The sunshine state is so popular that over 300,000 people move to. Under florida law, a spouse's elective share is 30 percent of the value of the entire state.

States With An Inheritance Tax Recently Updated For 2020

With inheritance tax, the person or organization that inherits the assets pays the taxes, and they pay only on what they inherit.

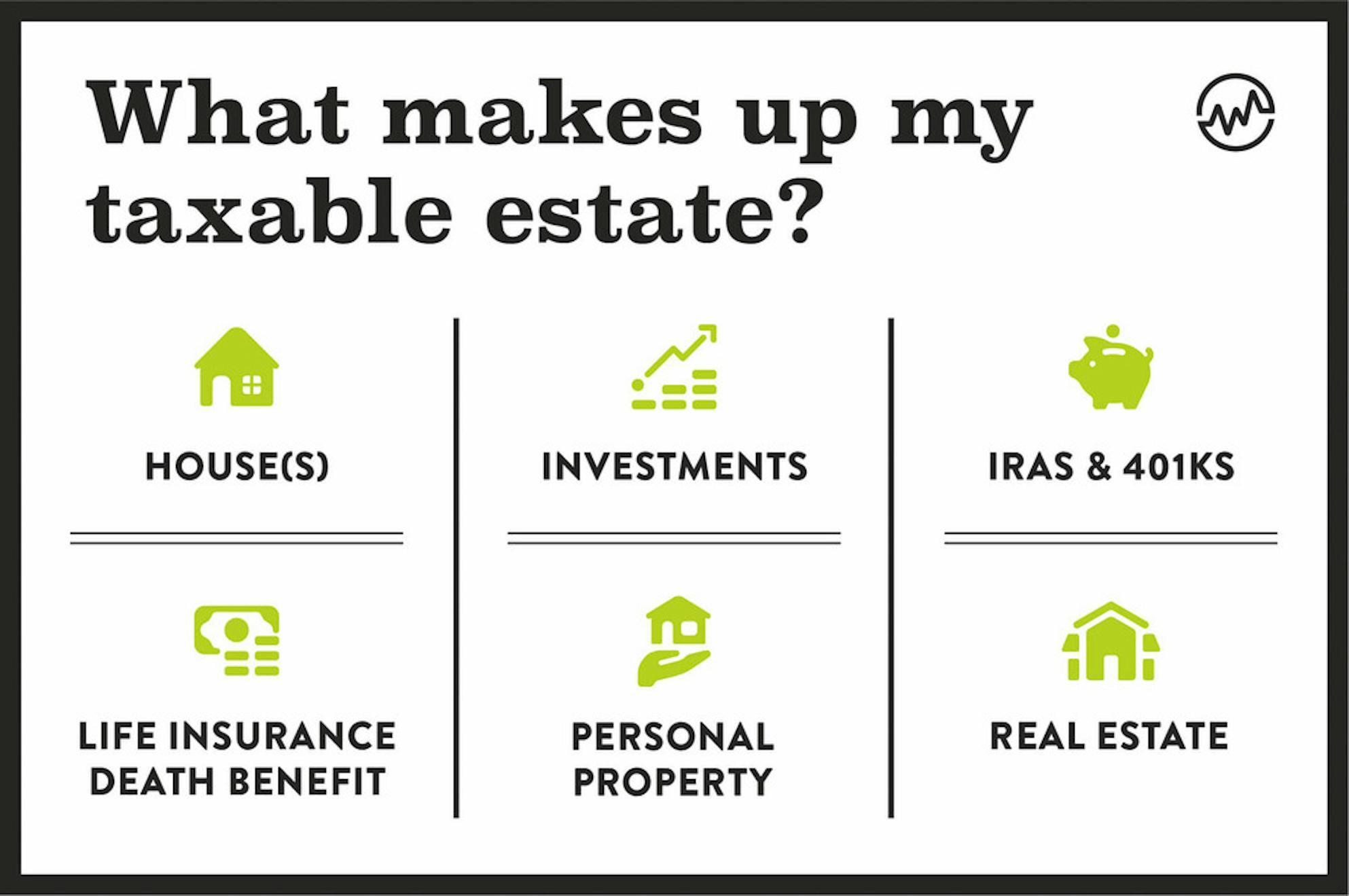

How does inheritance tax work in florida. The tax is levied on property that passes under a will, the intestate laws of succession, and property that passes under a trust, deed, joint ownership, or otherwise. When it comes to inheriting assets, it is important to have an understanding of the terms below. What are the tax implications of inherited property in florida.

Florida also has no gift tax. What is the inheritance tax? The tax is collected by the register of wills located in the county where the decedent either lived or owned property

An estate tax is a tax imposed on the gross estate assets and the tax is paid at the estate level before going to the beneficiaries. You don’t have to pay inheritance taxes on an inheritance in florida. The tax is levied based on the value of the assets that have been bequeathed, and is assessed based.

