On september 13, 2021, the u.s. The maximum estate tax rate would increase from 39% to 65%.

The House Ways And Means Committee Reports On Tax Law Changes

Increase in the federal estate tax rate.

Proposed federal estate tax changes. The pending changes to estate tax and gift taxes are on the table right now. A lowering of the estate tax exemption and changes to the treatment of capital gains and dividends are likely to survive the spending bill negotiations in congress, according to michael townsend. The current estate tax exclusion for an individual is $11.7 million (effectively $23.4 million for.

The proposed bill reduces the federal estate and gift tax exemption from $11.7 million per person to $5 million per person, indexed for inflation, prior to the scheduled sunset on january 1, 2026. The changes would be effective beginning after december 31, 2021. Estate and gift tax exclusion amount:

The federal estate tax is a tax on the transfer of wealth during an individual’s lifetime or after death. The biden administration has proposed sweeping estate tax impacts to the estate and gift structure. The proposed bill reduces the federal estate and gift tax exemption from $11.7.

Capital gains tax would be increased from 20% to 39.6% for all income over $1,000,000. The effect of the 2017 trump tax cuts. Proposed changes to federal tax code affecting tax and wealth management clients.

Net investment income tax would be broadened to cover more income if your total income was greater than $400,000. No expected change in the estate tax exemption for 2022 under the “build back better” legislation! Potential estate tax law changes to watch in 2021.

President biden has signaled some proposed tax changes of his own, but those tax proposals are not the only ones floating around washington. However, on october 28, and then again on november 3, the house rules committee released revised proposals after substantial. The house ways and means committee released tax proposals to raise revenue on september 13, 2021, which included notable changes to income tax and estate and gift tax.

Reducing the estate and gift tax exemption. The 2017 trump tax cuts. Unrealized gains would be taxed when assets transfer at death or by gift as if they were sold.

Reduce the current $11.7 million federal estate tax exemption to $3.5 million. The committee specifically proposed rolling back the 2017 trump tax cuts. By dobbslg | nov 15, 2021.

As of november, 2021, the proposed “build back better” legislation does not contain any changes to the federal estate tax exemption provisions. The budget reconciliation bill published by house democrats is silent to significant estate tax changes, including lowering the estate and gift lifetime exemption from $11,700,000 to $5,000,000. The proposed law would reduce the federal gift and estate tax exemption from the current $10 million exemption (indexed for inflation to $11.7 million for 2021) to $5 million (indexed for inflation to roughly $6.2 million) as of january 1, 2022.

Right now, you have a certain amount of money that you can pass on to a loved one without getting taxed. The proposed bill provides major changes to the estate and gift tax rules that could reverse parts of the tax cuts and jobs act of 2017 and significantly limit opportunities for estate and tax planning. The biden campaign proposed reducing the estate tax exemption to $3.5 million per person ($7 million for a married couple), which is what it was in 2009, while increasing the top rate to 45%.

The proposed impact will effectively increase estate and gift tax liability significantly. Effective january 1, 2022, the federal estate and gift tax exclusion will be cut in half to about $6.0 million after adjustment for inflation. The house ways and means committee recently introduced a wide variety of potential changes to the tax code.

One of the potential tax law changes, that would take effect at the beginning of 2022, is a reduction of the federal estate tax exemption. Such proposals include changes to the following: At present, the top federal estate tax rate is 40% and.

Additionally, these proposed tax rates would apply to taxable estates worth up to $1 billion. The bill would reduce the current federal estate and gift tax exemptions of $11.7 million per person to $3.5 million for transfers at death and $1 million for lifetime gifts. This was anticipated to drop to $5 million (adjusted for inflation) as of january 1, 2022.

Read on for five of the most significant proposed changes. This tax is imposed on the portion of an estate that exceeds the lifetime gift and estate tax exemption amount. House ways and means committee (the committee) released a draft of proposed changes to the federal tax code, including significant changes affecting trusts, estates, gifts and tax rates, among other proposals 1.

· a reduction in the federal estate tax exemption amount which is currently $11,700,000.

