Prices are subject to change without notice. And i think, frankly, most of those are pretty dated tools that, as we already discussed, don't do things like just take the information from my tax return so i don't have to type this.

Alternative To Bna Income Tax Planner Rtaxpros

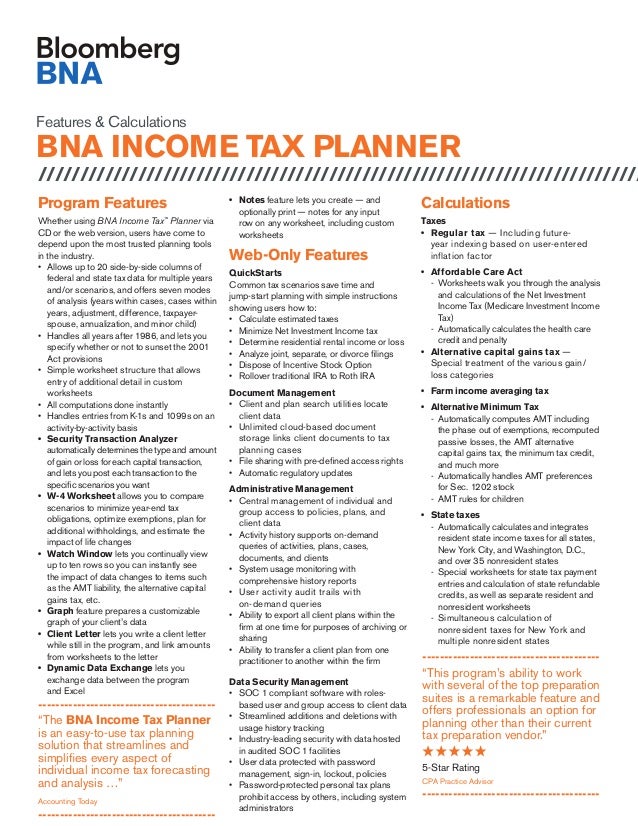

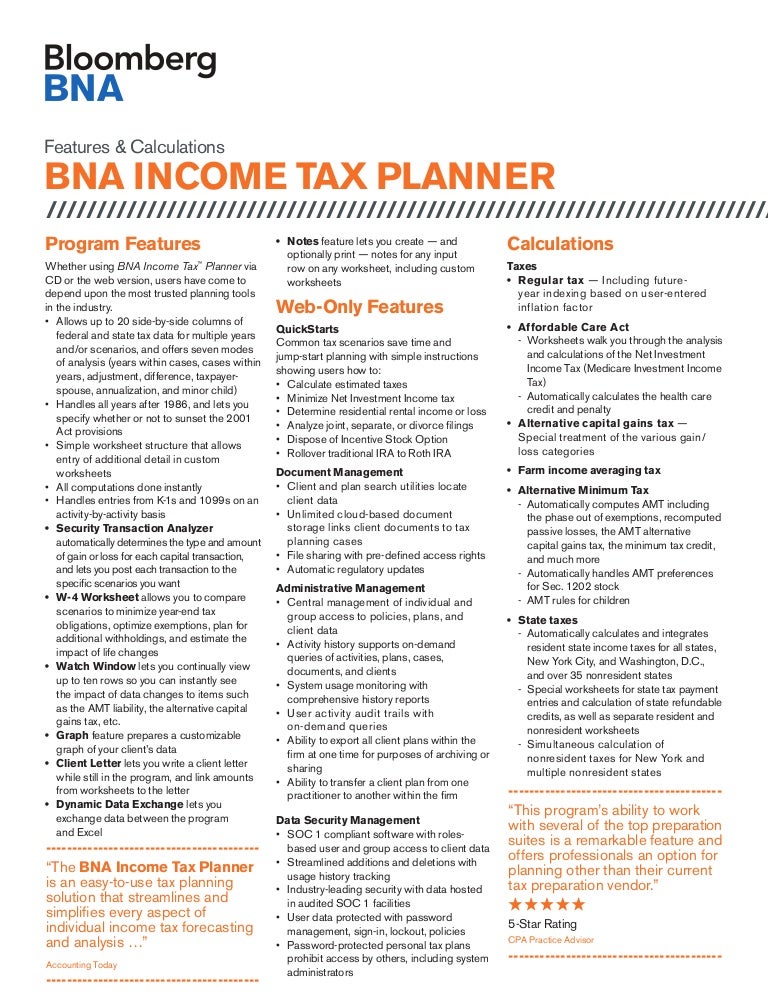

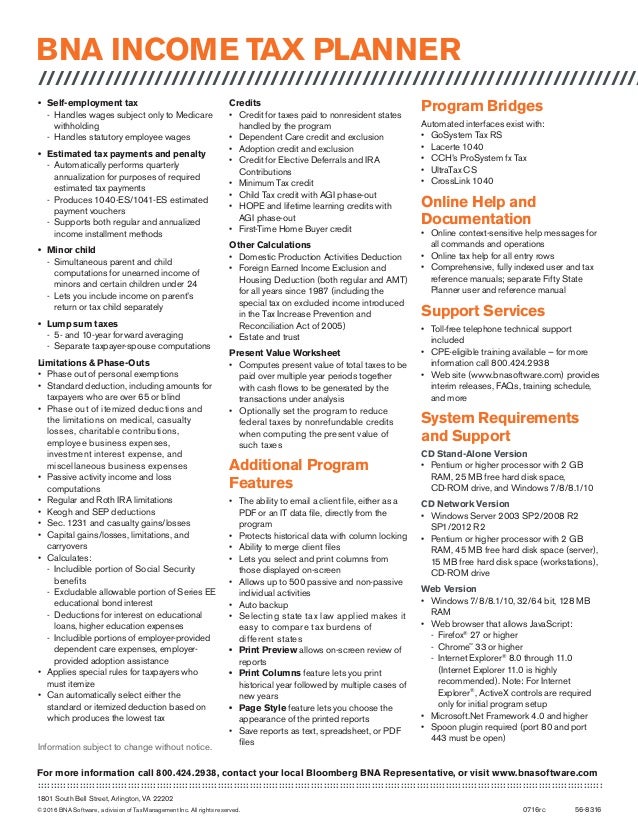

Income tax planner does the heavy lifting for you with timesaving wizards and tools, along with automated calculations and analysis.

Bna income tax planner cost. Individual income tax planning software solutions. Software products like corvee and bna income tax planner help you advise your clients in less time with various options. In year two, regular renewal fee applies to continue use of the product.

When it comes to pricing, we suggest either a value price model or packaging. Bna income tax planner, from bloomberg bna, is one of several tax and accounting applications designed for accounting professionals. Income tax planner quickly calculates federal, state, and nonresident income taxes for alternative minimum tax (amt), capital gains, estimated tax payments, stock options, and more.

The income tax planners like the bna (bloomberg tax&accounting) can run you thousands of dollars. The most trusted tax planning. Customization, data migration, training, hardware, maintenance, upgrades, and.

Sale price is available to first time purchasers of the product only (sorry no renewals). For example, if you want the income tax planner of your choice to come with support, there is extra pay for that, and so on. Bloomberg tax & accounting | income tax planner™.

Bna software, a bloomberg bna business, has launched bna income tax planner web, an online version of the company’s income tax software that provides several new features and lower maintenance costs. The tax planning software is just kind of a nascent category right now because we've got things like cs planner and bna income tax planner, but not much. Bna income tax planner web includes the ability to search for clients, store client notes, and share plans with team members.

The sale price is good for the first year only. Cost of individual plan exceeds cost of family plan. Income tax planner ™ program features whether using the web or desktop version of income tax planner, users have come to depend upon the most trusted planning tools in the industry.

Important offers, pricing details, and disclaimers. Bna/bloomberg tax planner caution alert software does anyone know where to go in bna to clear this caution alert: Read the article below in order to calculate the total cost of ownership (tco), which includes:

531 2001 10% bracket credit. Tax planning top tax planning products. The bna estate & gift tax planner just got better with an expanded quick start wizard and microsoft powerpoint slideshow presentations.

Bna income tax planner offers few flexible plans to its customers with the basic cost of a license starting from $1,150 per year. The pricing for these kinds of income tax planners mostly depends on the number of users and the deployment method. Bna allows us to model multiple scenarios for projects that involve stock options, stock sales, etc., so that we can compare a range of options for your analysis.

