Taxoshi is a cryptocurrency tax calculator focused on helping kiwis understand their tax position. Ird keeps a close watch on the dark web for any possible crypto tax evasion.

2021 End Of Financial Year Cryptocurrency Tax Checklist Cryptocurrency Tax Nz

Crypto hi, does anyone know whether koinly is a good site to calculate your crypto tax expenses?

Crypto tax calculator nz. Tai looked into crypto z and decided it would be a good investment. Buying crypto is not a taxable event (see example 2 below). Our step by step wizard and cryptocurrency tax calculator is fine tuned for new zealand and will help you figure out your crypto tax position to declare.

Throughout the year, for this example, the value of xtz remains the same ($3.78 nzd per token). While tai was keen to earn income, he also planned to sell crypto z once the value had gone up. I am relatively new to crypto and the nz tax rules are a bit confusing.

Exchanging your cryptoassets for different cryptoassets. Taxed on worldwide income including cryptoasset income from overseas. And the team always respond to any question i have.

Nz crypto investors are thrilled about investing in crypto assets, however, not many are aware of the tax treatment of the same. You’ll need to work out the nzd value of the cryptoassets. Simply copy the numbers into your annual tax return.

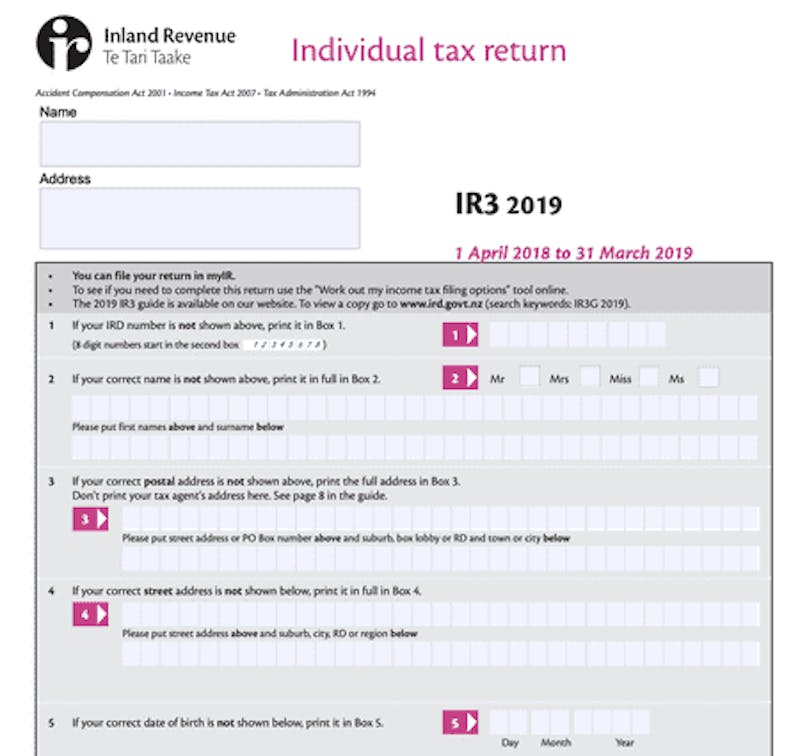

Tai kept a close eye on the crypto market. We are chartered accountants who specialise in cryptocurrency taxation. The form then helps you calculate if you have paid too much tax or not enough.

Valuation method of closing cryptocurrency tokens. Calculate the new zealand dollar value of your cryptoasset transactions. Income from trading, mining, staking, forks etc has to be reported in your annual tax return.

With the end of tax year coming up on the 7th of july next month, taxoshi’s automated. Cryptocurrency in new zealand is not taxed in the same way as foreign currency investments. A) if you are a tax resident.

Work out your cryptoasset income and expenses. Check out our free guide on crypto taxes in new zealand. Different cryptocurrency tax calculations may have significant implications of how much tax there is to pay (or refund), and the timing of tax payments (or tax refunds).

Kiwisaver, student loan, secondary tax, tax code, acc, paye. New zealand’s inland revenue does not treat these digital assets as legal tenders but as a form of property. In this you include all of the income you have made in the year from all sources (including wages, dividends, cryptocurrencies, etc) and all of the tax you paid.

Receiving mining or staking rewards. Find out what you need to. After the end of the tax year (31 march) you need to file an ir 3.