Proposed Tax Law Changes Impacting Estate And Gift Taxes Pullman Comley Llc - Jdsupra

The New Death Tax In The Biden Tax Proposal Major Tax Change

Gift And Estate Tax Laws No Changes From Congress After All

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

House Democrats Tax On Corporate Income Third-highest In Oecd

How The Tcja Tax Law Affects Your Personal Finances

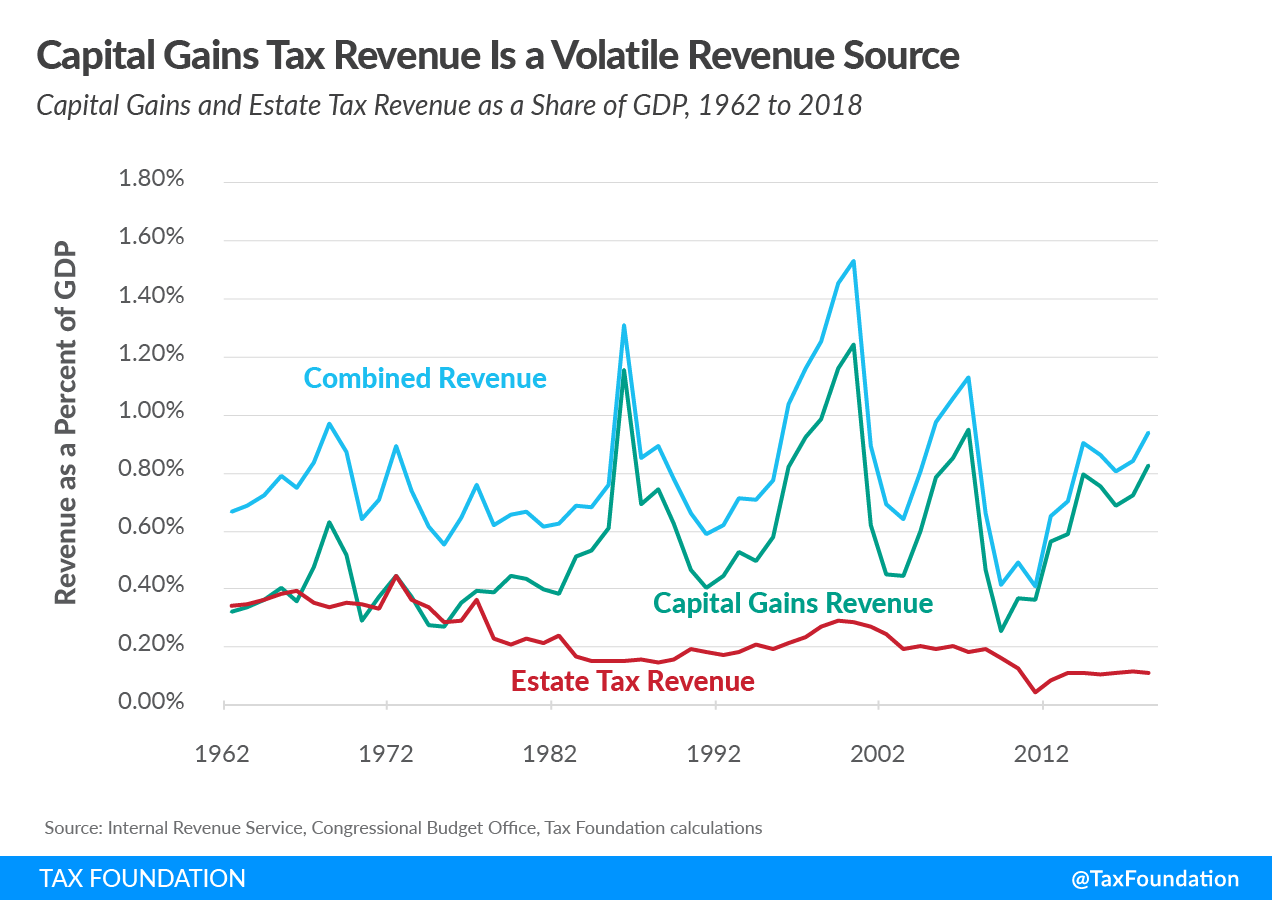

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

The New Death Tax In The Biden Tax Proposal Major Tax Change

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Stronger Estate Tax Would Hit More Inheritances Under Democrats Plan

