The tax rate for the company is 30%. Common expenses that are deductible include depreciation, amortization, mortgage payments and interest expense

Tax Shield Calculator Efinancemanagement

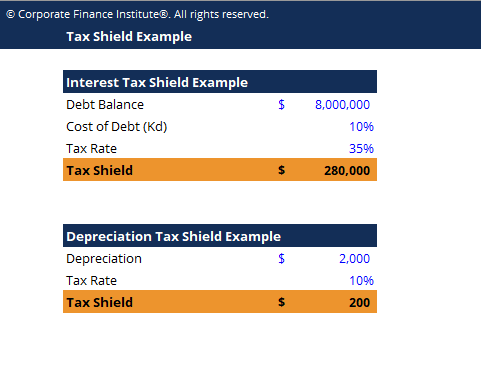

The interest tax shield can be calculated by multiplying the interest amount by the tax rate.

Interest tax shield calculator. The interest tax shield is an important consideration because interest expense on debt (i.e. Interest tax shield = interest. (5) this equation shows expicitly that the capital structure in is important, and not the capital structure in.

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest , medical expenses , charitable. So the total tax shied or tax savings available to the company will be $15900 if it purchases the asset through a financing arrangement. For individuals.tax rate is primarily used for interest expense and depreciation expense in the case of a company.

Tax shield is the reduction in the taxable income by way of claiming the deduction allowed for the certain expense such as depreciation on the assets, interest on the debts etc and is calculated by multiplying the deductible expense for the current year with the rate of taxation as applicable to the concerned person. The calculation of interest tax shield can be obtained by multiplying average debt, cost of debt cost of debt cost of debt is the expected rate of return for the debt holder and is usually calculated as the effective interest rate applicable to a firms liability. (4) ∑ = + = n t 1 t f f s (1 r) r dt e it is assumed.

The formula and variables are as follows. (2) is the formula for calculating the interest tax shield based on the modigliani and miller theory , eq. Interest expenses (via loan and mortgages) are tax deductible, meaning they lower the taxable income.

The tax shield strategy can be used to increase the value of a business, since it reduces the tax liability that would otherwise reduce the. Interest tax shield = average debt × cost of debt × tax rate Pv of tax shield will be added to the cash flow in time period 0 as a positive cash flow.

(3) is the formula of its present value. A tax shield is a reduction. Else this figure would be less by $ 2400 ($8000*30% tax rate), as only depreciation would.

Saving due to the payment of interest (vts). Thus, if the tax rate is 21% and the business has $1,000 of interest expense, the tax shield value of the interest expense is $210. It contains the total present value of the tax shield provided by the amortization of the asset, less the discounted loss of the tax shield from the eventual disposal of the asset.

The most important financing side effect is the interest tax shield (its). The argument is that the risk of the tax saving arising Interest tax shields refer to the reduction in the tax liability due to the interest expenses.

A tax shield is a reduction in taxable income for an organization achieved through claiming allowable deductions such as mortgage interest, medical expenses, charitable donations, amortization, and depreciation. A tax shield is an allowable deduction from taxable income that results in a reduction of taxes owed.tax shield can be claimed for a charitable contribution, medical expenditure etc. Use ocf formula to find.

Annual tax deductible depreciation ($): The tax savings are calculated as the amount of interest multiplied by the tax rate. Setting as weighted average return rates of debt and equity without tax shield we get:

Capital budgeting techniques (calculators) by: Tax shield on interest expense is another fancy way of saying the tax deduction that the business will receive on the interest it must pay as it makes its debt payments. They think tax shield, which is [interest expenses * tax rate], should be added back to calculate fcff because most companies deduct interest expenses in calculating taxes.

A tax shield is an allowable deduction from taxable income that results in a reduction of taxes owed. Thus, interest expenses act as a ‘shield’ against the tax obligations. D t kd] [3] according to myers (1974), the value creation of the tax shield is the present value of the interest tax shield discounted at the cost of debt (kd).

The calculation of interest tax shield can be obtained by multiplying average debt, cost of debt and tax rate as shown below. Interest = 8,000 (i.e., 200,000*4%) tax shield = (8,000 + 45,000) * 30% = $15,900. For example, for a company with a 15% loan of $200000 and a tax rate as 25%, the tax shield approach will be 15% x $200000 x 25% = $7500.

We can calculate this by taking interest expense and multiplying it by the marginal tax rate (which we should find in the footnotes): 1 it is based on the assumption that the main source of tax shields (hereinafter ts) is the. Hence we get the well known expression for :

Myers proposes calculating the vts in the following manner: How to calculate the tax shield. (4) in most cases the tax shield is the interests paid on times the marginal tax rate.

The value of these shields depends on the effective tax rate for the corporation or individual. Companies pay taxes on the income they generate.

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Taxes Icon - Business Calculator Ticket Payment Taxes Commerce And Shopping Business And Finance Tax Law And Justice Icon Tax

Tax Shield Formula How To Calculate Tax Shield With Example

Accounting Calculator Percent Percentage Tax Taxation Icon - Download On Iconfinder Accounting Calculator Icon

Voltage Divider Calculator Voltage Divider Resistor Divider

Indemnity Calculation Kuwait Online 2021 In 2021 Indemnity Kuwait Days And Months

Tax Shield Formula How To Calculate Tax Shield With Example

Ncdissue A Better Way To Grow Your Investment Contact Our Nearest Branch For More Details Call 0495 - 2 Loan Interest Rates Loan Company Finance Loans

Army Veteranowned David J Reali Cpa Cpa David J Veteran Owned Business

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Pin By Michael Ramsey On Stocks Cost Of Capital Finance Charts And Graphs

Financial Forecasting Model Templates In Excel In 2021 Financial Modeling Financial Debt

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Example Template - Download Free Excel Template

Financial Accounting Color Icon Financial Accounting Accounting Financial

Taxes Icon - Business Calculator Ticket Payment Taxes Commerce And Shopping Business And Finance Tax Icon Law And Justice Free Icons

Interest Tax Shield Formula And Calculation - Wall Street Prep

Comments

Post a Comment