While an inherited annuity can provide an unexpected windfall, the tax implications of withdrawing money from it could be costly. I inherited 3 annuities from my father who died in 2014.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities6-f3e0ae90db8b4a5398e3fcabd0538a92.png)

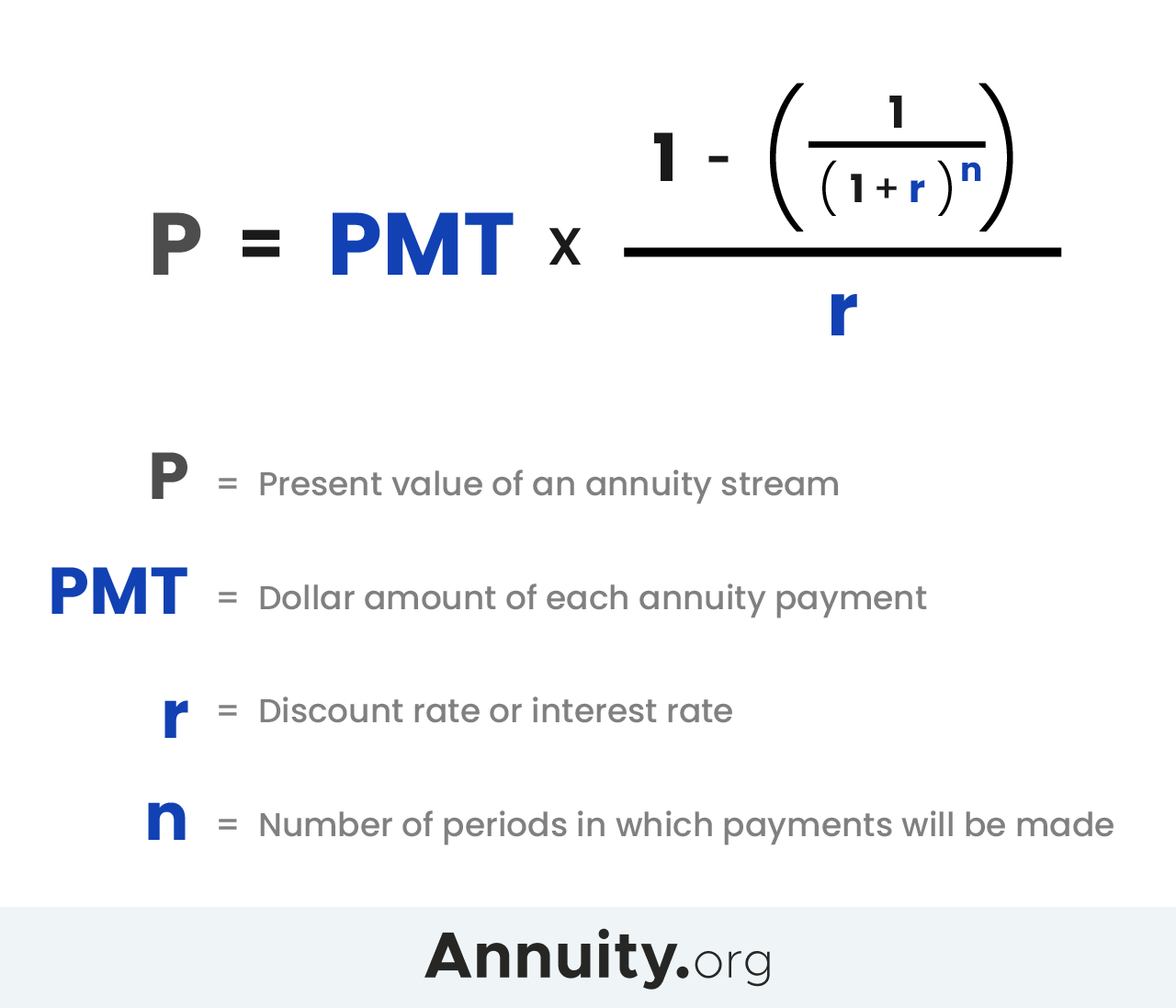

Calculating Present And Future Value Of Annuities

If you were born before jan.

Inherited annuity tax calculator. Any withdrawals from now on will be subject to ordinary income taxes. The payment structure chosen and the beneficiary’s status will determine how taxes are paid on an inherited annuity. So, the person who inherited the annuity can receive a guaranteed lifetime that will also spread out the tax liability.

