Most lessors generally reimburse themselves for the tax they. For example, if you buy a $10,000 car, you can expect to pay $422.50 to the state.

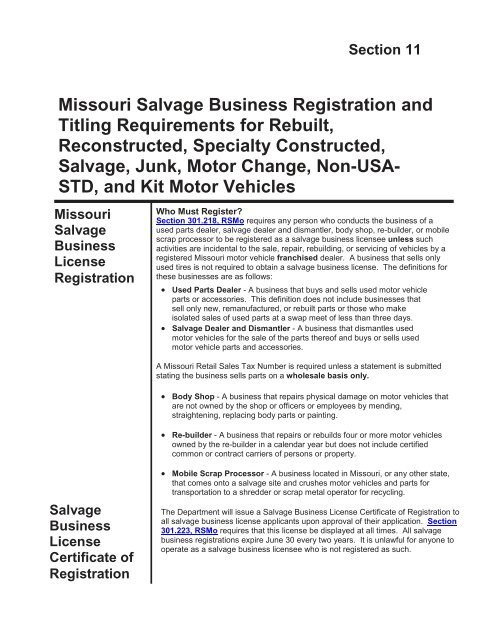

Section 11 Missouri Salvage Business Registration And Titling

In addition to paying for a safety inspection and an emissions inspection, you'll have to pay sales tax.

Do you pay sales tax on a leased car in missouri. For most states, car sales tax is calculated before a down payment and is based off the total selling price of the vehicle. The vehicle must also be emissions inspected within 10 days, if applicable. Boat and outboard motor titling and.

You don't have sales tax, you will have a use tax which usually the dealer puts in your payment. Assuming that the sales tax rate is 6%, $3,180 in. For vehicles that are being rented or leased, see see taxation of leases and rentals.

A copy of the missouri sales tax license. Registration (license plate) fees, based on either taxable horsepower or vehicle weight (if. You pay the personal property tax every year.

This table shows the taxability of various goods and services in missouri. There is also a local tax of up to 4.5%. Since the lease buyout is a purchase, you must pay your state's sales tax rate on the car.

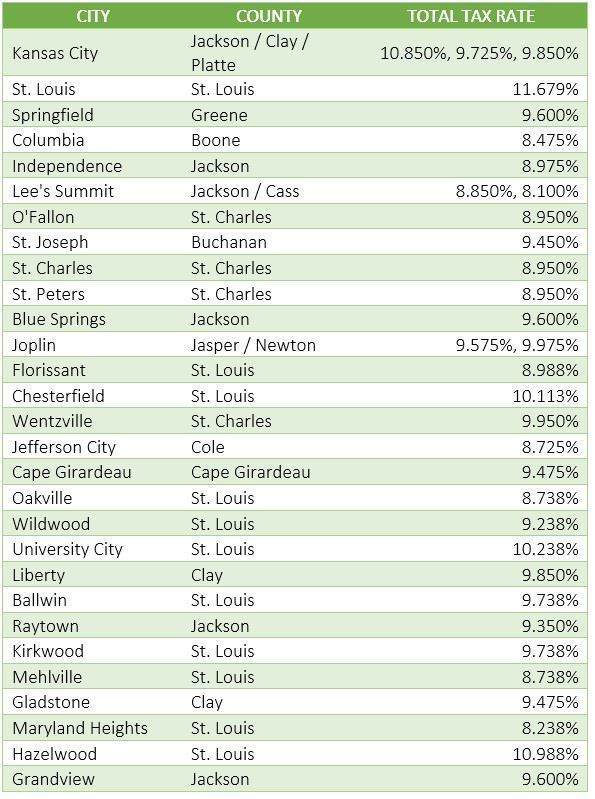

Add the tax payment to the lease payment. Missouri collects a 4.225% state sales tax rate on the purchase of all vehicles. And don't put the title in another state, only in the state that you reside in or the company is headquartered in.

At the very least, you have likely already paid at least some sales tax on the car, so it’s highly unlikely you need to pay taxes on the complete original price of the leased car. As of september 2011, oregon, alaska, new hampshire, montana and delaware do not assess a sales tax on consumers, but if you live in one of these states, you may be subject to. Although most states only charge sales tax on individual monthly payments (and down payment, if any), some states, such as texas, new york, minnesota, ohio, georgia, and illinois, require the entire sales tax to be paid up front, based either on the sum of all lease payments or on the full sale price of the vehicle, depending on the state.

The home for all missourians on reddit. Note that, if you traded in your car or truck, subtract the offered deduction from the sales price to figure out the amount for which you will be taxed. Any motor vehicle, trailer, boat, or outboard motor which is.

