If you are running an auto spare part shop, for instance, the inventory acquired from the wholesaler is exempt from tax. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate.

2

Purchaser must state a valid reason for claiming exception or exemption.

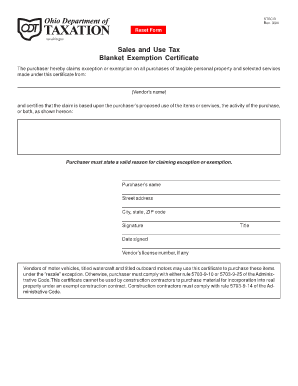

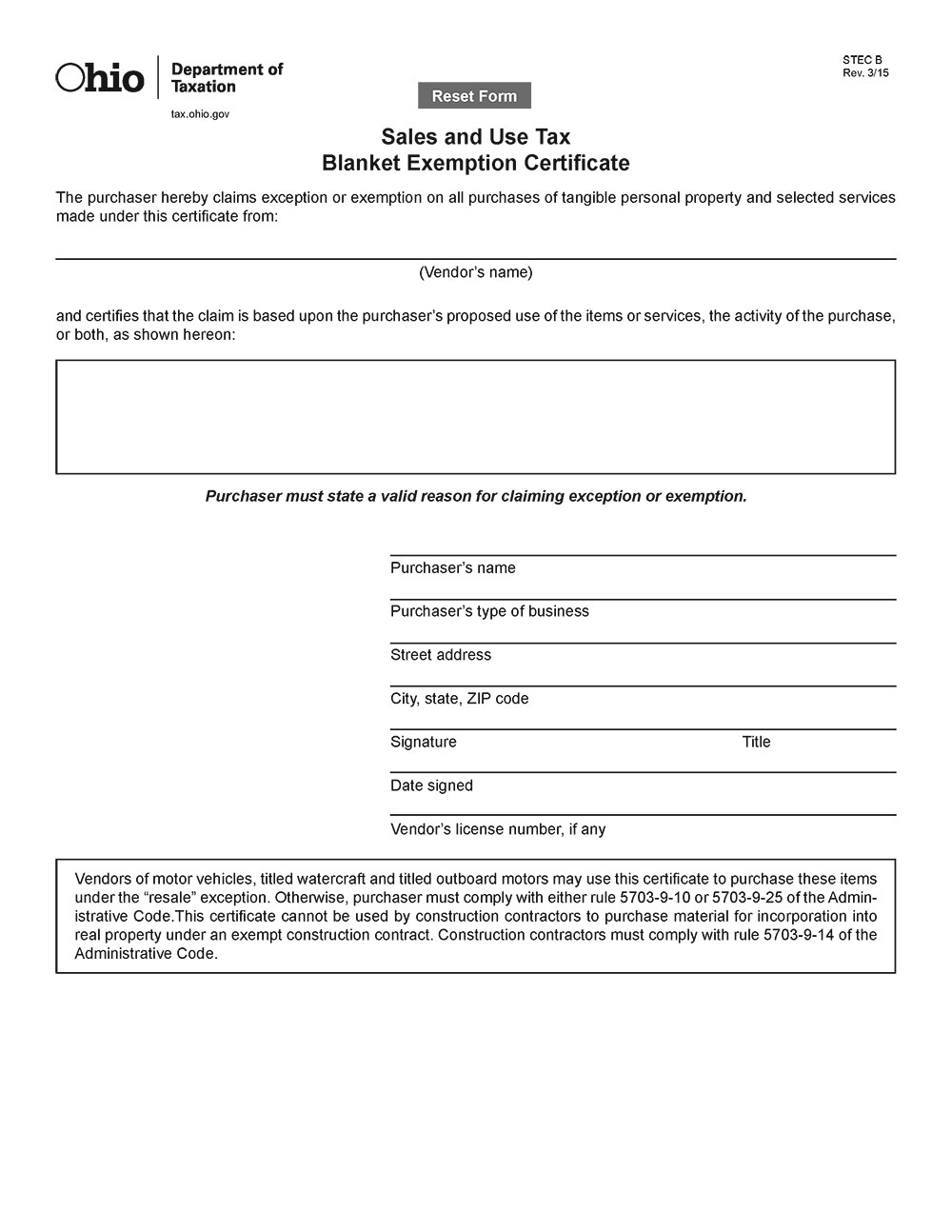

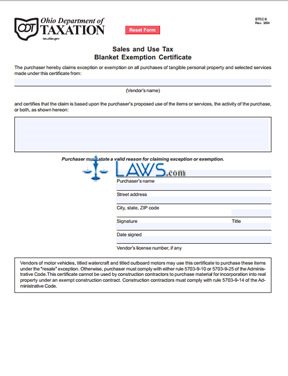

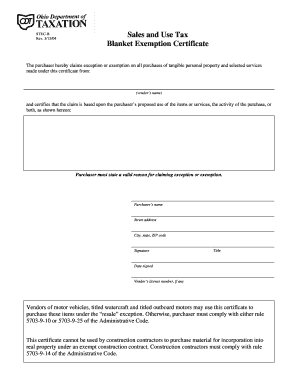

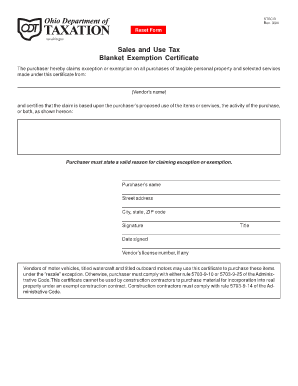

Tax exempt resale certificate ohio. State of ohio department of taxation sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certificate from vendor s name and certifies that the claim is based upon the purchaser s proposed use of the items or services the. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from: The issuing buyer and the recipient seller have the responsibility to determine the proper use of this certificate under

A resale certificate exempts the holder from paying sales tax when they purchase certain goods. By its terms, this certificate may be used only for claiming an exemption based on resale or on the incorporation of the item purchased into a product for sale. Contractee’s (owner’s) name exact location of job/project name of job/project as it appears on contract documentation the undersigned hereby certifi es that the tangible personal property purchased under this exemption from:

A seller’s permit is commonly known as a sales tax permit, reseller permit, resale certificate, sales tax exemption certificate, sales tax license or sales and use tax permit. How to use sales tax exemption certificates in ohio. This short guide will give you what you need to know to buy products for resale in ohio, and what to do if you’re presented with an ohio resale exemption certificate.

