Up until now, the tax rate on capital gain has been zero, 15% or 20%, depending on your income. The current maximum 20% rate will continue to apply to gains earned prior to september 13, 2021, as well as any gains that originate from transactions entered into under binding written contracts prior to september 13, 2021.

Bidens Proposed Retroactive Capital Gains Tax Increase White Sands Tax Solutions

While it is unknown what the final legislation may contain, the elimination of a rate increase on capital gains in the draft legislation is encouraging.

Retroactive capital gains tax september 2021. The capital gains tax increase as of september 13, 2021, there are no retroactive taxes in the proposal affecting individuals, estates or trusts. Perhaps, had congress looked to enact such changes earlier in 2021, the chance to make the capital gains tax changes retroactive (to, perhaps, the start of. Corporate tax rates, individual tax rates, estate tax rules also are on the negotiating table.

But additionally, he wants this implemented retrospectively to april 2021. The proposed tax increase on capital gains may be applied to taxpayers with annualized realized gains over $1 million,. It is important to note that it would not be retroactive to january 1, 2021, so all previously recognized portfolio activity or any sale agreed upon prior to october 1 st but executed post october 1 st (i.e., signed real estate contract or agreed upon business sale) would still be subject to the 20% capital gains rate.

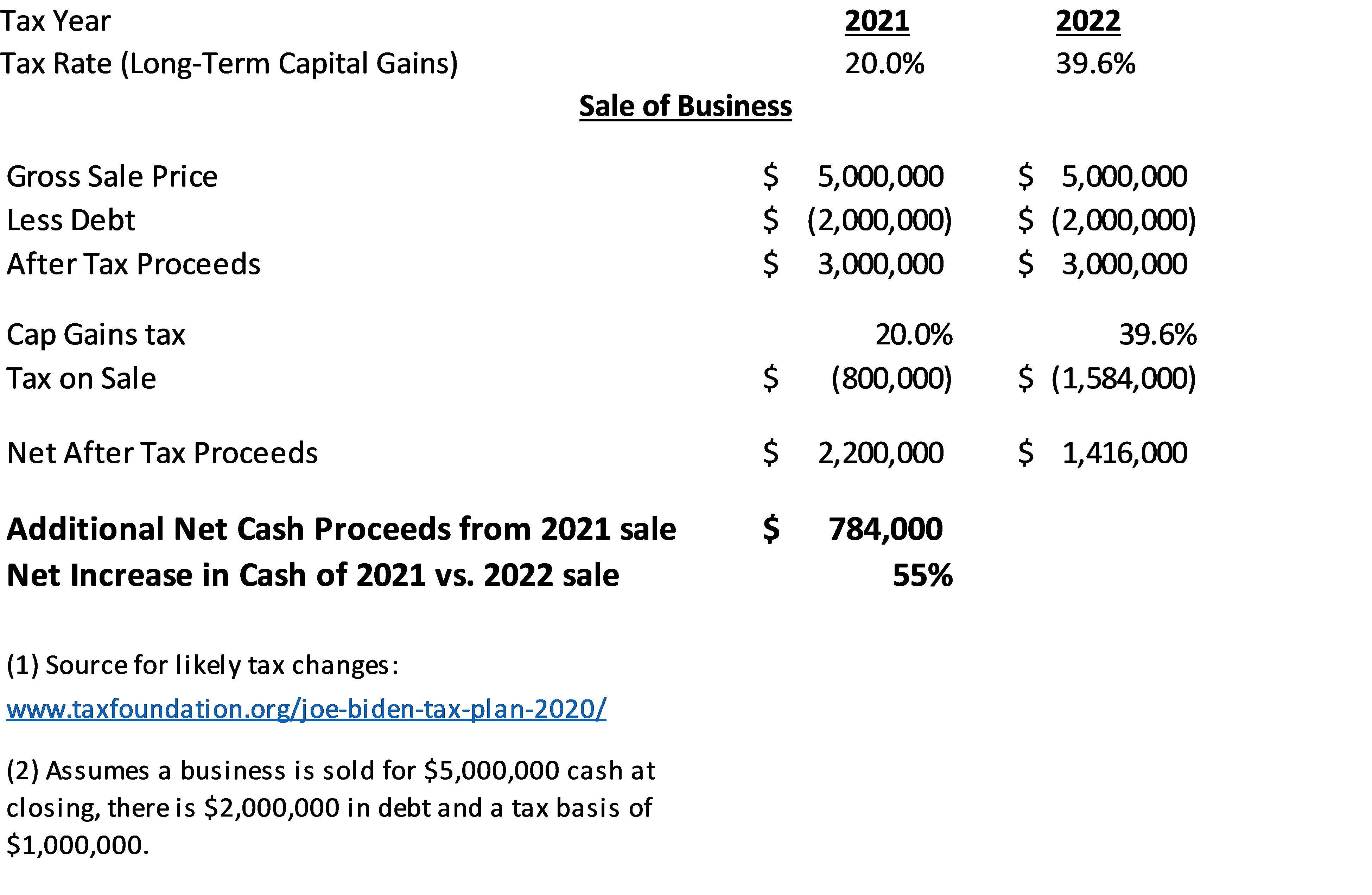

Is the retroactive tax increase constitutional or fair? Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill, and the potential effective date is critical for many investment decisions. Another would raise the capital gains tax rate to 39.6% for taxpayers earning $1 million or more.

