The sales tax rate is always 6%. Plus 3.125% of the amount over:

How High Are Cell Phone Taxes In Your State Tax Foundation

Subject to tax at the rate of 1 percent when sold for business use.

Idaho sales tax rate in 2015. Taxablity of utilities in the state sales tax. Plus 5.625% of the amount over: Idaho the sale or purchase of electricity, natural gas, and water are exempt from taxation when delivered to consumers at the place of.

The sales tax (rates of tax no.1) order 2008; Plus 6.625% of the amount over:. Essentially, you are not required to collect sales tax on shipping charges so long as the charge is stated separately on the invoice.

Ad a tax advisor will answer you now! These fees are separate from. Every 2021 combined rates mentioned above are the results of idaho state rate (6%).

Plus 4.625% of the amount over: Are shipping & handling subject to sales tax in idaho? Plus 3.625% of the amount over:

Plus 1.125% of the amount over: Questions answered every 9 seconds. Alabama is one of the last three states to still tax groceries at the full state sales tax rate, which disproportionately affects minorities and low income families with little children.

Gross receipts tax rate schedule effective july 1, 2015 through december 31, 2015. Municipality or county location code rate. This puts idaho right in the middle when you rank all the states, but the.

The tax foundation released its annual state tax comparison tuesday. “we did not want to. Questions answered every 9 seconds.

The table below summarizes sales tax rates for idaho and neighboring states in 2015. General introductory information on sales/use tax in spanish. Includes a statewide 1.25% tax levied by.

Currently, the following orders which prescribe the various rates of sales tax are in force: If the shipping charge is not stated separately, then it is considered to be a part of the taxable transaction, and the seller is. Idaho has slightly complicated rules when it comes to taxes on shipping.

Section 15 of the sales tax act 1972 empowers the minister to fix, by order published in the gazette, the rates of sales tax to be imposed on the taxable goods. There is no county sale tax for boise, idaho. The table also notes the state's policy with respect to types of items commonly exempted from sales tax (i.e., food, prescription drugs and nonprescription drugs).

