If your loan term is longer than your lease term, we compare the buy vs lease options to the time the lease expires, and then use your remaining loan term to calculator you outstanding loan balance. The after tax cost of the lease over 4 years is $17,833, or $4,458 per year.

Claiming Expenses On Rental Properties 2021 Turbotax Canada Tips

This means you only pay tax on the part of the car you lease, not the entire value of the car.

Car lease tax deduction canada calculator. If you use the standard mileage rate, you get to deduct 54.5 cents for every business mile you drove in 2018. And not by the person who listed the vehicle. If you lease a car that you use in your business, you can deduct your car expenses using the standard mileage rate or the actual expense method.

This is the total selling price of the car before taxes. Tax savings) $17,833 after tax cost of lease. If you pay sales tax on your car lease, you may be able to take a deduction for it on your federal income taxes.

Enter the car's msrp, final negotiated price, down payment, sales tax, length of the lease, new car lending rate. When the car provided by the employer is used for personal purposes in addition to official ones, the expenditure will be considered under rule 3(2)(a) and table ii of value of perquisites. From an income tax perspective, if you are eligible to deduct car expenses from either your business or employment income, these tax deductions for cars will be available over time are the same whether you lease or buy.

Let's say you live in ontario and. However, you and the person from whom you are. The table below provides further information on the same.

When completing your tax return, enter the amounts in the calculation of allowable motor vehicle expenses area on line 10 of form t777, statement of employment expenses, and attach it to your paper return. You may also deduct parking and tolls. The automobile benefits online calculator allows you to calculate the estimated automobile benefit for employees (including shareholders) based on the information you provide.

$24,768 (lease cost over 4 years) $6,935 (less: Enter the total number of days the vehicle was leased in the tax year and previous years. Enter the total lease payments deducted for the vehicle before the tax year.

For example, if your local sales tax rate is 5%, simply multiply your monthly lease payment by 5% and add it to the payment amount to get your total payment figure. The total lease payments deducted before the current tax year for your vehicle number of days the vehicle was leased during the current tax year and in previous tax years manufacturer's suggested list price for the vehicle the gst and pst rates for your province. Deducting sales tax on a car lease.

You can use a leasing calculator to estimate how much it will cost you to borrow money to buy a vehicle. Calculate after tax cost of lease. As well, the rules restrict the deduction of lease payments where the cost of the vehicle is greater than $30,000 (plus sales tax).

Your purchase price (including sales taxes) is added to a 2020 honda accord touring (id: Perks are determined by leasecosts canada inc.

Impact to the corporation if the company leases the car, it can deduct the actual leasing costs, subject to a limitation of $800 (plus sales tax) per month. If you entered into a lease agreement, you can choose to treat your lease payments as combined payments of principal and interest. Ranked as the #1 car payment calculator tool in canada, you can explore more than 1,000+ offers (2020 & 2019 models only) in one single place.

Enter the value that a dealer is giving you for your current vehicle. What are the tax implications of leasing a company car? Use this auto lease calculator to estimate what your car lease will really cost.

Interest expense for purchased vehicles, and lease payments for leased vehicles. Typically this is 36, 48, 60 or 72 months. When you use a passenger vehicle to earn farming or fishing income, there is a limit on the amount of the leasing costs you can deduct.

Term in months for your auto loan. Chart to calculate eligible leasing costs for passenger vehicles. Tax deductions when leasing a vehicle.

Annual interest rate for your loan. What you spend on the cost of your car is deducted at a rate decided upon by the canada revenue agency (cra). If the lease agreement for your passenger vehicle includes such items as insurance, maintenance, and taxes, include them as part of the lease charges on amount 20 of chart c.

You can deduct costs you incur to lease a motor vehicle you use to earn income. While the interest rate is a factor, the down payment you are able to pay up front and the length of the term can have a. Capital cost allowance (cca) most automobiles are “class 10” assets:

Enter the total lease charges payable for the vehicle in the tax year. Deduct the lease payments incurred in the year for property used in your business. Why use a leasing calculator?

You can't deduct any portion of your lease payments. If you lease a passenger vehicle, go to vehicle leasing expenses. Each of these items is subject to special rules that limit the portion of the actual cost that can be included in your total expenses.

