$8,423.75 plus 7.80% of excess over $161,750 $2,218.75 plus 6.80% of excess over $70,500.

Us Withholding Tax Rates

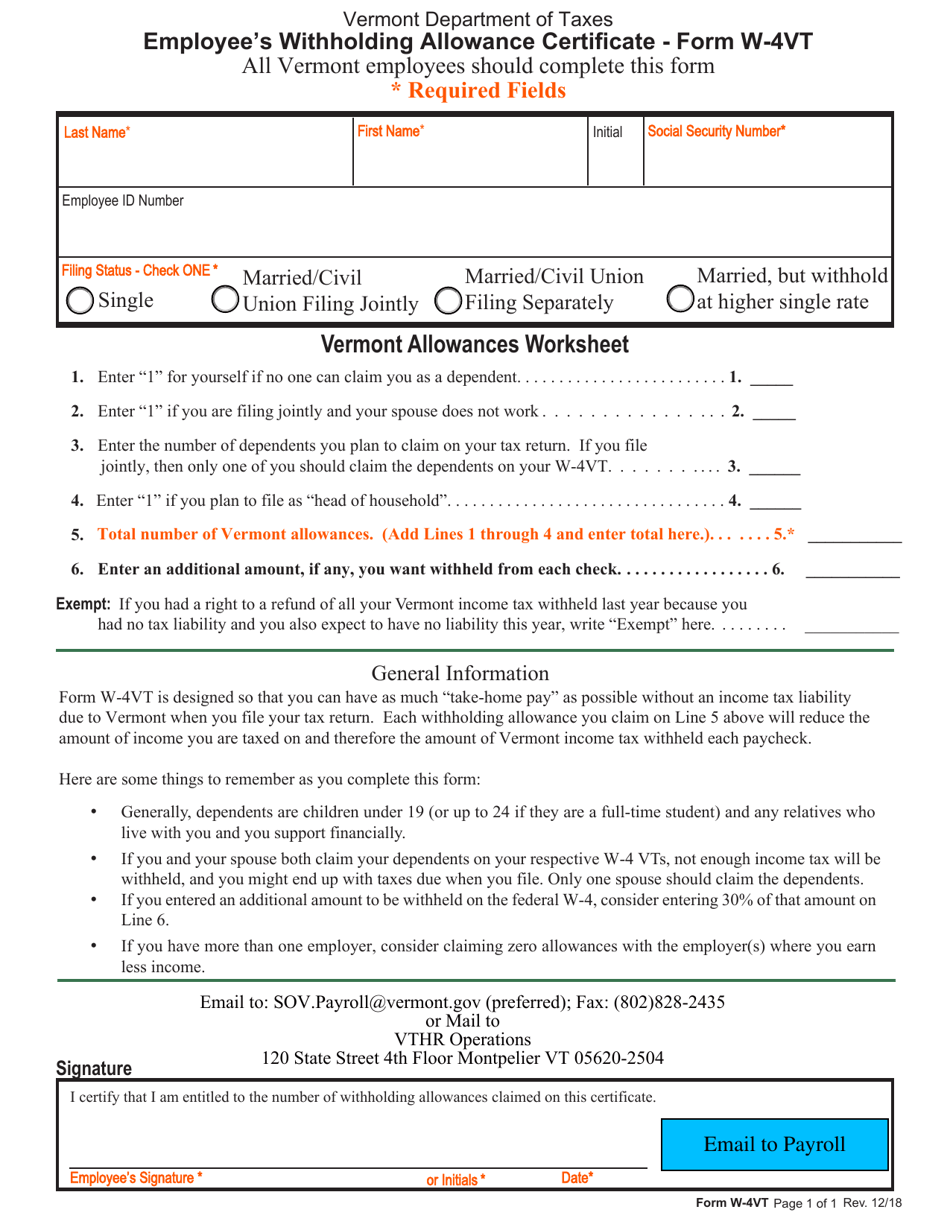

Here are some things to remember as you complete this form:

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Vermont income tax withholding. For periodic payments, the tax is computed using If federal exemptions were used and there are additional withholdings, proceed to step 8. If federal exemptions were used and additional federal tax was withheld, multiply the additional amount by 27 percent and add that to the result of step 7 to.

It should take one to three weeks for your refund check to be processed after your income tax return is recieved. If federal exemptions were used and additional federal tax was withheld, multiply the additional amount by 27 percent and add that to the result of. Divide the annual tax withholding by > 27 < to obtain the biweekly vermont tax withholding.

