$ this refund is claimed for the following reasons (check all that apply): When property is bought and sold, the assessor's office records the transfer of the property to reflect the most current owner in preparation for the annual assessment roll.

Fees Jefferson Parish Clerk Of Court

Property taxes for 2020 become due upon receipt of the tax notice.

Jefferson parish property tax due date. What is the rate of jefferson parish sales/use tax? Property taxes must be paid by december 31. Property owners may review their assessments and apply for additional relief during this time.

The due date for all registered fillers is the 1st of the month following the close of the calendar month of the reporting period. When contacting jefferson parish about your property taxes, make sure that you are contacting the correct office. Louisiana property taxes must still be paid regardless of a pending outcome for the appeal.

The jefferson parish assessor’s office has announced it is opening its tax rolls from september 29, 2021 through october 13, 2021. Find jefferson parish residential property records including property owners, sales & transfer history, deeds & titles, property taxes, valuations, land, zoning records & more. Free jefferson parish property records search.

When are sales taxes due and which date is used to determine if a return is paid on time? The parish is responsible for collecting all property taxes from the middle of november until the day of the tax sale, which is generally held sometime in or around june of each year. When do property tax bills go out and when do they become delinquent?

3.5% on the sale of prescription drugs and medical devices prescribed by a physician For example, property taxes for 2020 become due upon receipt of the notice and become delinquent if not paid by december 31, 2020. *due to the annual tax sale this site can only be used to view and/or order a tax research certificate.

Remember to have your property's tax id number or. Landry parish has the lowest property tax in the state, collecting an average tax of $202.00 (0.25% of median home value). When and how is my personal property assessed and calculated?

Most due apr 1, jefferson parish due mar 1. Tammany parish collects the highest property tax in louisiana, levying an average of $1,335.00 (0.66% of median home value) yearly in property taxes, while st. Jefferson parish collects relatively low property taxes, and is ranked in the bottom half of all counties in.

The median property tax (also known as real estate tax) in jefferson parish is $755.00 per year, based on a median home value of $175,100.00 and a median effective property tax rate of 0.43% of property value. They become due on december 1 and delinquent if not paid by december 31. 4.75% on the sale of general merchandise and certain services;

Property taxes notices are normally mailed during the last week of november for that taxable year. The assessor's office is responsible for uniformly and accurately appraising and assessing all property in jefferson parish for property tax purposes. Yearly median tax in jefferson parish.

When are property taxes due in louisiana? 15 days from book opening date. The due date for all registered fillers is the 1st of the month following the close of the

Faqs • jefferson parish sheriff's office, la • civicengage. The assessment date is the first day of january of each year. Books open for public inspection.

The sheriff transfers any unpaid taxes to the jefferson county clerk’s office, accruing statutory penalties as. The exact property tax levied depends on the county in louisiana the property is located in. 3.50% on the sale of food items purchased for preparation and consumption in the home;

Louisiana is ranked 1929th of the 3143 counties in the united. The bills are usually mailed in late november of each year. Owners in their senior years and property owners with certain disabilities with some protection from escalating property values due to inflation.

Taxes that remain unpaid after the louisiana property tax due date result in an interest computed at a rate of 1% per month until paid. The total number of parcels, both commercial and residential, is 185,245. The following local sales tax rates apply in jefferson parish:

Houses (4 days ago) online property tax system. Supervisor and finance division commander danette hargrave. Jefferson parish collects, on average, 0.43% of a property's assessed fair market value as property tax.

Since its inception, this special assessment level exemption has led to thousands of dollars in savings for seniors and property owners with certain disabilities. Total property taxes owed in jefferson for 2020 are $435.1 million, up 0.5% from $432.7 million in 2019. A return is considered delinquent after the 20th of the month following the close of the reporting period.

*payments are processed immediately but may not be reflected for up to 5 business days. They become delinquent on january 1, following their due date and are maintained and collected in the county sheriff’s office until april 15 each year. The median property tax in jefferson parish, louisiana is $755 per year for a home worth the median value of $175,100.