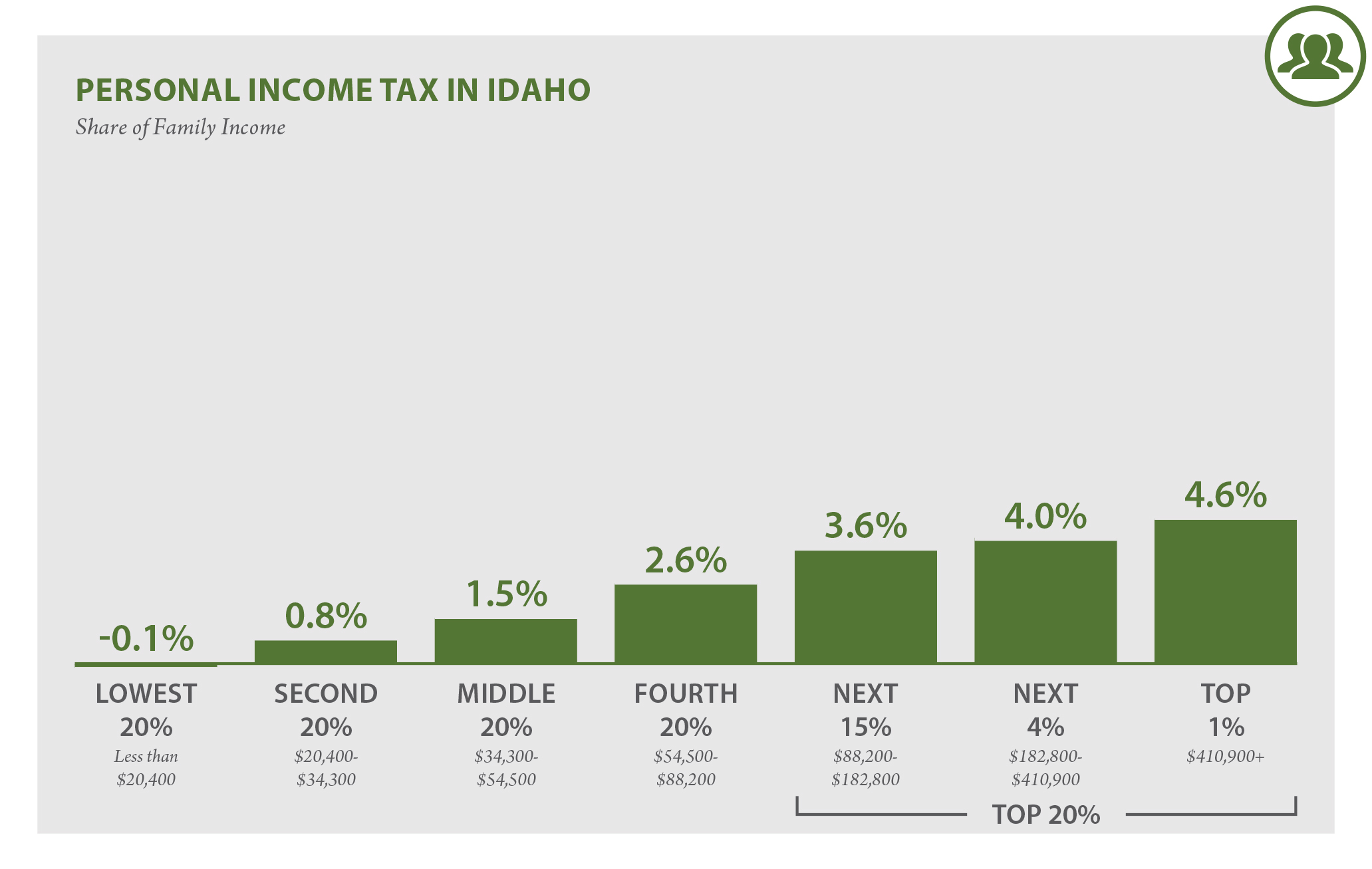

Lower income tax brackets, which now pay between 1.6 percent and 5.1 percent, wouldn’t change. Sales and use tax chart: 31 rows idaho (id) sales tax rates by city.

Includes statewide 1.0% tax levied by local governments in virginia. The sales tax rate in idaho for tax year 2015 was 6 percent. For use in clark county effective 7/1/2009 through 12/31/2015.

For use in white pine county effective 7/1/2009 and washoe county 7/1/2009 through 3/31/2017. The idaho state tax commission has updated information regarding the application of idaho sales and use tax to municipal wastewater treatment plants, the cities that own and operate them, and the contractors who work on them. As of august 2015, the highest total general sales tax rate in alabama is in the portions of arab that are in cullman county, which total to 13.5%.

