The median property tax (also known as real estate tax) in haralson county is $759.00 per year, based on a median home value of $109,000.00 and a median effective property tax rate of 0.70% of property value. The property tax rates are shown at a summary level and for individual properties.

Haralson County Tax Assessors Office

If the county board of tax assessors disagrees with the taxpayer’s return on personal property (such as airplanes, boats or business equipment and inventory), the board must send a notice of.

Haralson county tax assessor address. The buyer of the tax lien has the right to collect the lien, plus interest based on the official specified interest rate, from the property owner. The haralson county directory portal for local tax assessor offices provides a comprehensive guide to the public. Learn more about haralson county property records and search data related to property tax, appraiser, auditor and assessor records that may be available at the county clerk’s office.

4266 georgia hwy 120, buchanan, ga 30113 The median property tax in haralson county, georgia is $759 per year for a home worth the median value of $109,000. The certificate is then auctioned off in haralson county, ga.

Haralson county clerk & property records. Haralson county tax assessors office contact information. Search official public records for this jurisdiction to determine real property ownership.

Timothy redding real estate website. Haralson county collects, on average, 0.7% of a property's assessed fair market value as property tax. In addition, the website will include forms for change of address, homestead exemptions, and personal property exemptions specific to your situation.

Data may be searchable by owner's name, address or parcel number. View sales history, tax history,. Address the douglas county assessor’s office makes no warranties, either expressed or implied, concerning the accuracy or completeness of the data presented on this website for any other use, and assumes no liability associated with the use of this data.

4266 georgia hwy 120, buchanan, ga 30113 Search official public records for this jurisdiction to determine real property ownership. Let me get straight to the point.

Assessor’s conference room third floor administration building 240 constitution boulevard Wheeler county assessor haralson county assessor gwinnett county assessor mitchell county. The tax commissioner’s office is responsible for issuing vehicle tags, renewal of tag decals, application for titles for vehicles or mobile homes and the billing and collection of ad valorem (property) taxes.

Address, phone number, and fax number for haralson county tax assessors office, an assessor office, at georgia 120, buchanan ga. Beacon and qpublic.net are interactive public access portals that allow users to view county and city information, public records and geographical information systems (gis) via an online portal. Georgia is ranked 1925th of the 3143 counties in the united states, in order of the median amount of property taxes collected.

To get questions answered about your appraisal, find a property appraiser, or appeal a decision made by a property appraiser in haralson county, you can contact them at the following address: Office information for the haralson county, georgia property appraiser. Data may be searchable by owner's name, address or parcel number.

124,559 people compose 10,886 households. The county board of tax assessors must send an annual notice of assessment which gives the taxpayer information on filing a property tax appeal on real property (such as land and buildings affixed to the land). Haralson county is the 41st largest county in georgia in terms of population:

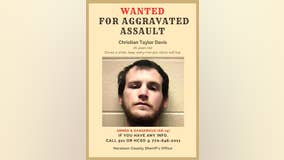

The site includes the name of the assigned tax assessor office for easy reference and related transaction. The haralson county sheriff's office enforces all laws and ordinances, protects life and property, preserves the peace and strives to prevent crime and disorder. Property located at 1755 haralson county scenic byway, buchanan, ga 30113 sold for $127,500 on jan 15, 2009.

Haralson county collects relatively low property taxes, and is ranked in the bottom half of all counties in the united states by property tax collections. Haralson county tax assessors office bob mcpherson chief appraiser p o box 548 buchanan, ga 30113 phone: Welcome to my site, where it's all about home.

All applications must be sent to the board of assessor's office no later than april 1st. As members of the haralson county sheriff's office, we are charged with the responsibility of serving and protecting the residents of haralson county and those who visit and pass through our county. The tax commissioner and staff are dedicated to providing prompt, professional, and courteous service to the taxpayers of haralson county;

Vote Natasha Overbey Pope Haralson County Tax Commissioner - Home Facebook

News Articles - Haralson County Board Of Commissioners

Haralson County School District

Haralson County

Vote Natasha Overbey Pope Haralson County Tax Commissioner - Home Facebook

Haralson County Tax Assessors Office

Haralson County School District

Haralson County School District

Haralson County Georgia Genealogy Familysearch

Zck84fwgmfwdnm

Felony Probation - Haralson County Board Of Commissioners

Bail Bonds In Haralson County Ga Ultimate Guide

Haralson County Georgia

Haralson County School District

Haralson County School District

Haralson County Tax Assessors Office

2

Vote Natasha Overbey Pope Haralson County Tax Commissioner - Home Facebook

Haralson County Northwest Georgia Regional Commission

Comments

Post a Comment