You must withhold vermont income tax on payments to vermont residents when federal withholding is required. Divide the annual tax withholding by 26 to obtain the biweekly vermont tax withholding. The amount of vermont tax withholding should be:

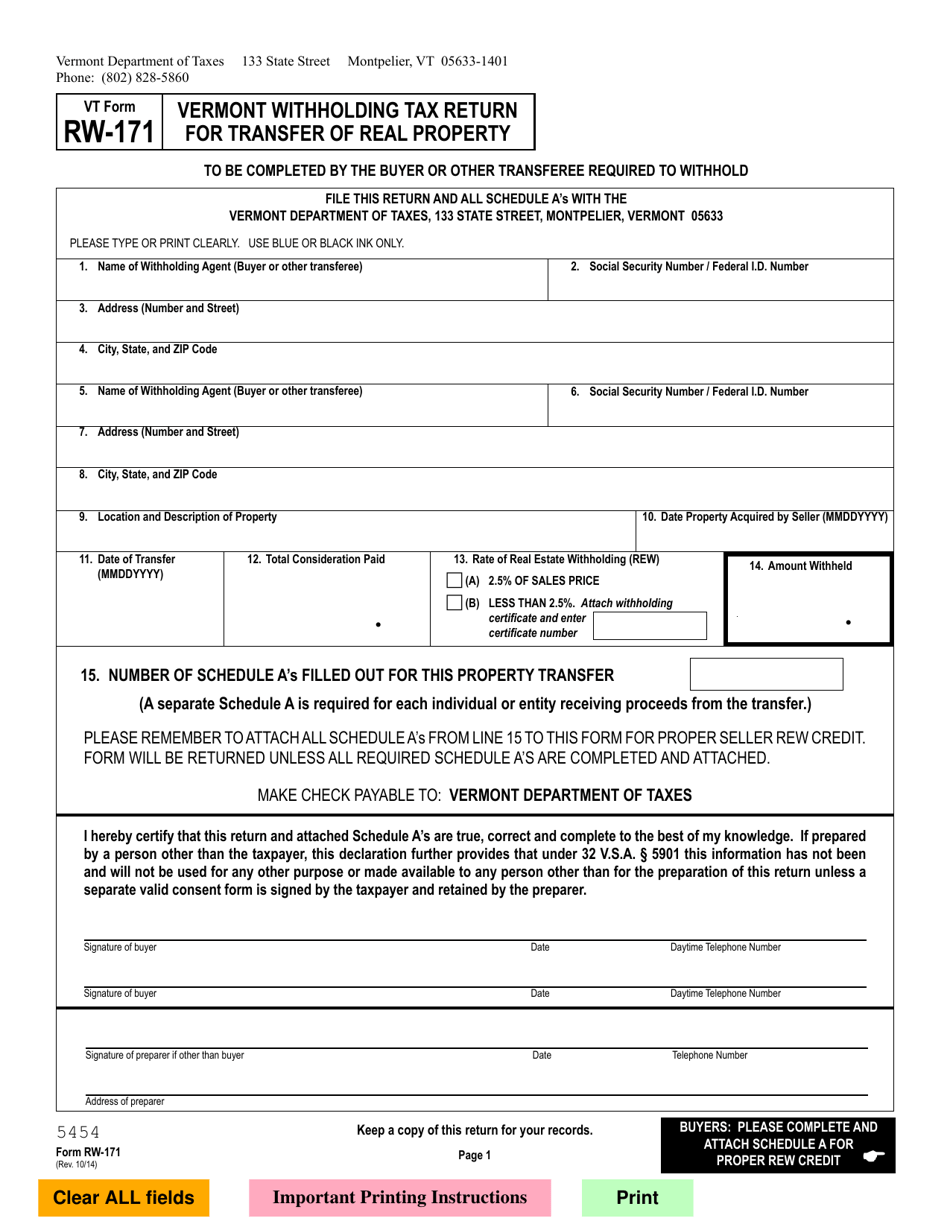

The income tax withholding formula for the state of vermont will include the following changes: If the seller is a nonresident of vermont, the buyer is required to withhold 2.5% of the payment for the property being transferred and remit it to the vermont department of taxes. Vermont withholding is also required where the recipient elects optional federal withholding and does not specifically state that the payment is exempt from vermont withholding.

If federal exemptions were used and there are additional federal withholdings, proceed to step 8. State income tax is due on a gain from a real estate sale in vermont. If your small business has employees working in vermont, you'll need to withhold and pay vermont income tax on their salaries.

$0.00 plus 3.55% of excess over $8,000. Over $161,750 but not over $242,000. If your state tax witholdings are greater then the amount of income tax you owe the state of vermont, you will receive an income tax refund check from the government to make up the difference.

