All eligible tax lien certificates are bundled together and sold as part of a single portfolio. Sheriff turns unpaid tax bills over to county clerk at the close of business:

Satisfying Tax Liens In Franklin County - Ohio Tax Liens - Libguides At Franklin County Law Library

Similarly the county assumes no responsibility for the consequences of inappropriate.

Franklin county ohio tax deed sales. Edward leonard, franklin county, oh, treasurer makes this clear: Franklin county ohio tax sale. The franklin county treasurer makes every effort to produce and publish the most current and accurate information possible.

Tax deeds are sold to the bidder with the highest bid. The purpose of the recorder of deeds is to ensure the accuracy of franklin county property and land records and to preserve their continuity. Interest rate and/or penalty rate:

Franklin county clerk 2021 tax bill sale timeline (for 2020 delinquent taxes) april 16, 2021: Look for lien certificate auctions in franklin county (columbus), cuyahoga county (cleveland), and hamilton county (cincinnati). Ohio revised code sections 5721.30 to 5721.43 permit the franklin county treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange for payment of the entire delinquency.

301 north main st., suite 203, lima, oh 45801. The sale vests in the purchaser all right, title and interest of warren county in the. After the tax lien sale, you get one year to pay off all lien charges and interest property.

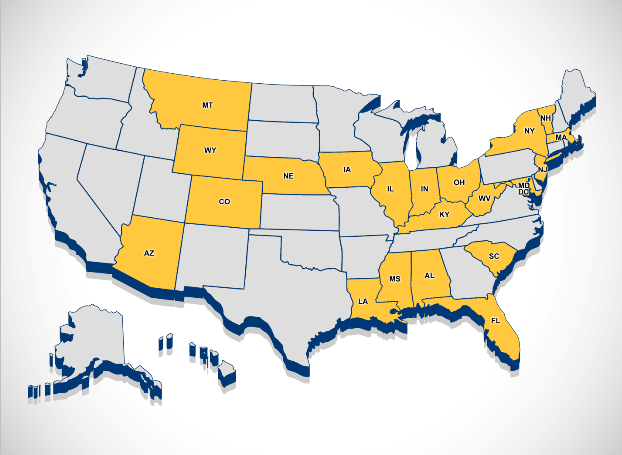

Ohio is unique in that it offers both tax lien certificates and tax deeds. The franklin county recorder of deeds, located in columbus, ohio is a centralized office where public records are recorded, indexed, and stored in franklin county, oh. These programs are used as a tool to encourage development and growth and to also create and preserve employment.

Generally, the minimum bid at an franklin county tax deeds sale is the amount of back taxes owed plus interest, as well as. Tax lien and tax deed: All properties held by franklin county are sold by public auction.

The auditor's office handles a wide variety of important responsibilities that affect all of franklin county's residents and businesses. In ohio, the county tax collector will sell tax deeds to winning bidders at the franklin county tax deeds sale. Find franklin county residential property records including property owners, sales & transfer history, deeds & titles, property taxes, valuations, land, zoning records & more.

Ohio is unique in that it offers both tax lien certificates and tax deeds. Successful bidders at the warren county ohio tax deed sale receive an ohio tax deed. For tax lien certificates, investors can get yields as high as 18% per annum with a one year right of redemption.

18% per annum (for tax lien certificates). In the first floor press room/auditorium of the franklin county courthouse, 373 s. Our sheriff sales are held every friday morning at 9:00 a.m.

To redeem delinquent property, contact the county clerk’s office. The franklin county recorder’s office had its busiest year on record in 2020, despite closing our physical office to the public in march. The county assumes no responsibility for errors in the information and does not guarantee that the data is free from errors or inaccuracies.

The county auditor is the selling agent for the state and is required by law to maintain a list of forfeited properties seized due to nonpayment of real estate taxes. The property is sold to the successful bidder (state laws differ), though often it is sold for the amount of unpaid taxes. Enjoy the pride of homeownership for less than it costs to rent before it's too late.

By submitting this form you agree to our privacy policy & terms. 5721.19) and tax lien certificates (see notes) (sec. At any time, the public can search properties owned by franklin county on this website through the property tax inquiry parcel search, by typing franklin county on the owner search line.

The tax incentive division handles the administration of charitable exemptions and abatement programs. Search for allen county sheriff's real estate sales listings by address, case number, defendant name, or sale date, or browse all property listings. Public outcry to highest bidder:

Provide a parcel number for the property you are inquiring about. There are currently around 40,000 parcels within franklin county that receive some form of tax incentive. In an effort to recover lost tax revenue, tax delinquent property located in franklin ohio is sold at the warren county tax sale.

“the purpose of the annual tax lien sale is to collect the delinquent real estate taxes owed to the county’s school districts, agencies and local governments.” local governments, like those listed here, depend on property taxes to operate. Notice in the state journal that certificates of delinquency will be advertised: After that time, tax buyers may grant an extension to the property owner or petition the circuit court for a tax deed transferring ownership.

Tax deeds are sold to the bidder with the highest bid. Sheriff sales are not held on federal holidays. You may also register on the day of sale starting at 7am at the courthouse.

Look for lien certificate auctions in franklin county (columbus), cuyahoga county (cleveland), and hamilton county (cincinnati). The county holds the property in trust for the taxing districts and any future sales are held according to the tax title statutes rcw 36.35. For tax lien certificates, investors can get yields as high as 18% per annum with a one year right of redemption.

All sales are pursuant to the provisions of the ohio revised code.

Auto Title Manual - Franklin County Ohio

Franklin County Auditor - Auditors Sale

Franklin County Recorder - Home

Satisfying Tax Liens In Franklin County - Ohio Tax Liens - Libguides At Franklin County Law Library

Franklin County Treasurer - Home

Franklin County Treasurer - Foreclosure

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

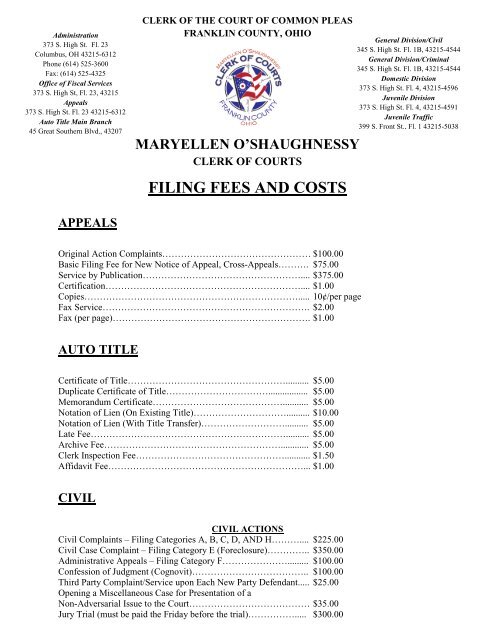

Filing Fees And Costs Appeals - Franklin County Ohio

Franklin County Treasurer - Delinquent Taxes

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Ohio Foreclosures And Tax Lien Sales Search Directory

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Maine Foreclosures And Tax Lien Sales Search Directory

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Ohio Republican Party Settles Tax Bill After Getting Hit With Lien - Clevelandcom

Search Ohio Public Property Records Online Courthousedirectcom

Comments

Post a Comment