This year, tax payer have to get new tin number before submitting tax return.they can get registration online. The cbdt has introduced a new facility.

Guide To Company Registration In Bangladesh - Emerhub

Father, mother, husband/wife's id card photocopy.

How to open tax file in bangladesh. After obtaining the approval for a branch or liaison office, a bank account must be opened in any bank in bangladesh. File itr for income from salary, interest, business, capital gains, house property & utilize deductions under 80c, 80d, 80ccf, 80g, 80e, 80u etc. Along with date of birth in lower case(example:.

To obtain tax identification number, one can apply either in manually or electrically through national board of revenue (nbr). What is the password to open itr ? Most likely can be only opened or accessed in software that has been used to create or save the.2021 file in first place.

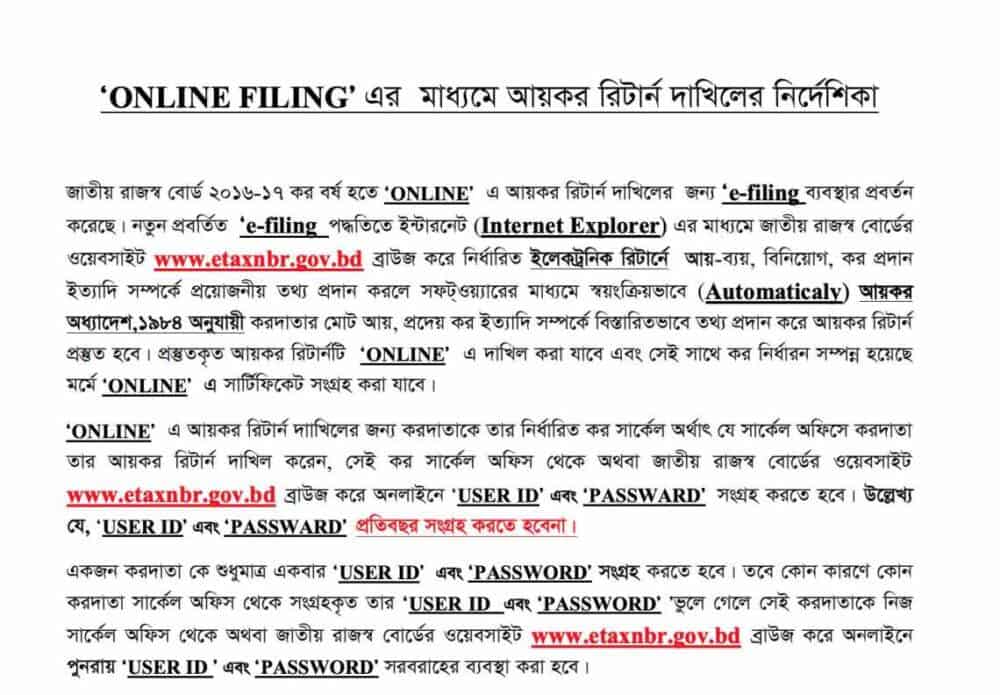

Provided that the above time limit may be extended upto such time as deemed fit by the chief controller of import and export; Individual income tax return means submission of return of annual income in the prescribed form to the deputy commissioner of taxes (dct) of respective individual taxpayer’s circle of nbr by a person. The typical etin number is 12 digit and if you had any tin numbers before;

(ix) serves in the board of directors of a company or a group of companies: No tax for liaison office or representative office. Your tax data file (.tax file) is not the same thing as a pdf copy of your return.

For some cases you may need to fill up a special form for declared special areas. Of credit shall be opened by all importers within one hundred and fifty days from the date of issue /registration of lca form: Because it's stored locally on your computer, we can't retrieve tax data files prepared in the turbotax cd/download software.

It might very well be that some conversion of.2021 file is possible, depends on the particulal type of the file. Tax is the main source of revenue for the government of any country. The cbdt has issued the relevant itr forms for the assessment year.

