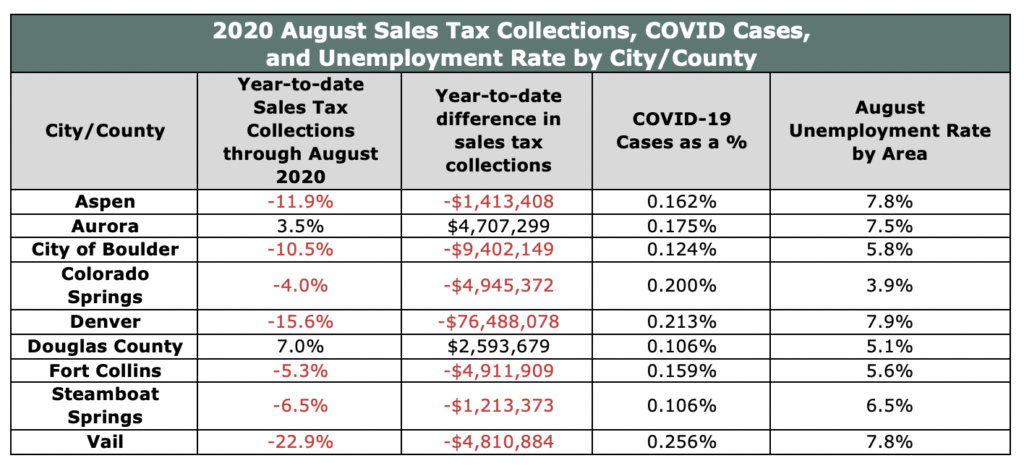

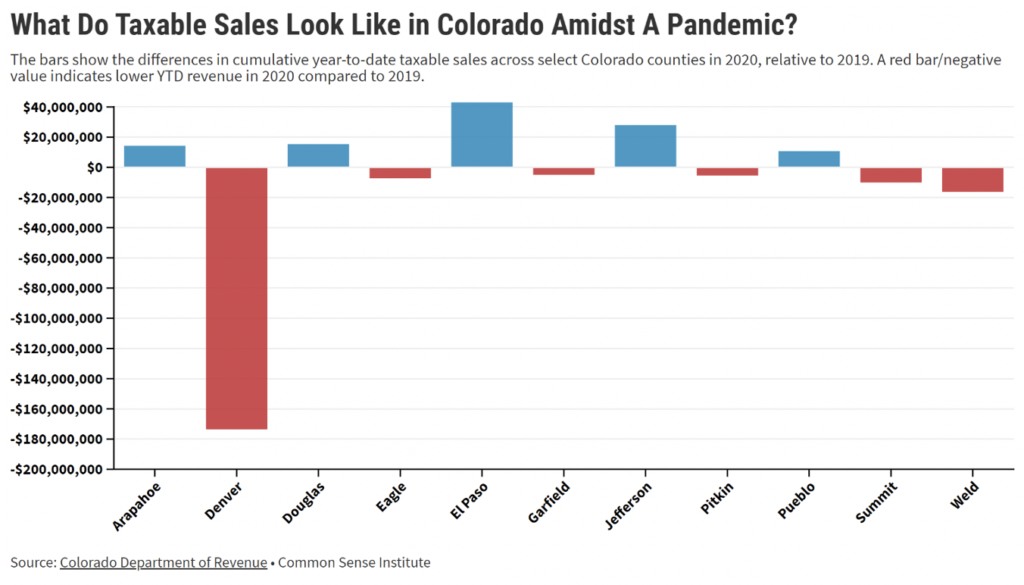

Boulder, co sales tax rate. Ytd september 2020 sales tax (including audit revenue) declined by $7,322,484 (or 8.8%) when. There is no applicable city tax.

The boulder, colorado sales tax is 8.85%, consisting of 2.90% colorado state sales tax and 5.95% boulder local sales taxes.the local sales tax consists of a 0.99% county sales tax, a 3.86% city sales tax and a 1.10% special district sales tax (used to fund transportation districts, local attractions, etc). The minimum combined 2021 sales tax rate for boulder, colorado is. The county sales tax rate is %.

2020 boulder county sales & use tax. Try it now & grow your business! Colorado assesses a flat tax of 4.63 percent of an individual's taxable federal income.

The 80303, boulder, colorado, general sales tax rate is 8.845%. The current total local sales tax rate in boulder county, co is 4.985%. The current total local sales tax rate in boulder, co is 4.985%.

The tax rate for admission to an event is 5.0% of the price of the ticket or admission. The esd tax is on top of the city of boulder sales tax rate of 3.86%. Boulder county does not issue licenses for sales tax as the county sales tax is collected by the colorado department of revenue (cdor).

Special event vendor rate charts 2018 (manual rate chart) 2018 (food for home consumption only) 201 7 (manual rate chart) The 8.845% sales tax rate in boulder consists of 2.9% colorado state sales tax, 0.985% boulder county sales tax, 3.86% boulder tax and 1.1% special tax. This document lists the sales and use tax rates for all colorado cities, counties, and special districts.

The 9% sales tax rate in boulder creek consists of 6% california state sales tax, 0.25% santa cruz county sales tax and 2.75% special tax. The sales tax jurisdiction name is santa cruz county tourism marketing district, which may refer to a local government division. The december 2020 total local sales tax rate was 8.845%.

