Parents with children aged 17 years or under are mostly eligible for the new child tax credit. The maximum amount of payment per month is up to $300 for each child under six and $250 for each child six and older.

The Child Tax Credit Toolkit The White House

Eligible filers will only receive half of the total ctc in the form of advance payments.

Child tax credit 2021 eligibility. The maximum income limitations have been raised. Starting july 15, families will start receiving monthly payments as high as $300 per child as part of the new expanded child tax credit. To qualify for advance child tax credit payments, you — and your spouse, if you filed a joint return — must have:

2021 child tax credits eligibility. That said, the child tax credit payments you receive during 2021 are based on the irs’ estimate of your 2021 child tax credit eligibility from your 2020 return. Parents must have an earned income of at least $2,500.

For 2021 only, congress increased the credit to $3,000 for children ages 6 to 17 and. There is no minimum income or earned income requirement. The credit will also be fully refundable.

Eligible filers will be able to claim the other half of the ctc when they file their 2021 income tax return. Previously, the credit had excluded children who had turned 17 and was limited to $2,000 per child. Those with children under the age of 6 will receive $300 per month, while those with children from 6.

Up to $3,000 per child, with half of credit as $250. $3,000 for each qualifying child aged 6 through 17 (previously $2,000) $3,600 for each qualifying child under the age of 6 (previously $2,000). Up to $3,600 per child, with half of credit as $300 monthly payments.

Aside from having children who are 17 or younger as of december 31, 2021, families will only. The irs is providing eligible families with payments ranging from $250 to $300 per month. Filed a 2019 or 2020 tax return and claimed the child tax credit on the return;

Eligible parents are able to receive $3,600 a year for each child under six and $3,000 for each child under 18 for 2021, according to the bill’s text. The child tax credit is a federal benefit that reduces income tax liability for people with children. Can you claim the child tax credit while living abroad?

Parents may qualify for the full child tax credit payments if they meet one of the following rules outlined by the irs. The maximum child tax credit is $300 per month for each qualifying child under the age of six. If your qualifying child was alive at any time during 2021 and lived with you for more than half the time in 2021 that the child was alive, then your child is a qualifying child for purposes of the 2021 child tax credit.

The maximum age requirement has been raised from 16 to 17. Still, even if your magi is well above the threshold for the 2021 child tax credit, you may still be eligible for the standard amount of $2,000 per qualifying child. Payments will be monthly, totaling $300 for families with younger children and $250 for families with older ones.

Eligibility requirements have changed for the 2021 child tax credit. For 2021, a legal dependent who is age 17 or younger (as of december 31, 2021) can qualify for the child tax credit. Families eligible for the child tax credit are those that have children who will not turn 18 before january 1, 2022, and that do not provide more than 50% of his or her own support.

How do i qualify for 2021 child tax credit payments? The irs will start sending half the total child tax credit in advance monthly payments to. In addition, children must live with the taxpayer claiming the credit for more than half of the 2021 tax year.

American expats living abroad are generally able to claim the child tax credit—and possibly even the 2021 upgrades. To claim your child tax credit 2021, you should be qualified for three main criteria: As a result, you will receive advance child.

These changes apply to tax year 2021 only. The new system is part of the american rescue plan, which. Until 2021, the credit was $2,000 per child under age 17, based on the child’s age at the end of the year.

Child tax credit 2021 eligibility. The credit begins to phase out when modified agi is above $75,000 for single filers, $150,000. All children must possess a social security number.

At present, on a monthly basis families are able to claim 300 dollars per child under the age of six and 250 dollars per child between the ages of six and 17, with the child tax credit program. Once the update is made, the irs will adjust the remaining payment amounts for the rest of the year. It is a credit that reduces taxes owed as opposed to a deduction that reduces taxable income.

2021 child tax credit age brackets. Children also must have a social security. There are no certain requirements for receiving child tax credit 2021, however, the payment starts decreasing when an unmarried person makes $75,000, married $150,000, and for heads $112,500.

