Is a 457 or roth ira better? Do you have a qualifying hardship?

Retirement Portfolio Withdrawal Requirements Library Insights Manning Napier

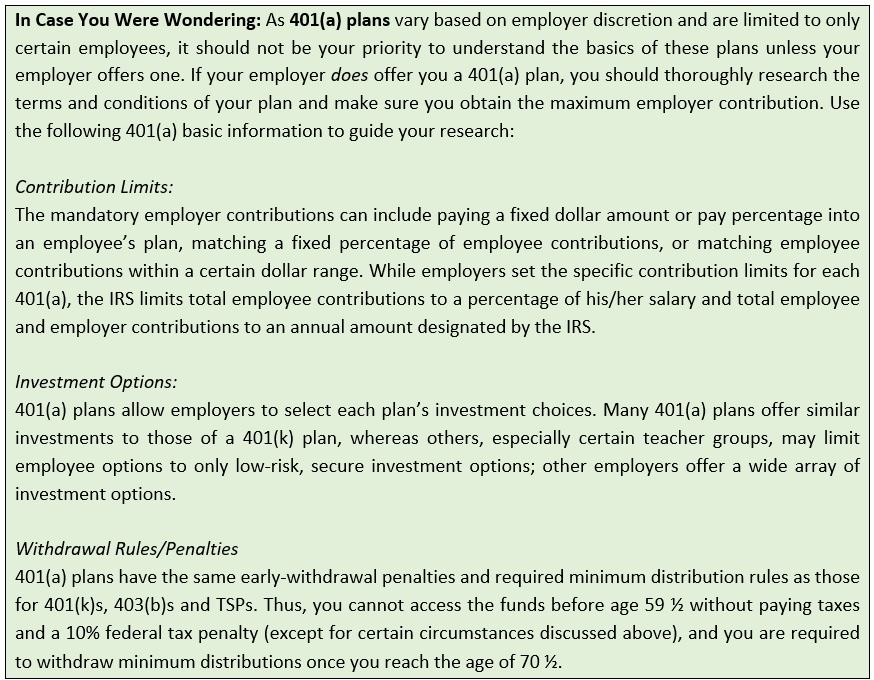

If you participate in the plan, your 457(b) account contributions and earnings are excluded from your taxable income until you withdraw them.

Can i withdraw from my 457 without penalty. Please define qualified, and provide any other stipulations that must met. Click to see full answer in respect to this, can i withdraw my 403b when i leave my job? You can take money out of your 457 plan without penalty at any age, although you will have to pay income taxes on any money you withdraw.

When can i withdraw money from my 403b without penalty? Cashing out the plan if you're under age 59 1/2, you may also face a 10 percent irs penalty for an early distribution. Money saved in a 457 plan is designed for retirement, but unlike 401 (k) and 403 (b) plans, you can take a withdrawal from the 457 without penalty before you are 59 and a half years old.

You are permitted to withdraw money from your 457 plan without any penalties from the internal revenue service no matter how old you are. Beneficiaries can avoid taxation by rolling over the 457 distribution to a qualified retirement. You can withdraw your money from 457 before age 59½ without a 10% penalty, unlike a 401(k), but you will owe taxes on any withdrawal.

No, buying a house is not a hardship. You can take money out of your 457 plan without penalty at any age, although you will have to pay income taxes on any money you withdraw. Have you left your employer?

If you have a 457(b), you can withdraw funds from the account without facing an early withdrawal penalty. There is no penalty for an early withdrawal, but be prepared to pay income tax on any money you withdraw from a 457 plan (at any age). Yes, if your governmental employer 457(b) plan allows rollovers, those rollover accounts are still subject to the same 10% early penalty tax rules if they are later withdrawn as taxable.

Although you won't pay a 10 percent penalty on early withdrawals, you will find that 457(b) withdrawal rules require that you pay taxes on the amount at the time you withdraw it. For traditional gold iras, you have to. Unlike with 401(k)s and 403(b)s, the irs won't slap you with a penalty on withdrawals you make before age 59.

