The home depot tax exempt id number is used when making tax exempt purchases in lieu of the state issued tax exempt id number. This is a mandatory step regardless of whether the.

2

Lowes tax exempt account number 8509837121.

Lowes tax exempt number. Many people confuse an ein number with a tax exempt number, or believe that the two numbers are interchangeable. You need a tax exempt form from the state treasurer's office. For more information, please refer to the.

How do i get a tax exempt id number? Email the following to [email protected] you would like to set up multiple users, please submit all of the required information below for each individual user. To get started, we’ll just need your home depot tax exempt id number.

O yes o no (if yes, please provide tax exempt certificate to store.) estimated monthly expenditures at lowe’s $ _____ section 2 — company information. State law interpretation lets lowe's give shoppers tax. They should not need a phone number.

All registrations are subject to review and approval based on state and local laws. I farm and use quite a bit of farming supplies and do not have a problem in most places when i use my tax exempt number; If you qualify as a tax exempt shopper and already have state or federal tax ids, register online for a home depot tax exempt id number.

Please allow 24 to 48 hours for a pending certificate status to be finalized. Ein for organizations is sometimes also referred to as taxpayer identification number or tin or simply irs number. If you are not using mytax illinois to renew, then you must mail the required documentation to the following address:

Shop tax free event and a variety of products online at lowes.com. In fact, they are two completely separate and different numbers. Use mytax illinois to quickly renew your sales tax exemption (e) number electronically by scanning the above required documentation and attaching the scanned files to your renewal request.

Tax exempt number for commercial card users present this number before each purchase you make at any lowe’s for university business purposes. The law did not change any of the items that qualify for exemption. Applying for tax exempt status.

Use your home depot tax exempt id at checkout. Certificates are available immediately after they're validated. If they ask for a phone number, request that they look up the account under berea college.

If you qualify as a tax exempt shopper and already have state or federal tax ids, register online for a home depot tax exempt id number. The id number will be numeric only and is displayed on the printed registration document. (1) it's my understanding that by accepting your pto's tax id #, the vendor is accepting the risk.

If this number is not presented at the time of purchase you will be charged sales tax. An ein number is a federal tax identification number issued by the irs and is used to identify businesses and other entities operating in the united states. Company/applicant full legal name (account will be set up in this name) _____ dba name (if different than legal name) _____ street address (street name and number required)_____ city

An ein, or employee identification number, must be obtained. First, you'll need to apply for an employer identification number (ein). If he is audited, and it turns out he failed to collect sales tax from a taxable customer, he gets the slap.

Use your home depot tax exempt id at checkout. You are looking for the sales and use tax resale and exemption form. Farmers and ranchers must have an ag/timber number to make exempt purchases of qualifying items on or after jan.1, 2012.

As of january 31, the irs requires that form 1023 applications for recognition of exemption be submitted electronically online at www.pay.gov. That why some vendors won't accept your word that your group is tax exempt, and need a copy of the letter. The employer identification number (ein) for lowes companies inc is 560578072.

But, to make purchases of these items exempt from sales tax, the purchaser must now give the seller a new completed exemption certificate with an ag/timber. Establish your tax exempt status. Link to lowe's home improvement home page.

A copy of the articles of incorporation must be submitted. They will be able to Does lowes do tax exempt.

The number is auto assigned by the system during the registration process. View or make changes to your tax exemption anytime. State forms can be found at:

You can down load the forms, fill them out, and print them from the following link:

2

How Does Lowes Not Charge Sales Tax - Tax Walls

How Does Lowes Not Charge Sales Tax - Tax Walls

2

2

2

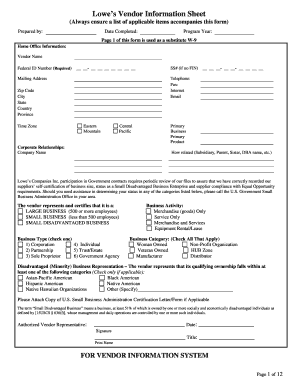

Lowes W9 - Fill Online Printable Fillable Blank Pdffiller

Lowes Tax Exempt

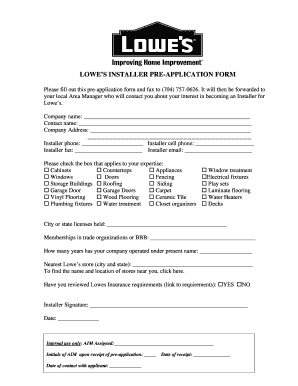

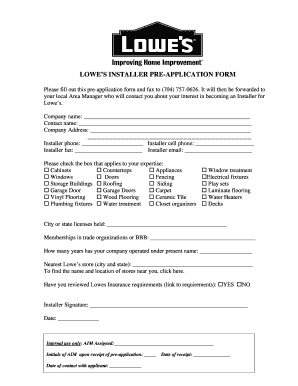

Lowes Job Application Pdf - Fill Out And Sign Printable Pdf Template Signnow

2

Tax Exempt - Stores Who Honor The Tribal And Band Cards - Posts Facebook

2

2

For Jlynne123 Hope This Will Help U A Little As Cashier Rlowes

Edge

Tax Exempt - Stores Who Honor The Tribal And Band Cards - Posts Facebook

Tax Exempt - Stores Who Honor The Tribal And Band Cards - Posts Facebook

Lowes Commercial Account - Business Information

2

Comments

Post a Comment