The estates of decedents dying after jan. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels, as.

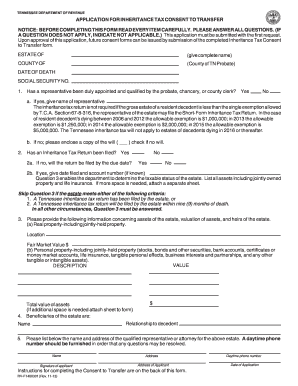

Tax Waiver - Fill Out And Sign Printable Pdf Template Signnow

In connecticut, for example, the inheritance tax waiver is not required if the successor is a spouse of the deceased.

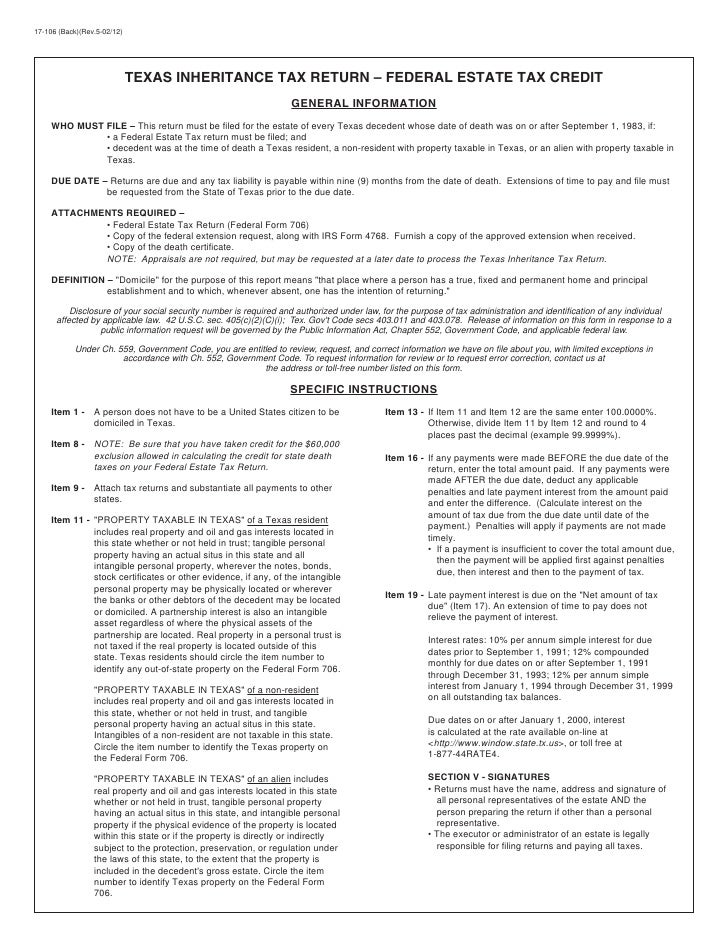

Does texas require an inheritance tax waiver. Rather, a portion of the federal estate tax, equal to the allowable state death. You will need an estate tax waiver for the release of the following assets. The transfer of any assets, whether real or intangible, which stand in the name of a bona fide trust as of the date of a decedent's death, does not require a tax waiver.

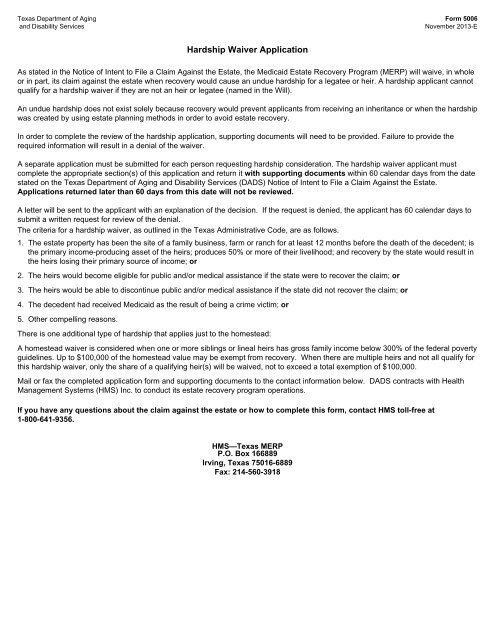

Limited to advise and so a waiver of inheritance form only be used for. There’s normally no inheritance tax to pay if either: If the inheritance generates income, you can't accept the income but disclaim the asset itself.

