My ey is an exclusive personalized resource from ey. The proposed amendments, if adopted, would be retroactively effective for texas franchise tax.

Family Office Models Which One To Choose --- Administrative Hybrid Or Comprehensive Httppwcto19qppqm Family Office Administration Model

I'm filling out an online job application (chili's).

Tax credit survey ey. Replacing the version published in june 2019. Work opportunity tax credit (wotc) quick reference card (qrc) a. Our tax professionals can also provide help with identifying solutions for tax related services associated with people, compliance, reporting and law.

They're asking for my ssn for a tax credit survey. Work opportunity tax credit (wotc) is a program that provides federal tax incentives to employers that hire employees from various targeted groups who consistently face barriers to employment. As many companies are taking advantage of the employee retention credit (erc), questions have been raised as to how the erc should be accounted for.

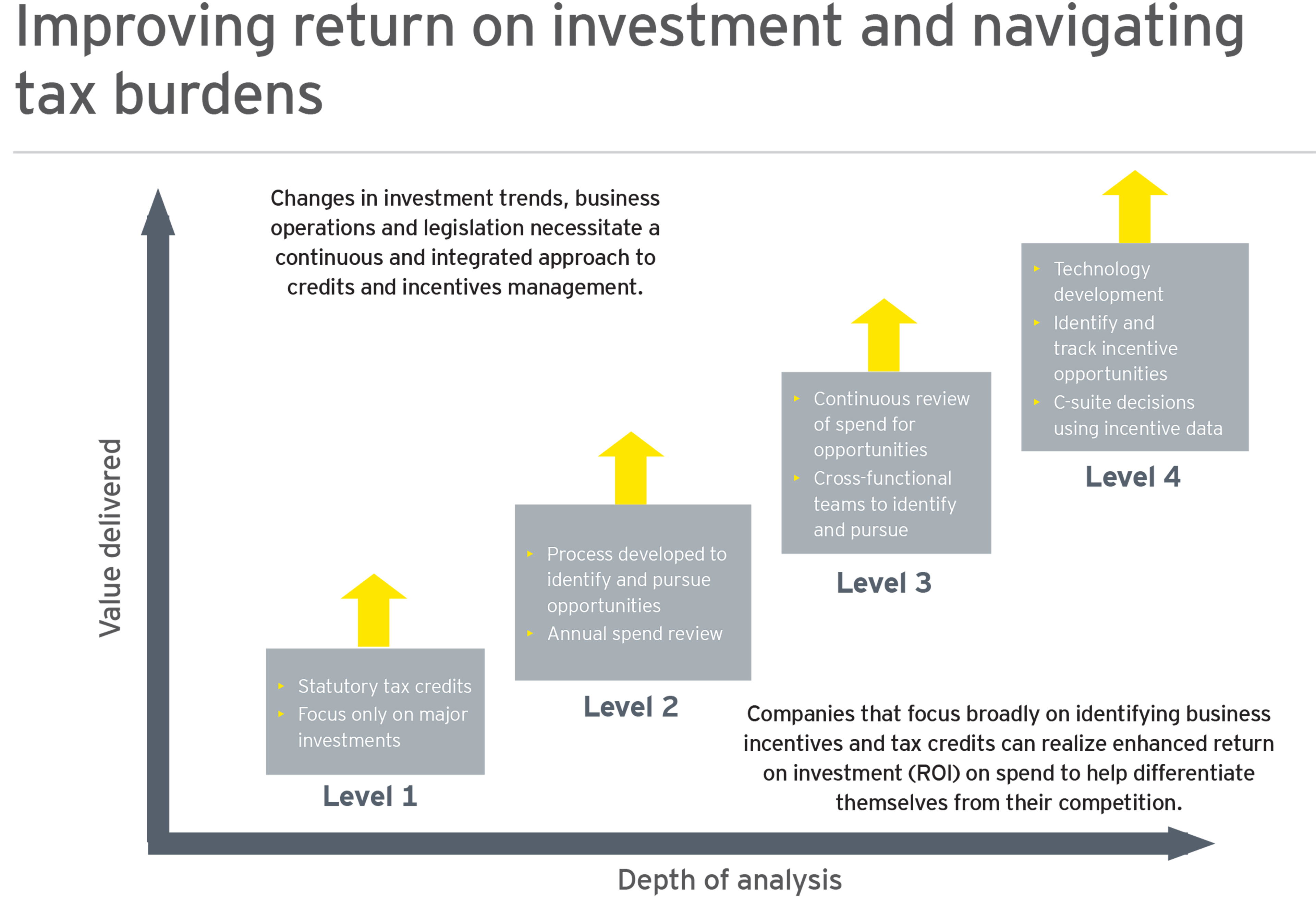

Tax benefits tax credit of up to 25% of the investment, and deduction of 100% of the investment tax credit of up to 25% of the investment, and deduction of 100% of the investment i+d+i income tax credit for msmes national: Capturing opportunities and managing risks over the long term.”. We invite you to leverage our experience, knowledge and business insights to help you succeed.

At any time via email at ey.ihd@ey.com; What ey can do for you The website on the search bar is wotcgs.ey.

Are employers participating in the employee social security tax deferral program? More generally, a clear increase in both the total amount of r&d expenditure and in the cost of the measure can be observed. More information on my ey is available here.

Are you having trouble signing in? Admin.code section 3.599 (section 3.599), regarding the tax credit for research and development (r&d) activities. The tax credit benefit can range from $2,400 to $9,600 depending upon the employee’s category of eligibility.

Ernst & young (ey) is an independent tax consulting firm that has been hired by this employer to administer this and other federal tax credit programs. Ey tax alert aar allows gst input tax credit to manufacturer on certain promotional materials provided to franchisees, distributors and. The research tax credit is mainly available to businesses in the manufacturing industries (58.3% in 2015 and 61% in 2017), and especially electrical and electronics industry first and then pharmacy and perfumery industry.