You live longer than 10 years. With regard to inherited annuities, and this is good for both purchases and beneficiaries to understand, the same general rules are applicable: Calculate the required minimum distribution from an inherited ira.

How taxes are paid on an inherited annuity will depend on the payout structure selected and the. The taxes you may owe are dependent upon the distribution option you choose. Our goal is to help you make smarter financial decisions by providing you with interactive tools and.

Spousal continuance will allow the surviving spouse to continue the deceased’s annuity and avoid paying taxes at the time of death. For each i assume yes, part of the distribution was an rmd. Estate taxes may come into play as well.

Any funds used to purchase the annuity that were already taxed will not be taxable moving forward. If they opt for a lump sum payment, beneficiaries must pay any taxes payable right away. Inheriting a qualified annuity, on the other hand, means owing taxes on any withdrawals from the annuity, including principal and interest.

The difference between the principal paid into the annuity and the value of the annuity at the annuitant’s death is subject to income tax. Annuities / by jason burman. It is possible for the annuitant’s spouse to take over the contract in his or her own name if the beneficiary is the spouse.

If the beneficiary is a spouse of the deceased annuitant, they can carry on with the original annuity contract without any immediate tax implications. Inherited annuity payouts may follow different tax rules. Irs publication 575 says that, in general, those inheriting annuities pay taxes the same way that the original annuity owner would.

The same options apply to spousal inherited annuities, but with one additional option, spousal continuance. However, funds that were not taxed prior to the annuity will be taxed as. Your life expectancy is 10 years at retirement.

Like the qualified annuity, there is a restriction on taking funds out before age 59½, again subject to a 10% penalty. The difference stems from the way the two types of annuities are funded. Turbotax is asking what part of the distribution was an rmd.

Turbotax is asking if the withdrawals were rmds. So if the annuity buyer paid $10,000 and the death benefit. Rmd amounts depend on various factors, such as the beneficiary's age, relationship to the beneficiary, and the account.

Although you can’t completely avoid taxes on annuity payouts, by understanding how an annuity is structured and how you choose to receive the benefits, you can minimize the tax burden while taking greater advantage. People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitant’s death. So you're going to have to pay taxes on an inherited annuity.

The income from an inherited annuity is taxed. If you have inherited a retirement account, generally you must withdraw required minimum distributions (rmds) from an account each year to avoid irs penalties. The original annuity contract holder must include a death benefit provision and name a beneficiary.

Tax rules, tax implications, tax liability, and if you need to pay taxes on the inherited annuity will all come into play. How to figure tax on inherited annuity. How do i calculate this?

Now, the good news is, most carriers, most annuity companies will.

How To Calculate Annuities On A Finance Calculator 6 Steps

Fixed Annuity Rates March 2019 Annuity Saving For Retirement Insurance Marketing

Pros And Cons Of Investing In Mutual Funds - Lindas Stocks Mutuals Funds Investing Investing 101

Use Inheritance To Pay Off Credit Card Debt Not Mortgage - Paying Down Credit Cards - Ideas Of Paying Down Cr Paying Off Credit Cards Dollar Annuity Retirement

/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

Calculating Present And Future Value Of Annuities

The Rules Of Back Pay For Child Support - Child Support Laws - Ideas Of Child Support Laws Childsupport Laws Chi Child Support Laws Child Support Supportive

12 Best Calculator Plugins For Your Wordpress Site

Present Value Of An Annuity How To Calculate Examples

What To Do With Multiple Pension Pots Httpswww2020financialcoukwhat-to-do-with-multiple-pension-potswhat To Pensions Pension Fund Retirement Benefits

Baird Bond Funds Ultra-short Fact Sheets Et Ed Snipping Screenshot In 2021 Bond Funds Fund Management Facts

Income Tax Calculator For Fy 20-21

2021 Investment Outlook Investing Financial Coach Economic Trends

Vanguard - Retirement Nest Egg Calculator Preparing For Retirement Retirement Calculator Retirement

How To Calculate Annuities On A Finance Calculator 6 Steps

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities2-9c9db03774fd45fc83501879e123f82d.png)

Calculating Present And Future Value Of Annuities

Answers To Medicare Questions - Fidelity Medicare Health Insurance Coverage Veterans Health Care

Pendapatan Nasional Rumus Menghitung Pdb Pnb Dan Lain-lain Retirement Savings Calculator Savings Calculator Saving For Retirement

The Complete Guide To The Roth Ira Traditional Ira Roth Ira Retirement Accounts

16 Annuity Calculators The Annuity Expert

Comments

Post a Comment