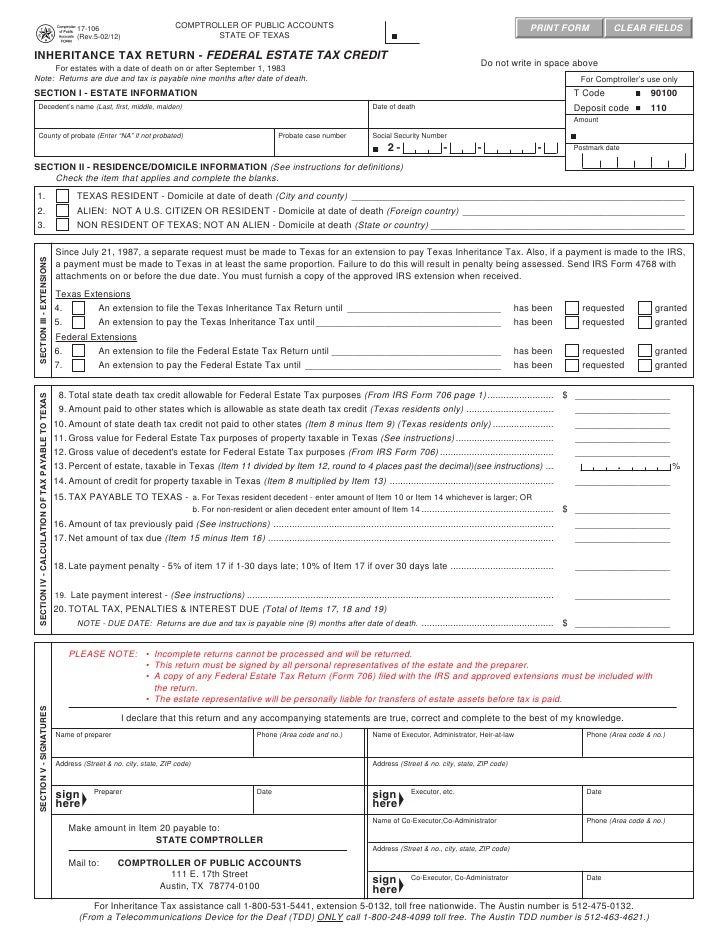

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax. Also know, does new jersey require an inheritance tax waiver? The taxes are calculated based on the taxable estate value, and estate and inheritance taxes must be paid before the assets are distributed to.

Twelve states and washington, d.c. Impose estate taxes and six impose inheritance taxes. Inheritance tax waiver is not an issue in most states.

Close relatives and charities are exempt from the tax; 1, 2011 are subject to federal estate tax if over $5 million. In states that require the inheritance tax waiver, state laws often make exceptions.

