Certain tax records are considered public record, which means they are available to the public. In city of richmond the reassessment process takes place every two years.

How Much Will Your House Be Worth In 2030 Uk House Price Map London Property House Prices Home Buying

1000 x $1.20 (tax rate) = $1,200 real estate tax.

City of richmond property tax records. Personal property taxes are billed once a year with a december 5 th due date. Welcome to bs&a online, powered by bs&a software. Property taxes are determined at local levels, being used for schools, fire and police protection, public parks and other benefits.

When contacting city of richmond about your property taxes, make sure that you are contacting the correct office. Search by name through property, tax, and utility billing records. Tax relief programs are available in city of richmond, which may lower the property's tax bill.

Tax relief programs are available in city of richmond, which may lower the property's. City of richmond, macomb county. In city of richmond the reassessment process takes place every two years.

You can also purchase tax certificates in person by visiting the property tax department on the main floor of city hall. Netr online • richmond city • richmond city public records, search richmond city records, richmond city property tax, virginia property search, virginia assessor. The library of virginia holds an extensive collection of richmond land tax records and personal property tax records dating from the late eighteenth century into the twentieth.

Richmond city assessor’s office | 900 e. Personal property would include machinery and equipment and is generally reported by. If you prefer to pay for the tax certificate by credit card, please visit www.apicanada.com to open an account and order your tax certificate.

Houses (6 days ago) virginia tax code requires that all properties currently must be assessed for taxation at 100% of market value. Broad st, rm 802 | richmond, va 23219 | phone: Tax records are not available at the virginia historical society.

Personal property tax records for richmond, city of. Bs&a software provides bs&a online as a way for municipalities to display information online and is not responsible for the content or. The city assessor is responsible for listing and keeping the records for all real and personal property in the city of richmond.

Richmond tax records include documents related to property taxes, business taxes, sales tax, employment taxes, and a range of other taxes in richmond, virginia. From the marvel universe to dc multiverse and beyond, we cover the greatest heroes in print, tv and film. City of richmond real estate search program.

Town of richmond 5 richmond townhouse road wyoming, ri 02898 ph: See detailed property tax report for 1476 talent town rd, richmond county, va. Parcel number search by parcel number through property and tax records.

We accept cash, personal check, cashier’s check, and money order. Property value / 100 = 1000. Tax records include property tax assessments, property appraisals, and income tax records.

A richmond property records search locates real estate documents related to property in richmond, virginia. The city assessor determines the fmv of over 70,000 real property parcels each year. The virginia tax code represents the main legal document regarding taxation.

Public property records provide information on land, homes, and commercial properties in richmond, including titles, property deeds, mortgages, property tax. Only property tax and parking tickets may be paid online. Please correct the errors and try again.

Virginia tax code requires that all properties currently must be assessed for taxation at 100% of market value. Search use the search critera below to begin searching for your record. The real estate tax is the result of multiplying the fmv of the property times the real estate tax rate established.

The results of a successful search will provide the user with information including assessment details, land data, service. Return to personal property tax records. This utility allows a person to interactively search the city of richmond real property database on criteria such as parcel id, address, land value, consideration amount etc.

City of richmond 6911 no. This page is filled with customizable widgets that allow you to interact with the bs&a data provided by the online and desktop applications. 3 road richmond bc v6y 2c1 manage your property.

Personal property taxes are assessed on any vehicle, motorcycle, boat, trailer, camper, aircraft, motor home, or mobile home owned and registered as being garaged in richmond county as of january 1 st of each tax year. Find property records, vital records, inmate and court records, professional and business licenses, contractor licenses and much more. Real property is generally land and all the improvements attached to it.

City Of Richmond Ky - Community Information - Home Facebook

The Aliana City Of Richmond County Of Fort Bend Tx Zip Code 77407 Benhuynhrealtor The Neighbourhood Richmond Cool Websites

Path To Equity Richmond

Access Denied Ridgewood Street View Property Records

Divorce Taxes 101 Filing Taxes After A Divorce Foreclosed Homes For Sale Real Estate Buying Foreclosed Homes

Blank Commercial Invoice Invoice Template Word Invoice Template Certificate Of Achievement Template

1000 Grace St St Lukes Hospital Nw Corner Harrison At Grace Richmond Va Richmond Richmond Virginia

The Next Big Thing Richmond Free Press Serving The African American Community In Richmond Va

Indianapolis-opoly Board Games Games Colorado

Boards And Commissions Richmond

Tourist On Travel Spaces Attraction In Richmond City Richmond Hotel Virginia Is For Lovers Richmond Virginia

1254 Greenway Drive Hilltop Green Ca - Compass House Prices Richmond House Styles

6727 Heritage Haven Richmond Tx 77469 House Styles Mansions Home

Municipal Court City Of Richmond

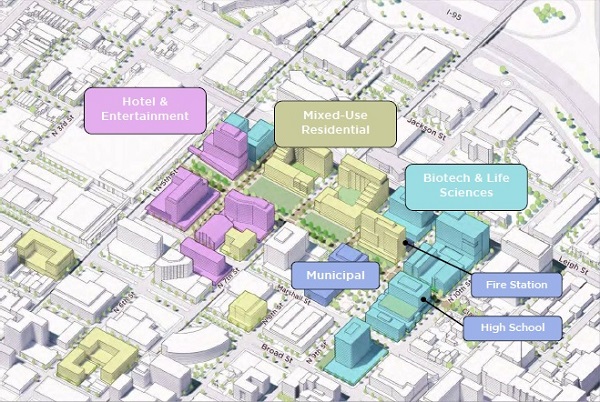

Citys New City Center Plan Envisions Downtown Without The Coliseum - Richmond Bizsense

City Of Richmond Ky

One Window House Venice California Touraine Richmond Architects Photo Fotoworksbenny Chan Architect Architecture Architecture House

Richmond Property Tax 2021 Calculator Rates - Wowaca

Pin On Important Topics

Comments

Post a Comment