If your adjusted gross income for the year is over $150,000 then you must pay at least 110% of last year’s taxes. The second safe harbor is based on the tax owed in the immediately preceding tax year.

2

Your september payment and your january payment will be $2,500 each.

Nc estimated tax payment safe harbor. You expect your withholding and credits to. If the total liability for the prior tax period or the projected liability for the current tax Taxpayers are required to make estimated tax payments when there is a combined franchise and excise tax liability of $5,000 or more, after applicable tax credits, for both the prior tax year (annualized if the tax period was less than 12 months) and the current tax year.

If your payments equal or exceed 90% of what is owed in the current year, you can escape a penalty. The second safe harbor is based on the tax you owed in the immediately preceding tax. This safe harbor is generally 100% of the prior year’s tax liability.

If you expect to owe less than $1,000 after subtracting your withholding, you’re safe. Individuals with annual agi of $1,000,000 or more must pay in 90% of the current year's tax to avoid a penalty. In addition, the law provides safe harbor prepayments.

Safe harbor estimates calculate at 110% of current year tax for returns with federal taxable income over $150,000 only when code. Estimated tax is the amount of tax an estate or trust expects to owe for the year after subtracting: Estimated tax safe harbor that is based on the tax shown on your 2000 tax return is 110% of that amount if you are not a farmer or fisherman and the adjusted gross income shown on

The amount of any credits. And, if certain conditions are met, your penalty is waived or reduced. So long as you follow.

If you pay 100% of your tax liability for the previous year via estimated quarterly tax payments, you’re safe. You expect to owe at least $1,000 in tax for the current tax year, after subtracting your withholding and credits. Pick up the paper form at one of our service centers;

Suppose your tax for the year is $10,000 and your prepayments total $5,600. For tax years beginning on or after january 1, 1999, taxpayers with taxable gross income exceeding $150,000 ($75,000 for married/civil union partner, filing separate) meet the safe harbor exception for the underpayment of estimated tax if the total amount of all payments of estimated tax made on or before the last date prescribed equals 110% of last year’s tax pursuant to n.j.s.a. In that case, you're required to.

This method is recommended only if you expect your income to be close to what it was last year. The irs also accepts tax payments by phone, and using a credit or debit card, but service fees do apply. Mail the completed paper form and your estimated payment to the north.

However, for taxpayers whose agi exceeds $150,000 ($75,000 for married taxpayers filing separately), the prior year’s safe harbor is 110%. Dedicate part of your earnings to estimated taxes. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding.

If you’re estimating a down year, so long as you pay within 90% of your actual liability for the current year, you’re safe. The first safe harbor is based on the tax owed in the current year. Enter information on the ncest screen to.

If your adjusted gross income for the year is. This is also known as the “safe harbor rule”. If your adjusted gross income for the previous year was above a certain amount, the safe harbor estimated payment rule changes a bit.

The tax system is based on a “pay as. If you make estimated tax payments for this year that are at least 100% of the tax owed on your prior year return, then you will not owe an estimated tax penalty. Here is the main part of the safe harbor rule:

There are two safe harbors: This safe harbor is generally 100% of the prior year’s tax liability. The amount of any tax withheld.

You can also pay your estimated tax online. North carolina safe harbor estimated tax. No penalty is imposed if the amount paid for the current year is equal to at least 90% of the taxpayer’s current tax liability.

You must pay estimated tax payments for returns with taxable income of $50,000 or more electronically. The first safe harbor is based on the tax you owe in the current year. Even if your income grew this year, you will avoid estimated tax penalties if you match the payments that you owed in the previous year (but you will still have to make up the additional.

You calculate that you need to pay $10,000 in estimated taxes throughout the year, and you don't make your first payment until june 15 (when the second estimate is due), so your first payment will be $5,000. The safe harbor estimated tax has three components, which we’ll outline here. *north carolina does not have vouchers to send with estimates.

If you pay 100% of your tax liability for the previous year via estimated quarterly tax payments, you’re safe. When current year agi exceeds $150,000 ($75,000 if married filing separately) but is less than $1,000,000 ($500,000 if married filing separately), they must pay in 110% of the prior year's amount to avoid the penalty. The estimated safe harbor rule has three parts:

No penalty is imposed if the amount paid for the current Individual tax forms and publications individual income tax forms and instructions. Bob’s 2018 form 1040 shows.