Tax Accountant Resume Samples Qwikresume

Bna Income Tax Planner - Quickstart Overview - Youtube

Databloomberglpcom

2011 Review Of Bna Software Bna Income Tax Planner Cpa Practice Advisor

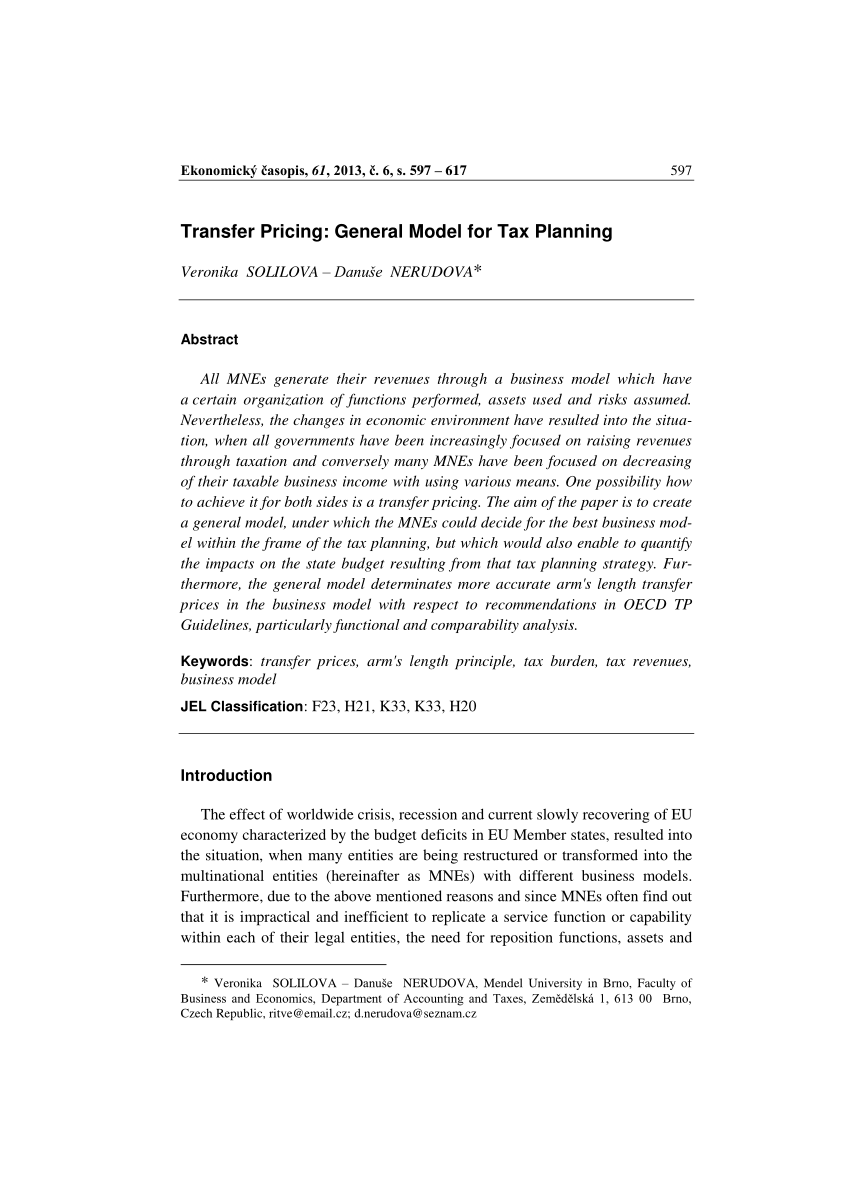

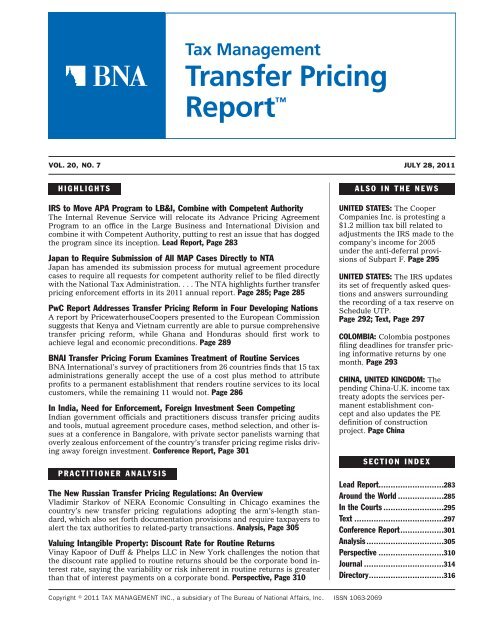

Pdf Transfer Pricing General Model For Tax Planning

Bna Income Tax Planner - Why Rated 6410 Jun 2021 Itqlick

Bna Income Tax Planner Data Sheet

Bna Income Tax Planner Data Sheet

Income Tax Planner Pricing Alternatives More 2021 - Capterra

Income Tax Of Portuguese Listed Companies In Financial And Corporate Social Responsibility Reports