If an individual’s death occurred prior to that time, then an estate tax return would need to be filed. You’ll need to check the laws of the state where the person you are inheriting from lived. It matters only where the deceased lives, not the beneficiary.

Example your estate is worth £500,000 and your tax. The inheritance is a tax imposed by some states on an heir’s right to receive his or her inheritance. Inheritance tax only applies when the beneficiary inherits property from someone who lived in a state that has an inheritance tax.

No, florida does not have an inheritance tax (also called an “estate tax” or “death tax”). 2020 inheritance taxes in florida florida does not have a separate inheritance (“death”) tax. The inheritance tax is imposed on the clear value of property that passes from a decedent to some beneficiaries.

Florida also does not assess an estate tax, or an inheritance tax. There are no inheritance taxes or estate taxes under florida law. This applies to the estates of any decedents who have passed away after december 31, 2004.

A very small number of states have inheritance taxes, and again, florida is not one of them. Whether you’re someone involved in planning for your estate or an heir in line to receive an inheritance, it’s important to know the truth about the florida inheritance tax. What you need to know about estate tax in florida.

An inheritance tax is a tax levied against the property someone receives as an inheritance. The estate is responsible for paying the estate tax while the person inheriting is responsible for paying the inheritance tax. Ad an inheritance tax expert will answer you now!

In pennsylvania, for instance, the inheritance tax may apply to you even if you live out of state, as long as the deceased lived in the state. Second, the income taxes from the sale of the house will not be too bad. There is no inheritance tax in florida, but other states’ inheritance taxes may apply to you.

This lack of inheritance tax, combined with the absence of florida income tax, makes florida attractive for wealthy individuals wanting to reduce their tax liability. The state constitution prohibits such a tax, though floridians still have to pay federal income taxes. Since florida is on the above list, the state does not require an inheritance tax waiver.

The standard inheritance tax rate is 40%. The florida probate court will award your spouse's inheritance, called the elective share, out of the estate assets before distributions to any other beneficiaries are made. The strength of florida's low tax burden comes from its lack of an income tax, making them one of seven such states in the u.s.

Estate taxes are collected from the estate before any of the assets are given out. It’s only charged on the part of your estate that’s above the threshold. Ad an inheritance tax expert will answer you now!

Hope this this was helpful. An inheritance tax is a tax imposed on specific assets received by a beneficiary and the tax is usually paid by the beneficiary, not the estate. First, the property taxes will go up if you inherited the person’s homestead and you have your own homestead.

It is only one of seven states that does not have an income tax. Just because florida lacks an estate or inheritance tax doesn’t mean that there aren’t other tax filings that an estate must complete. However, it’s important to point out that with estate and inheritance taxes, these taxes could apply to the property you receive as an inheritance if.

For example, if you live in florida and you inherit money from an uncle who lives in kentucky, which is one of the six states that does impose an inheritance tax, you may owe inheritance taxes to the state of. Florida is an attractive state to live in for several reasons. If your parent owned the house for a very long time, then the property taxes will go up a lot.

The federal estate tax only applies if the value of the estate exceeds $11.4 million (2019), and the tax that’s incurred is paid out of the estate/trust rather than by the beneficiaries. In pennsylvania, for instance, direct descendants pay. Florida residents and their heirs will not owe any estate taxes or inheritance taxes to the state of florida.

Their tax rate varies depending on their relationship to the deceased. Also, florida does not require inheritance and estate taxes. The federal government, however, imposes an estate tax that applies to residents of all states.

Pin By Roxanne Hoover On Got To Go-florida Tax Rate Income Tax Moreno

Inheritance Tax Advice For Expats And Non-uk Residents - Experts For Expats

Inheritance Tax How Much Will Your Children Get Your Estate Tax - Wealthfit

Recent Changes To Estate Tax Law Whats New For 2019

Florida Inheritance And Estate Tax Definition Alper Law

Florida Estate And Inheritance Taxes - Estate Planning Attorney Gibbs Law - Fort Myers Fl

What Is Inheritance Tax

Russian Inheritance Law And Writing Wills In Russia Expatica

Uk And Ireland Impose Highest Taxes On Inheritance Of All Major Economies - Uhy Internationaluhy International

Florida Inheritance And Estate Tax Definition Alper Law

How To Avoid Estate Taxes With A Trust

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

State Estate And Inheritance Taxes Itep

How To Avoid Estate Taxes With A Trust

Florida Estate Tax - Rules On Estate Inheritance Taxes

Usattorneyscom What To Do If You Win The Powerball Jackpot Estate Tax Inheritance Tax Tax Preparation

How To Beat The Five-year Inheritance Tax Freeze Httpswwwmoneyinternationalcominheritance-tax-freeze Expats Iht Tax In 2021

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Comments

Post a Comment