Estimated tax payments must be sent to the north carolina. Here’s how to calculate your estimated tax payment using the safe harbor rule. You must make quarterly estimated tax payments for the current tax year (or next year) if both of the following apply:

Safe harbor can be applied to estimated taxes giving you some leeway in how much you need to pay. The “safe harbor” rule of estimated tax payments paying 100% of the taxes you owed in the previous year is sometimes referred to as the safe harbor rule. If your payments equal or exceed 90% of what you owe in the current year, you can escape a penalty.

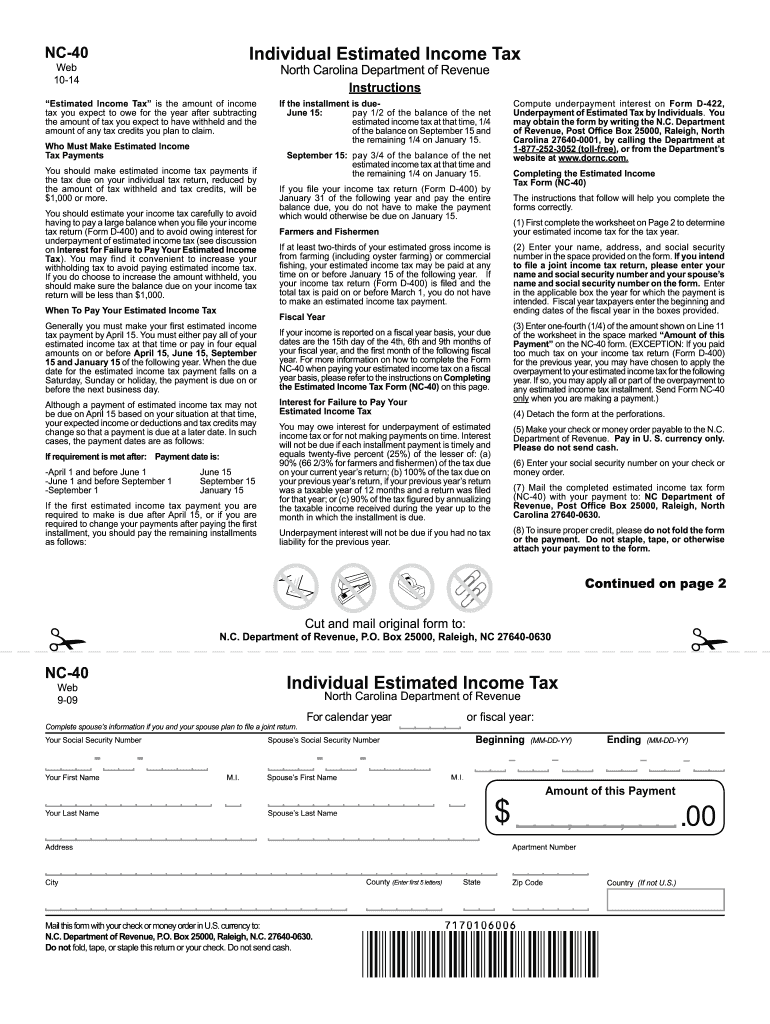

If you are unable to file and pay your north carolina estimated tax electronically or want to use a paper form, visit download forms and instructions to access instructions and download the paper form; Estimated tax payment safe harbor details. For calendar year filers, estimated payments are due april 15, june 15, and september 15 of the.

Tax Extensions Due To Covid-19 Fml Cpas

Quarterly Estimated Tax Payments - What You Need To Know

How To Calculate Quarterly Estimated Taxes In 2021 1-800accountant

2

What To Know About Covid-19 And Taxes Deadline Delays The Cares Act And More

Ask The Tax Genius When To Pay Taxes On Gamestop Stock Policygenius

2

2

Safe Harbor For Underpaying Estimated Tax Hr Block

2

How To Calculate Estimated Taxes The Motley Fool

Nc Estimated Tax Payment - Fill Out And Sign Printable Pdf Template Signnow

Making Estimated Tax Payments Sc Associates

Instructions For Form 1040-nr 2020 Internal Revenue Service

2

Safe Harbor For Underpaying Estimated Tax Hr Block

State Income Tax Extensions Weaver Assurance Tax Advisory Firm

2021 Form Sc Dor Sc1040es Fill Online Printable Fillable Blank - Pdffiller

2

Comments

Post a Comment