The long term capital gain tax is graduated, 0% on income up to $40,000, 15% over $40,000 up to $441,450, and 20% on income over $441,451 (in some cases, add the 3.8% obamacare tax). If this were to happen, it may not only seem unfair, but it is also bad tax policy. Are retroactive tax increases constitutional or even fair?

The president’s proposed 43.4% capital gain rate is supposed to hit only those earning $1m or more, but if you bought a house 30 years ago that is now worth over. Introduces a 3% surtax on income >$5m (including capital. One idea in play is a retroactive capital gains tax increase, raising the top tax rate, currently 23.8 percent, imposed on the gain from the sale of assets held longer than a year.[9] president biden’s budget proposal suggested raising the rate on such capital gains to 43.4 percent for households with income over $1 million, effective for all sales on or after april 2021.

Increased to 25% from the current 20% rate, with retroactive application to gains arising from transactions occurring after september 13, 2021, subject to a binding contract exception. The long term capital gain tax is graduated, 0% on income up to $40,000, 15% over $40,000 up to $441,450, and 20% on income over $441,451 (in some cases, add the 3.8% obamacare tax). 9 president biden’s budget proposal

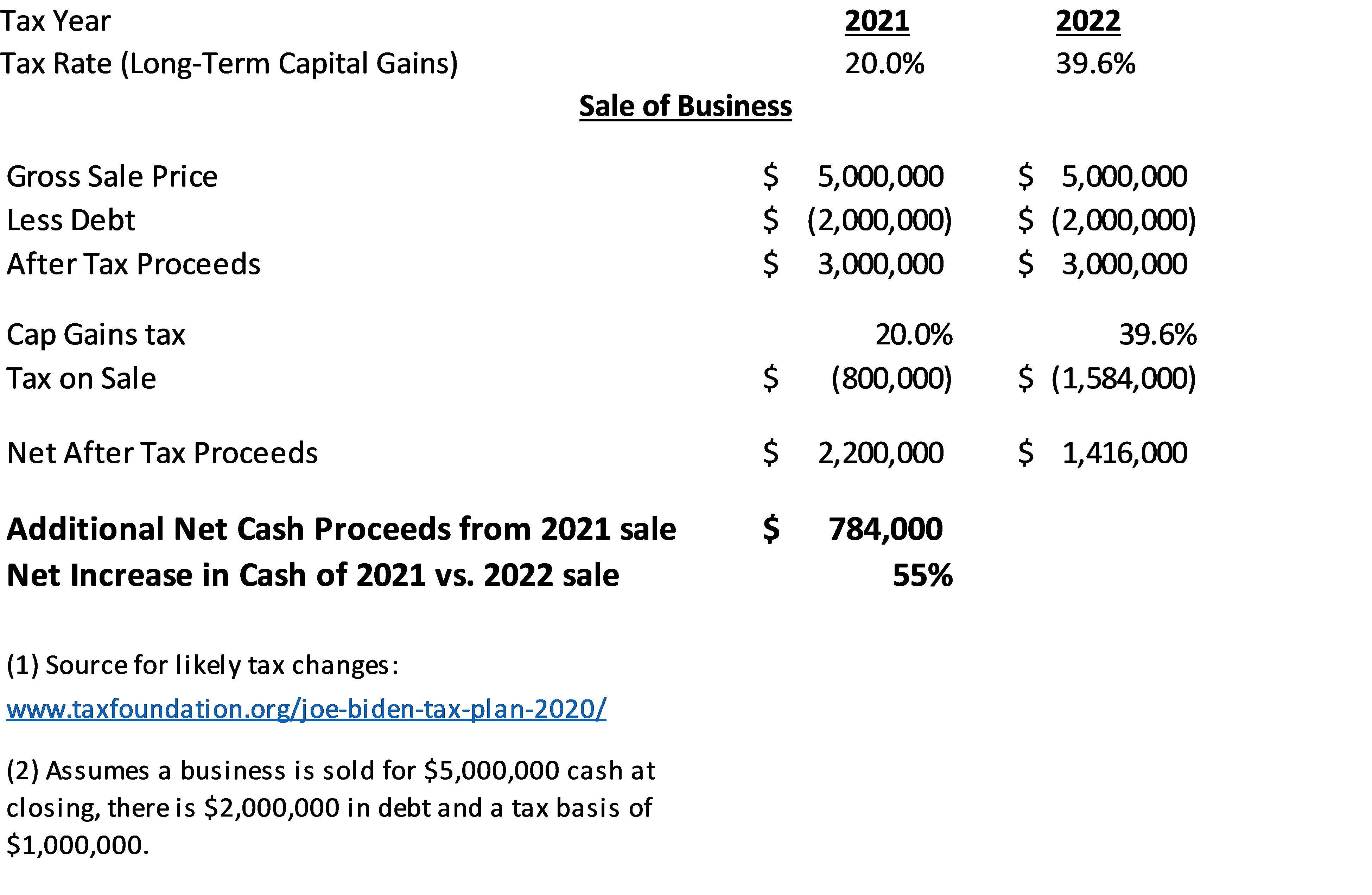

1 congress already passed one budget reconciliation bill in 2021 (the american rescue plan), which was for the fiscal year ending 2021. In some cases, you add the 3.8% obamacare. Therefore, there could be an additional 8% tax on a transaction that closes in 2022 vs 2021.

Currently, the top capital gain tax rate is 23.8 percent for gains realized on assets held longer than a year. The long term capital gain tax is graduated, 0% on income up to $40,000, 15% over $40,000 up to $441,450, and 20% on income over $441,451 (in some cases, add the 3.8% obamacare tax). An exception to this retroactive effective date applies to written binding contracts in effect as of september 12, 2021 (in the case of the 50% limit on the gain exclusion for qsbs) or september 13, 2021 (in the case of the.

In some cases, we will add a 3.8% obamacare tax, but in the worst case, the total tax will be 23.8%. Faq on capital gains outlook and effective date. One of the proposals congress is considering sets the top rate for taxing capital gains at 25%, up from 20% under current law.

As we enter into a new era of tax code proposals from the biden administration, it’s important to be thinking about what those changes may mean when planning for the upcoming tax season and retirement. Previously, the tax rate on capital gains was zero, 15%, or 20%, depending on income. Up until now, the tax rate on capital gain has been zero, 15% or 20%, depending on your income.

