If no conjunction appears between the two names, both must endorse the check. We will charge a very small fee to process the check, but then you'll be on your way with cash in hand.

Browse Our Example Of Direct Deposit Authorization Form Template Payroll Direct Instruction Project Management Templates

If a check with two names says “and,” on the pay to the order of line then everyone has to endorse the check.

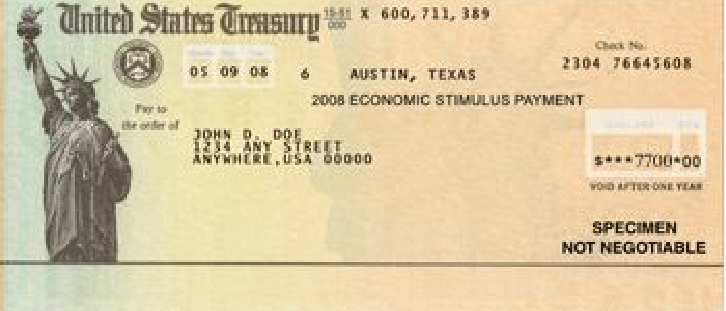

Cash tax refund check with two names. The check has both of our names on it so no one will cash it and no bank will deposit it, i don’t know what to do it’s been 2 years. If it truly is a corporation, the check should have been sent made out to that corporation. Expect to pay a fee when you cash a tax refund check at a bank at which you are not a customer, although the bank may waive the fee if you open an account with your refund check.

Jun 13, 2013 at 8:26pm estrellita said: If the check is made out to two names with “or” between them you can deposit it with only your signature. If it has “and” between the names the bank might not accept it with only one signature.

Banks may also impose a limit on the amount they will cash. If the word “and” appears between the two names, both must endorse the check. I work at a bank and i know we won't take a check made out to john and jane doe unless both are on the account or both sign the check.

Ho can i cash a tax refund check if it is in both mine nd my late husband’s names? It probably says somewhere on it that it must be endorsed exactly as the check was made out. Alternatively you can hand deliver the check to an irs local office which can be found near you on www.irs.gov in either case you want to write up correspondence detailing exactly what the name problem is and requesting your account be reviewed and corrected in addition to a new check.

I agree to put it in the joint account. Two signatures are not always required on a joint refund check. The governing regulation is indorsement and payment of checks drawn on the united states treasury, 31 cfr part 240.

Some banks don't require endorsement for checks that are only deposited. You can request a direct deposit of your income tax refund into an account that is in your name only. For a tax refund i saw an advertisment where they will cash it for free,but this morning i called walmart to see the max amount fgor a tax refund they will cash,and they will cash up to $2999,even if you want to puty it on one of the visa cards they do now,it still cant be over this amount.so this sux cuz im sure alot people,such as myself have.

You might check with your bank to see if that's the case, and if so, just deposit the check as pam states. (“and/or” is treated as “and.”) if the word “or” appears between the two names, either can endorse the check. I need advice my husband completed suicide before he could file his taxes so i filed them.

Whether you or your spouse. Your mother's name is a part of your address. However, it does have a rule on checks payable to deceased persons.

When the internal revenue service issues a tax refund to joint taxpayers in the form of a check, you will receive the check with both of your names printed on it. If you have an account at a bank or credit union, it can usually cash your tax refund check without fees. However, if you don’t have an account, you have two options:

If you plan to cash the check independently, alert the other party so you can avoid possible. Interestingly enough, fms says nothing about jointly payable checks in this regulation. Bank of america (if it is a tax refund check, all payees must also be joint owners of the bank of america account.) chase;

Most banks will allow this if both parties sign the check. Because banks have strict regulations for cashing checks made out to two parties, you’ll have a lesson in togetherness as you cash a joint tax refund. This is not a 2 party check;

It is because it is a tax refund check. When you file your federal and state taxes jointly with your spouse and a refund is due, you will receive a check addressed to both parties. We don’t have a joint account.

Try a real bank instead of walmart, and see what they say. Provide one of our associates with your tax refund check and a valid state id. We specialize in cashing checks for individuals that do not have a bank account.

I filed jointly for us. At least one form of id should include your photo. Banks & credit unions that cash tax refunds.

My bank won’t allow me to deposit/cash it without having him present or having a joint account. But i would take his death certificate and your dpoa to the bank just in case you can't get the check issued in your name by the irs. With windowed envelopes, the entire mailing address is printed on the face of the check.

Some banks might be more lax, but i think this is pretty standard. My question is why are you getting a tax refund to you personally on a tax refund for a corporation. Bring your tax refund check to a check cashing store, like united check cashing.

My federal and state tax refund checks are made payable to me “and” my spouse, who is incarcerated.

Pin On Best Of Doughrollernet

Stolen Tax Refund What To Do If This Happens To You Money

What Do Do If You Still Havent Received Your Tax Refund Toms Guide

3 Ways To Cash A Check Made Out To Two People - Wikihow

Gephardt How To Tell If A Surprise Tax Refund Is Real

Dad Day Brown Envelopes Tax Refund

Photograph Of A Form 1040 And One Hundred Dollar Bills Laying On Top Of It Income Tax Income Tax Deadline Tax Season

2nd Quarter 941 Due Employer Identification Number Name Tracing Financial Services

Still Didnt Get Your Stimulus Checks File A 2020 Tax Return For A Rebate Credit Even If You Dont Owe Taxes

Cash Register Icon For Tax Declaration App In 2021 Cash Register Declaration Cash

Pin By Office Templates Online On Office Templates Invoice Template Office Templates Invoicing

Heres The No 1 Thing Americans Do With Their Tax Refund Gobankingrates

Tax Refund Check Images Stock Photos Vectors Shutterstock

Phony Tax Refunds A Cash Cow For Everyone Krebs On Security

Tax Refund Check Images Stock Photos Vectors Shutterstock

Treasury Checks Images Stock Photos Vectors Shutterstock

What Is A Two Party Check Where Can You Cash It Mybanktracker

Wheres My Second Stimulus Check In 2021 Prepaid Debit Cards Visa Debit Card Tax Refund

How To Safely Deposit Your Tax Refund Into Your Bank Account

Comments

Post a Comment