Before you can put your cryptoasset net income (or loss) in your tax return you need to: If you own bitcoin or are considering buying bitcoin, it is important to understand what tax reporting obligations might apply. He stakes the tokens and receives 734 xtz throughout the year.

New zealand's best paye calculator. Receiving a payment in cryptoassets. Using crypto to purchase goods or services is a taxable event.

Instead, bitcoin (and other forms of digital currency) is taxed in the same way as property. There are further rules you need to be aware of if your cryptoassets are trading stock. File your crypto taxes in new zealand learn how to calculate and file your taxes if you live in new zealand.

Contact us today to discuss your situation and how we can help: It does not depend on what they are called. While there are different types of cryptoassets, the tax treatment depends on the characteristics and use of the cryptoassets.

You need to file a tax return when you have taxable income from your cryptoasset activity. Based on today’s market value of $3.78 nzd per xtz, john buys 13,227 xtz with the intention to earn rewards. Some cryptoasset transactions may not have an nzd value, such as:

Calculating the new zealand dollar value of cryptoassets. Cryptoassets are treated as a form of property for tax purposes. Inland revenue considers cryptocurrencies as property, rather than currency or money.

This means that the normal tax rules that apply to personal property also apply to cryptocurrency. You need to use amounts in new zealand dollars (nzd) when filing your income tax return. A cryptocurrency trader closing tokens held at year end are accounted for as trading stock.

Calculate your take home pay from hourly wage or salary. You need to work out your cryptoasset income and expenses before you can work out your net income (or loss) for your income tax return. Selling crypto for fiat (e.g., nzd) is a taxable event (examples below) trading one coin for another is a taxable event.

New zealand bitcoin tax laws. B) if you are new or returning tax resident after 10 years. Koinly can generate the right crypto tax reports for you.

Whether you are filing yourself, using a tax software like turbotax or working with an accountant. I highly recommend cryptotaxcalculator for taking the hassle and complexity out of doing your crypto taxes. Calculate your crypto taxes in minutes ⚡ supports 300+ exchanges ᐉ coinbase coinspot coinjar ato compliant.