Steps for filling out the ohio sales and use tax exemption certificate. If you wish to use an ohio. You can do this by presenting a resale certificate (sometimes called a reseller’s permit or by other names) to your vendor at checkout.

Almost every wholesale company will require a sales tax. Obtaining your sales tax certificate allows you to do so. Generally, resale certificate holders are businesses that either resell or use the purchased goods as parts in their own offerings.

Our platform provides your business with a comprehensive exemption certificate management (ecm) platform, which enables your customers to fill out tax exemption certificates in an intuitive workflow. The seller keeps the certificate and may then sell property or services to the purchaser without charging sales tax. Exemption certificates are prescribed by the tax commissioner and can be obtained from a local printer or office supply store.

In ohio, you need to complete and present an ohio sales and use tax blanket exemption certificate to the merchant from which you are buying the products to be resold. Items must be for resale or qualified business use. Sample forms are available on our web site by searching tax forms.

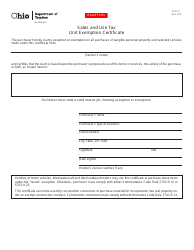

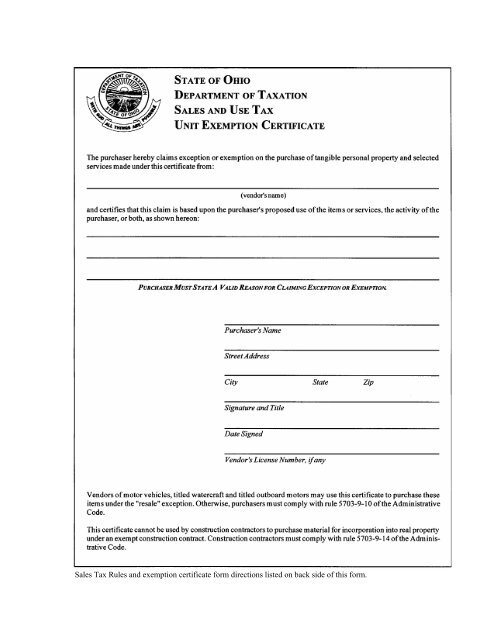

He will need either a sales and use tax unit exemption certificate (form stec u) or a sales and use tax blanket exemption certificate (form stec b). If you purchase an item from a wholesale organization, or even another retailer, and are reselling the item, in most situations, you will be exempt from paying state sales tax. As a retailer, you have the chance to buy items that you intend to resell without paying sales tax at the time of purchase.

In the state of ohio it is formally referred to as a vendor’s license. Exemptax stays on top of complex regulations and provides an intuitive way to link state verifications with your resale and tax exemption certificates. To obtain an ohio farm tax exempt form, a farmer should visit the department of taxation's website.

(vendor’s name) and certifi or both, as shown hereon: 44 votes) most businesses operating in or selling in the state of ohio are required to purchase a resale certificate annually. In ohio, this sellers permit lets your business buy goods or materials, rent property, and sell products or services tax free.

Sales and use tax contractor’s exemption certifi cate identifi cation of contract: This license will furnish a business with a unique ohio sales tax number, otherwise referred to as an. Sellers would never need to seek a resale certificate for nontaxable goods or from confirmed customers that are often excluded, such as the federal government, the state of ohio, or any other local government office, according to the ohio department of taxation (as long as the invoice reflects that the buyer is a tax exempt entity).

Sales and use tax blanket exemption certificate. Ohio tax exemption, ohio resale certificate, ohio sale and use tax, ohio wholesale certificate, etc. When you buy an item for resale, you purchase the item without paying state sales tax.

Ohio resale certificate general description taxable items intended for resale are not subject to sales tax in ohio. Most businesses operating in or selling in the state of ohio are required to purchase a resale certificate annually. (vendor’s name) and certi fi es that the claim is based upon the purchaser’s proposed use of the items or services, the activity of the purchase,

Sales and use tax unit exemption certifi cate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from: Why your business needs a ohio sellers permit. The purchaser fills out the certificate and gives it to the seller.

How to use and accept resale certificates.

V0xtelx4xn8mem

Ohio Resale Certificate Trivantage

Free Form Sales And Use Tax Blanket Exemption Certificate - Free Legal Forms - Lawscom

Pin On Degree Certificate

2

Exemption Certificate Forms Department Of Taxation

How To Get A Non-taxable Transaction Certificate In New Mexico - Startingyourbusinesscom

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Printable Ohio Sales Tax Exemption Certificates

Ohio Tax Exempt Form - Fill Online Printable Fillable Blank Pdffiller

Ohio Tax Exempt Form For Farmers - Fill Online Printable Fillable Blank Pdffiller

2

How To Get A Sales Tax Exemption Certificate In Ohio - Startingyourbusinesscom

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Pin On Real Estate Investing

Ohio Resale Certificate Pdf - Fill Online Printable Fillable Blank Pdffiller

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

2

Ohio Tax Exempt Form - Holland Computers Inc

Comments

Post a Comment