Income and capital gains earned by companies are taxed at a flat rate of 25%. A corporate income tax reduction of between 10% to 100% for a minimum investment of idr 1 trillion;

Lowongan Kerja Pt Sampoerna Telekomunikasi Indonesia Net1 Jawa Barat Bandung Mei 2019 Kerja Pendidikan Perjalanan Bisnis

The treaty does not discuss capital gains.

Capital gains tax indonesia. Neilmaldrin noor, a spokesperson for the indonesian directorate general of taxes, said that the authority is considering a tax scheme for capital gains generated from cryptocurrency trades, reuters reports tuesday. Singapore does not charge tax on capital gains. • sale of land and/or buildings located in indonesia.

Or a corporate income tax reduction of up to 50% for taxpayers in the telecommunication, Companies listed on the indonesia stock exchange (idx) that offer at least 40 percent of their total share capital to the public obtain a 5 percent tax cut (hence a tax rate of 20 percent applies for these public companies). The tax treatment on capital gains would then be subject to the domestic tax laws of each state, as governed by article 21 (i.e., income not expressly mentioned).

The gains taxes are taxed at different percentages. A cfc is a foreign entity that is at least 50% owned by an indonesian taxpayer or at least 50% collectively owned by indonesian taxpayers. “it is important to know that if there is a profit or capital gain generated from a transaction, the profit is an object of income tax,” the official stated.

Are investment income and capital gains taxed in indonesia? Assets arising from tax amnesty program indonesia has rolled out tax amnesty program from 1 july 2016 to 31 march 2017 and any newly declared assets under this program cannot be depreciated or amortised for tax purposes. The rates applied to taxable income are shown below.

They have owned it for 10 years; Meskipun sudah banyak negara yang menerapkan capital gains tax, bagaimana menentukan desain kebijakan yang tepat untuk menerapkan capital gains tax masih jadi perdebatan. 4 indonesian pocket tax book 2020 pwc indonesia corporate income tax limitations.

Capital gains earned by indonesian resident are taxable with 25% corporate income tax. Gains on the disposal of land and/or buildings are taxed at 5% (final tax) of the transaction value. The tax is 5% final tax (or 2.5% from 8 september 2016) on the taxable a 0.1% final withholding tax is imposed on proceeds of sales of publicly listed shares through the indonesian stock exchange.

Indonesia individual income tax guide 7 taxation on capital gains and investment income capital gains are generally assessable at standard income tax rates, together with other income of the individual. In general, a corporate income tax rate of 25 percent applies in indonesia. A 0.1% final withholding tax is imposed on proceeds of sales of publicly listed shares through the indonesian stock exchange.

The proceeds from sales of shares listed on the indonesian. An additional tax of 0.5% applies to the share value of founder shares at the time of an initial public offering. Neilmaldrin noor, a spokesperson for the indonesian directorate common of taxes, mentioned that the authority is contemplating a tax scheme for capital features generated from cryptocurrency trades, reuters reported on tuesday.

It is their only source of capital gains in the country 0.1% final tax on the proceeds of a share sale for. The property is directly and jointly owned by husband and wife;

The capital gains tax in indonesia is the taxes that taxed at normal rates on the ordinary income that is derived by an individual. Where capital gains are sourced in indonesia, indonesia will have the right to tax. The acquisition costs of these assets are based on the value declared in the tax amnesty declaration letter.

An additional tax at the rate of 0.5% of the share value is levied on sales of founder shares associated with public. How capital gains taxes in indonesia are calculated. Indonesia taxation and investment 2018 (updated december 2017) 4 the tax incentives are as follows:

However, there are several exemptions: The same tax rate exists for corporations and individuals for capital gains): The scope of cfc income also covers income from indirectly owned cfc with a minimum of 50% ownership by another cfc, or

Concessions are, however, available where a dta is in force. The calculations for gains taxes would defer based on the category being taxed: Secara istilah, capital gains tax sendiri merupakan pajak yang dikenakan atas keuntungan (gains) pengalihan aset, seperti saham dan properti.

Where capital gains are sourced in indonesia, indonesia will have the right to tax. “you will need to know that if there’s a revenue or capital acquire generated from a transaction, the revenue is an object of earnings tax,” the official said. Based on worldwide income taxation concept, overseas investment income and capital gains are.

Capital gains are generally assessable together with ordinary income and subject to tax at the standard cit rate. 5% of the final tax based on the capital gains tax indonesia proceeds or taxable sale value, whichever is higher<. An overview of the capital gains tax in indonesia.

