Judicial branch offices and courts are closed thursday, november 11, for veterans day holiday. Use this form for a decedent who died before 1/1/1999.

2

This resolution states that the register of deeds will no.

North carolina estate tax certification. The estate tax, sometimes referred to as the “death tax,” is a tax levied against the estate of a recently deceased person before the money passes to the designated heirs. This is a north carolina form. North carolina is not one of those states.

Cash, certified check, or money order) 5. The property tax division of the north carolina department of revenue is the division responsible for this administration. Inheritance and estate tax certification | north carolina judicial branch.

What is a certificate of tax liability? Certification an individual who is a u.s. Certification an individual who is a u.s.

An estate tax certification under g.s. Estate tax certification (for decedents dying on or after 1/1/99): This resolution states that the register of deeds will no.

The appointed agent must sign the form in front of a notary. If available, read the description and make use of the preview option well before downloading the sample. County assessor and appraiser certifications.

Inheritance and estate tax certification (for decedents dying prior to january 1, 1999) g.s. North carolina estate tax certification. Estate tax certification (for decedents dying on or after 1/1/99):

There is a federal estate tax and some states also levy a local estate tax. North carolina law requires the department of revenue to provide a certification and continuing education program for county assessors and appraisers. Use the space below to explain any transfers over which the decedent retained any interest (such as a life estate), as well as any

North carolina estate tax certification. This certification must be affixed to the deed. Certification an individual who is a u.s.

The estate tax is different from the inheritance tax. Deeds and deeds of trust originating in north carolina must show the draftsman's name on the first page of the document. I, the personal representative in the above estate, certify that:1.

What is the estate tax? First name * last name * company name * mailing. Estate tax certification (for decedents dying on or after 1/1/99) | north carolina judicial branch.

Individual income tax refund inquiries: Estate tax certification for decedents dying on or after 1 1 99. Resident process agent to provide a north carolina point of contact for court service.

A ctl places a judgment on any real or personal property that is held by a taxpayer and it makes the liability public information. Estate tax certification for decedents dying on or after 1 1 99 form. Judicial branch offices and courts are closed thursday, november 11, for veterans day.

North carolina department of revenue. Estate tax certification (for decedents dying on or after 1/1/99): Don't know the parcel number?

This resolution states that the register of deeds will no. The court fee to start the process is $120 (acceptable forms: Deeds must have tax certification obtained from the alleghany county tax administrator.

This is an official form from the north carolina administration of the courts (aoc), which complies with all applicable laws and statutes. Streamlined sales and use tax agreement certificate of exemption form. Estate tax certification (for decedents dying on or after 1/1/99):

Real estate document recording checklist. North carolina estate tax certification. Use this form for a decedent who died before.

Uslf amends and updates the forms. For further information, please review nc gen. In order to get a clear title to the property, the ctl must be satisfied or resolved.

First name * last name * company name * mailing. First name * last name * company name * mailing. Visit the gis portal which provides multiple search options to search by owner(s) name, street address, street name, subdivision, pin or visual point and click from aerial photos and links to the parcel data sheet, tax bills, tax certifications, land transfers, real estate.

The following table may be. In the general court of justice before the clerk in the matter of the estate of state of north carolina county note: Use this form for a decedent who died before 1/1/1999.

Use this form for a decedent who died before 1/1/1999. Grantor's signature must be properly notarized.

Blog - The Brocker Law Firm

2

2

Register Of Deeds Lenoir County North Carolina Official Website

Texas Board Of Legal Specialization Board Certified Lawyers In Texas

The Need For A Pour Over Will - Estate Planning

How Probate Works In North Carolina

2

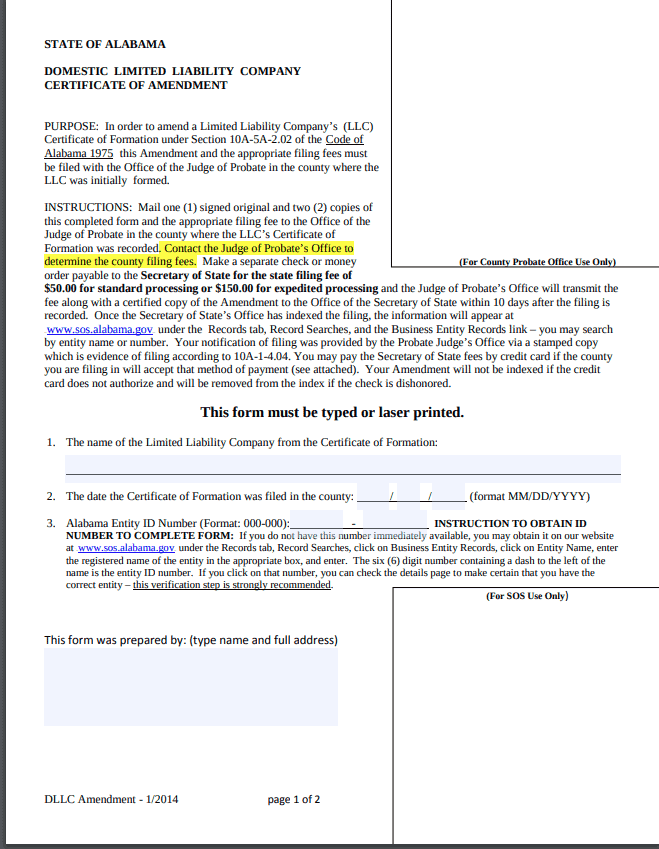

How To File An Alabama Llc Amendment With The Secretary Of State

2

Back To Genealogy Basics - Marriage Records Are You My Cousin Marriage Records Genealogy Family Tree Genealogy

2

How Do I Put A 1099-s Inherited Home Sale On My Irs Taxes

Tax Forms Documents - Brunswick County Government

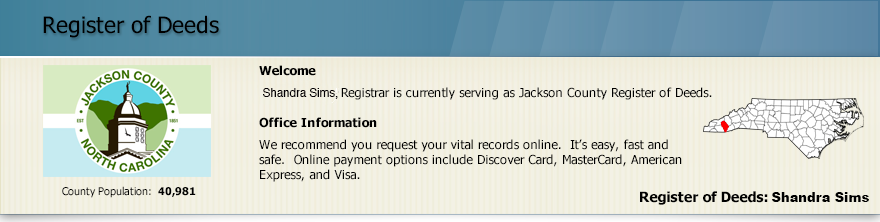

Jackson County - Birth Certificates Death Certificates Marriage Certificates Register Of Deeds Vital Records

2

What Is A Small Estate Affidavit - Hopler Wilms Hanna

Reasons Why An Appraisal Comes In Low Real Estate Advice Real Estate Tips Real Estate Information

How To Prove Ownership Of Real Estate - Deedscom

Comments

Post a Comment