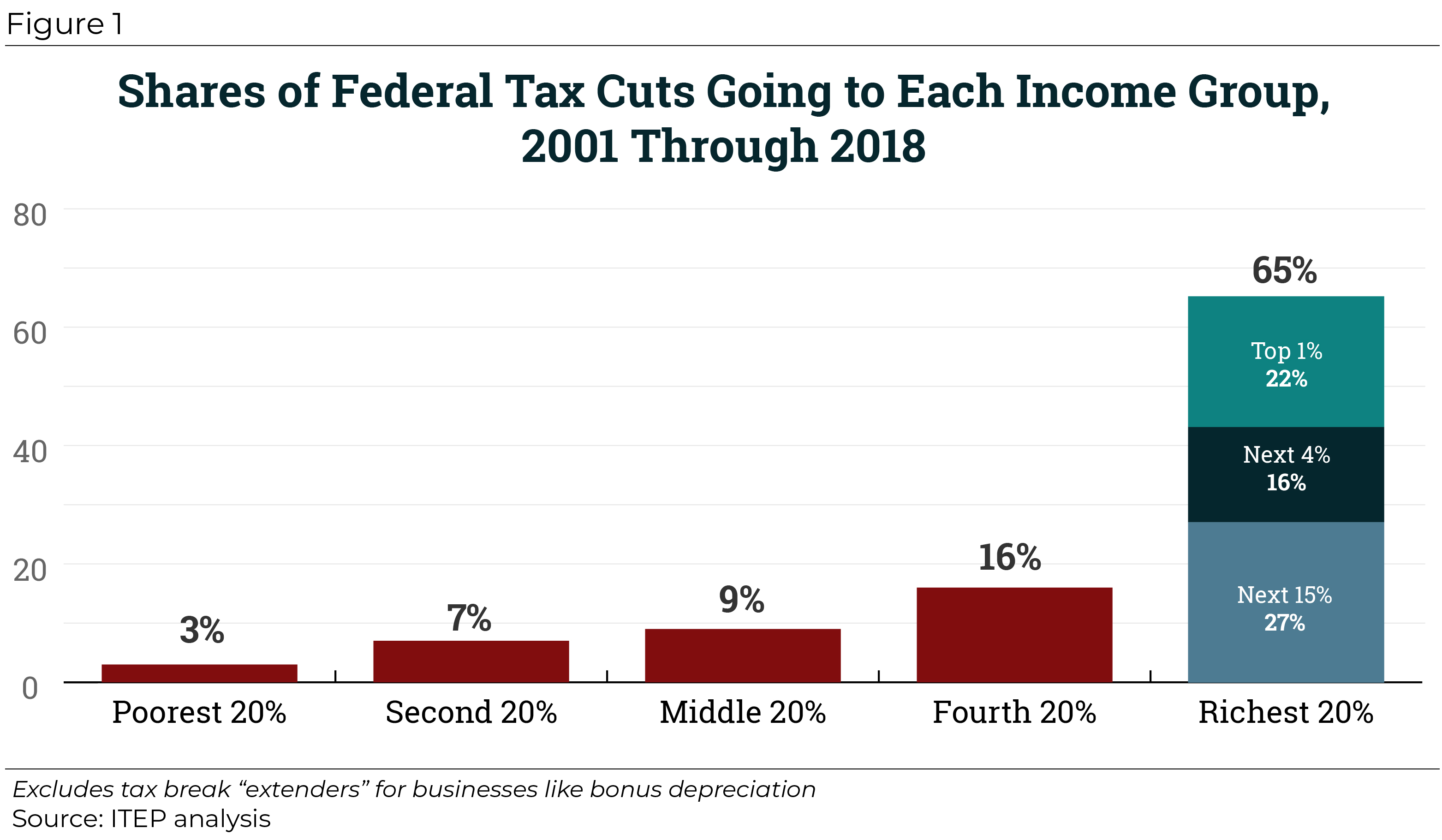

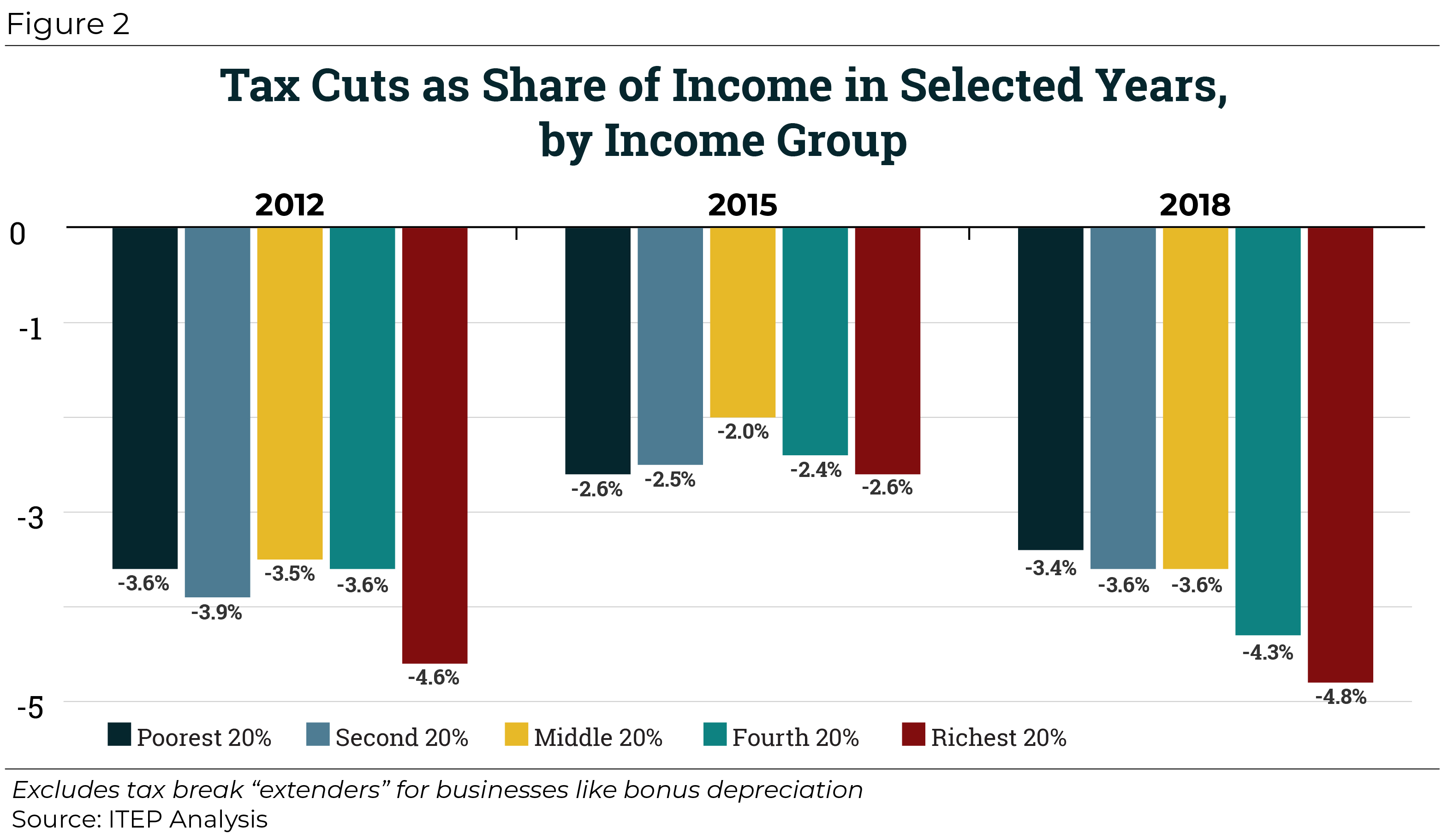

Federal Tax Cuts In The Bush Obama And Trump Years Itep

Hey President Biden - What Are You Doing On Estate Taxes