The cra lets you deduct the business percentage of your vehicle lease payments. The most common method is to tax monthly lease payments at the local sales tax rate. The canada revenue agency (cra) does not keep any of the data you provide to complete your calculation.

What Can Independent Contractors Deduct

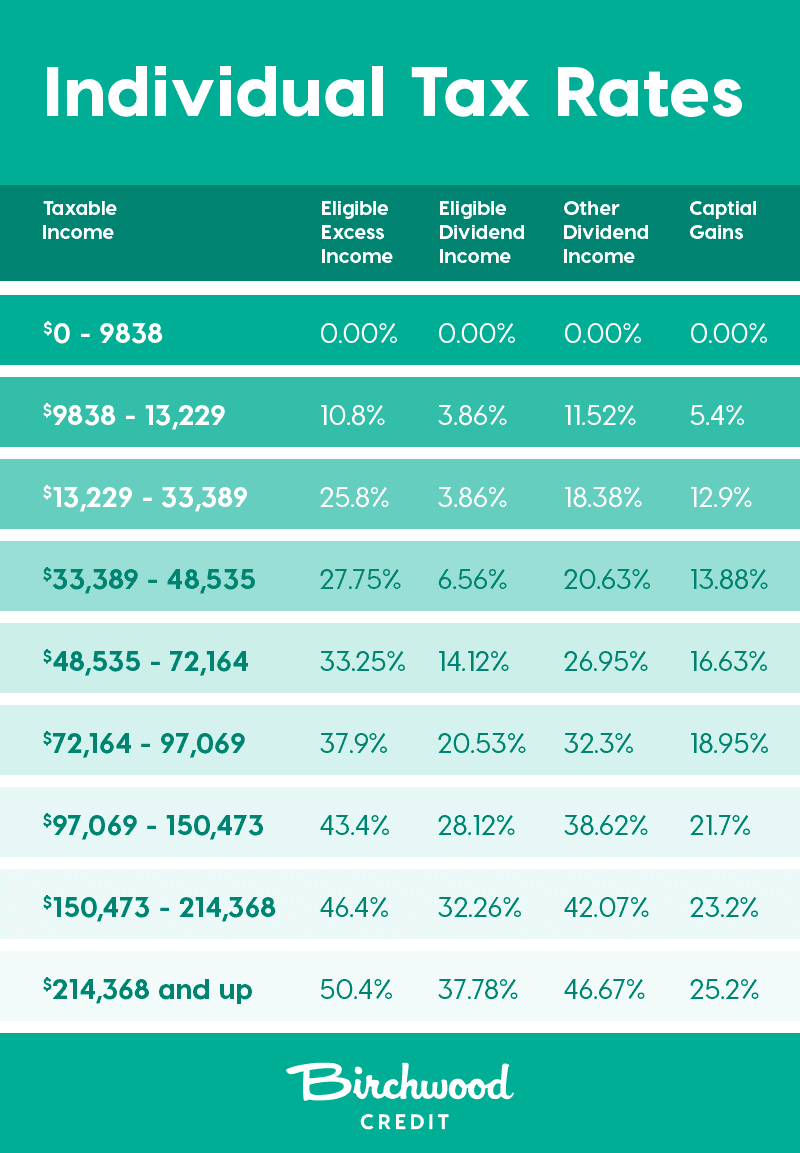

Manitoba Tax Brackets 2020 Learn The Benefits And Credits

Trucking Spreadsheet Download And Bookkeeping Software For Truck Drivers Pernillahelmersson Spreadsheet Template Bookkeeping Templates Spreadsheet

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Is It Better To Lease Or Buy A Car For A Business In Canada

How To Write Off 100 Of Your Car And Save 22826 Of Tax Immediately - Cherry Chan Chartered Accountant Your Real Estate Accountant

No You Cant Deduct That 11 Tax Deductions That Can Get You In Trouble Inccom

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Whats The Difference Between A Tax Credit And A Tax Deduction In Canada - Loans Canada