We provide the scale, the technology, the teams, the challenges, the learning and the relationships for you to personalize and evolve your career. Ask for the internet help desk and report the following message id: After the required certification is secured, taxable employers claim the wotc as a general business credit.

Employers must apply for and receive a certification verifying the new hire is a member of a targeted group before they can claim the tax credit. Based on your answers, more questions may display. Take the survey, answering questions as needed.

Ey is a global leader in assurance, consulting, strategy and transactions, and tax services. It offers access to ey technologies, insights, people, events and learning opportunities to make a better working world for you. Finance act 2019 introduced changes to the r&d tax credit regime that predominantly focuses on small and micro companies.

N/a tax credit of up to 50% of the investment for all msmes whose investigation, technological (r&d) tax credit” guidelines in july 2020, 1. Working across ey tax, law, and people advisory services, you’ll collaborate with clients to make better decisions through insights into government policy, regulatory obligations and operations.

At ey, your career in tax is truly yours to build. You may need to download and electronically sign forms as part of this task. Ey has competencies in business tax, international tax as well as transactional tax.

Understandably, the form 941 reporting process is complex and includes a new worksheet 1. When you finish the survey, the system checks whether the employer can receive tax credits. If necessary, upload any documents needed to complete this task.

Since 1998 wotc.com provides wotc services and wotc consulting to companies and cpa's nationwide. Into your web browser to access the mckesson wotc survey. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over.

On april 16, 2021, the texas comptroller of public accounts (tx comptroller) released proposed amendments to its franchise tax rule, 34 tex. For ey if the recruiter is coming back to you to add your social/ fill out a tax credit survey can you assume that those steps are good? New york and washington dc, 22 june 2021.

No fees until tax credits are claimed. + 91 40 6736 2000 Employers may meet their business needs and claim a tax credit if they hire an individual who is in a wotc targeted group.

