Form 8971, information regarding beneficiaries acquiring property from a decedent. Form 706, federal estate tax return.

General Power Of Attorney Form Pdf Power Of Attorney Form Power Of Attorney Estate Planning Checklist

Can a taxpayer deduct more than $10,000 of real estate tax on a north carolina return?

North carolina estate tax return. An estate is a legal entity created as a result of a person's death. An estate or trust that is granted an automatic extension to file a federal income tax return will be granted an automatic extension to file. North carolina estate tax return.

Form 1041, income tax return for estates. If you live or work in nc when you die, your estate may be subject to these taxes. North carolina does not collect an inheritance tax or an estate tax.

You may also need to file an income tax return for the estate. Beneficiary's share of north carolina income, adjustments, and credits. Use this form for a decedent who died before 1/1/1999.

In the matter of the estate of state of north carolina county note: You’ll need to file a final income tax return for the decedent. While there isn’t an estate tax in north carolina, the federal estate tax may still apply.

Description estates and trusts income tax instructions. Reopen the estate (after probate is closed) notice to beneficiaries that they are named in a will. You will be informed about the amounts by the clerk’s office.

Complete this version using your computer to enter the required information; So, if your home sells for $300,000, you would multiply 300,000 x 0.002 to get an excise tax amount of $600. There’s also a number for inquiries into individual tax refunds:

An estate tax certification under g.s. File your north carolina and federal tax returns online with turbotax in minutes. The inheritance tax rate in north carolina is 16 percent at the most, according to nolo.

Vermont's estate tax is a flat rate of 16% on the portion of a. Description estates and trusts tax credit summary. Effective january 1, 2013, the north carolina legislature repealed the state's estate tax.read on for information on how the north carolina estate tax was applied to the estates of those who died prior to 2013.

North carolina currently does not enforce an estate tax, often referred to as the “death tax.” but the federal government levies the estate tax on the portion of your estate that you pass on to your heirs if it’s valued above a certain limit. Then print and file the form. In this article, we break down north carolina’s inheritance laws, including what happens if you die without a valid will, and what happens to your property.

The estate will need its own tax identification number if sets up an estate checking account, or if there is interest or dividends payable to the estate. The exemption is portable for spouses, meaning that with the right legal steps a couple can protect up to $22.36 million upon the death of both. Efiling is easier, faster, and safer than filling out paper tax forms.

Published by north carolina administrative office of the courts judge marion r. Estate trusts » estates and. Another way in which the transfer of wealth can be taxed is through the collection of an “inheritance tax.

Description beneficiary's share of north carolina income, adjustments, and credits. An antique automobile must be assessed at the lower of its true value of five hundred dollars ($500.00). Or concerning federal and state taxes payable by the estate.

Some states still charge an estate tax (death tax). Court costs and fees must be paid to the clerk of superior court. Efile your north carolina tax return now.

The federal estate tax exemption increased to $11.18 million for 2018, when the 2017 tax law took effect. Previous to 2013, if a north carolina resident died with a large estate, it might have owed both federal estate tax and a separate north carolina estate tax. If you are inheriting from someone in another state, your inheritance may also be subject to a state death tax from the originating state.

However, state residents should remember to take into account the federal estate tax if their estate or the estate they are. Free for simple returns, with discounts available for taxformfinder users! Even though north carolina has neither an estate tax or nor an inheritance tax, the federal estate tax still applies to north carolinians, depending on the value of their estate.

You must keep accurate records and file accurate accounts.

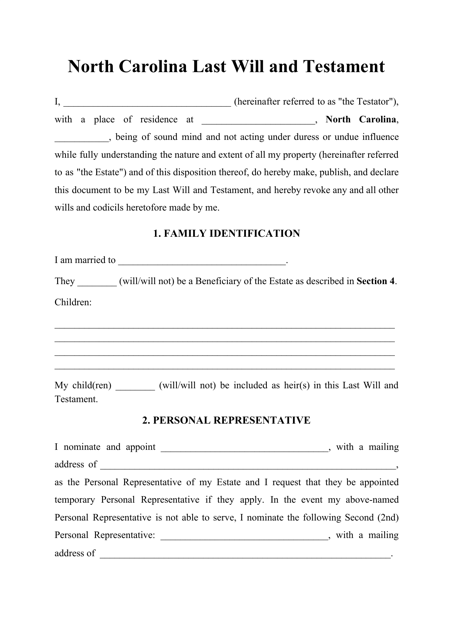

North Carolina Last Will And Testament Legalzoomcom

Lodging The Mast Farm Inn Beautiful Cabins Mansion Hotel Beautiful Hotels

15 Things To Know Before Moving To North Carolina - Smartasset

Top 10 Safest Cities In North Carolina - Newhomesource

Lake Tomahawk Black Mountain Nc Mountain Travel Lake Fall Colors

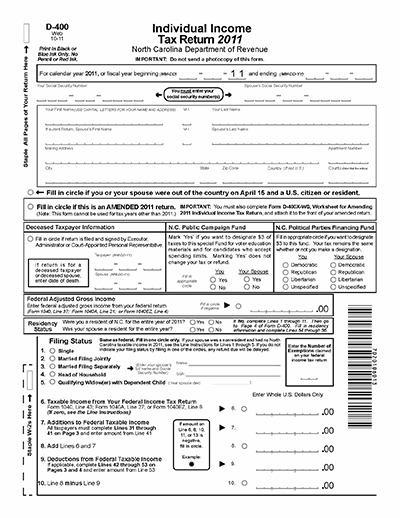

North Carolina Income 2021 2022 Tax Return Nc Forms Refund Status

South Carolina Vs North Carolina - Which Is The Better State Of The Carolinas

North Carolina Sales Tax - Small Business Guide Truic

Free North Carolina Power Of Attorney Forms Pdf Templates Power Of Attorney Form Power Of Attorney Attorneys

Pin By Hendrick Melville On Writing Meme Diy Travel Journal Travel Journal Packing Tips For Travel

North Carolina Last Will And Testament Template Download Printable Pdf Templateroller

Xtkbprh0hwrqhm

North Carolina First

Taxes State Ncpedia

15 Things To Know Before Moving To North Carolina - Smartasset

Irs Tax Problems Irs Taxes Tax Debt Tax Services

Tax Comparison - North Carolina Verses South Carolina

Pbmares Insights 2021 North Carolina Tax Reform

Murphy Nc Map One-mile Hike Into The Nantahala National Forest Leads To This North Carolina Mountains Murphy Nc Nc Mountains

Comments

Post a Comment