The due date for all registered fillers is the 1st of the month following the close of the calendar month of the reporting period. All participants must reside in jefferson parish and not be receiving any other federal or state food nutritional benefits or assistance (ebt/food stamps, snap, meals on wheels, etc.).

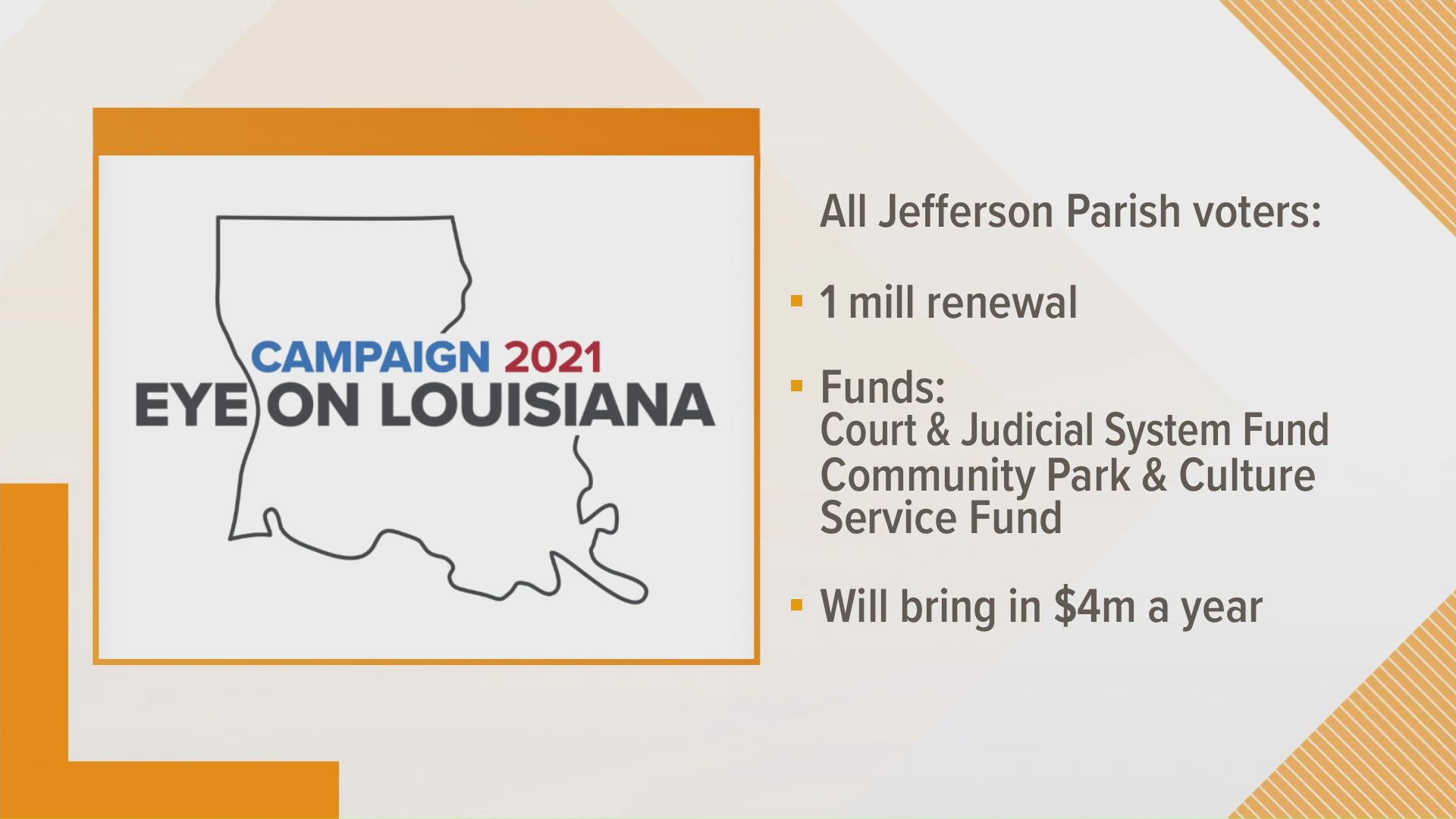

Tax Proposals On Jefferson Parish Ballots Wwltvcom

The link below will take you to the jefferson parish sheriff's office 'forms and tables' page of their web site.

