The idaho income tax has seven tax brackets, with a maximum marginal income tax of 6.92% as of 2021. Idaho does have a deduction of up to 60% of the capital gain net income of qualifying idaho property.

Idaho Income Tax Calculator - Smartasset

Capital gains go overwhelmingly to wealthy, white households.

Idaho state income tax capital gains. The percentage is between 1.6% and 7.8% depending on the actual capital gain. Gains from the sale of the following don't qualify for the deduction: Detailed idaho state income tax rates and brackets are available on.

The time in which you owned your idaho house is going to play a role in the type of idaho capital gains tax you could end up being responsible for. Idaho axes capital gains as income. “capital gain net income” is the amount left over when you reduce your gains by your losses from selling or exchanging capital assets.

However, certain types of capital gains qualify for a deduction. Idaho axes capital gains as income. Ad a tax advisor will answer you now!

Taxes capital gains as income and the rate is a flat rate. Taxes capital gains as income and the rate is a flat rate of 3.23%. Idaho allows a capital gains deduction for qualifying property located in idaho.

Capital gains are taxed as regular income in idaho, and subject to the personal income tax rates outlined above. Capital gains are generated by wealth. If a partner had other capital gains to report and reported capital gain net income on his federal income tax return, he would be entitled to part or all of the capital gains deduction computed on the idaho property in paragraph 173.03.a.

In idaho, the uppermost capital gains tax rate was 7.4 percent. But the tax rates are not. Idaho does not have a special tax rate for gains and losses on stocks, bonds, or other intangibles.

About 85 percent of capital gains go to the wealthiest 5 percent of taxpayers; Questions answered every 9 seconds. Capital gains tax is the tax that you pay on those capital gains.

Rsaveeal property that is held for at least one year is eligible for a deduction of 60% of the net capital income (that is the net gain after expenses). In addition, taxpayers with agi over $200,000 ($250,000 married filing jointly) are subject to the 3.8 percent net investment income tax. Taxes capital gains as income and the rate reaches 6.6%.

Of this rule, limited to the amount of the capital gain net income from all property included in taxable. Additional state capital gains tax information for idaho the combined rate accounts for federal, state, and local tax rate on capital gains income, the 3.8 percent surtax on capital gains and the marginal effect of pease limitations (which results in a tax rate increase of 1.18 percent). Taxes capital gains as income and the rate reaches 5.75%.

Idaho does have a deduction of up to 60% of the capital gain net income of qualifying idaho property. 75 percent go to the top 1 percent of taxpayers. For tax year 2001 only, the deduction was increased to 80% of.

Of the capital gain net income included in federal taxable income from the sale of idaho property. Only capital gains from the following idaho property qualify: Taxes capital gains as income and the rate is a flat rate of 4.95%.

Taxes capital gains as income and the rate reaches 5.75%. Ad a tax advisor will answer you now! Questions answered every 9 seconds.

Farm capital gains is very complicated. (a) real property* held for at least 12 months The capital gains rate for idaho is:

While the federal government taxes capital gains at a lower rate than regular personal income, states usually tax capital gains at the same rates as regular income. Because wealth is highly concentrated, so is capital gains income. Real or tangible personal property not located in idaho *****

The general capital gains tax rate for the farm is 15% federal. 52 rows the capital gains tax calculator is designed to provide you an estimate on the cap gains tax.