Missouri vehicle tax is 4.225 percent of the sales price of the car. The lessor is the owner of the vehicle and is liable for tax. When lessors lease vehicles for a term longer than one year, they owe use tax up front on the selling price of the vehicle.

(this protects people who lease from having a spike in how much they owe if state sales taxes are increased.) The sales tax license must be in the name of the motor vehicle/ marinecraft leasing company. Use tax does not apply if the purchase is from a missouri retailer and subject to missouri sales tax.

For additional information click on the links below: A sales tax shall be charged to and paid by a leasing company which does not exercise the option of paying in accordance with section 144.020, on the amount charged for each rental or lease agreement while the motor vehicle, trailer, boat, or outboard motor is domiciled in this state. Part of a customer's charges for a leased vehicle and are subject to sales tax.

This is the place for anything related to the state of missouri. If you are interested in the sales tax on vehicle sales, see the car sales tax page instead.scroll to view the full table, and click any category for more details. State sales tax is 4.225%, and you'll also have to pay a local sales tax (varies depending on county).

The maximum tax that can be charged is 725 dollars on the purchase of all vehicles. $14.50 for title (includes the $6 processing fee) This calculation is only an estimate based on the information you provide.

Missouri vehicle taxes add up quickly. Missouri charges an auto sales tax of 4.225% of the sales price you paid for your car of truck. When you purchase a car, you pay sales tax on the total price of the vehicle.

Upon returning to missouri the vehicle must be safety inspected within 10 days. An earlier version of this information guide incorrectly stated that a late payment or penalty charge that is billed to a lessee is not subject to kansas sales tax. Subtract these values, if any, from the sale price of the unit and enter the net price in the calculator.

What kind of taxes do i have to pay if i buy a vehicle in missouri? Sales of tangible media property are subject to sales tax in missouri. Motor vehicle titling and registration.

A sales tax license can be obtained from the missouri department of revenue at the following address: Unlike sales tax, which requires a sale at retail in missouri, use tax is imposed directly upon the person that stores, uses, or consumes tangible personal property in missouri.

2

Missouri Car Loan Deficiency Laws Missouri Real Estate Lawyer Missouri Real Estate Lawyer