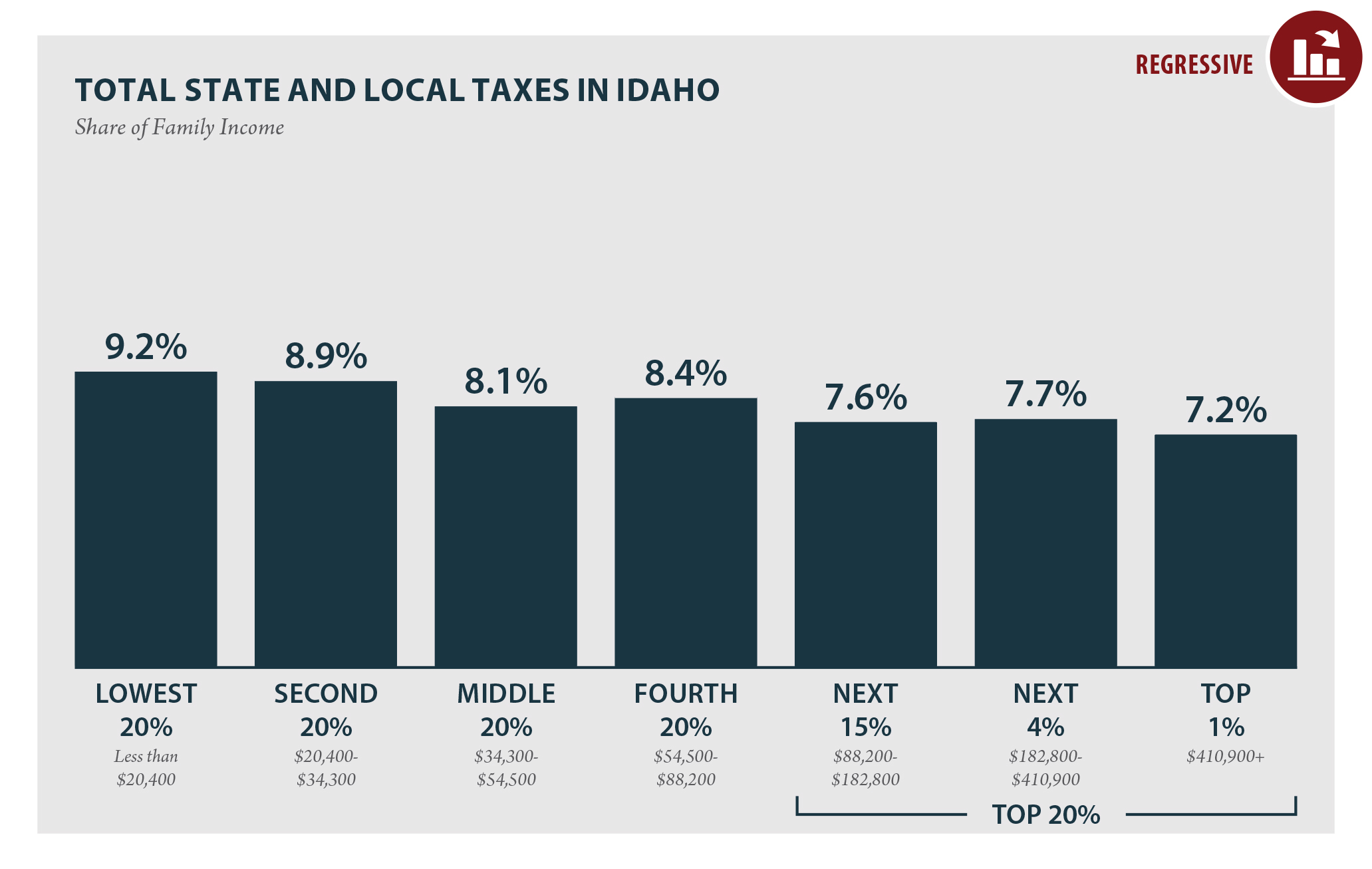

The state sales tax rate in idaho is. That means 9.5 percent of all idaho personal income goes to local and state taxes. 8, effective july 1, 2015;

Ad a tax advisor will answer you now! Dealerships may also charge a documentation fee or doc fee, which covers the costs incurred by the dealership preparing and filing the sales contract, sales tax documents, etc. Components of sales and use tax rates

There is no city sale tax for boise. Food sales subject to local taxes. Neither would idaho’s corporate tax rate, which would stay at 7.4 percent.

Nevada sales tax rate scheduled to decrease to 6.5% on july 1, 2015. The sales tax (rates of tax no.2) order 2008. The boise, idaho, general sales tax rate is 6%.

Tax typically applies to sales of materials that are incorporated into real property.

Taxes Idaho Vs Washington Local News Spokane The Pacific Northwest Inlander News Politics Music Calendar Events In Spokane Coeur Dalene And The Inland Northwest

Combined State And Local General Sales Tax Rates Download Table

Pin On Data Visualization

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Sales Taxes In The United States - Wikiwand

Historical Idaho Tax Policy Information - Ballotpedia

Oregons Business Taxes Tied For Lowest In The Nation Oregon Center For Public Policy

