When you dispose of an asset, if you have a realized profit or gain, this is subject to capital gains tax. Imagine if you could appreciate wealth over time while in the process increase your tax refund, or at a minimum reduce what you may owe in taxes.

The Complete Guide To Crypto Tax Loss Harvesting Tokentax

This year hasn’t been good to cryptocurrency markets.

Tax loss harvesting crypto. The lack of a wash sale rule. However, there is one important difference! The wash sale rule currently applies to stocks and other securities.

Tax loss harvesting is not specific to crypto. In simple terms, if you quickly trade out of the crypto you are in and then back into it, you realize profits / losses at that point. What is tax loss harvesting?

Profits and losses from crypto are subject to capital gains tax. But if this same taxpayer had previously harvested $40,000 worth of losses on earlier crypto transactions, they'd be able to offset the tax they owe. When you dispose of an asset but made a loss, you.

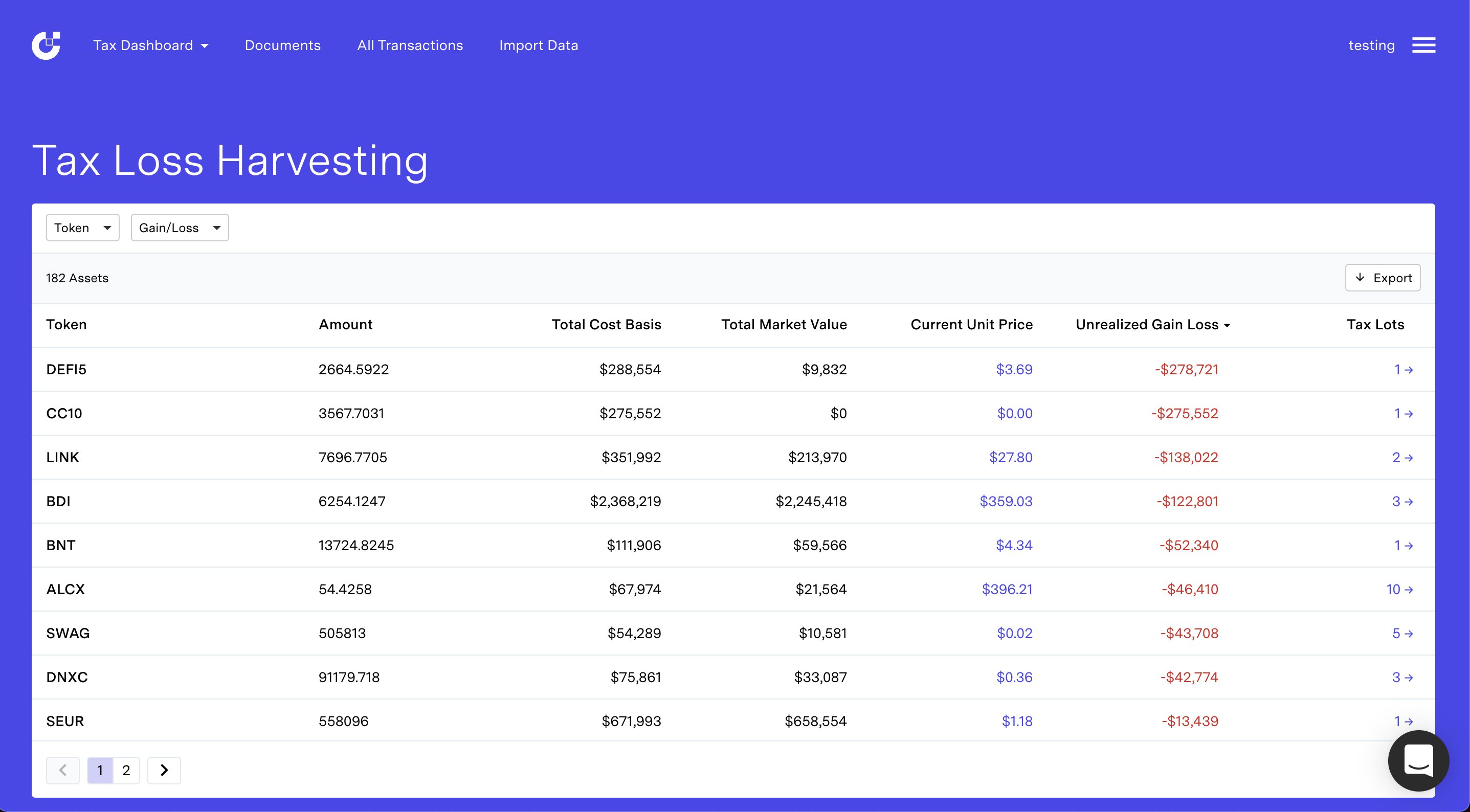

Tax loss harvesting is a compelling form of tax planning that allows people to offset their tax expenses by selling assets at a loss before the end of the calendar year. By “harvesting” the loss, investors can offset taxes on both gains and income. Tokentax is proud to announce the tax loss harvesting dashboard, right in.

Thus, if you had crazy gains early in the year, then went back into crypto and now have losses on paper because you hodl’d, you can offset your gains (and thus reduce or eliminate your tax. Last week we posted explaining how tax loss harvesting allows you to realize capital losses, thereby saving you huge amounts on. Now, instead of taxing you fully on your $900 gain from rabbitcoin, the irs will deduct your losses from catcoin and turtlecoin and offset the loss.