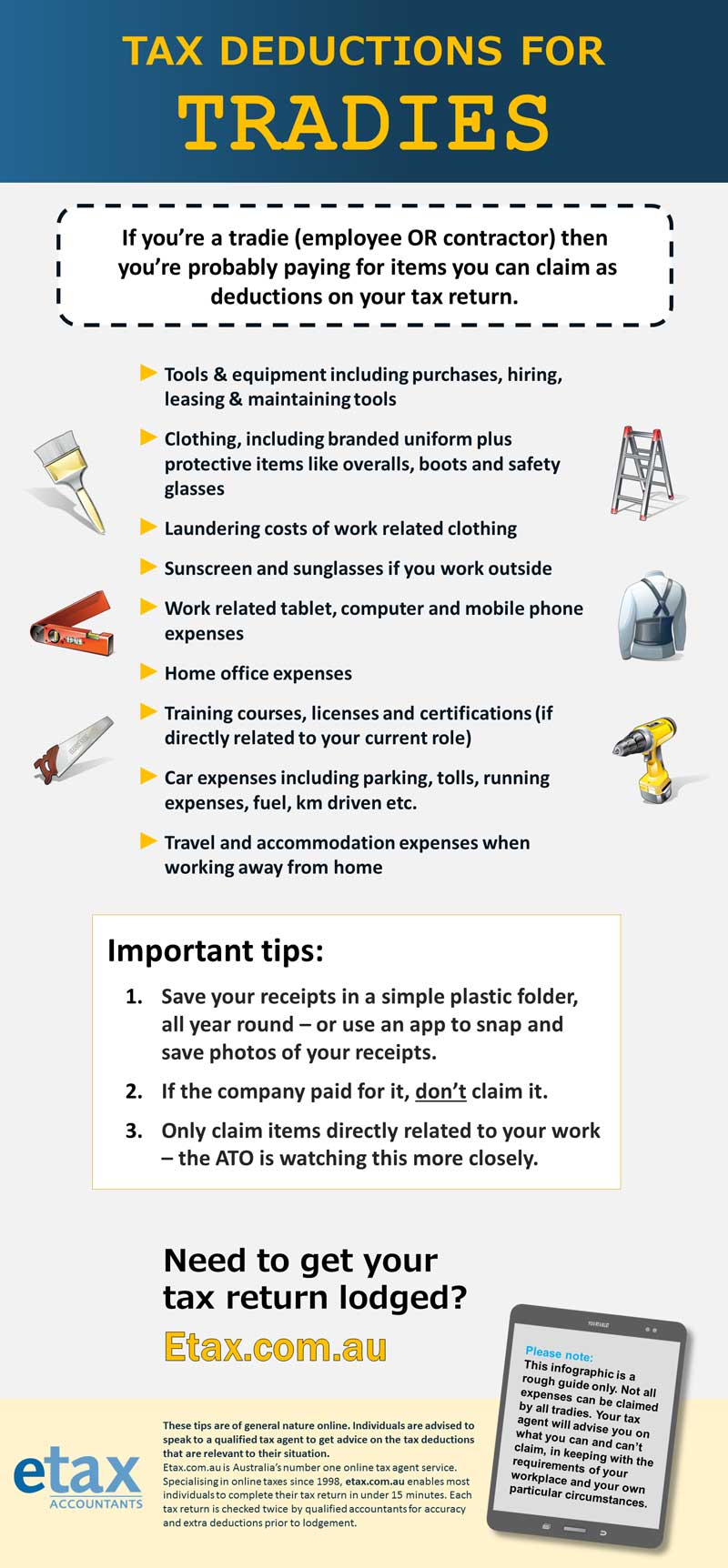

Tax Deductions For Tradies - Give Your Refund A Boost

Is It Better To Buy Or Lease A Car Taxact Blog

.png)

Maximizing Tax Deductions For The Business Use Of Your Car - Turbotax Tax Tips Videos

Kalfa Law How To Calculate Tax Deductions For Vehicle Expenses

Section 179 Tax Deduction Port Orchard Ford

List Of The Expenses You Can Claim As A Tax Deduction In Australia Is You Commercial Rental Property Real Estate Investing Rental Property Investment Property

The Ultimate Guide To Business Tax Deductions For Contractors 2021 - Box Advisory Services

Kalfa Law How To Calculate Tax Deductions For Vehicle Expenses

Top 25 Small Business Tax Deductions - Small Business Trends

Car Expenses What You Can And Cannot Claim As Tax Deductions

Comments

Post a Comment