What are the recent changes to south carolina rollback tax laws? This offers property tax breaks to homeowners who are over the age of 65, permanently disabled or legally blind.

2019-2021 Form Sc Pt-401-i Fill Online Printable Fillable Blank - Pdffiller

Even though there is no south carolina estate tax, the federal estate tax might still apply to you.

South carolina estate tax exemption 2021. Applications seeking the 6% exemption are due by january 30, 2021, to the beaufort county assessor. Vermont also continued phasing in an estate exemption increase, raising the exemption to $5 million on january 1, compared to $4.5 million in 2020. According to the south carolina department of revenue, the homestead exemption relieves you from taxation on the first $50,000 in fair market value of your owned legal residence if you are over the age of 65, or you are totally and permanently disabled, or you are legally blind.

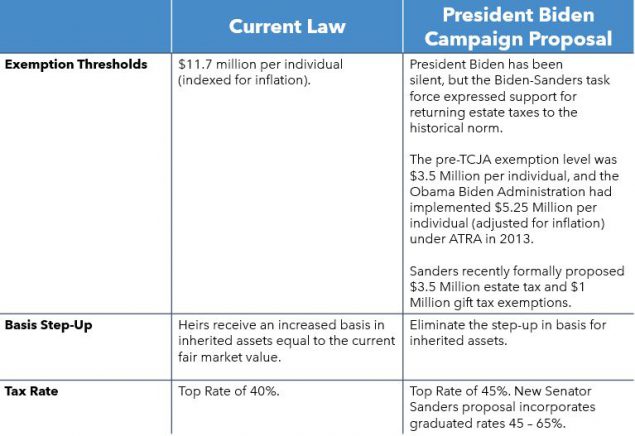

However, with the democrats in office, we could see a reduction as early as 2022. If you submitted your application on or after june 1, 2021 you may check the status here: Here’s an example of how to calculate your federal estate tax burden:

The estate tax exclusion is $4,000,000 as of 2021, after the district chose to lower it from $5,762,400 in 2020. Who is exempt from paying property taxes in sc? However, estates valued at less than $1,000,000 are not taxed in any jurisdiction.

South carolina has a capital gains tax on profits from real estate sales. Estate tax rates are typically assessed in brackets after the exemption threshold, like income tax is assessed. No estate tax or inheritance tax

What taxes do seniors pay in south carolina? What are the recent changes to south. No estate tax or inheritance tax.

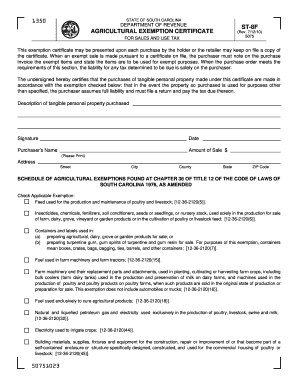

This is an annual election available to qualified entities and qualified owners starting in 2021. View exemptions for applications submitted prior to june 1,. The county assessor however automatically will apply rollback taxes to any property in which the purchaser has not filed an application to continue an agricultural use special assessment ratio property tax exemption.

We streamlined the property tax exemption application process to. Let’s say your estate is worth $14 million and you aren’t married. Right now, qualifying homeowners are exempt from paying taxes on $50,000 of their property’s value.

The top estate tax rate is 16 percent (exemption threshold: Those tax exemptions are currently set to be reduced to $5,700,000, or less, by 2025. The applicable south carolina county will not prorate rollback taxes between purchasers and sellers.

In 2021, the exemption is $11,700,000 per individual and $23,400,000 for a married couple. Currently, south carolina does not impose an estate tax, but other states do. The south carolina capital gains rate is 7% of the gain on the money collected at closing.

The federal estate tax exemption is $11.18 million in 2018. (2) where the property remains taxed at 6% ratio. Subtracting the exemption of $11.18 million, leaves you with a taxable estate of $2.82 million.

The tax rate, as of 2019, typically starts at 10% and then increases in steps up to about 16%. The district of columbia moved in the opposite direction, lowering its estate tax exemption from $5.8 million to $4 million in 2021, but simultaneously dropping its bottom rate from 12 to 11.2 percent. The top estate tax rate is 16 percent (exemption threshold:

This tax is portable for married couples, meaning that if the right legal steps are taken a married couple’s estate of up to $22.36 million is exempt from the federal estate tax when both spouses die. Applications seeking the 6% exemption are due by january 30, 2021, to the beaufort county assessor. In addition there is a federal estate tax imposed on estates in excess of a threshold, called an “exemption,” that changes from time to time.