Summary Of Proposed 2021 Federal Tax Law Changes Burr Forman - Jdsupra

Federal Tax Cuts In The Bush Obama And Trump Years Itep

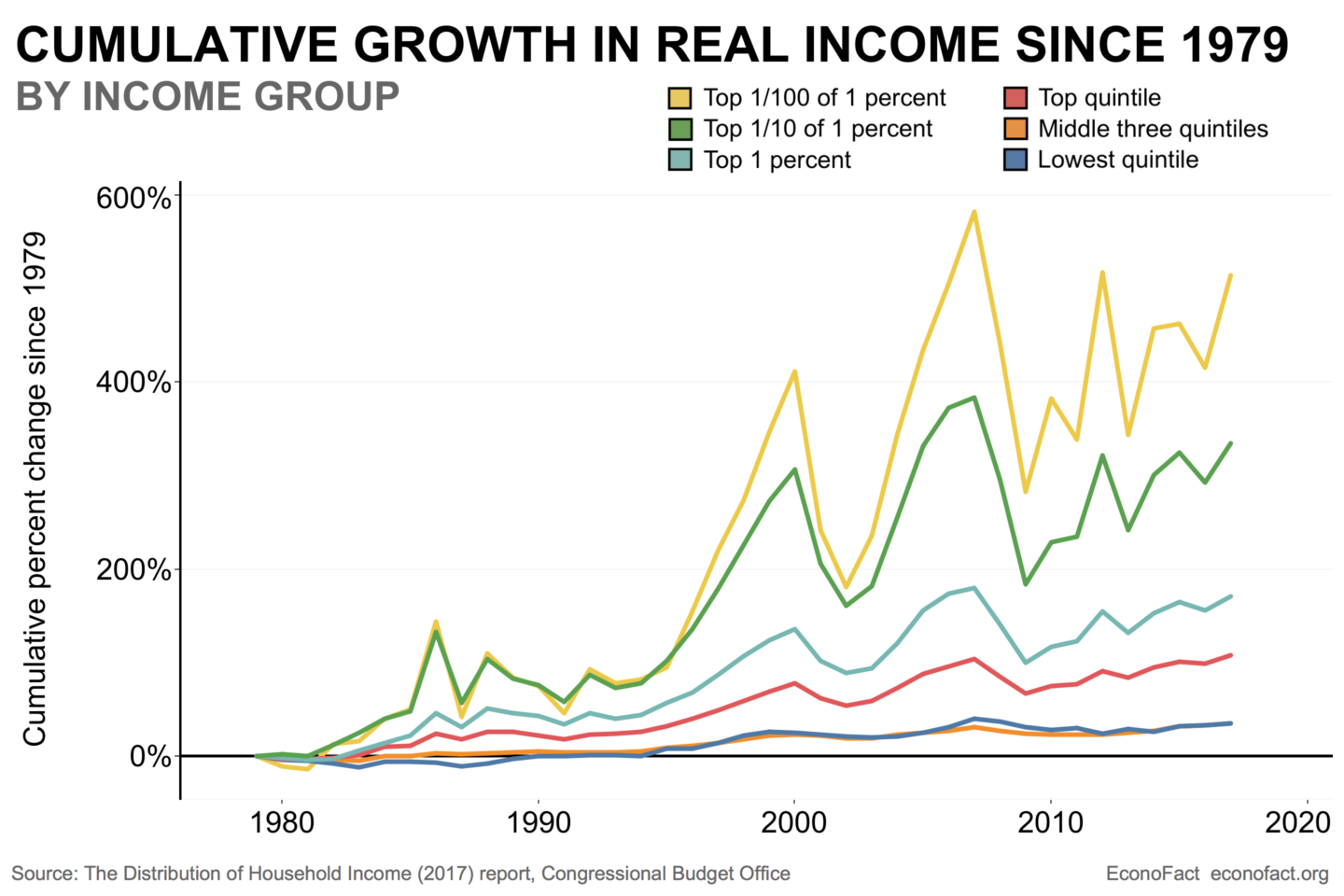

Taxing The Rich Econofact

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

The Generation-skipping Transfer Tax A Quick Guide

Proposed Legislation To Change Estate And Gift Tax Planning Stoel Rives Llp - Jdsupra

Comments

Post a Comment