Gains on shares listed in indonesia are taxed at 0.1% (final tax) of the transaction value. In arriving at effective capital gains tax rates, the global property guide makes the following assumptions: Capital gains derived by an individual are taxed as ordinary income at the normal rates;

Lihatlah Keuntungan Secara Realistis Rata-rata Trader Yang Untung Menang Sebesar 50-60 Dari Trading Merek In 2021 Business Funding Risk Management Crypto Currencies

Indonesia-singapura Perbarui Perjanjian Penghindaran Pajak Berganda P3b

Indonesia Fintech Festival Iff 2019 Kembali Hadir Di Tahun Ini Untuk Menjadi Wadah Bagi Pelaku Industri Fintech Dalam Mengedukasi Festival Startup Indonesia

Inilah 10 Situs Populer Trading Bitcoin Indonesia Terbaik Pengikut Membaca Populer

Capital Gains Tax Indonesia The Basics Of Accounting And Tax Reporting

With Its Breathtaking Backdrop Of The Dreamland Pecatu Bali Indonesiathis 16 Units Villa And 87 Units Apartmentsis In The Perfect Setting For A Special Fam

5 Ways To Buy Bitcoin In The United Kingdom Buy Bitcoin Bitcoin The Unit

Aax Mendukung 11 Mata Uang Global Untuk Penyetoran Dan Penarikan Di 2021 Dolar Kanada Kepemimpinan

Djp Online Adalah Cara Termudah Dan Paling Pantas Bagi Wajib Pajak Untuk Membayar Pajak Tepat Waktu Tanpa Perlu Rep Capital Gains Tax Income Tax Tax Deductions

Kumpulan Dp Bbm Menyambut Datangnya Puasa Ramadhan 1437h 2016 Gambar Gerak Animasi

Pemerintah Bakal Ubah Sistem Transaksi Njop Menjadi Capital Gain Tax Pemerintah Dunia Penyakit

Lowongan Kerja Terbaru Di Cileungsi In 2021 Kerja Rohani Sarjana

Pin On Asset Management

Theoceanview Resort Will Be Fully Managed Enabling Investors To Obtain A Great Annual Rental Return

Pin On Finance Tax Saving

Corporate Income Tax Rate And Facility Pajak Penghasilan Jenis

Dukung Umkm Ini Dia Fasilitas Yang Ditawarkan Bekraf Ekonomi Kreatif Kreatif Instagram

Teruslah Konsisten Dalam Melakukan Pekerjaan Anda Trading Forex Trader Stocks Stockmarket Forexsignals Pips Forextrader Forextrading In 2021 Playbill Broadway

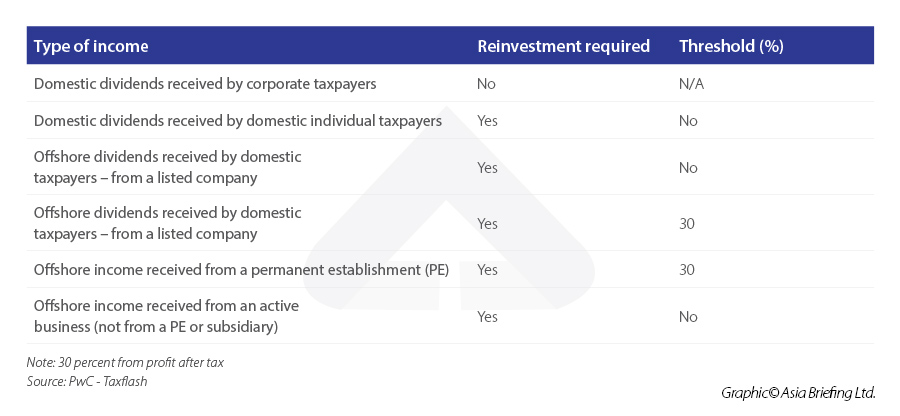

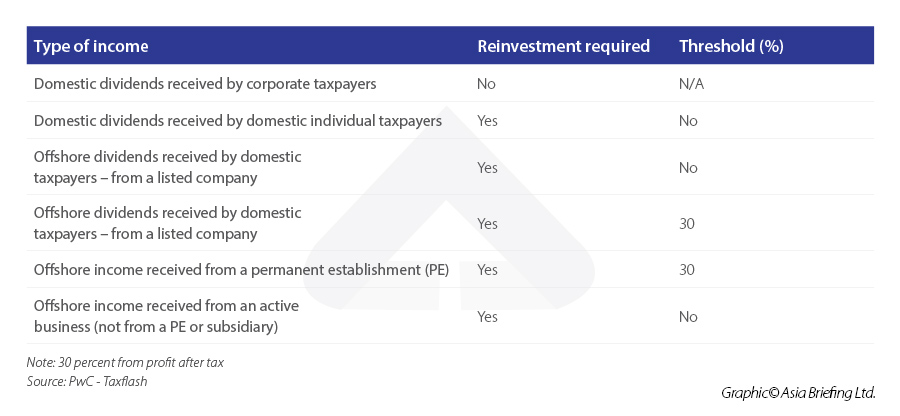

What Are The Changes In Tax Treatment Under Indonesias Omnibus Law

Comments

Post a Comment