I'm a brit and worked in the uk and us, both for the same employer on local contracts (i.e. A us national but uk resident person has been granted restricted stock units (rsus) by his american employer.

Pdf Venture Capital And Government Policy

Rsus are not taxable when they are granted.

How are rsus taxed in the uk. 1) income tax (plus possibly other witholdings, like social security) when granted 2) capital gains when sold While he was working there he earned rsu's for his work, which will vest over the next 4 years. Income tax @ 40% of remaining = £6,896;

Rsus that provide securities on vesting. You will also pay employers national insurance. Client has rsu's from work performed in uk.

Ordinary tax on current share value. Rsus are taxed upon vesting and in the tax year in which they are granted. Employee nic @ 2% = £344;

It’s vital to remember that rsus are taxed at vesting—not at exercise. For businesses that employ internationally mobile employees (imes), or are considering doing so, and who provide (or who may provide) equity incentive compensation (for example, stock options and restricted stock units (rsus)) to their imes, there are many tax issues that need to be considered in order to ensure that the relevant employer complies with its tax obligations. Salary £130,000, rsu value £20,000.

Rsus (at least for me) are taxed in two ways: He has just been asked to complete an uk tax return for 2013/14 (deadline 8 may 2015). Where the rsu is taxed as a securities option, the cgt acquisition cost is then just what was paid to acquire the shares and any amount taxed in the uk as a securities option gain.

The uk tax treatment for rsus is similar to how your salary is taxed. Not an assignment, though not sure that matters anyway) and was granted rsus throughout this period. 50% tax and nic paid.

Am i correct in assuming that these rsu's will be taxed in the uk, less a. The first time that they are exposed to tax is upon vesting, at which time both income tax and nic are due. The united kingdom is one of them, so americans who live in the uk will most likely not be double taxed and can utilize benefits through our software like the foreign tax credit, foreign earned income exclusion, and treaty.

Hi there i also have received rsus from my us employer which have vested in the last taxation year. Options have a stated expiration date (often, but not always, 10 years from the date they are granted.) taxation. Employee total salary before rsu is £100,000.

If you are awarded rsus, each unit represents one share of stock that you will be given when the units vest. Employers will usually deal with this under paye and so, if you are the recipient of some rsus, initially there is nothing you need to do to make that happen. Therefore, although my thoughts here are focused on rsu awards, the same broad methods for reclaiming any overpaid tax can be transferred to offsetting income taxation from salary and bonus.

Total tax and nic = £10,000; There is no tax to pay when rsus are granted. At vesting, the rsus were taxed heavily by withholding rsus and so in reality i probably received $20,000 worth of shares at most, which i have sold over time.

Rsus form a part of an individual’s income and tax rules are applied similarly to salary and bonuses. The difference between this and Postby scrambler2 » mon aug 13, 2012 5:45 am.

If you already earn in excess of this and the rsus take you over £150,000 you will pay 45% income tax plus the employers national insurance. The proceeds of these rsu's are paid through my salary , on my pay slip and therefor my p.60, and they are taxed again paye. The rsus are subject to ni and income tax at your marginal rate on their value at the time they vest.you can either choose to pay the tax yourself and receive all the shares,but most people will opt to have shares deducted to pay for these deductions.so if you are a higher rate tax payer you will be due to pay 42% tax and ni which would mean your 50 shares would.

Employee shares is taxed in the uk as general earnings, they are normally treated as acquired at their market value. Here’s the tax summary for rsus: Rsus are converted to shares once they are vested, and therefore do not expire.

Until 5 april 2016, the money’s worth of the shares may have been earnings. This is a common misconception because stock options are taxed only when they are exercised. Rsus are taxed as ordinary income at the time they become vested and liquid.

You will pay income tax and national insurance on the value of rsus vested. Until 5 april 2016, normally the securities would be taxed as money’s worth under itepa03/s62 (see ersm20500). Through the scheme, a proportion of those rsus have already been sold to cover my taxation liability, withholding tax.

Selling rsus the next time you need to consider uk taxes is if you come to sell the shares that you now hold. These vest on a quarterly basis after the first anniversary of the grant date. A stock option is taxed at the time it is exercised.

If the rsus take you over £100,000 you will pay income tax at a marginal rate of 60%, plus the employers national insurance. We have a client who is british domicile and moved back to the uk in january 2021, after working in california for the last 5 years. From april 2016, william is charged to tax under chapter 5 of part 7 on the market value of the shares received at.

