The refunds by direct deposit will start on july 14, while those by paper check will begin july 16. The first $10,200 of 2020 jobless benefits ($20,400 for married couples filing jointly) was made nontaxable income by the american rescue plan in march.

Interesting Update On The Unemployment Refund Rirs

If you’re due a refund from the irs for receiving 2020 unemployment benefits when they were still taxable, your money could arrive soon.

Unemployment federal tax refund 2020. It also shows how much you paid in federal taxes. The american rescue plan act of 2021 became law back in march. The irs will automatically refund money to eligible people who filed their tax.

If i have already received a refund of my. Taxpayers who filed early this year and have been waiting endlessly for tax refunds related to a change in the way unemployment benefits were taxed on 2020 returns report seeing money in. Since then, the irs has issued over 8.7 million unemployment compensation refunds totaling over $10 billion.

If you received an overpayment of unemployment compensation in 2020 and you repaid any of it in 2020, subtract the amount you repaid from the total amount you received. This is not the amount of the refund taxpayers will receive. After more than three months since the irs last sent adjustments on 2020 tax returns, the agency finally issued 430,000 refunds on monday to those who qualify for.

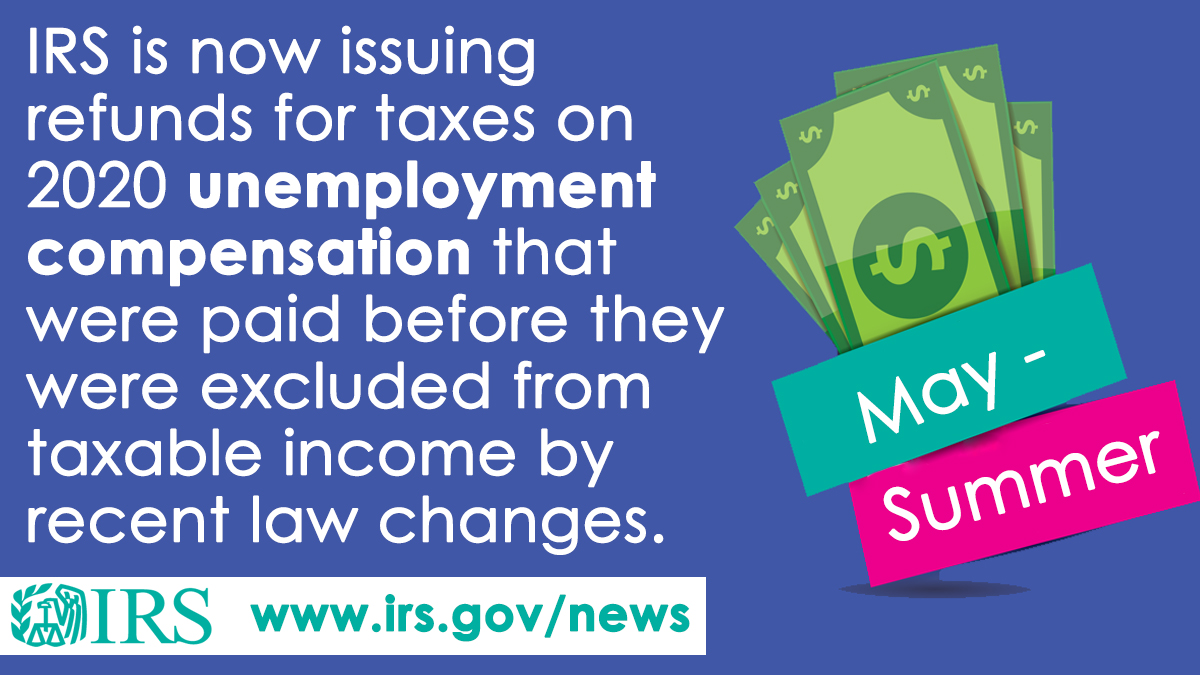

Taxpayers should not have been taxed on up to $10,200 of the unemployment compensation. The exemption, which applied to federal taxes, meant that unemployment checks sent during the. Since may, the irs has been sending tax refunds to americans who filed their 2020 return and reported unemployment compensation before tax law changes were made by the american rescue plan.