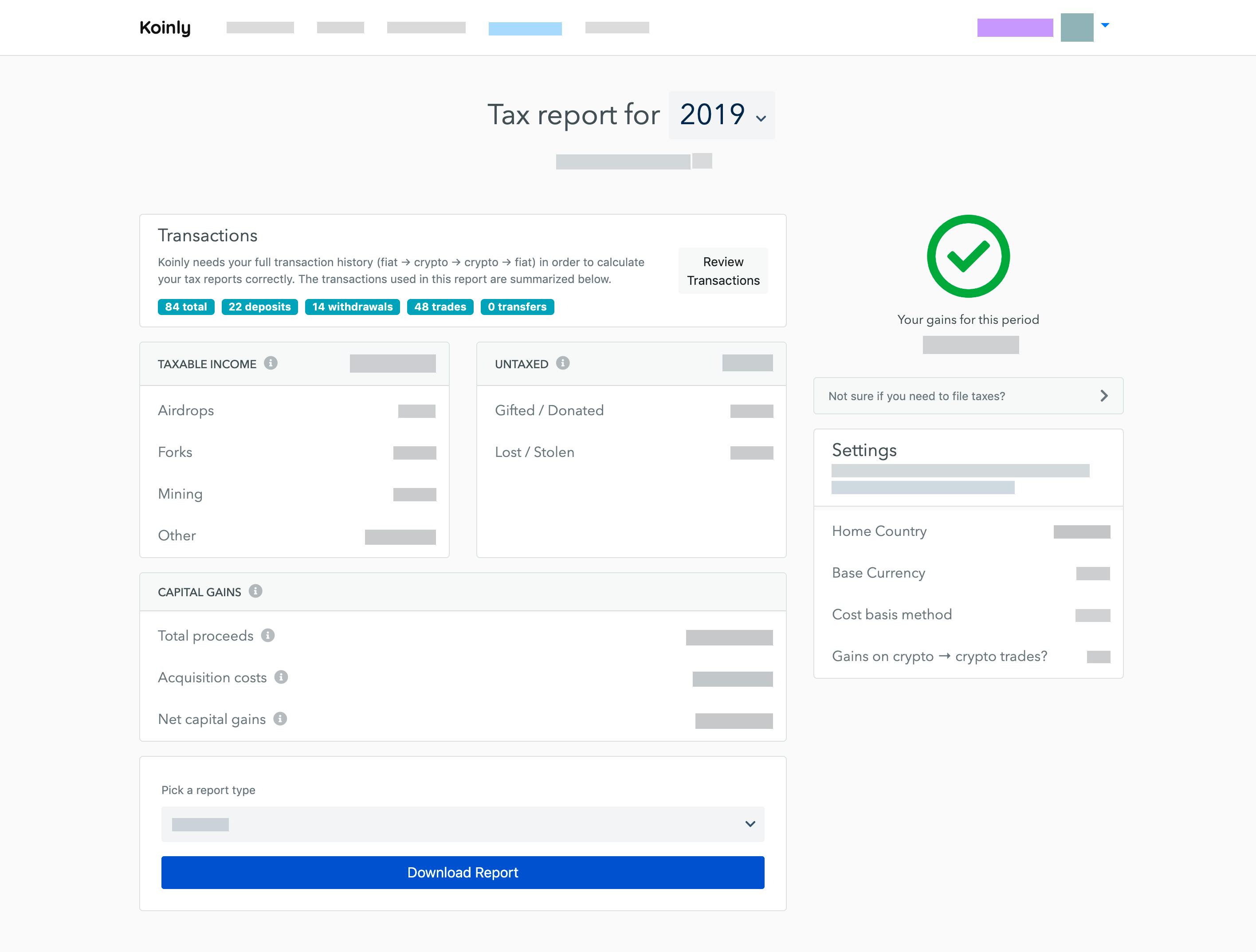

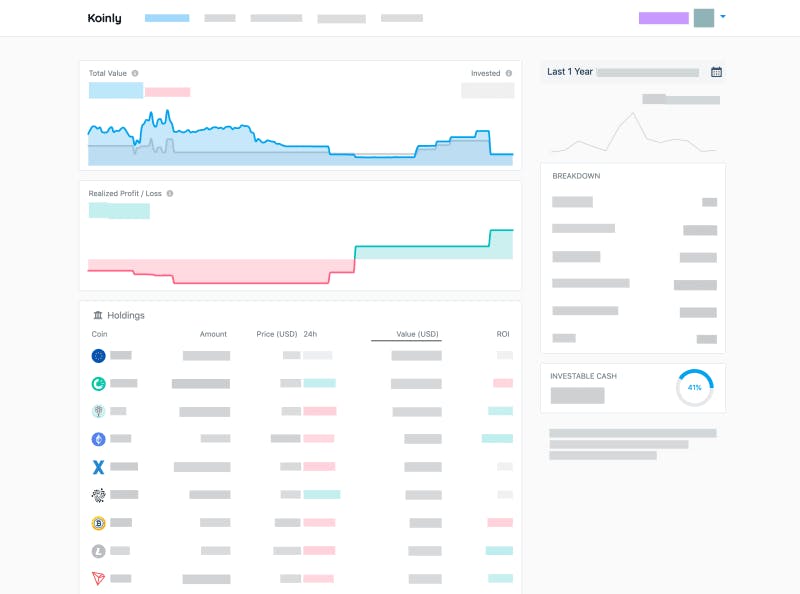

Koinly helps new zealanders calculate their income from crypto trading, mining, staking, airdrops, forks etc. Generate complete tax reports for mining, staking, airdrops, forks and other forms of income. The tax residency status of an individual affects how tax is paid in new zealand on the cryptoasset income.

The exchange paid tai regular amounts of crypto z. Inland revenue has recently given an update on its thinking on how bitcoin and other cryptocurrencies should be dealt with from a tax perspective. John’s 734 xtz have a market value of $2,775 which is taxable income to.

An unrealised profit is when the market value of a token is higher than the original purchase price. Tai bought a large amount of crypto z and staked it with the exchange. We have a range of services available for investors, traders, miners and businesses involved with cryptocurrency.