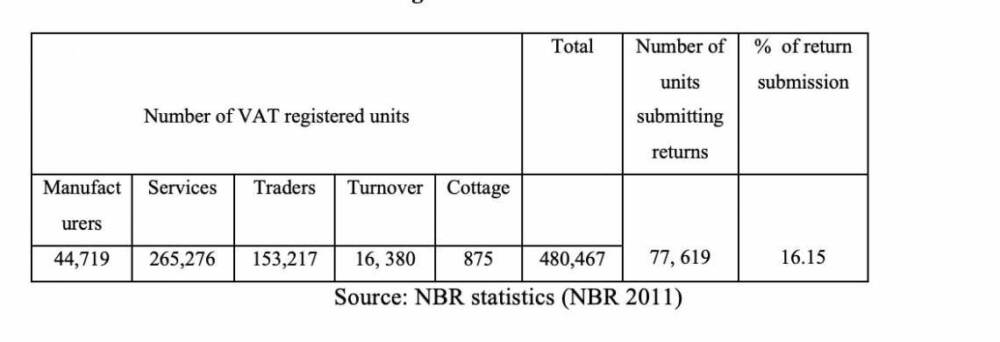

The last resort would be to try another computer and login to efiling there. This includes detailed data, some dating back almost twenty years, on balance of payments,. The standard rate of vat in bangladesh is 15%.

In bangladesh the national board of revenue (nbr) is the only authority to provide tin certificate to the applicant. Bangladesh bank took another step forward in making its vast repository of data accessible to the general public. Bangladesh bank open data initiative.

Turnover tax applicable to turnover tax payer up to taka 8 million is 3% (vat is not applicable to them). Income tax deptt sent you a encripted pdf , and most of the tax payers find himself unable to open their itr. Bank account opening and us$ 50,000.

A.tax file can only be opened in the turbotax cd/download software. The java and excel versions have been discontinued by the it department from this year. But lo/ro has no commercial activities in bangladesh as discussed above so, they have no income.

With income tax in particular, different statutory requirements for e.g. The rates of tax applicable in bangladesh are as follows: You might need to register for new etin numbers online.

You can extend the name by filing an extension request just before the expiry date. Citizenship certificate (as applicable) 6. Income advance tax, source tax deduction, tax exemptions, tax rebate, procedures for filing annual tax returns along with their assessments, etc., and their correlation, which can be found difficult without proper knowledge.

Data from the monthly economic trends publication can now be easily downloaded by anyone interested, free of cost, into an excel file. Passport / driving license / tin certificate. (b) for import under foreign aid/grant and barter/sta, l/c shall be opened

Bank account opening and bringing in the paid up capital this step is only applicable if the proposed company has foreign shareholding. Who is bound to file income tax return? The password for the itr is combination of pan (in lower case) and date of birth in ddmmyyyy format.

Online tin registration and tax calculation in bangladesh. Supplementary duty at different rates on luxury goods and various services. An assessee liable to pay tax on his taxable income.

Here one by one, we will explain the procedures and regulations in. Select open tax return from the file menu (windows) or turbotax menu (mac), browse to the location of your.tax or tax data file (not the pdf), select it, and then select open. As the branch office has commercial activities so if it makes profit then it is liable to pay tax at 35%.

An amount of foreign exchange equivalent to us$ 50,000 or more must be brought in as inward remittance in bangladesh within 02(two) months from the date of issuance of the bida permission letter. One can either obtain tin certificate in bangladesh manually or electronically by applying to nbr. Click continue under the return you want to open, or.

In some condition, individual tax payers must obtain tin certificate and file the tax return to dct.

How To Collect E Tin Certificate From Online In Bd Only 5 Minutes

Free Hotel Receipt Template Invoice Template Word Invoice Format Invoice Template

Pharmacy Medicine Shop Flyer Vol-01 Corporate Identity Template Flyer Template Flyer Pharmacy

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

Can You Deposit Indian Rupees To Nre Account Savings Investment Tips Savings And Investment Accounting Investment Tips

How To Register For E-tin Etin In Bangladesh Just In 10 Minutes

Pin On Online Earning Bd Real Online Earning

Online E-tin Registration And Income Tax Return 2021-22

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

Bankingfinancial Awareness 24th December 2019 Awareness Banking Financial

Online E-tin Registration And Income Tax Return 2021-22

Pin On Mes Enregistrements

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

What Documents Require With Return Of Income To Nbr In Bangladesh

Return Submission May Be Mandatory For All Tin Holders

Bangladesh Independence Day Vector Template Design Illustration Bangladesh Independence Flag Png And Vector With Transparent Background For Free Download Illustration Design Template Design Independence Day

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

Contract Law Flowchart Offer And Acceptance Damages Contract Law Offer And Acceptance Flow Chart

Comments

Post a Comment