2017 and 2018 income tax withholding instructions, tables, and charts. The amount of withholding tax depends on employee’s income. What is vermont withholding tax?

If additional federal tax was withheld, multiply the additional amount by 26 percent and add that to the result of step 7 to obtain the biweekly vermont tax withholding. Income you are taxed on and therefore the amount of vermont income tax withheld each paycheck. If additional federal tax was withheld, multiply the additional amount by 26 percent and add that to the result of step 7 to obtain the biweekly vermont tax withholding.

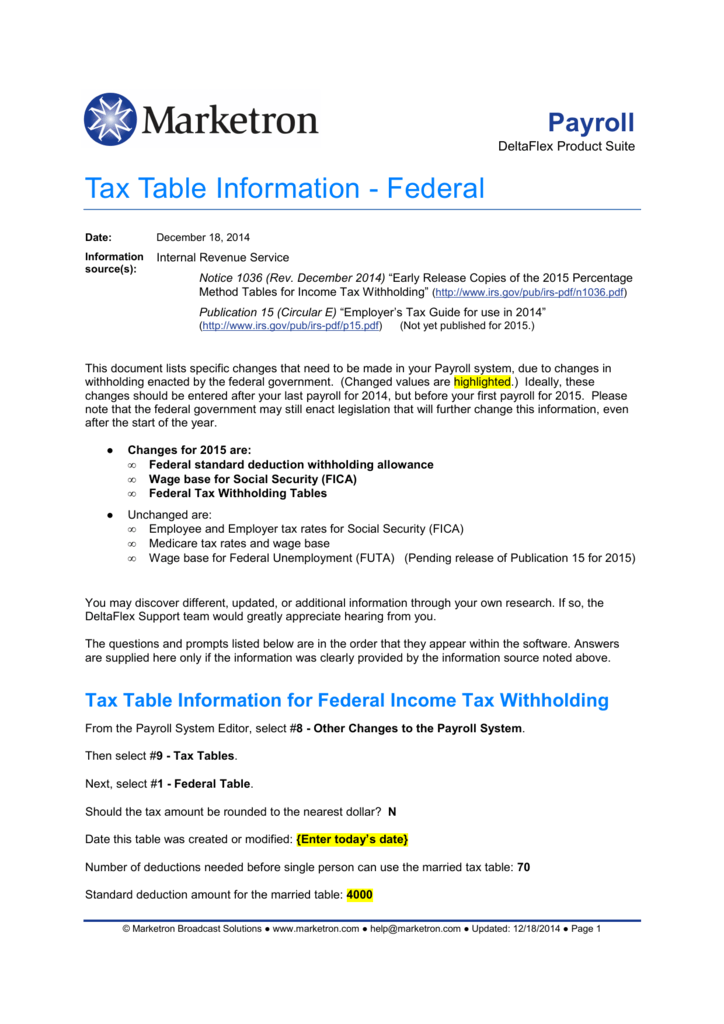

The annual amount, per exemption, will increase from $4,000 to $4,050. Divide the annual tax withholding by 26 to obtain the biweekly vermont tax withholding. This is in addition to having to withhold federal income tax for those same employees.

If federal exemptions were used and there are additional withholdings, proceed to step 8. You must withhold vermont income tax on payments to vermont residents when federal withholding is. If federal exemptions were used and there are additional withholdings, proceed to step 8.

If the amount of taxable income is: If additional federal tax was withheld, multiply the additional amount by 26 percent and add that to the result of step 7 to obtain the biweekly vermont tax withholding. Divide the annual tax withholding by 26 to obtain the biweekly vermont tax withholding.

If the seller obtains a commissioner’s certificate, withholding may be reduced or eliminated. The single, head of household, and married tax tables has changed. If additional federal tax was withheld, multiply the additional amount by 27 percent and add that to the result of step 7 to obtain the.

If federal exemptions were used and there are additional withholdings, proceed to step 8. The single or head of household and married withholding tables will increase. Divide the annual tax withholding by 26 to obtain the biweekly vermont tax withholding.

Over $8,000 but not over $70,500. Vermont withholding is also required where the recipient elects optional federal withholding and does not specifically state that the payment is exempt from vermont withholding. The annual amount per exemption has increased from $4,050 to $4,250.

Divide the annual tax withholding by 26 to obtain the biweekly vermont tax withholding. Therefore, the withholding tax should be similar to the state income tax range. Over $0 but not over $8,000.

Over $70,500 but not over $161,750. The income tax withholding formula on supplemental wages for the state of vermont includes the following changes: Here are the basic rules on vermont state income tax withholding for employees.