Bna Income Tax Planner Data Sheet

Income Tax Planner Cpa Practice Advisor

Transfer Pricing Report

Research Review Select Bloomberg Income Tax Planner For Your Business Producthood

Income Tax Planner Pricing Alternatives More 2021 - Capterra

Tax Accountant Resume Samples Qwikresume

Bna Income Tax Planner - Why Rated 6410 Jun 2021 Itqlick

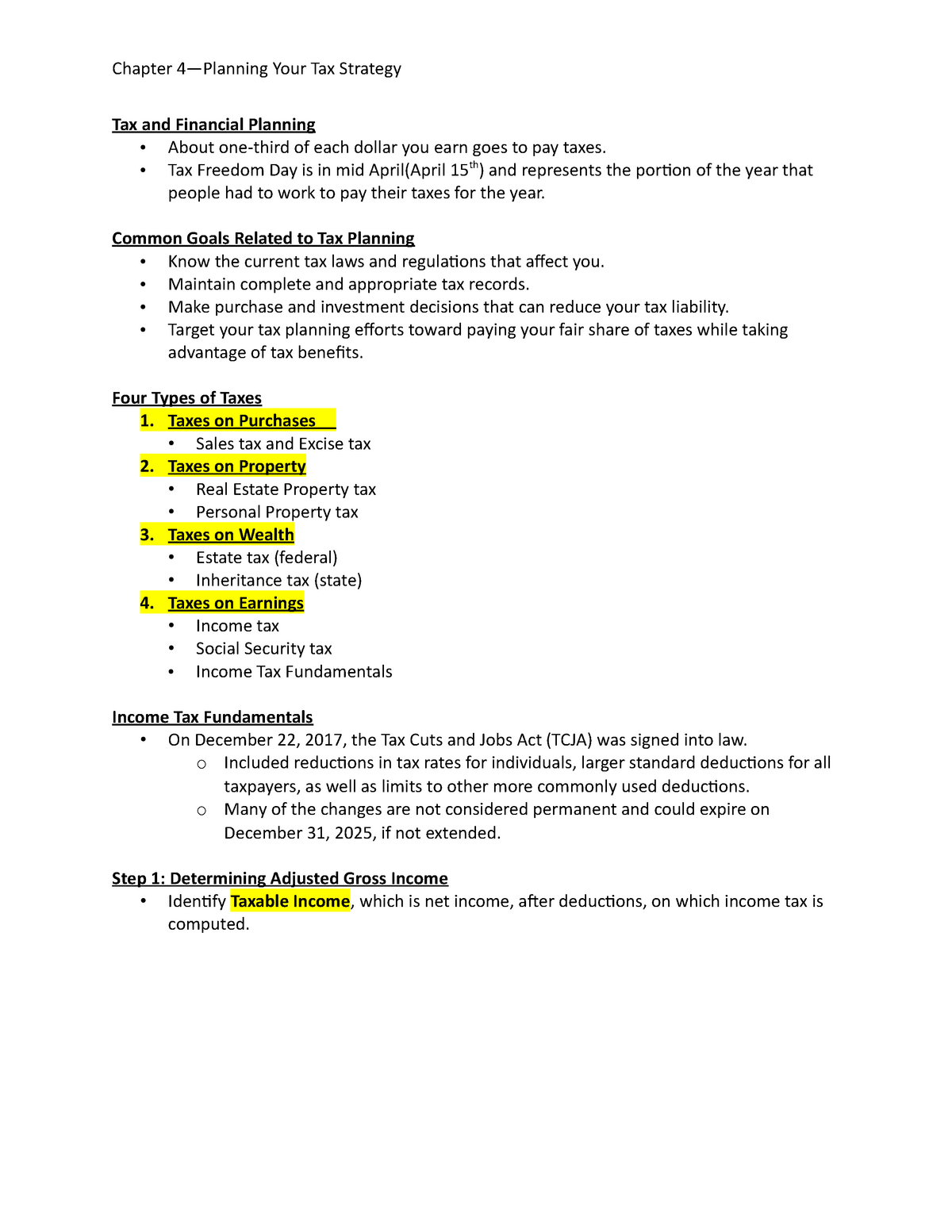

Chapter 4 Personal Finance Planning Your Tax Strategy - Fin 2000 - Studocu

Helpbnaitwebcom

Comments

Post a Comment