Real estate taxation is a year in arrears, meaning to be exempt for the current year, you must be the owner of record and your effective date of disability must be on or before 12/31 of the previous year. The top inheritance tax rate is 15 percent (no exemption threshold) rhode island: The rates range from 18% to 40%.

In particular, we may see changes to the estate tax. However, south carolina also has a 44% exclusion from the capital gains flowing from the 1040 federal return, effectively reducing the state tax to 3.92%. South carolina has no estate tax for decedents dying on or after january 1, 2005.

Starting in 2022, the exclusion amount will increase annually based on.

2021 Guide To Potential Tax Law Changes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2020 Estate And Gift Taxes Offit Kurman

2021 Guide To Potential Tax Law Changes

Honolulu Property Tax - Fiscal 2021-2022

Scanning The Horizon In A Sea Of Noise - Rockefeller Capital Management

Sc Exemption Certificate - Fill Out And Sign Printable Pdf Template Signnow

New Yorks Death Tax The Case For Killing It - Empire Center For Public Policy

2016-2021 Form Sc St-8 Fill Online Printable Fillable Blank - Pdffiller

2021 Guide To Potential Tax Law Changes

South Carolinas 2021 Tax Free Weekend Kicks Off On Friday August 6

Property Tax Relief For Homeowners - Disability Rights North Carolina

How Do State Estate And Inheritance Taxes Work Tax Policy Center

2021 Guide To Potential Tax Law Changes

Important California Property Tax Exemptions For Seniors - Homehero In 2021 Social Security Benefits Property Tax Tax Exemption

Solar Tax Exemptions Sales Tax And Property Tax 2021 - Ecowatch

Recent Changes To Estate Tax Law Whats New For 2019

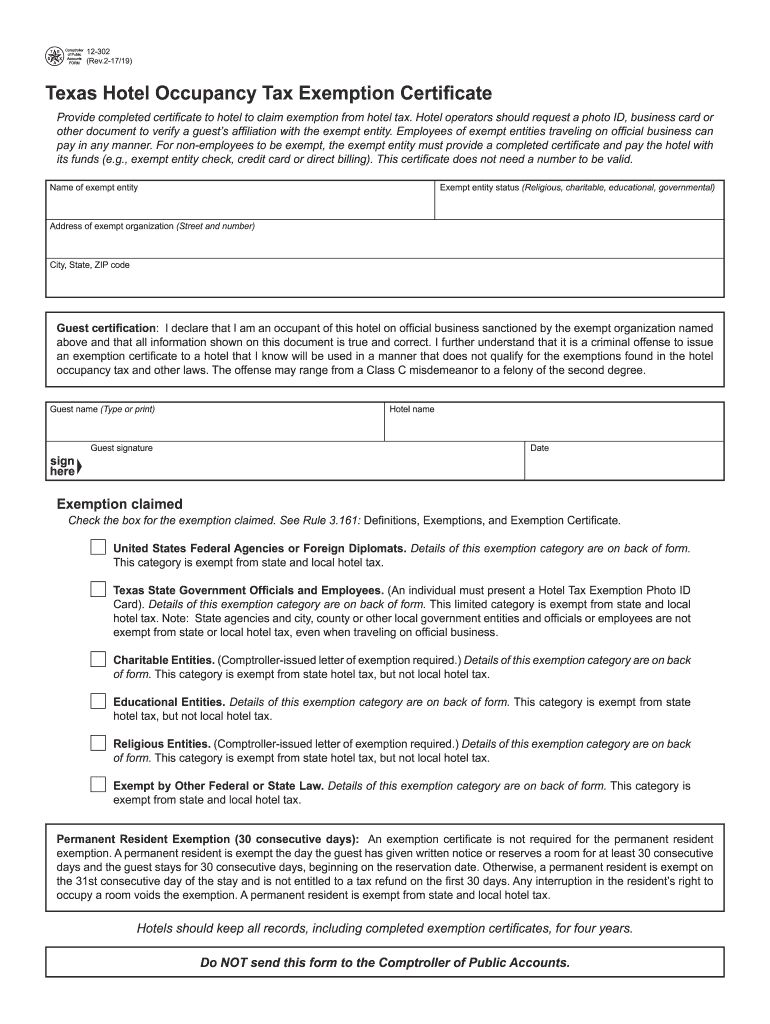

2017-2021 Form Tx Comptroller 12-302 Fill Online Printable Fillable Blank - Pdffiller

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Comments

Post a Comment