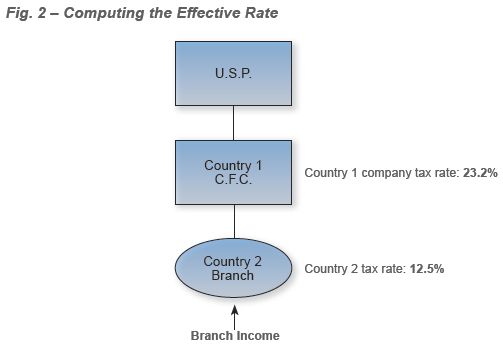

Corporate income tax rate of 21%) and the u.s. The treasury and the irs concluded the tested unit standard is a more targeted measure than the qbu standard and “will be more easily” applied than the qbu standard.

International Aspects Of Tax Cuts And Jobs Act

Separate “books and records” for each tested unit.

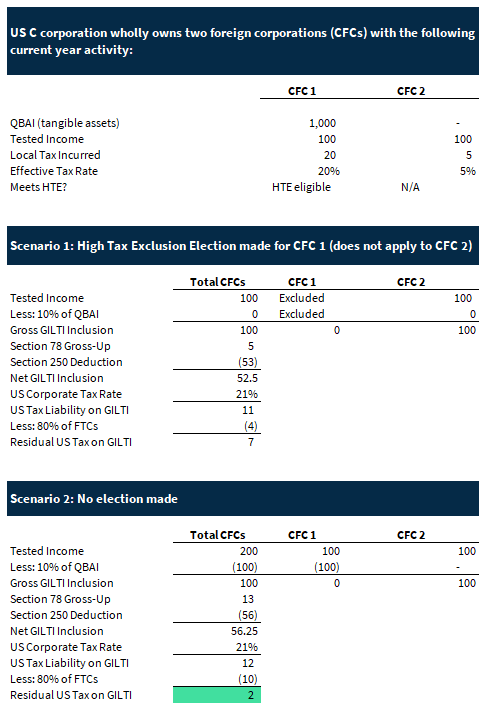

Gilti high tax exception tested unit. This threshold is unchanged from the proposed regulations. Shareholder that owns a cfc. The proposed regulations also include a number of additional revisions to the final gilti hightax exception.

New administrative burdens await for taxpayers. The proposed subpart f income exception, in other words, would apply separately to each tested unit of a cfc, rather than to separate items of subpart f income determined at the cfc level. To be eligible for the exclusion, the cfc’s earnings must be subject to an effective foreign corporate income tax rate that is greater than 90% of the current u.s.

Corporate tax rate, which is 21%). Corporate income tax rate were retained. The gilti high foreign tax exception allows a complete exclusion of gilti tested income from the federal taxable income of a u.s.

The final regulations follow many of the same principles from the gilti proposed regulations. Federal corporate income tax rate. The tested unit may appear doggedly alien to anyone used to subpart f, for under those rules the process is slightly different:

International Aspects Of Tax Cuts And Jobs Act

Lwcom

Lwcom

Highlights Of The Final And Proposed Regulations On The Gilti High-tax Exclusion - True Partners Consulting

Final Gilti Hte Regs Provide Flexibility Grant Thornton

Final Gilti High-tax Regulations And The Tested Unit Would A Rose By Any Other Name Smell As Sweet - Tax - United States

Lwcom

International Aspects Of Tax Cuts And Jobs Act

Lwcom

High-tax Exception Now Available For Gilti Income Sciarabba Walker Co Llp

Treasury Issues Final Regulations For Gilti High-tax Exclusion And Proposed Regulations For Subpart F High-tax Exception - Wilkinguttenplan

Understanding Gilti - For Us Expats In Canada - Maroof Hs Cpa Professional Corporation Toronto

Gilti High Tax Election In The United States Of America

Lwcom

Gilti High-tax Exclusion How Us Shareholders Can Avoid The Negative Impact Sch Group

Lwcom

International Aspects Of Tax Cuts And Jobs Act

Assetseycom

Gilti High-tax Exclusion Final Regulations Crowe Llp

Comments

Post a Comment