Subaru Ascent Suv Lease Finance Prices - St Peters Mo

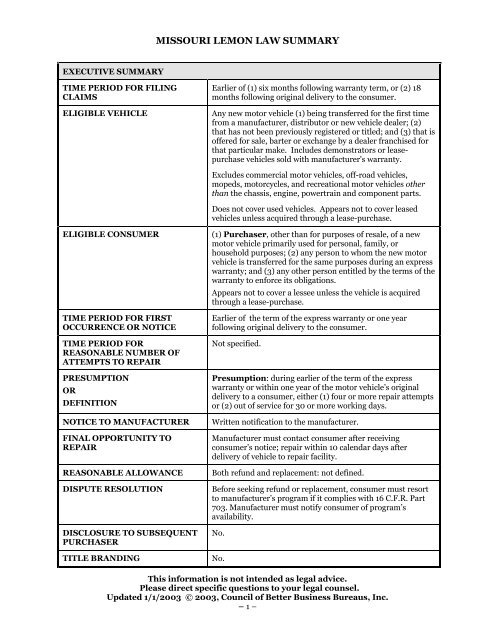

Missouri Lemon Law Summary - Better Business Bureau

2

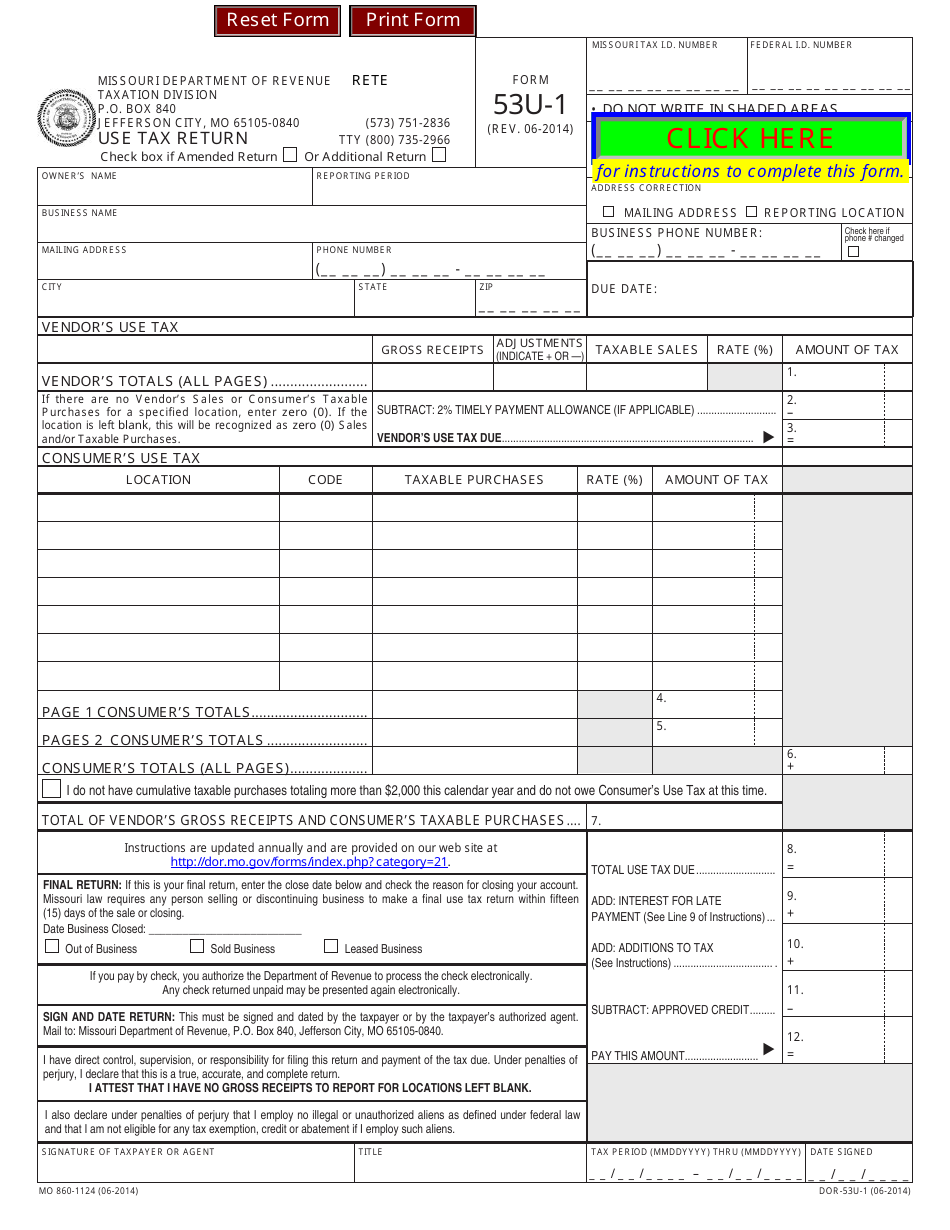

Form 53u-1 Download Fillable Pdf Or Fill Online Use Tax Return Missouri Templateroller

How Does A Car Lease Work Gary Crossley Ford Kansas City Mo

Subaru Outback Lease Offers Deals - Creve Coeur Mo

Missouri Sales Tax Guide For Businesses

2

Missouri Title Transfer Etags Vehicle Registration Title Services Driven By Technology

2021 Honda Pilot Lease Deal 329mo For 36 Mos Jefferson City Mo

2

Monthly Rental Agreement Real Estate Forms Rental Agreement Templates Being A Landlord Real Estate Forms

Used Volkswagen Atlas For Sale In Saint Louis Mo Carscom

Missouri Car Sales Tax Calculator

2

Used Honda Cr-v For Sale In Kansas City Mo Edmunds

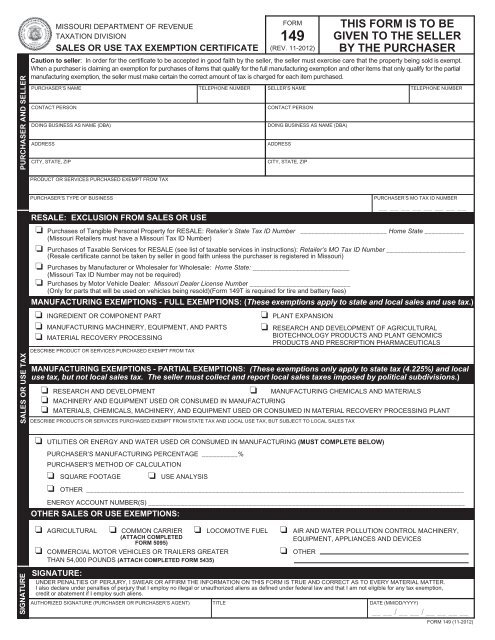

Form 149 Sales And Use Tax Exemption Certificate - Missouri

Comments

Post a Comment