Food tax jefferson parish. (formerly food stamps), family independence temporary assistance program (fitap), kinship care subsidy program (kcsp) or child support enforcement services programs. Jefferson parish, louisiana sales tax rate 2021 up to 9.2%. 3.5% on the sale of prescription drugs and medical devices prescribed by a physician

Pay property tax online in the parish of jefferson, louisiana using this service! Louisiana is ranked 1929th of the 3143 counties in the united. 4.75% on the sale of general merchandise and certain services;

Taxes per month = $118.13 3.50% on the sale of food items purchased for preparation and consumption in the home 3.50% on the sale of prescription drugs and medical devices prescribed by a. 200 derbigny st., 4th floor, suite 4200.

What is the rate of jefferson parish sales/use tax? Meals will be inspired by recipes from local restaurants. Jefferson parish collects a 4.75% local sales tax, the maximum local sales tax allowed under louisiana law.

Groceries are exempt from the jefferson parish and louisiana state sales taxes. Jefferson parish government building 200 derbigny st. Jefferson parish collects, on average, 0.43% of a property's assessed fair market value as property tax.

Meals will be delivered via contactless home deliveries for those who are unable to pick up meals from a designated location. Location address delinquent on the 20th year: Jefferson parish sheriff's office bureau of revenue and taxation sales tax division p.

When are sales taxes due and which date is used to determine if a return is paid on time? This exemption is for a 100% disabled veteran as determined by the united states department of veterans affairs. 1855 ames blvd., suite a.

3.50% on the sale of food items purchased for preparation and consumption in the home; The jefferson parish sales tax is 4.75%. Suite 1200 gretna, la 70053:

The jefferson parish sales tax rate is %. The following local sales tax rates apply in jefferson parish: The parish is named for founding father thomas jefferson;

You can find the sales/use tax registration form there: A separate tax return is used to report these sales. Box 248, gretna, la 70054 year amended return fill circle filing period state tax identification number account no.

The voters of jefferson parish recently passed this exemption into law and it becomes effective beginning january 1, 2012. Jefferson parish public school system. Has impacted many state nexus laws and sales tax collection requirements.

The median property tax in jefferson parish, louisiana is $755 per year for a home worth the median value of $175,100. If you have documents to send, you can fax them to the. A return is considered delinquent.

Those persons claiming an exemption from jefferson parish sales tax 200 derbigny street, suite 1200 gretna, la 70053. Jefferson parish has a lower sales tax than 61% of louisiana's other cities and counties.

Take the yearly taxes, and divide by 12. Jefferson parish sales tax is charged to those who are determined to be end users of tangible personal property. Yearly median tax in jefferson parish.

File and pay state taxes electronically through the department of. Residents with questions about their property tax collection. The jefferson parish food stamp office refers to the louisiana state agency that administers the supplemental nutrition assistance program (snap) in jefferson parish, la.

Remember to have your property's tax id number or parcel number available when you call! The 2018 united states supreme court decision in south dakota v.

Arkansas 2014 Optional Issue Issued 2014 Type University Of Arkansas At Fayetteville Serial Format Ua A License Plate University Of Arkansas Novelty Sign

Plaquemines Parish Louisiana Facts Genealogy Records Links Plaquemines Parish Parish Louisiana History

A Glimpse Of Louisiana Louisiana New Orleans Travel Film

Faqs Jefferson Parish Sheriffs Office La Civicengage

Xtxn54cvfe0zym

Xtxn54cvfe0zym

On The Bayou Filming Swamp Shark Photo By Active Entertainment Film Louisiana Shark Photos International Tourism Louisiana

Xtxn54cvfe0zym

Faqs Jefferson Parish Sheriffs Office La Civicengage

Economic Contributions Of Forestry And Forest Products On Webster Parish Louisiana

More Iranians Buying Passports In Other Countries To Evade Us Travel Ban Sanctions Passport Us Travel Travel

Lake Titicaca Basin Lake Titicaca Lake Cartography

/cloudfront-us-east-1.images.arcpublishing.com/gray/HVZBKS75QJAANKNYJQYTIAULGM.jpg)

Jefferson Parish Collected 323152 Less In Taxes In June

Pin On Frenchquarter On Instagram

Ben The Boys Monument Located In Front Of The Mer Rouge La Post Office In Morehouse Parish Parish Lake Providence Local Events

I886h11tbeipwm

The True Story Of Madam Cj Walker Two Dollars And A Dream - Youtube Two Dollars True Stories Artist Album

Pin On Etcetera

Industry Leaders L3 Jabil 3 Daughters Commit To St Pete Florida For The Long Haul Econdev Economicde Petersburg Florida Petersburg St Petersburg Florida

Comments

Post a Comment