In the tax year 2021, under the new provisions, families are set to receive a $3,000 annual benefit per child ages 6 to 17 and $3,600 per child under 6. It's $250 per month for each child aged six to 17.

The Child Tax Credit Toolkit The White House

Where Is My September Child Tax Credit 13newsnowcom

Child Tax Credit 2022 Qualifications What Will Be Different Marca

Child Tax Credit 2021 8 Things You Need To Know - District Capital

Child Tax Credit 2021 Payments How Much Dates And Opting Out - Cbs News

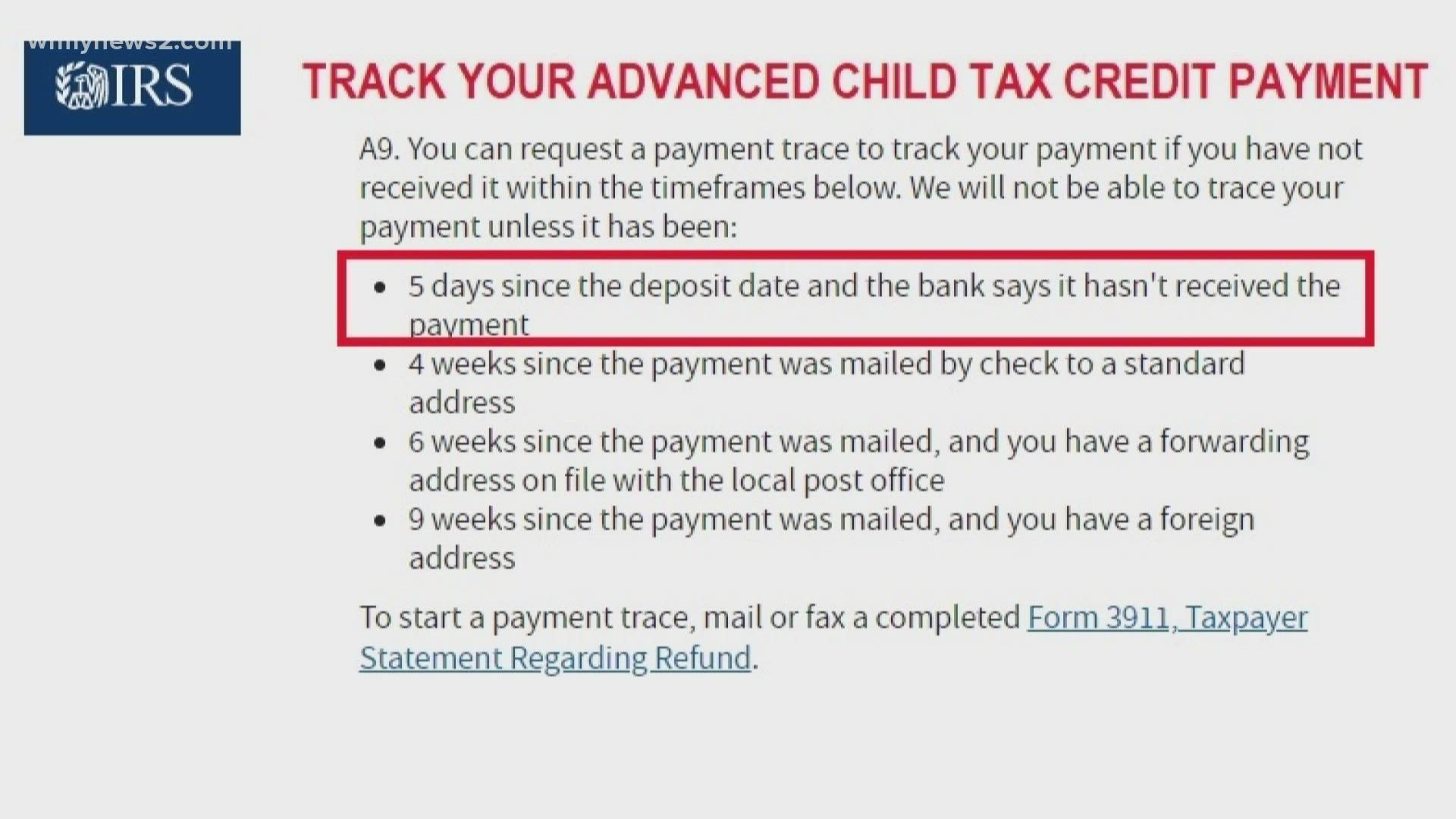

Child Tax Credit What We Do Community Advocates

New Child Tax Credit Brings A Drop In Households Reporting Hunger Npr

Five Facts About The New Advance Child Tax Credit

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Child Tax Credit 2021 How To Track September Next Payment Marca

