The texas public records links below open in a new. The first step of the process is getting access to the tax delinquent property list in your county.

![]()

Home Page - Wv Real Estate Assessment

When property taxes go unpaid, or are delinquent for a period of time, this is recorded by the tax assessor or tax collector.

Are delinquent taxes public record. Some county treasurers will refer to this list by different names, like: Any unpaid balance due may then be subject to sale to a third party. Delinquent collection activities by fiscal year note:

Perform a free texas public record search, including arrest, birth, business, contractor, court, criminal, death, divorce, employee, genealogy, gis, inmate, jail, land, marriage, police, property, sex offender, tax, vital, and warrant records searches. Every tax delinquent property is compiled together in. In prior editions of the irs data book, table 25 was presented as table 16.

This is a request for public records made under opra and the common law right of access. When people don’t pay their taxes, the treasurer’s office will create a running list of who still owes them money (this is the same list they use to mail out their delinquent tax notices). Certain tax records are considered public record, which means they are available to the public, while some tax records are only available with a freedom of information act (foia) request.

Navigation property summary search resul tax history gis parcel sales history split history tax description logout refine search new search print property summary our records are updated may, august and january. Search arkansas county property tax and assessment records by owner name, parcel number or address. Tax returns are not public record;

Please acknowledge receipt of this message. If you fail to pay your taxes when they are due, the irs will begin the collections process. Showing results 1 through 250 out of 19349.

You must first purchase a tax history search. The florida department of revenue is authorized by law (section 213.053 (19), florida statutes) to publish the names of taxpayers who have large unresolved tax liabilities. With the increasing number of online tax filing services, some information is being used and sold publicly, but that is not advocated by the internal revenue service (irs).

These lists are compiled in every jurisdiction across the us housing market and are a matter of public record. Every effort is made by the greene county treasurer’s office to work with taxpayers who have fallen behind on their taxes. This starts with a bill for the amount that is past due.

Enter the parcel number of. Show only delinquent taxpayers with revoked licenses. Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all.

This is a request for public records made under opra and the common law right of access. Assessor, treasurer and delinquent taxes iowa county treasurer 222 n. Please acknowledge receipt of this message.

More than $5,000, including tax, interest, penalty, fees, and costs, and. If the 1st installment is delinquent, a 10 percent penalty is imposed. What’s more, the tax office must advertise delinquent tax liens in the name of the january 6 record owners and not in the name of prior owners.

However, access to these lists differs widely from one area to the other. “delinquent tax roll” “tax delinquent list” “tax forfeiture list” I am not required to fill out an official form.

To begin, please enter the appropriate information in one of the searches below. Welcome to the delinquent tax online payment service. That’s the key to this real estate investment strategy.

The information displayed reflects the tax record as of january 1st of the calendar year. Property tax payments must be received, or united states postal service (usps) postmarked, by the delinquency date to avoid penalties. You may enter search terms in any combination of fields.

If you fall behind on your taxes, numerous payment options are available. The amount is unpaid more than 90 days after all appeal rights have expired. Tax records include property tax assessments, property appraisals, and income tax records.

Tax returns are not public record. Records of the millard county treasurer reflect unpaid 2020 taxes, certifications, and attachments which became delinquent on november 30, 2020 for the taxpayers and parcels listed. List of all properties with delinquent taxes owed, over the amount of one dollar ($1.00) yours faithfully, community member

If your unpaid taxes have been sold (at an annual tax sale, scavenger sale or over the counter), the clerk's office can provide. Search iowa county property tax and assessment records by county, address or tax key number. The notice will include the total tax due, including unpaid taxes, penalties, and.

This service allows you to search for a specific record within the delinquent tax database to make a payment on. These taxpayers have not paid, or arranged to pay, their debt. On january 4, 2008 the delinquent taxpayer list was updated to include delinquent taxpayers who owe:

This is a different rule from that governing the collection of delinquent taxes on personal property, which is permitted against only the january 1 listing owner. Tax returns contain confidential information that is not readily available to the public. Otherwise, the payment is delinquent and penalties will be imposed in accordance with state law.

Name / doing business as.

Public Records County Of Northumberland

2

How To Read A Tax Deed Sale List - Youtube Reading List Investing

Advanced Search - Taxsys - Broward County Records Taxes Treasury Div

North Dakota Foreclosures And Tax Lien Sales Search Directory

2

2

![]()

Home Page - Wv Real Estate Assessment

2

Auction Draws Large Crowd Outstanding Taxes Local News Scnowcom

One Of The Steps In Buying A Home Is To Have A Title Search Completed Prior To Closing Many First Time Buyers May Not Hav Title Insurance Title Things To Know

2

2

2

Youve Ever Had To Deal With Delinquent Taxes And The Internal Revenue Service Then You Will Be A Bit Familiar Wit Tax Attorney Legal Services Tax Lawyer

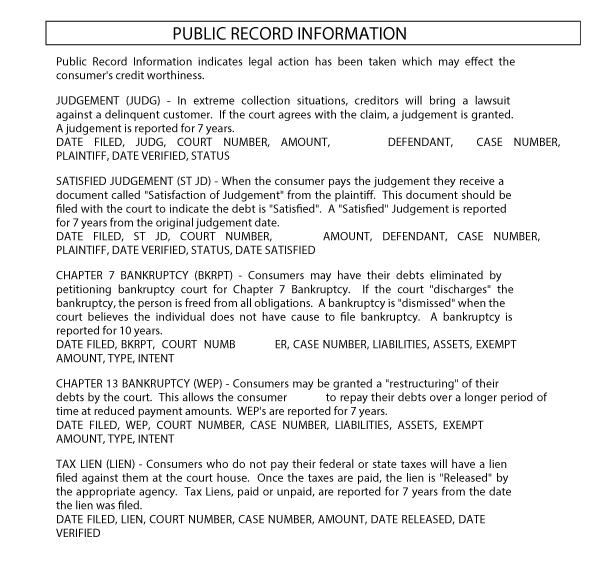

Tenant Screening Reports - Sample With Aaa Credit Screening

Delinquent Taxes

Property Taxes Wyckoff Nj

Lctc-u

Comments

Post a Comment