You can not withdraw money under any circumstances. You can take money out of your 457 plan without penalty at any age, although you will have to pay income taxes on any money you withdraw. You can take metals possession without penalty after the age of 59 1/2 or more.

But if you’ve been saving in a 403(b), you’ll take a 10% penalty surtax on any distributions you take before you hit age 59.5. A section 457 plan, sometimes called a 457(b) plan, is a type of retirement plan offered to some government employees and nonprofit workers. You will, however, owe income.

However, if you need the money and are willing to face the consequences, you have the right to withdraw it when you leave your job.in certain limited circumstances, the. This is a very important rule that often times goes overlooked with the 457 plan. If you have a 457 plan and you die, your beneficiary can take distributions from the plan immediately.

If you withdraw before this age, you may have to pay 10% penalty unless you have a first time home purchase or have to pay for college. You generally can't withdraw funds from a 457 plan before retirement age while you're still employed by the same employer, but there are opportunities for cashing out a 457 plan early if you have an unexpected emergency. Unlike other retirement plans, under the irc, 457 participants can withdraw funds before the age of 59 as long as you either leave your employer or have a qualifying hardship.

Money saved in a 457 plan is designed for retirement, but unlike 401(k) and 403(b) plans, you can take a withdrawal from the 457 without penalty before you are 59 and a half years old. However, distributions are still taxed as ordinary income. So, if patricia, a firefighter who has a 457 retirement plan, a pension from her county, and an ira, decides to retire at age 51 she can withdraw funds from the 457 and begin receiving payments from her pension without penalty.

How are 457 withdrawals taxed? It is true that borrowing from a 457 (b. Money saved in a 457 plan is designed for retirement, but unlike 401(k) and 403(b) plans, you can take a withdrawal from the 457 without penalty before you are 59 and a half years old.

There is no penalty for an early withdrawal, but be prepared to pay income tax on any money you withdraw from a 457 plan (at any age). You can not withdraw money under any circumstances. Money saved in a 457 plan is designed for retirement, but unlike 401(k) and 403(b) plans, you can take a withdrawal from the 457 without penalty before you are 59 and a half years old.

Differences between 457 plans and 401(k) and 403(b) plans There is no penalty for an early withdrawal, but be prepared to pay income tax on any money you withdraw from a 457 plan (at any age). Beneficiary distributions avoid the early withdrawal penalty of 10 percent, regardless of the age of the beneficiary.

Typically, you must wait until you're 59 1/2 to withdraw contributions without penalty if you're still working.

Pin By Kimberlee Erickson Daugherty On Financial Freedom Types Of Taxes Financial Freedom Retirement Accounts

Everything You Need To Know About A 457 Real World Made Easy

Everything You Need To Know About A 457 Real World Made Easy

16 Ways To Withdraw Money From Your 401k Without Penalty Nasdaq

What Age Can You Withdraw From 401k

Should You Make Early 401k Withdrawals - Due

4 Ways To Avoid The 10 Early Withdrawal Penalty - Retire By 40

Dont Fear The Penalty - Financial 180

Retirement Portfolio Withdrawal Requirements Library Insights Manning Napier

How To Access Retirement Funds Early

Important Ages In The Us For Retirement Savings Withdrawals And Collecting Social Security Retirement Age Saving For Retirement Plan For Life

2

Are You Thinking Of Accessing Your Retirement Funds Due To Covid-19

Borrow From Your 401k Without Penalty Nextadvisor With Time

401k Penalty Free Withdrawals Coronavirus Cares Act - Youtube

How Can I Take An Early Withdrawal From My 401k Without Being Penalized Simplifi

Coronavirus Relief 100k 401k Loans Penalty Free Distributions Greenbush Financial Group