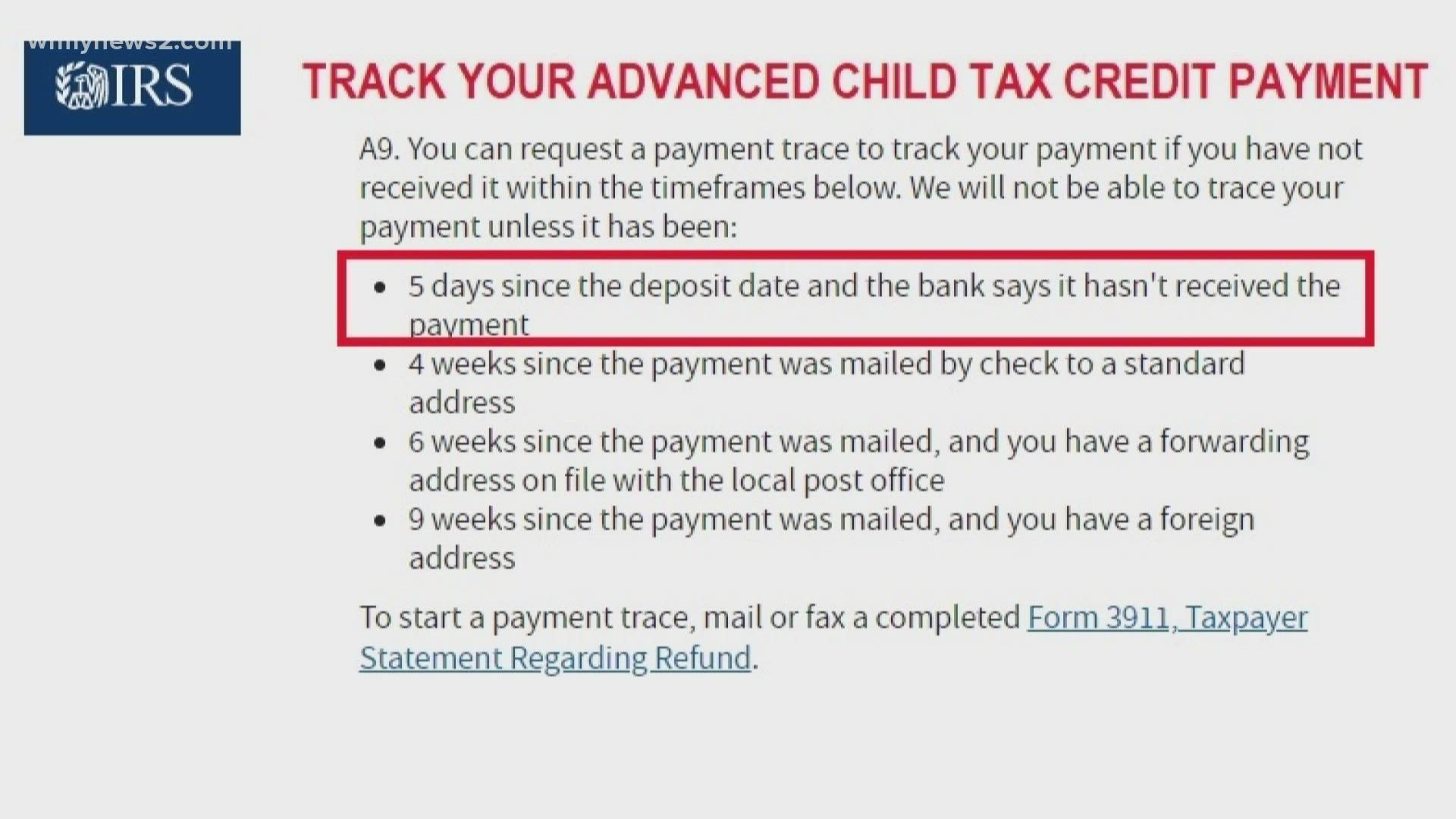

Child Tax Credit Missing A Payment Heres How To Track It - Cnet

Tax Tip 2021 Advance Child Tax Credit Information For Us Territory Residents - Tas

Late Child Tax Credit Payments From Irs Arriving Now - Fingerlakes1com

Taipa Requests Govt To Bring Tower In Gst Itc Eligibility Category In 2021 Business Software Tax Credits Bring It On

