Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents. All unpaid quarters must be selected and paid.

5xbu_vpce9mjym

Manatee county tax collector property search.

Manatee county tax collector property search. Manatee county tax collector's office 819 301 boulevard west bradenton, fl. Invalid payment for account number: Manatee county tax records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in manatee county, florida.

Manatee county tax collector 4333. Use the form below to locate your property tax account. These records can include manatee county property tax assessments and assessment challenges, appraisals, and income taxes.

Real estate property id #: In order to determine the tax bill, your local tax assessor’s office takes into account the property’s assessed value, the current assessment rate, as well as any tax exemptions or abatements for that property. Real estate property id #:

Tax deed sales are properties offered for sale to the highest bidder for delinquent taxes. Manatee county tax | property tax website. The seminole county tax collector makes every effort to produce and publish the most current and accurate information possible.

For help with installment payments, click on the 'help' menu item and select 'how to search & pay taxes online'. Tax deed sales are properties offered for sale to the highest bidder for delinquent taxes. Search manatee county, fl property records by owner name, account number, or street address.

13823 messina loop unit 103. Get property records from 3 treasurer & tax collector offices in manatee county, fl. Angie mccoy is the manatee county tax collector's employee of the quarter.

You will be routed to the appropriate agency's website for the services we do not provide. Manatee county tax collector 4333 u.s. The custodian of public records for the manatee county property appraiser:

Free manatee county treasurer & tax collector office property records search find manatee county residential property records including owner names, property tax assessments & payments, rates & bills, sales & transfer history, deeds, mortgages, parcel, land, zoning & structural descriptions, valuations & more. Manatee county tax collector 4333 u.s. Find manatee county tax records.

The public records division oversees the management of all paper and electronic records created by the county; The manatee county tax collector's office does not provide all of the online services listed below. Pro members in manatee county, fl can access advanced search criteria and the.

Angie mccoy is the manatee county tax collector's employee of the quarter. Joseph family rev trust dtd 10/31/13. Once you have located your account, you.

I highly recommend this location for your dl needs. Lot 6038 mill creek ph vi pi#5641.3590/9. The seminole county tax collector makes every effort to produce and publish the most current and accurate information possible.

