Every other tax that has been challenged on these grounds has been upheld. The constitution may not even permit taxation of unrealized gains.

Supreme Court Tax On Unrealized Capital Gains Is Unconstitutional - Youtube

In a way, they're viewed as merely “paper” gains, in.

Tax on unrealized gains unconstitutional. Fifth, a tax on unrealized capital gains is flatly unconstitutional. It will likely be challenged in court as unconstitutional. It will likely be challenged in court as unconstitutional.

That would exclude “small” business owners and farmers. But congress could raise that floor to, say, $50 million. President trump proposed taxing unrealized gains above $10 million at death.

In sum, the democrats’ proposed new tax on unrealized capital gains is likely an unconstitutional wealth tax, and if it passes, the treasury. Joseph bishop henchman, vice president of tax policy and litigation at the national taxpayers union foundation, said: That would be impossible with wyden’s wealth tax for the simple reason that there are many more billionaires in new york and california than in mississippi.

Americans oppose taxing unrealized gains. That’s why the sixteenth amendment was adopted, to allow income taxes to be constitutional. The 16th amendment authorizes taxation of “income,”… unrealized gains.

He argued that capital gains taxation is unconstitutional under the 16th amendment. These unrealized gains should be taxed at ordinary rates. A tax on an increase in unrealized capital gains is only on the most stretched of interpretations a tax on income.

Senate finance committee chairman ron wyden has released a draft of his proposed tax on the unrealized gains on billionaires (estimated to. A tax on such dividends is a tax an capital increase, and not on income, and, to be valid under the constitution, such taxes must be apportioned according to. The plan will be included in the democrats’ us$ 2 trillion reconciliation bill.

The democrats’ plan to tax billionaires’ unrealized capital gains has a problem: The democrats’ plan to tax billionaires’ unrealized capital gains has a problem: Rahn took mitchell's analysis a step further.

The constitution may not even permit taxation of unrealized gains. The 16th amendment authorizes taxation of “income,” and the definition of that seemingly simple word has spawned a long history of complicated case law. That proposed tax is likely unconstitutional.

The constitution may not even permit taxation of unrealized gains. The constitution forbids “direct taxes” unless they are apportioned among the states according to population. Secretary janet yellen has been discussing in various media, the biden administration is now revealing an unrealized capital gains tax from stocks and bonds.

President biden unveils unrealized capital gains tax for billionaires. A stock dividend, evincing merely a transfer of an accumulated surplus to the capital account of the corporation, takes nothing from the property of the corporation and adds nothing to that of the shareholder; The 16th amendment authorizes taxation of “income,” and the definition of that seemingly simple word has spawned a long.

“as long as it is imbalanced and unrealized income and. Under current law, individuals pay capital gains tax only when gains are realized, usually when they sell assets such as stocks, close businesses, and paintings. In the pollock case of 1895, they came to a similar conclusion.

Under current tax law, unrealized gains are not considered income by the irs and are therefore not taxable. A tax on unrealized investment gains of very wealthy people could lead to constitutional challenges that end up before a skeptical u.s. In reality it is a tax on wealth.

An attempt to tax unrealized capital gains was struck down in the macomber case of 1920. The democrats' planned tax on billionaires faces a problem:

Wyden Details Proposed Tax On Billionaires Unrealized Gains - Roll Call

Taxing Unrealized Capital Gains The Crazy Fed Proposal To Tax Profits That Dont Exist Scottsdale Bullion Coin

Democrats Tax On Unrealized Capital Gains Likely Unconstitutional

The Trouble With Unrealized Capital Gains Taxes - The Spectator World

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

Billionaire Tax Faces Likely Constitutional Challenge - Wsj

Democrats Proposed Tax On Unrealized Capital Gains Likely Unconstitutional The Heritage Foundation