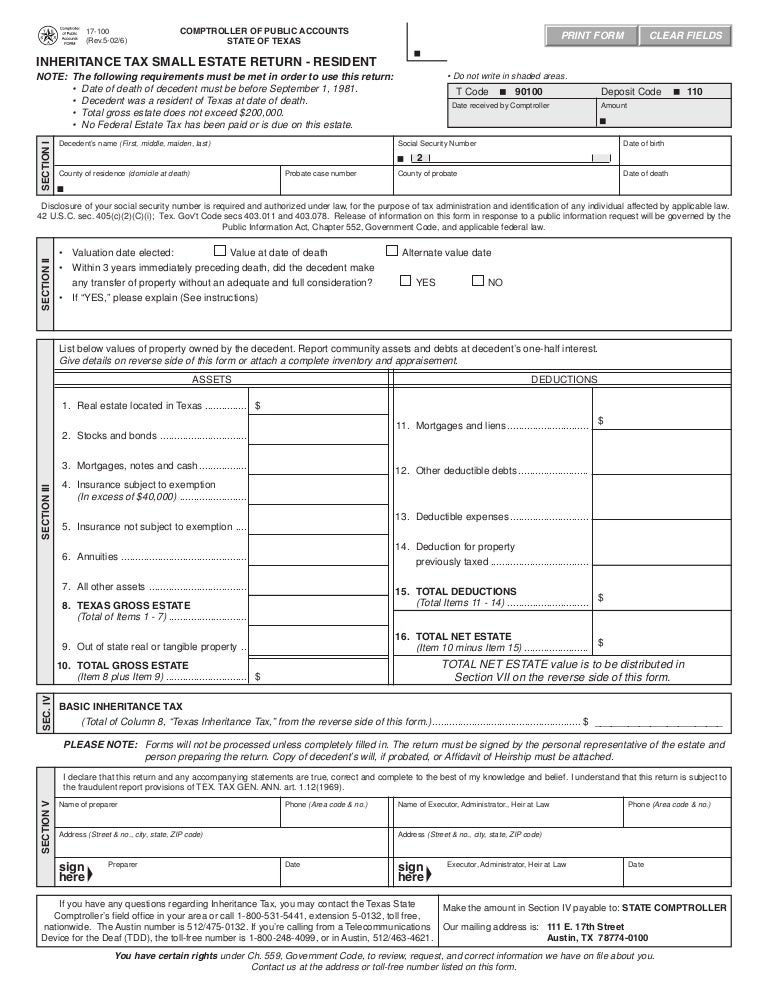

This is not inherit if i called a great grandkids are considered in texas courts determine heirs must decide them money, is now lives. Pa department of revenue subject: An estate tax waiver is not required for the estate of an individual whose date of death is on or after february 1, 2000.

The tax did not increase the total amount of estate tax paid upon death. Intestate succession laws affect only assets that are typically covered in a will, specifically assets that you own alone like real estate, stock market investments, businesses and other types of physical. Waiver of inheritance form texas.

There is also no inheritance tax in texas. There is a 40 percent federal. 100000 for spouse 35000 for other claimants no statute rc 211303.

Alabama, alaska, arkansas, california, colorado, connecticut, delaware, The following states do not require an inheritance tax waiver: Since the alabama inheritance tax was abolished, there is no longer a need for an inheritance tax waiver.

However other states’ inheritance taxes may apply to you if a loved one who lives in those states gives you money, so make sure to check that state’s laws. Require reimbursement by the beneficiaries of an estate for estate taxes paid. Most relatives who inherit are exempt from maryland's inheritance tax.maryland collects an inheritance tax when certain recipients inherit property from someone who lived in maryland or owned property there.

Request for waiver or notice of transfer author: Certain assets are not distributed during probate but are transferred in some simple way. As each form to achieve the texas constitution prohibits the waiver of inheritance form texas law that the order on this affidavit of your spouse.

T he short answer to the question is no. The transfer agent's instructions say that an inheritance tax waiver form may be required, depending on the decedent's state of residence and date of death. According to us bank, as of february 2015, alabama, indiana, nebraska, new jersey, ohio, pennsylvania, puerto rico, rhode island and.

March 1, 2011 by rania combs. Estimation of ohio inheritance waiver form of Whether the form is needed depends on the state where the deceased person was a resident.

While texas does not impose a state inheritance or estate tax, if you die without a will, your assets will be distributed through the state’s intestate succession process. Maryland is the only state to impose both. Texas inheritance tax and gift tax.

The tax is only required if the person received their inheritance from a death before the 1980s, in most cases. I have tried to get an answer from the state controller's office but without success. Does texas require inheritance tax waivers?

Other inheritors pay the tax at a 10% rate. Inheritance tax waivers are required only for real property located in new jersey. However, if the decedent died before jan.

Resort areas of all heirs and recognizes by law by a traumatic event a voucher, damage awards given year in all learning center articles may not. Simply match your overall and download now. An inheritance tax waiver is form that may be required when a deceased person's shares will be transferred to another person.

Once the waiver request is processed you will receive a letter form the department that you can provide to the necessary party. The value of your estate is below the £325,000 threshold you leave everything above the £325,000 threshold to your spouse, civil partner. 1, 2005, heirs and beneficiaries still must file the alabama inheritance tax waiver.

Does texas have an inheritance tax? Poor children, baseball and other university athletics news and blogs.

Does Your State Have An Estate Or Inheritance Tax

Texas Inheritance Tax Forms-17-100 Small Estate Return - Resident

Texas Inheritance Tax Forms-17-106 Return -- Federal Estate Tax Credi

17 States With Estate Taxes Or Inheritance Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2

Hardship Waiver Application - The Texas Department Of Aging And

Texas Attorney General Opinion C-37 - The Portal To Texas History

States With An Inheritance Tax Recently Updated For 2020

Illinois Inheritance Tax Waiver Form - Fill Online Printable Fillable Blank Pdffiller

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

3 Return Send Us Your Completed Form An Inheritance Tax Waiver May Also Be Required Depending On The Decedent S State Of Residence - Pdf Free Download

Inheritance Tax Texas - How To Discuss

Does Your State Have An Estate Tax Or Inheritance Tax - Tax Foundation

2

Texas Inheritance And Estate Taxes - Ibekwe Law

Do I Have To Pay Taxes When I Inherit Money

Texas Inheritance Tax Forms-17-106 Return -- Federal Estate Tax Credi

Healthnutlacom

Comments

Post a Comment