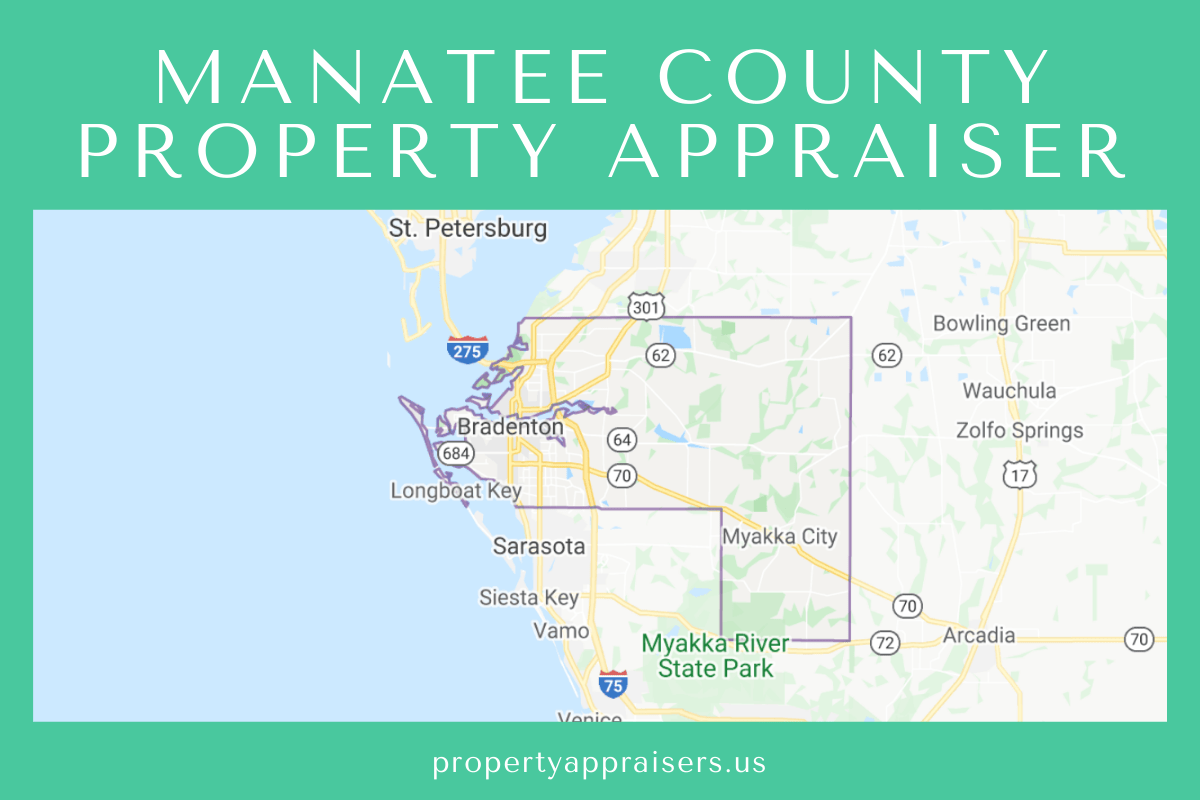

Welcome to the manatee county property appraiser’s website. Manatee county tax collector property search. They are maintained by various government offices in manatee county, florida state, and at the federal level.

Free manatee county treasurer & tax collector office property records search find manatee county residential property records including owner names, property tax assessments & payments, rates & bills, sales & transfer history, deeds, mortgages, parcel, land, zoning & structural descriptions, valuations & more. Manatee county tax collector 4333. To be eligible to use this service, you must have already requested to receive property tax bills by email when you paid your property taxes online or when you applied for the installment plan.

The manatee county tax collector's property tax payment site, where you will be able to continue making your online payment. 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000. Taxing authority assessed value exemptions taxable value millage rate taxes levied;

Pro members in manatee county, fl can access advanced search criteria and the. Search manatee county, fl property records by owner name, account number, or street address. They are a valuable tool for the real estate industry, offering both.

Manatee county tax collector 4333 u.s. I highly recommend this location for your dl needs.

Manatee County Tax Collector - Driver License Office - 10 Reviews - Departments Of Motor Vehicles - 904 301st Blvd W Bradenton Fl - Phone Number

Manatee County Property Tax Collection Underway Pay Early To Save

/cloudfront-us-east-1.images.arcpublishing.com/gray/75HYTQZ2V5GU7HZ4U5AGIWGGJM.png)