This is also true in the crypto space, where tools like cointracker can help you do tax loss harvesting for your cryptos. Crypto tax loss harvesting is simply disposing your digital assets that you bought at peaks that are down in the market and buying them back immediately. Towards the end of every year, you will come across a lot of talk about tax loss harvesting, especially in the usa, where it is a very popular technique.

How much you’ll pay depends on how long you’ve held the asset for and where you live. You have probably heard about it as it relates to your traditional investments as well. When you reduce your capital gains, you owe less taxes.

By using crypto loss harvesting, you should report both the $900 gain and $140 loss to the irs. Crypto tax loss harvesting is one of the strategies if you’re looking to reduce your crypto taxes. The sold cryptocurrency can then be replaced in the portfolio in order to maintain an optimal asset allocation and expected returns.

It’s not all bad though. This way, you are not losing your position in the asset but you get to accumulate losses to write off against other gains. And, if you take a loss in crypto, you can offset other capital gains in assets like.

What is crypto tax loss harvesting? If you’re smart, with a little planning, you can save a lot of money on your taxes even outside of cryptocurrency. What this means is that if you bought bitcoin and other cryptos when their prices were high.

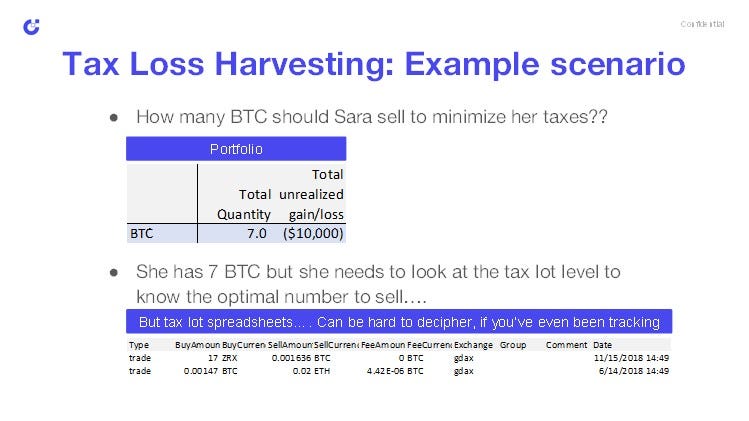

They may then buy the asset back at the reduced price to hodl it for later gains. You have to analyze the performance of each transaction and classify it according to the corresponding crypto and the holding period. Teller, cfa, chief investment strategist, green harvest asset management the wall street journal recently highlighted the practice of tax loss harvesting crypto assets to capture.

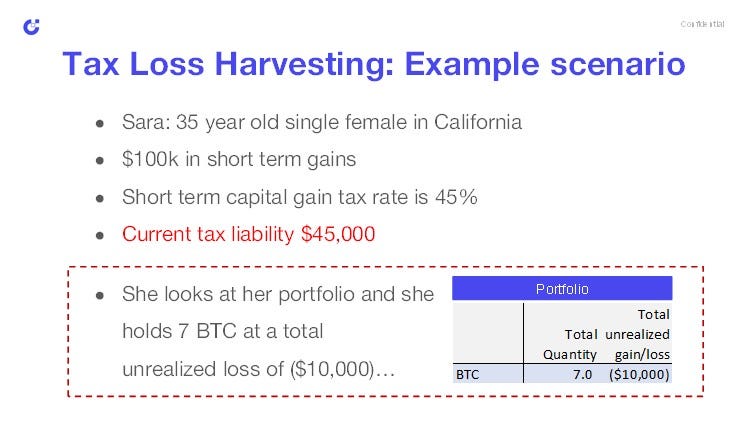

Crypto tax loss harvesting is when an investor sells crypto at a loss to create a capital loss to offset it against their capital gains and reduce their overall tax bill. Tax loss harvesting is selling off assets you hold at a loss to reduce your capital gains. If your losses are greater than your gains by more than $3,000, the extra losses above the $3,000 limit can be carried forward to future tax years.

By harvesting your crypto losses you can save a ton of money on your tax bill.

.jpg)

The Beginners Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax

Crypto Tax Loss Harvesting A Complete Guide Taxbit Blog

How To Do Tax Loss Harvesting For Your Cryptos Jean Galea

.jpg)

The Beginners Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax

Tax-loss Harvesting How To Get Part Of The Money You Lost In Crypto Back From The Irs By Alex Miles Tokentax Medium

Irzdb8bvr3t6ym

Harvesting Crypto Losses Just Got Easier Taxbit Releases Updates To Tax Optimizer Taxbit Blog

Save Money On Crypto Taxes With Tax Loss Harvesting Tokentax

Crypto Tax Loss Harvesting Tokentax

Cryptocurrency Tax Loss Harvesting Archives - Crypto Village Accelerator

The Complete Guide To Crypto Tax-loss Harvesting

.jpg)

The Beginners Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax

Crypto Tax Loss Harvesting How To Harvest Your Crypto Losses In 3 Steps Zenledger

Cryptocurrency Tax Loss Harvesting Cryptocurrency Tax Nz

Tax-loss Harvesting How To Get Part Of The Money You Lost In Crypto Back From The Irs By Alex Miles Tokentax Medium

All About Cryptocurrency Tax Loss Harvesting - Sfs Tax Problem Solutions

Crypto Tax Loss Harvesting A Complete Guide Taxbit Blog

.jpg)

The Beginners Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax

Tax-loss Harvesting How To Get Part Of The Money You Lost In Crypto Back From The Irs By Alex Miles Tokentax Medium

Comments

Post a Comment