You only pay tax on rsus when they vest. At this point, if the value of the shares has increased above the value you were deemed to acquire them at then you will have a taxable gain, and if this exceeds your available annual exemption (currently £12,300) then there will be tax to pay on the gain. I was granted rsus whilst employed (temporarily, but resident for tax purposes) in the uk.

Deducting employer’s nic @ 13.8% = £2,760; Salary £100,000, rsu value £25,000.

Payroll4freecom - Free Payroll Service Software Calculation And Checks Payroll National Parks Vacation Time

New Irs Cost Basis Reporting Rules - Pdf Free Download Irs Dividend Reinvestment Plan Tax Guide

What Is A Restricted Stock Unit - Robinhood

Masters Champion Has The Common Sense Running Advice We All Need Right Now Running Runners World Running Marathon Training

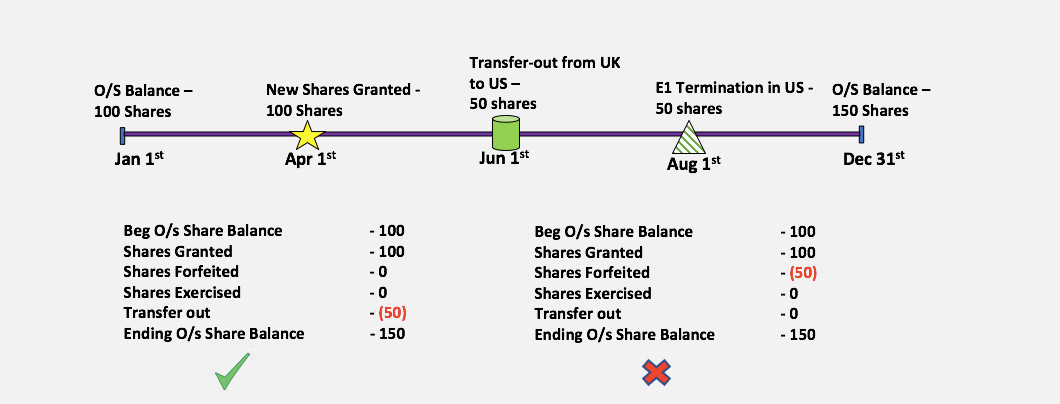

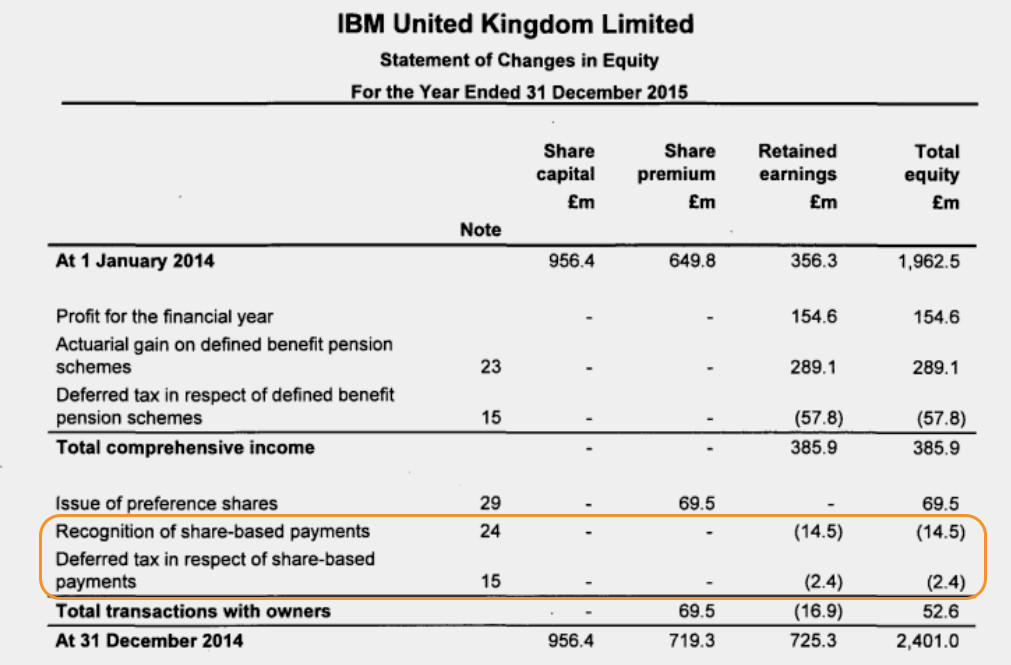

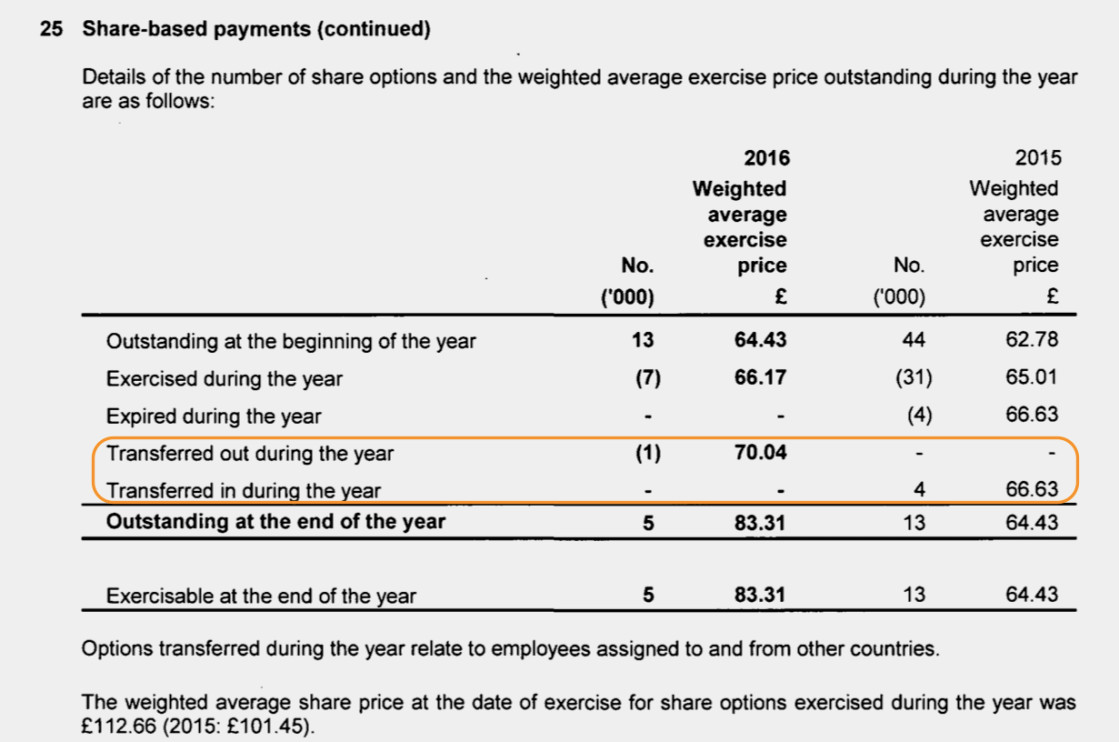

Issuing Equity Abroad Top Tax Challenges Of International Subsidiaries - Equity Methods

Pdf Three Outcomes Of Service Recovery Customer Recovery Process Recovery And Employee Recovery

Mechanical Street Park Leominster Premier Park Play Outdoor Shelters Pergola Commercial Umbrellas

Selling Stock Options Rsus Wealthfront Blog Selling Stock Crypto Currencies Stock Options

Pin On Book Ui

Pdf Searching For Internal And External Factors That Determine Working Capital Management For Manufacturing Firms In Pakistan

Equity Compensation Restricted Stock Units Vs Restricted Stock Awards - Ipohub

Issuing Equity Abroad Top Tax Challenges Of International Subsidiaries - Equity Methods

16 Simple Ways To Feel Connected To The World Around You Simple Way Thought Catalog Simple

Managing Restricted Stock Units The Unit Debt Management Personal Finance

Which Is Better Stock Options Or Rsus - All You Need To Know Stock Options Staging Companies Options

Esop - Espp Mobility Tax Taxation Guide - Us Accounting Accounting Services Stock Broker

10 Principles Of Economics You Should Know Economics Lessons Teaching Economics Economics

Issuing Equity Abroad Top Tax Challenges Of International Subsidiaries - Equity Methods

Pin On Book Ui

Comments

Post a Comment