Biden plans to increase this to 43.4 percent for households earning more than $1 million. The president’s proposed 43.4% capital gain rate is supposed to hit only those earning $1m or more, but if you bought a house 30 years ago that is now worth over $1m, you. Retroactive effective date for capital gains tax increase is a bad idea.

Another would raise the capital gains tax rate to 39.6% for taxpayers. In some cases, you add the 3.8% obamacare tax, but at worst, your total tax bill is 23.8%. One of the proposals congress is considering sets the top rate for taxing capital gains at 25%, up from 20% under current law.

The president’s proposed 43.4% capital gain rate is supposed to hit only those earning $1m or more, but if you bought a house 30 years ago that is now worth over. Are retroactive tax increases constitutional or even fair? Still another would make the change to capital gains tax retroactive, with a start date of april 2021.1,2

A retroactive capital gains tax increase. At this point, many ideas are being considered as legislators look for ways to raise revenue to help pay for the build back better plan. One idea in play is a retroactive capital gains tax increase, raising the top tax rate, currently 23.8 percent, imposed on the gain from the sale of assets held longer than a year.

Still another would make the change to capital gains tax retroactive, with a start date of april 2021.

Yellen Argues Capital Gains Hike From April 2021 Not Retroactive

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step-up In Basis Among Others

Time Is Running Out Close Before December 31st 2021 For Potentially Significant Tax Savings - Newbridge Group

Crystal Ball Gazing To The Past - Article By Pearson Co

Possible Retroactive Capital Gains Hike Panics Investors Qsbs Holders Could Be At Risk - Qsbs Expert

Wall Street Panicking That Bidens Tax Hikes Will Be Retroactive

2021-2022 Proposed Tax Changes Wiser Wealth Management

A Retroactive Tax Increase - Wsj

Critics Sound The Alarm Ahead Of Possible Retroactive Capital Gains Tax Hike

Crystal Ball Gazing To The Past - Article By Pearson Co

Steps Advisors Could Take Ahead Of Potential Changes In Capital Gains Tax Law Aperio

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains Rsuperstonk

Business Owners Speed Up Planned Sales Over Biden Tax Hike Fears

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step-up In Basis Among Others

The Real Question On A Capital Gains Hike Is Whether Its Retroactive

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains Rsuperstonk

Capital Gains Tax Hike And More May Come Just After Labor Day

.png)

Bidens Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp - Jdsupra

Advisors Look For Ways To Offset Bidens Retroactive Capital Gains Tax Hike

Comments

Post a Comment