Manatee County Tax Collector 2020 Mobile Home Decals Expire December 31

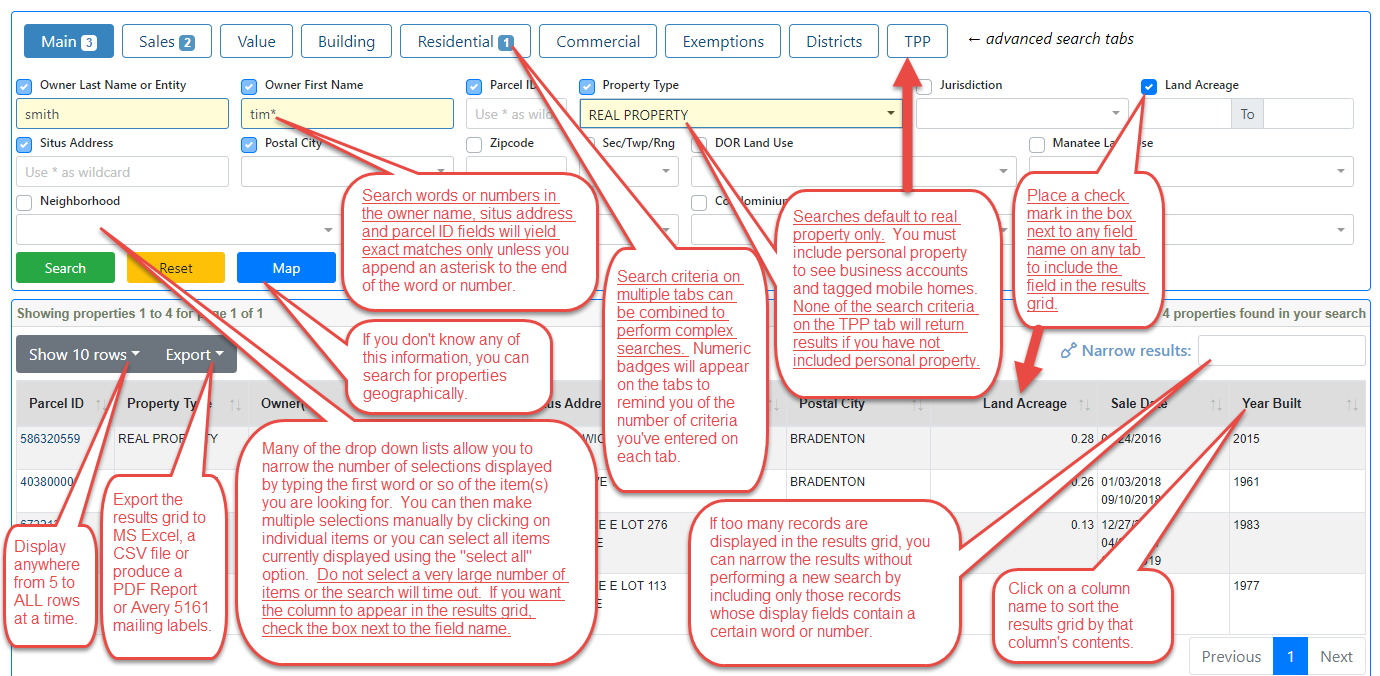

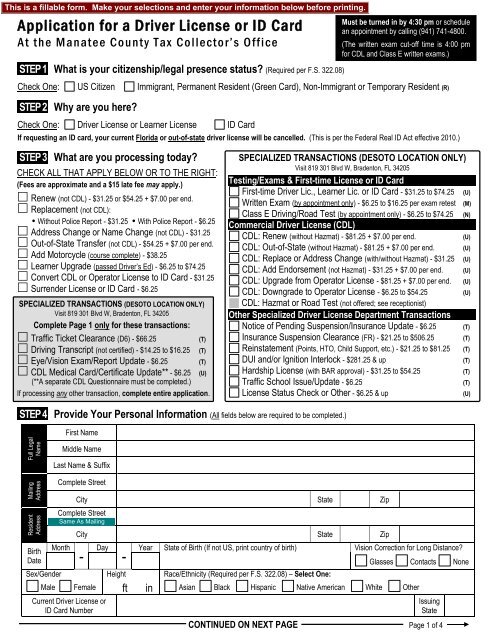

Property Search Tips Manatee County Property Appraiser

Manatee County Tax Motor Vehicle General Information

Manatee County Florida Property Search And Interactive Gis Map

/cloudfront-us-east-1.images.arcpublishing.com/gray/75HYTQZ2V5GU7HZ4U5AGIWGGJM.png)

Manatee Countys 2021 Property Tax 4 Discount Ends December 2

Manatee County Tax Collector - North River - Public Services Government - 4333 Us 301 N Ellenton Fl - Phone Number

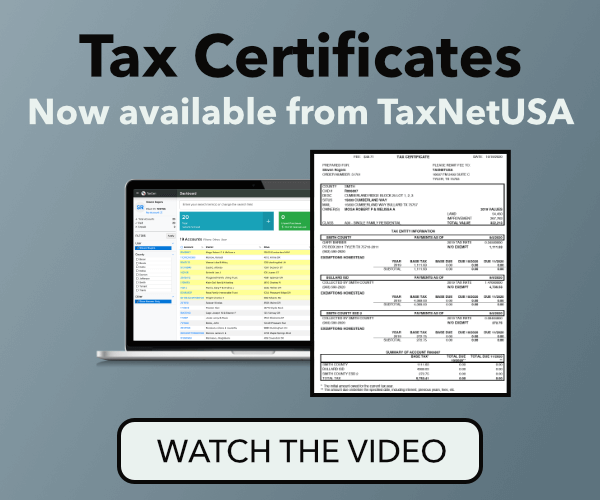

Driver License Application - Manatee County Tax Collector

Manatee County Tax Property Tax Website

Registrations - Taxsys - Manatee County Tax Collector

Manatee County Property Appraiser How To Check Your Propertys Value

/cloudfront-us-east-1.images.arcpublishing.com/gray/75HYTQZ2V5GU7HZ4U5AGIWGGJM.png)

Manatee Countys 2021 Property Tax 4 Discount Ends December 2

Manatee County Tax Collector

Manatee County Tax Collector - North River Branch - Home Facebook

Search Manatee County Property Appraiser

Manatee County Tax Collector

/cloudfront-us-east-1.images.arcpublishing.com/gray/75HYTQZ2V5GU7HZ4U5AGIWGGJM.png)

Manatee Countys 2021 Property Tax 4 Discount Ends December 2

/cloudfront-us-east-1.images.arcpublishing.com/gray/75HYTQZ2V5GU7HZ4U5AGIWGGJM.png)

Manatee Countys 2021 Property Tax 4 Discount Ends December 2

/cloudfront-us-east-1.images.arcpublishing.com/gray/KXIHXGRJJJF2DL656UKP47HZ2A.PNG)

Comments

Post a Comment