How To Access Retirement Funds Early

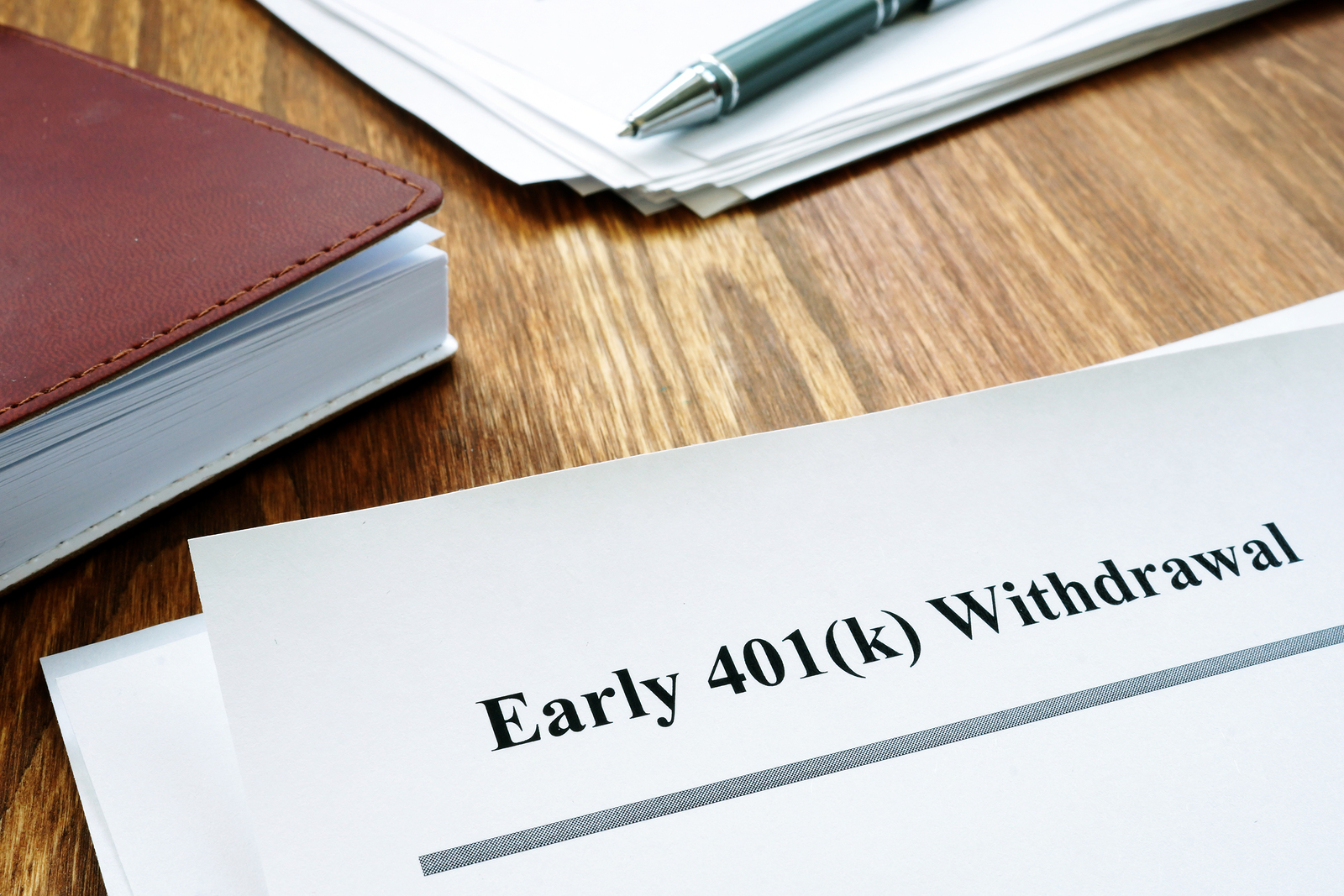

Taxation Of Annuities Ameriprise Financial

Comments

Post a Comment