Historical Idaho Tax Policy Information - Ballotpedia

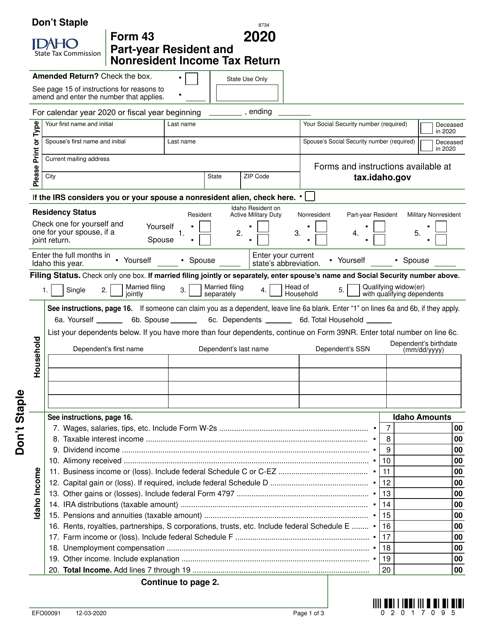

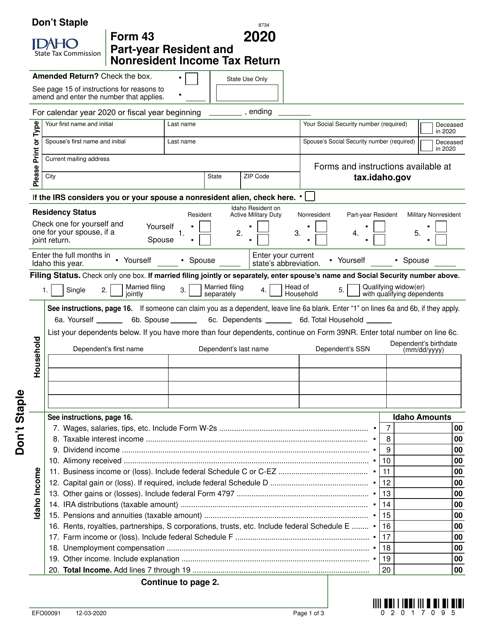

How To Prepare And File An Amended Idaho Income Tax Return

Guide To Combined Reporting - Idaho State Tax Commission

Guide To Combined Reporting - Idaho State Tax Commission

Idaho Retirement Tax Friendliness Retirement Calculator Property Tax Investing

Guide To Combined Reporting - Idaho State Tax Commission

Idaho Income Tax Brackets 2020

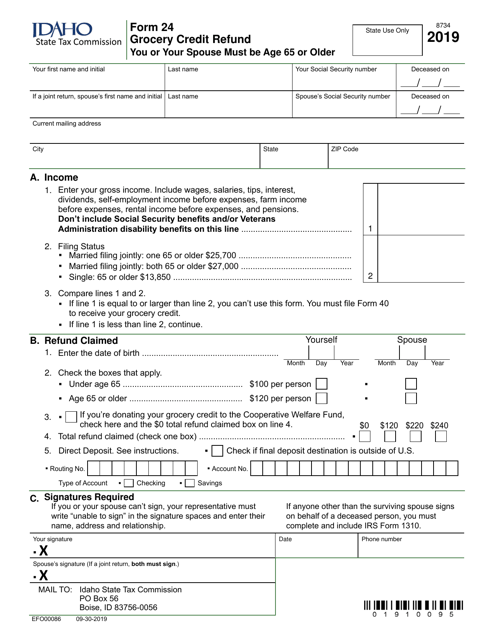

Idaho State Tax Commission Forms Pdf Templates Download Fill And Print For Free Templateroller

Guide To Combined Reporting - Idaho State Tax Commission

Idaho State Tax Software Preparation And E-file On Freetaxusa

Idaho Income Tax Rates For 2021

2

Taxes 1099-r Public Employee Retirement System Of Idaho

Idaho Tax Forms And Instructions For 2020 Form 40

The 10 Best States For Retirees When It Comes To Taxes Retirement Locations Retirement Retirement Advice

Idaho State Tax Commission Forms Pdf Templates Download Fill And Print For Free Templateroller

Filing An Idaho State Tax Return Things To Know Credit Karma Tax

Idaho Income Tax Calculator - Smartasset

Reasons Why Having Good Credit Is Important For Modern Living Money Life Hacks National Insurance Good Credit

Comments

Post a Comment