Withholding tax is the amount of employee’s pay withheld by the employer and sent directly to the government as partial payment of state income tax. 27 rows total vermont income tax withheld from your employees for the reporting period employers. If federal exemptions were used and there are additional federal withholdings, proceed to step 8.

2017 and 2018 income tax withholding instructions, tables, and charts.

Tax Withholding For Pensions And Social Security Sensible Money

Vt Form Rw-171 Download Fillable Pdf Or Fill Online Vermont Withholding Tax Return For Transfer Of Real Property Vermont Templateroller

Updated W4 Forms For 2020

2

Us Withholding Tax Rates

Us Withholding Tax Rates

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

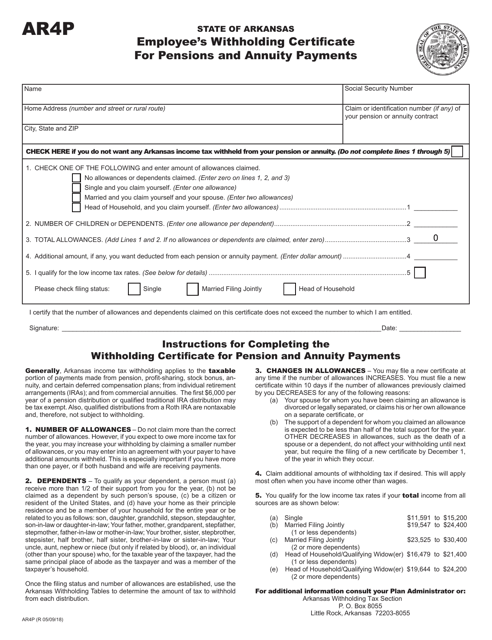

State W-4 Form Detailed Withholding Forms By State Chart

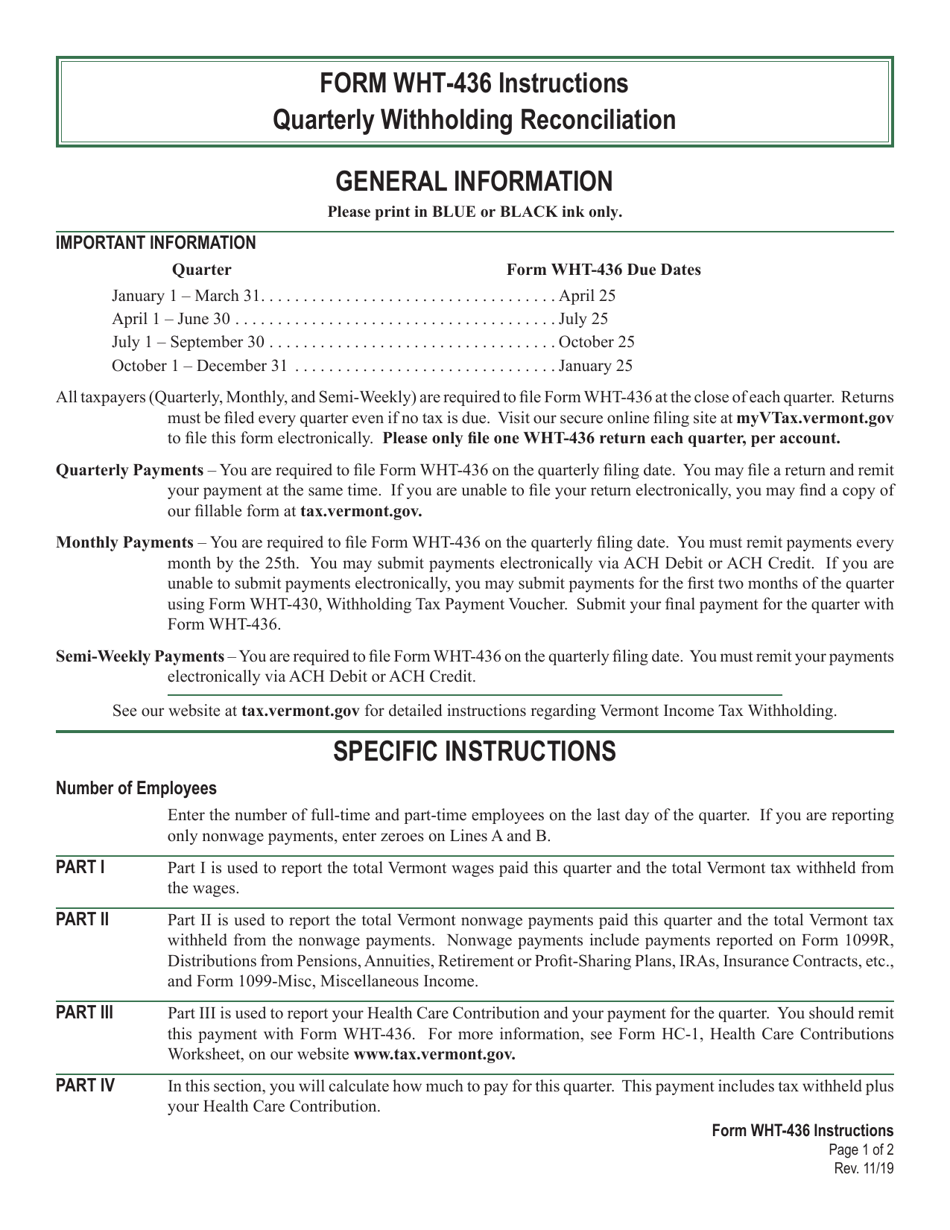