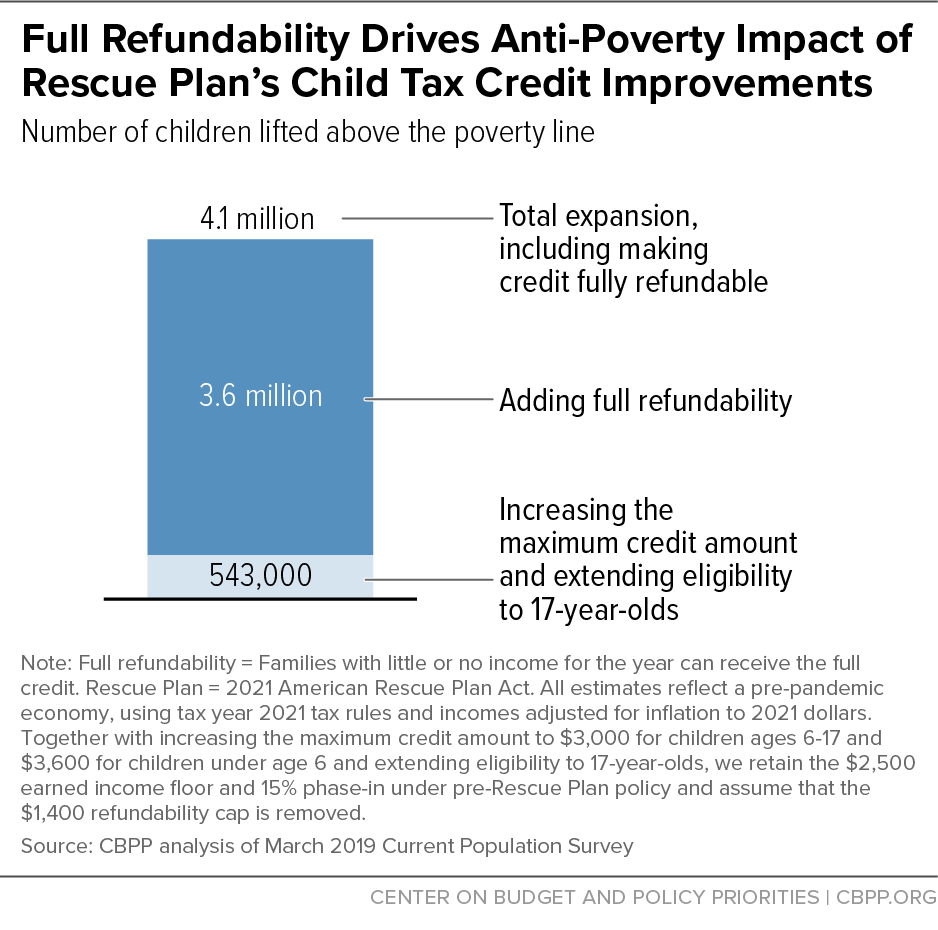

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

2021 Child Tax Credit Heres Who Will Get Up To 1800 Per Child In Cash And Who Will Need To Opt Out

Child Tax Credit Children 18 And Older Not Eligible 13newsnowcom

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Irs Child Tax Credit Payments Start July 15

Comments

Post a Comment