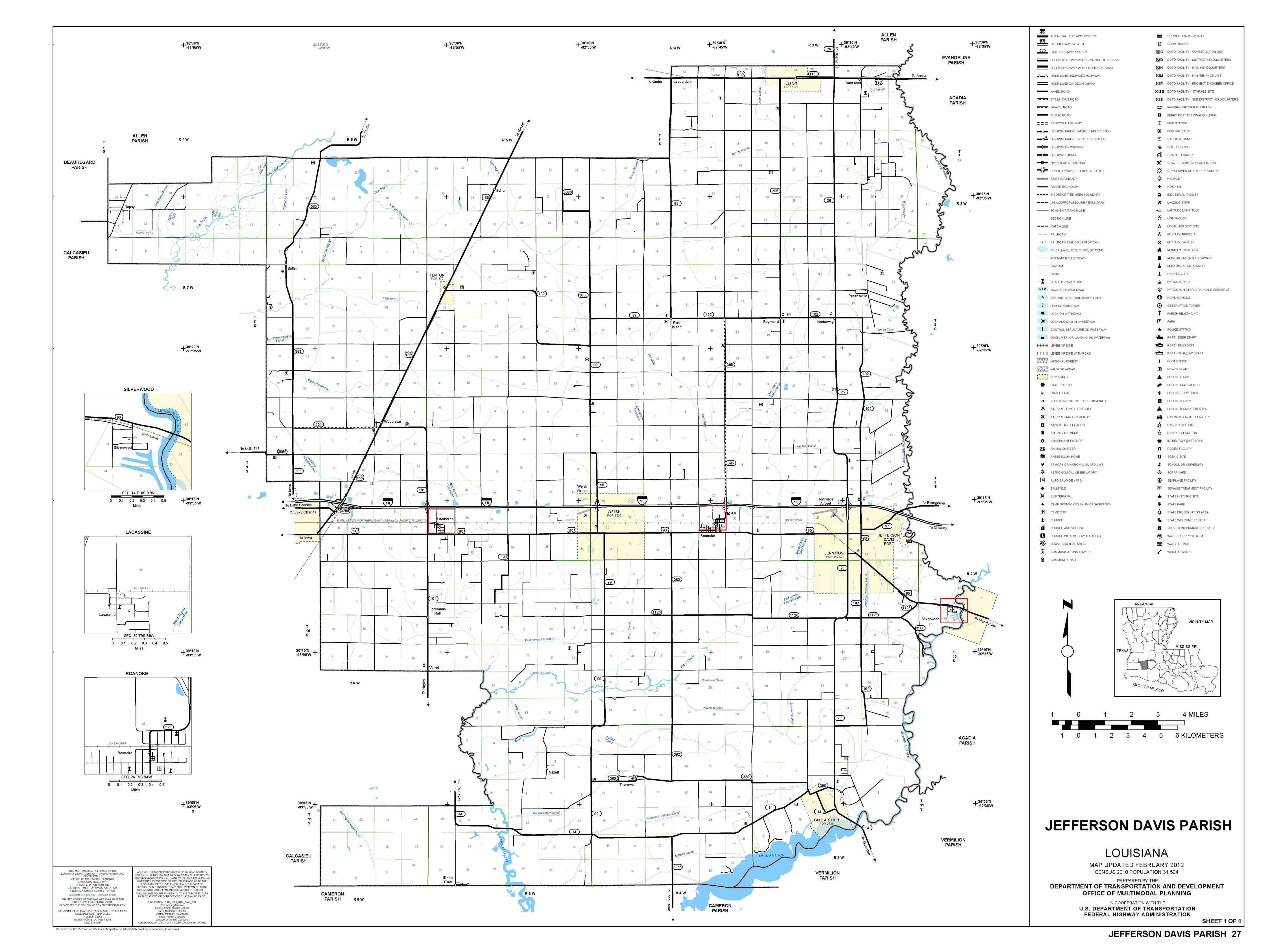

The jefferson davis parish tax division is under the command of tax collection dept. The tax was overpaid because of an error on the part of the taxpayer in mathematical computation on the return or on any of the supporting documents.

Payments Jefferson Parish Sheriff La - Official Website

Filepolltaxrecieptjefferson1917jpg - Wikipedia

Tax Assessment Reductions Available To Some Property Owners

Tax Division - Jefferson Davis Parish Sheriffs Office

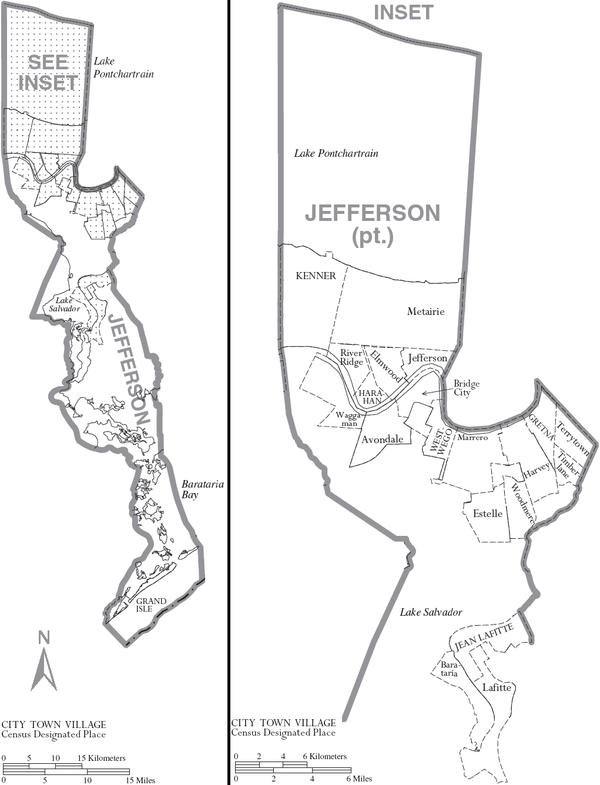

Jefferson Parish Louisiana - Wikiwand

Payments Jefferson Parish Sheriff La - Official Website

Jefferson Parish Sheriffs Office Jefferson Parish Sheriffs Office

Yubbnohrcfya_m

2

2

E-services Jefferson Parish Sheriff La - Official Website

Jefferson Parish Clerk Of Court Forms - Fill Online Printable Fillable Blank Pdffiller

Jefferson Parish Public Schools - Posts Facebook

Yubbnohrcfya_m

Jefferson Parish Arrest Court And Public Records

Online Property Tax System

2

2

Tax Division - Jefferson Davis Parish Sheriffs Office

Comments

Post a Comment