Tax forfeited land sale list current as of: However certain properties are not salable and remain vested to the state of minnesota.

Crow Wing County Tax Forfeited Land Map - Tax Walls

Is there a difference between tax forfeited land and mortgage foreclosure?

Tax forfeited land brainerd mn. Crow wing county conducts one public auction land sale per year. Revenues and expenditures for general operations (governmental funds) percent total total increase 2020 2019 (decrease) revenues taxes $ 1,833,659 $ 1,649,183 11.19% tax increment 19,213 franchise. A judgment is entered against the property if they remain unpaid through april, and the forfeiture process is begun.

Property search & tax statement. View cass county information about tax forfeited land sales including list of properties or sign up to be placed on the land sale mailing list, a fee will apply. 3% assurance fee, $25 state deed fee, $46 recorder fee, 0.33% deed tax if over $500 or $1.65 if $500 and.

Isanti county manages the properties while in trust for the state. The brainerd hra may from time to time request that the county convey property at a price less than the assessed market value (the “conveyance price”), if the brainerd hra determines that acquisition of For over a century, the citizens of minnesota have authorized the government and the courts to confiscate a taxpayer's real property, as a last resort, in order to compensate the taxing districts for lost revenue due to delinquent real property taxes.

The sale will be held at 10:00 am on friday july 23 at the land services building, 322 laurel street in brainerd. Properties offered for sale have forfeited to the state of minnesota for failure to pay property taxes. Following a review period these properties are made available to the public for purchase;

For over a century, the citizens of minnesota have authorized the government and the courts to confiscate the taxpayer's real property, as a last resort, in order to compensate the taxing districts for lost revenue due to delinquent real property taxes. Following a review period per minnesota statutes, these properties are. Crow wing county 2021 tax forfeited land sale.

Tax forfeited land is when an owner has unpaid property taxes to the county. Classification also includes current and potential use of the land. What fees are involved with purchasing forfeited land?