Normally, any unemployment compensation someone receives is taxable. Your social security number or individual taxpayer identification number. The irs started sending another 1.5 million tax refunds to people who overpaid federal taxes on unemployment benefits received in 2020.

Refunds are the result of the american rescue plan. The tax agency recently issued about 430,000 more refunds averaging about $1,189 each. Also enter “repaid” and the amount you repaid on the dotted line next to line 7.

Since may, the irs has been sending tax refunds to americans who filed their 2020 return and reported unemployment compensation before tax. Receiving a refund, letter, or notice. The internal revenue service will issue 4 million tax refunds this week to filers who paid too much in taxes for their 2020 unemployment benefits.

Irs will recalculate taxes on 2020 unemployment benefits and start issuing refunds in may. Washington — the internal revenue service recently sent approximately 430,000 refunds totaling more than $510 million to taxpayers who paid taxes on unemployment compensation excluded from income for tax year 2020. In total, over 11.7 million refunds have been issued, totaling $14.4 billion.

The american rescue plan waived federal tax on up to $10,200 of unemployment benefits, per person, collected in 2020. The american rescue plan act, which was signed on march 11, included a $10,200 tax exemption for 2020 unemployment benefits. However, a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation.

Since may, the irs has been making adjustments on 2020 tax returns and issuing refunds averaging around $1,600 to those who can claim an unemployment tax break. Enter the result on line 7. The american rescue plan act of 2021 excluded up to $10,200 in unemployment compensation per taxpayer from taxable income paid in 2020.

I filed my 2020 returns on 03/12 and received my fed refund and paid my state balance within a week. To check the status of your 2020 income tax refund using the irs tracker tools, you'll need to give some information: Include all unemployment compensation received on line 7.

After more than three months since the irs last sent adjustments on 2020 tax returns, the agency finally issued 430,000 refunds on monday to those who qualify for the unemployment tax break. It comes as the federal tax deadline is this friday, october 15, for those who filed for an extension. The irs efforts to correct unemployment compensation overpayments will help most of the affected taxpayers avoid filing an amended tax return.

The irs is sending unemployment tax refunds starting this week. People might get a refund if. And more unemployment relief is to be expected […]

What are the unemployment tax refunds? Many households are still waiting on 2020 tax refunds as almost seven million returns are yet to be processed by the irs credit:

Unemployment Tax Refunds Irs Says Millions Will Receive One - Mahoning Matters

Still Waiting On Your 10200 Unemployment Tax Break Refund How To Check The Status

Irs Now Adjusting Tax Returns For 10200 Unemployment Tax Break Forbes Advisor

Unemployment Tax Refund How To Calculate How Much Will Be Returned - Ascom

Americas Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits - The Washington Post

Irs Now Adjusting Tax Returns For 10200 Unemployment Tax Break Forbes Advisor

Irsnews Taxsecurity On Twitter Irs Is Issuing Refunds For Taxes Paid On 2020 Unemployment Compensation Excluded From Income The First Adjustments Are For Single Taxpayers Who Had The Simplest Tax Returns Details

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

Will You Get A Second Income Tax Refund Irs Starts Issuing Unemployment Refunds Cpa Practice Advisor

Paying Taxes On Unemployment Checks Everything You Need To Know - Cnet

Irs Sending Out 4 Million Surprise Tax Refunds This Week Wpricom

Irs Sending Out More 10200 Unemployment Tax Refund Checks Heres How To Track Your Payment

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowacom

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment - Cnet

312154 Unemployment Tax Returns Internal Revenue Service

How Will Unemployment Tax Break Refund Be Sent In Two Phases By The Irs - Ascom

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs To Start Sending 10200 Unemployment Benefit Tax Refunds In May

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status - Ascom

Comments

Post a Comment