Boulder county’s sales tax rate is 0.985% for 2020 sales tax is due on all retail transactions in addition to any applicable city and state taxes. Colorado's corporate income tax rate is a flat 4.63 percent assessed on colorado net income, defined as the corporation's federal taxable income, with some modifications. For ease of use, this is deducted from all deposits so that buffconnect reflects the.

The december 2020 total local sales tax rate was also 4.985%. The rate is comprised of individual, voter‐approved county sales and use tax ballot measures adopted to support county programs in conservaon, transportaon, offe nder management, nonprofit capital investment and sustainability.

Summerlin A Master Planned Community In Las Vegas Nv Amenities Maps Community Master Planned Community How To Plan Las Vegas

Colorado Sales Tax Rates By City County 2021

Sales And Use Tax City Of Boulder

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

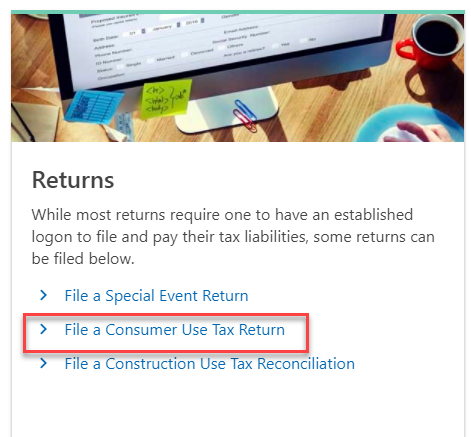

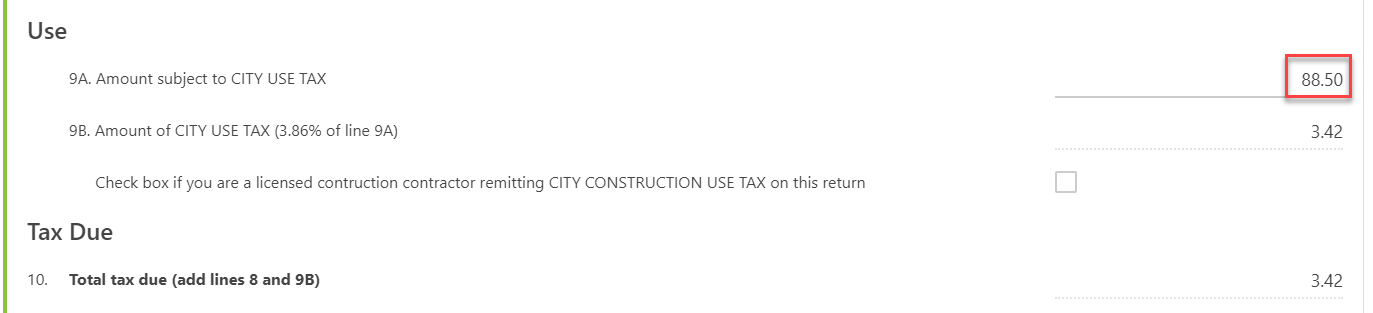

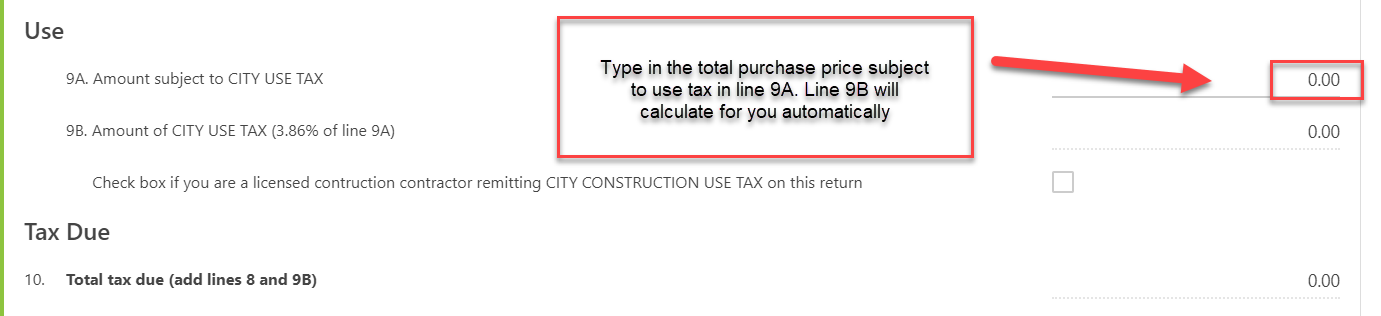

Use Tax City Of Boulder

Should Boulder Do Away With Sales Tax On Groceries - Boulder Beat

Use Tax City Of Boulder

Geotax Spatial Boulder City Small Biz

Insurance Ads Life Health Life Insurance Banner - Banner Ads Web Template Psd Download Here Graphicr Insurance Ads American Life Insurance Life Insurance

Taxes In Boulder The State Of Colorado

Pin On Wisdom

Use Tax City Of Boulder

Login Instagram I 2021

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Use Tax City Of Boulder

Boulder Exploring New Taxes Fees As Revenues Falter - Boulder Beat

Use Tax City Of Boulder

Comments

Post a Comment