Cryptocurrency Tax Nz Chartered Accountants And Cryptocurrency Specalists

Pin On How To Start An Online Business

David Kemmerer Cryptotradertax

Account Suspended Real Estate Infographic First Time Home Buyers Selling Real Estate

Nvidia Aims To Build Better Robots With The Isaac Initiative Nvidia Graphic Card Data Center

Bitpay In New Partnership Allows You To Receive Tax Return In Btc Tax Return Bitcoin Tax Refund

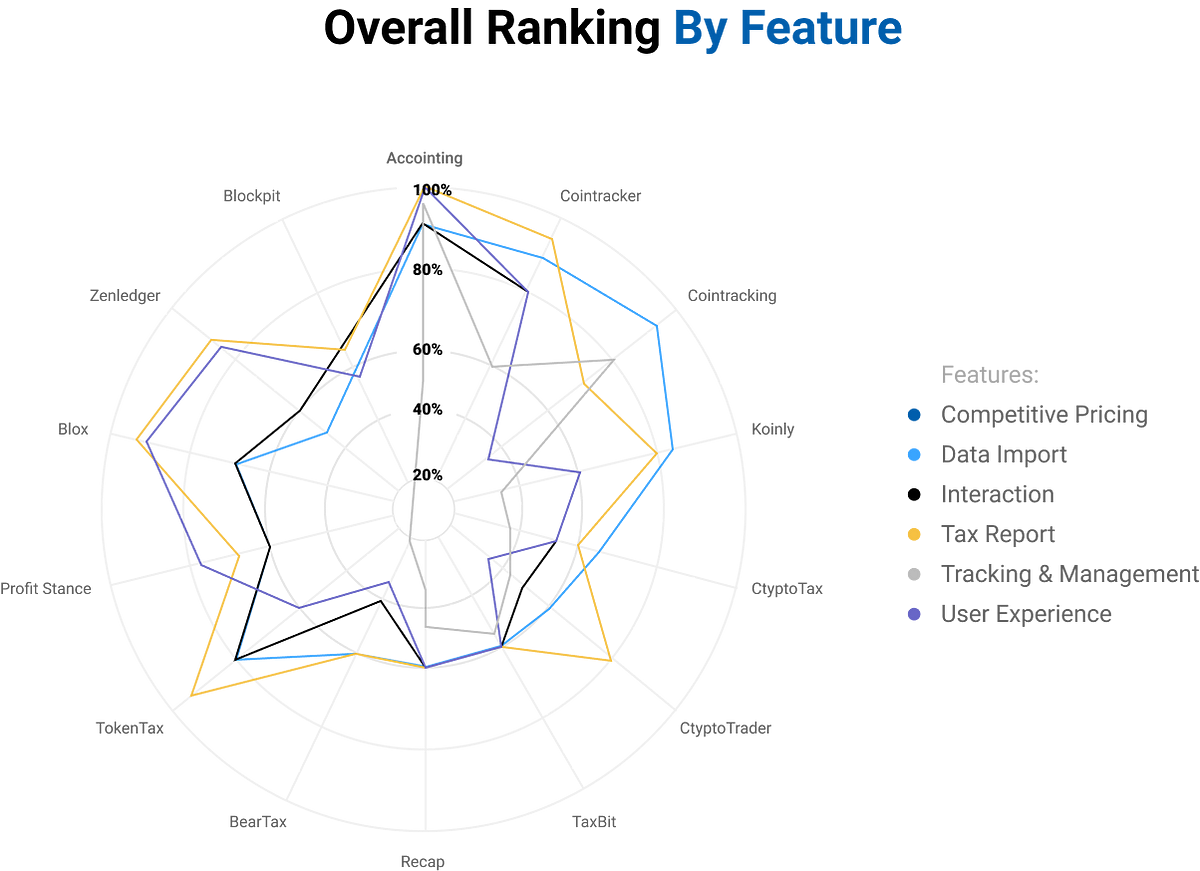

Best Crypto Tax Software In 2021 Coinmonks

Declaring Crypto Taxes In New Zealand Inland Revenue Koinly

/images/2021/08/16/cryptocurrency-taxes.jpg)

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

Cryptocurrency Tax Basics Cryptocurrency Tax Nz

Cryptocurrency Tax Nz Chartered Accountants And Cryptocurrency Specalists

Declaring Crypto Taxes In New Zealand Inland Revenue Koinly

Guide To Cryptocurrency Taxes In Nz Glimp

Best Crypto Tax Software In 2021 Coinmonks

Next Steps - Australia Crypto Tax Report Cryptotradertax

Koinly Crypto Tax Calculator For Australia Nz

Which Cost Basis For Your Crypto Tax Fifo Vs Lifo Vs Hifo Koinly

![]()

Taxoshi Get Your Crypto Tax Under Control

Best Crypto Tax Software In 2021 Coinmonks

Comments

Post a Comment