Billionaire Tax Faces Likely Constitutional Challenge - Wsj

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

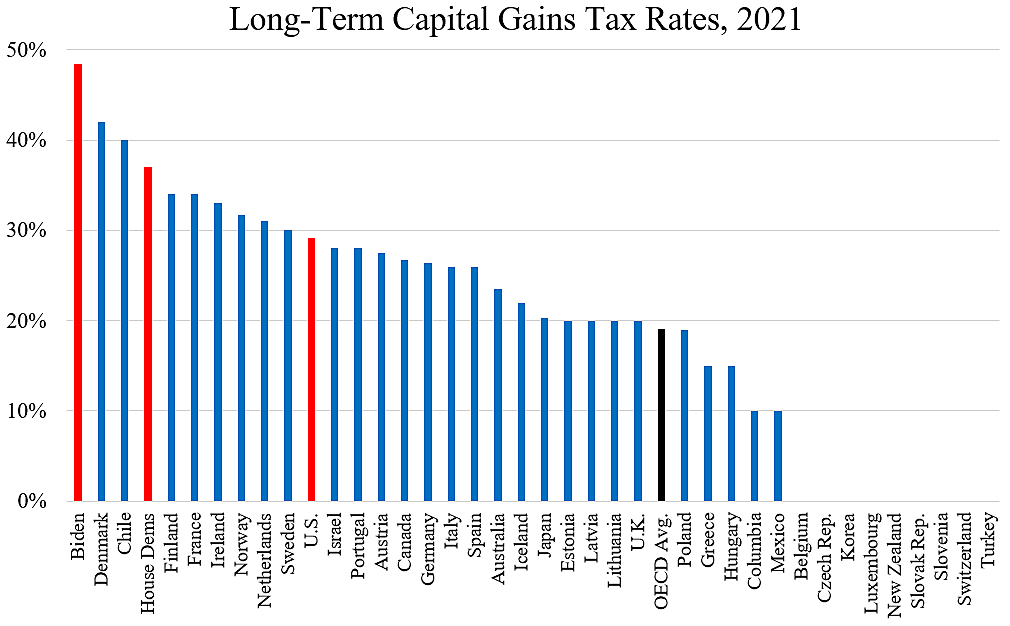

Capital Gains Taxes And The Democrats Cato At Liberty Blog

Nancy Pelosi Says A Wealth Tax On Billionaires Unrealized Gains Is On The Way - Mish Talk - Global Economic Trend Analysis

Dems Latest Idea To Fund Their Spendapalooza As Desperate As It Gets

Billionaire Tax Faces Likely Constitutional Challenge - Wsj

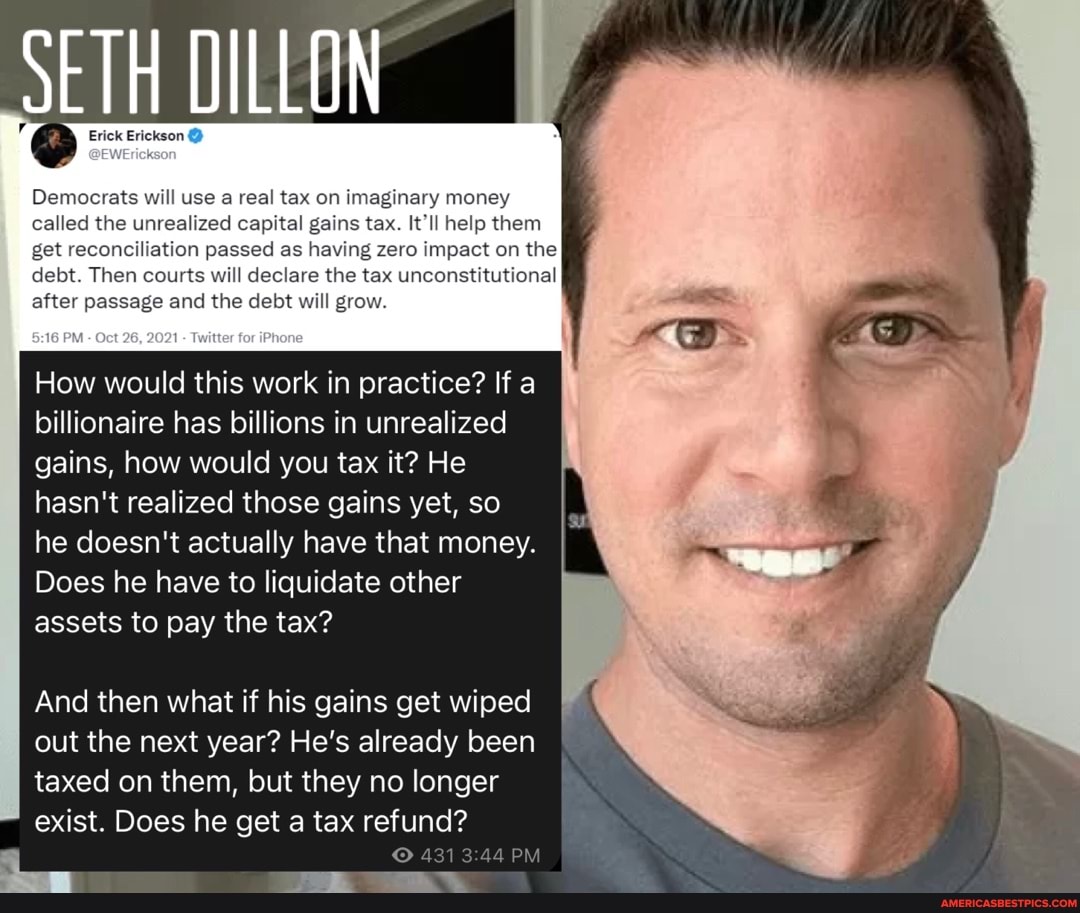

Erick Erickson Democrats Will Use A Real Tax On Imaginary Money Called The Unrealized Capital Gains

Digging Further Into The Question Is Taxing Unrealized Gains Constitutional - Mish Talk - Global Economic Trend Analysis

Tax On Billionaires Unrealized Gains Will Likely Be In Budget Package Democrats Say Rwallstreetbets

Opinion Bidens Latest Tax-the-rich Scheme Would Be An Unworkable And Possibly Unconstitutional Mess - The Washington Post

Robert Nelsen On Twitter The New Unconstitutional Wealth Tax On Unrealized Gains Is Crazy For Markets In The Long Run Wildly Complicated To Implement And If You Think Wealth Taxes Once Adopted

Democrats Proposed Tax On Unrealized Capital Gains Likely Unconstitutional The Heritage Foundation

Comments

Post a Comment