Download Instructions For Vt Form Wht-436 Quarterly Withholding Reconciliation And Health Care Contribution Pdf Templateroller

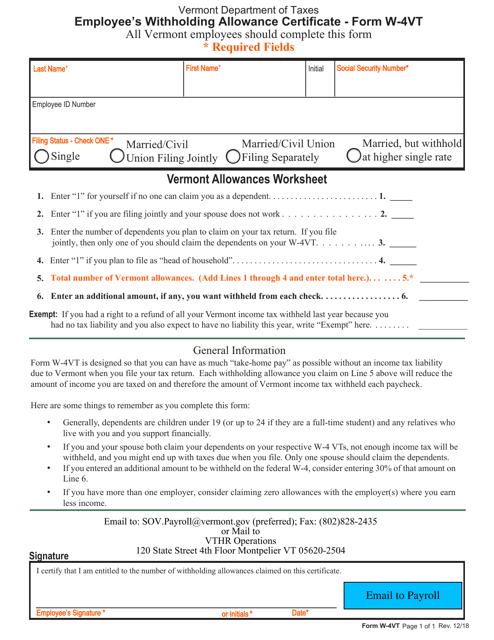

Vt Form W-4vt Download Fillable Pdf Or Fill Online Employees Withholding Allowance Certificate Vermont Templateroller

Us Withholding Tax Rates

State W-4 Form Detailed Withholding Forms By State Chart

Us Withholding Tax Rates

11 Money Saving Strategies Money Saving Strategies Money Saving Tips Stock Quotes

Irs Installment Agreement Franklin Park Il 60131 Mm Financial Consulting Inc Irs Taxes Payroll Taxes Internal Revenue Service

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

2

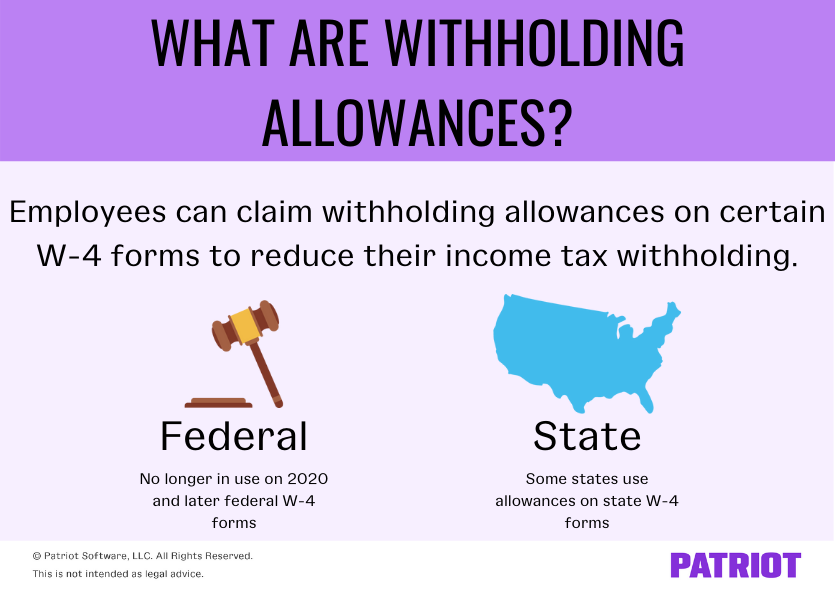

Withholding Allowances Payroll Exemptions And More

Vt Form W-4vt Download Fillable Pdf Or Fill Online Employees Withholding Allowance Certificate Vermont Templateroller

Comments

Post a Comment