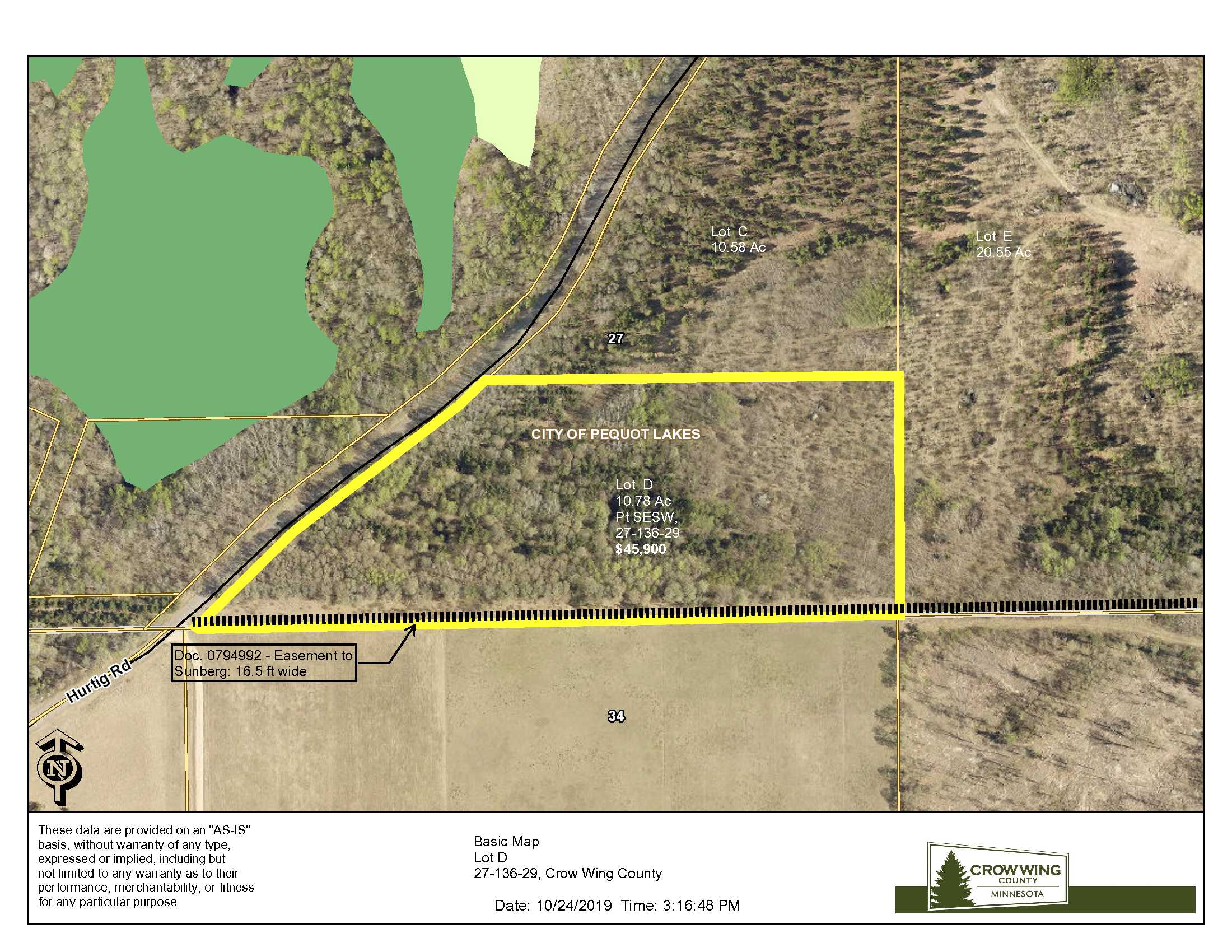

Crow wing county (the “county”) maintains a list of tax forfeited properties (each a “property”). Tax forfeited land, managed and offered for sale by st. Deeds for the following platted parcel(s) will not contain a restrictive covenant which will prohibit enrollment of the land in a state funded program providing compensation for conservation of marginal land or.

Whether it’s protecting our natural resources, fairly valuing property as part of the property tax process, or managing public lands for recreation and forestry, we are devoted to professional, efficient, and effective programs and services. A mortgage foreclosure is when an owner defaults to a bank or other financial institution. This website is audioeye enabled and is being optimized for accessibility.

A list of land for potential sale is prepared by the land & minerals department and submitted for county board approval. State of minnesota department of natural resources approval is also necessary for certain parcels (on water,. The sale will be governed by the provisions of minnesota statute 282 and by the resolution of the.

Our goal is to return these lands to productive use on the local tax rolls. Tax forfeited lands are lands whose title has been acquired by the state of minnesota due to non payment of property taxes. General information about crow wing county tax forfeited land sales.

Crow Wing County Distributes Tax-forfeited Property Timber Sales Revenue Brainerd Dispatch

Crow Wing County Tax-forfeited Property For Sale Despite Objections Brainerd Dispatch

Crow Wing County Tax-forfeited Property For Sale Despite Objections Pine And Lakes Echo Journal

Crow Wing County 2021 Tax Forfeited Land Sale Brainerd Dispatch

Breezy Point Tax-forfeited Lot Sale In The Infancy Stages Hra Says Brainerd Dispatch

Crow Wing County Tax Forfeited Land Map - Tax Walls

Crow Wing County Tax Forfeited Land Map - Tax Walls

Crow Wing County Tax Forfeited Land Map - Tax Walls

Becker County Selling Tax-forfeited Land Detroit Lakes Tribune

Crow Wing County Minnesota Tax Forfeited Land Sale - 2021 By Brainerd Dispatch - Issuu

Crowwingus

County-owned Tax-forfeited Lands Can Be Impossible To Access Brainerd Dispatch

Potlatch Selling 10k Acres In Hubbard County Park Rapids Enterprise

Cass County Board 461k Collected From Sale Of Tax-forfeited Land Brainerd Dispatch

Crow Wing County Agrees To Transfer 5 Tax-forfeited Properties To City Of Baxter Pine And Lakes Echo Journal

Crow Wing County 2021 Tax Forfeited Land Sale Brainerd Dispatch

26 Acres Pequot Lakes Mn Property Id 12597984 Land And Farm

Report Finds Thousands Of Minnesota Public Acres Off Limits To The Public Echo Press

Ideal Township Tax-forfeit Property Pulled From Land Sale Could Become A Park Brainerd Dispatch

Comments

Post a Comment