Pin On Infographics

Pin On Mapystics Maps

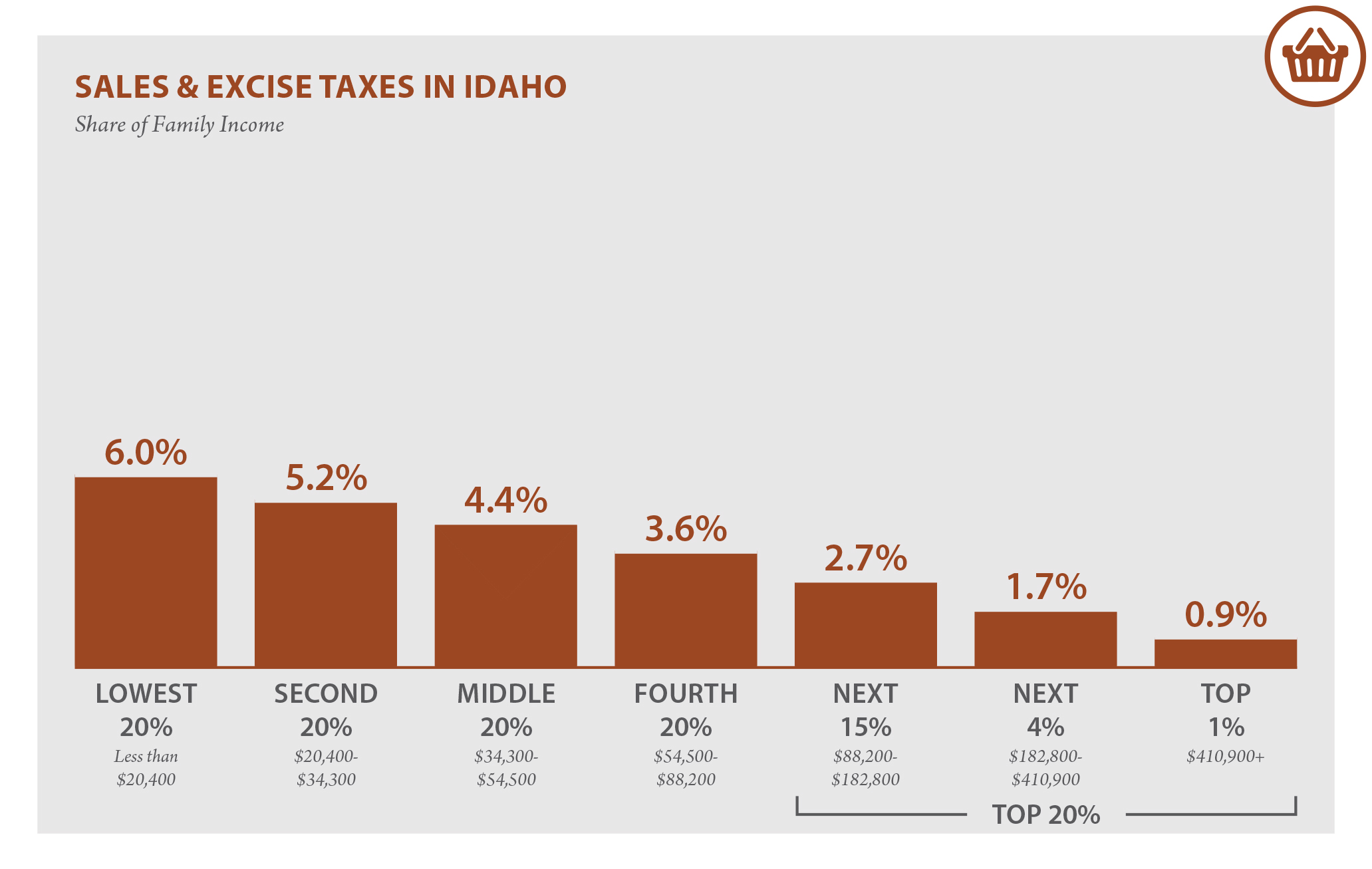

Idaho Who Pays 6th Edition Itep

Littourati - Main Page - Blue Highways Moscow Idaho Idaho Travel Idaho Adventure Idaho Vacation

Idaho Who Pays 6th Edition Itep

States With Highest And Lowest Sales Tax Rates

How Idahos Taxes Compare To Other States In The Region Boise State Public Radio

Idaho Who Pays 6th Edition Itep

Pin On Surety Bonds

Sales Taxes In The United States - Wikiwand

How Idahos Taxes Compare To Other States In The Region Boise State Public Radio

How Idahos Taxes Compare To Other States In The Region Boise State Public Radio

Comments

Post a Comment