For assistance, please email ey support at myeysupport@ey.com. These were measures for which various bodies and interested parties had been calling for over the last few years, and You will be prompted to enter:

Wotc (work opportunity tax credit) is a federal tax credit available to employers, rewarding them for every new hire who meets eligibility requirements.

Global Location Investment Credit And Incentives Services Ey - Us

Iasa Ey Deck Presentation

Ey Budget 2021 Could Be Seen As Ushering In The Era Of The New Reliables Irish Business Focus

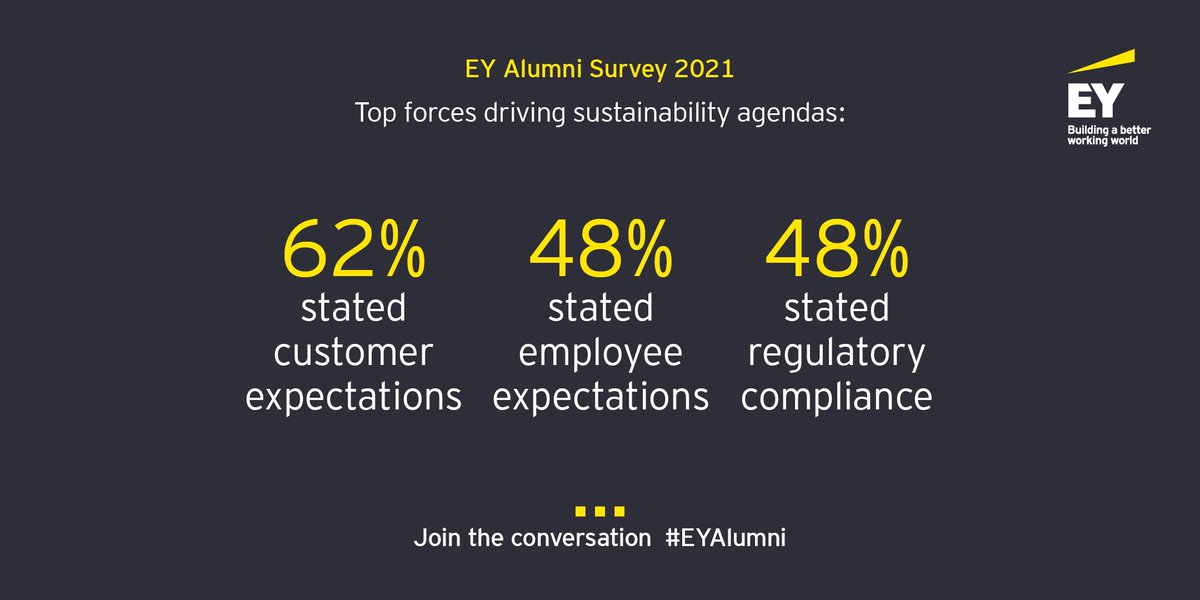

Ey Sustainable Impact Ey_sustainable Twitter

Ey Sustainable Impact Ey_sustainable Twitter

2

Ey Study More Than Half Of Employees Globally Would Quit Their Jobs If Not Provided Post-pandemic Flexibility

Greece - Jurisdiction Rankings Itr World Tax

K8yb4lxh530qmm

Ey Study More Than Half Of Employees Globally Would Quit Their Jobs If Not Provided Post-pandemic Flexibility

Ey Survey For 12th Annual Domestic Tax Conference Ranked Flat Taxes First And Vat Second As Ideal Tax Regime

Malecon Bar Grill In Bonao Monsenor Nouel Santo Domingo Dominican Republic Street View

Ey Alumni - Home Facebook

Ey Again Rated 1 Most Attractive Professional Services Employer By Universum And Climbs Worlds Best Workplaces List Ey - Netherlands

2

Ey Alumni - Home Facebook

Ey Study More Than Half Of Employees Globally Would Quit Their Jobs If Not Provided Post-pandemic Flexibility

Ey Sustainable Impact Ey_sustainable Twitter

Greece - Jurisdiction Rankings Itr World Tax

Comments

Post a Comment