City of san antonio total: Total state & local rate:

Sanantoniogov

The minimum combined 2021 sales tax rate for san antonio, texas is.

San antonio sales tax rate 2019. For state use tax rates, see use tax by state. (b) compute net operating profit after tax (nopat) for 2019, assuming a federal and state statutory tax rate of 22%. , tx sales tax rate.

There is no applicable county tax. The current total local sales tax rate in san antonio, tx is 8.250%. 77 rows property tax rate calculation worksheets.

Trends in wages increased by 3.1 percent in q3 2021. Build the online store that you've always dreamed of. 6% for the first month;

Combined with the state sales tax, the highest sales tax rate in texas is 8.25% in the cities of houston , san antonio , dallas , austin and fort worth (and 108 other cities). Many states allow local governments to charge a local sales tax in addition to the statewide sales tax, so the actual sales tax rate may vary by locality within each state. The homeownership rate in san antonio, tx is 53.5%, which is lower than the national average of 64.1%.

0.125% dedicated to the city of san antonio ready to work program; 1.000% city of san antonio; Between 2018 and 2019 the median property value increased from $155,600 to $171,100, a 9.96% increase.

Senate bill 2 (sb2) of the 86 th texas. The texas sales tax rate is currently %. That means the city cashes in on $381 million property taxes for the general fund, 5.4 percent higher than the fy 2019 adopted budget.

0.500% san antonio mta (metropolitan transit authority);. Boost your business with wix! Here are some of the highlights:

Civilian 16 and up population: These tax rates are then applied to the values (less any exemptions) certified by the chief appraiser on the unit's appraisal roll to calculate the levy (tax) for the year. A delinquent tax incurs interest at the rate of 1% for the first month and an additional 1% for each month the tax remains delinquent.

And an additional 2% for the sixth month, for a total of 12%. The county sales tax rate is %. Management, business, science, and arts:

The cost of living in san antonio, tx is 14 percent higher than the national average. *fy 2019 sales tax assumes 3.8% growth rate. Build the online store that you've always dreamed of.

Natural resources, construction, and maintenance: Rate ticked down, quarterly growth was strong, wages continued to climb, home sales increased, and office demand remained steady in the fourth quarter of 2019. The effective tax rate for the city of san antonio this year is 54.266 cents per $100 valuation.

Assume that all items on the 2019 income statement will persist. The fed noted that the recent strength in the index was due to solid job growth and a lower unemployment rate, suggesting continued growth in the san antonio economy. The average salary in san antonio, tx is $64k.

There is no applicable county tax. Ad with secure payments and simple shipping you can convert more users & earn more!. The 8.25% sales tax rate in san antonio consists of 6.25% texas state sales tax, 1.25% san antonio tax and 0.75% special tax.

An additional 1% for each of the following 4 months; In addition to interest, delinquent taxes incur the following penalties: Choose any state for more information, including local and municiple sales tax rates is applicable.

Boost your business with wix! (round your answer to the nearest whole number.) 2019 nopat = $ 10,840 0.250% san antonio atd (advanced transportation district);

Bexar county lowered its tax rate last year to. The san antonio sales tax rate is %. $34.8 million to address housing affordability

This is the total of state, county and city sales tax rates. The sales tax jurisdiction name is san antonio atd transit , which may refer to a local government division. The fy 2020 budget keeps property tax rate at 55.827 cents per $100 valuation.

The median property value in san antonio, tx was $171,100 in 2019, which is 0.711 times smaller than the national average of $240,500. San antonio applicable sales tax current rate local sales tax revenue (in millions) city tax: Planned use of fund balace $4.3m.

Click here for a larger sales tax map, or here for a sales tax table. Ad with secure payments and simple shipping you can convert more users & earn more!. Sales and use tax san antonio’s current sales tax rate is 8.250% and is distributed as follows:

Sanantoniogov

San Antonio Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tax Rates Bexar County Tx - Official Website

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

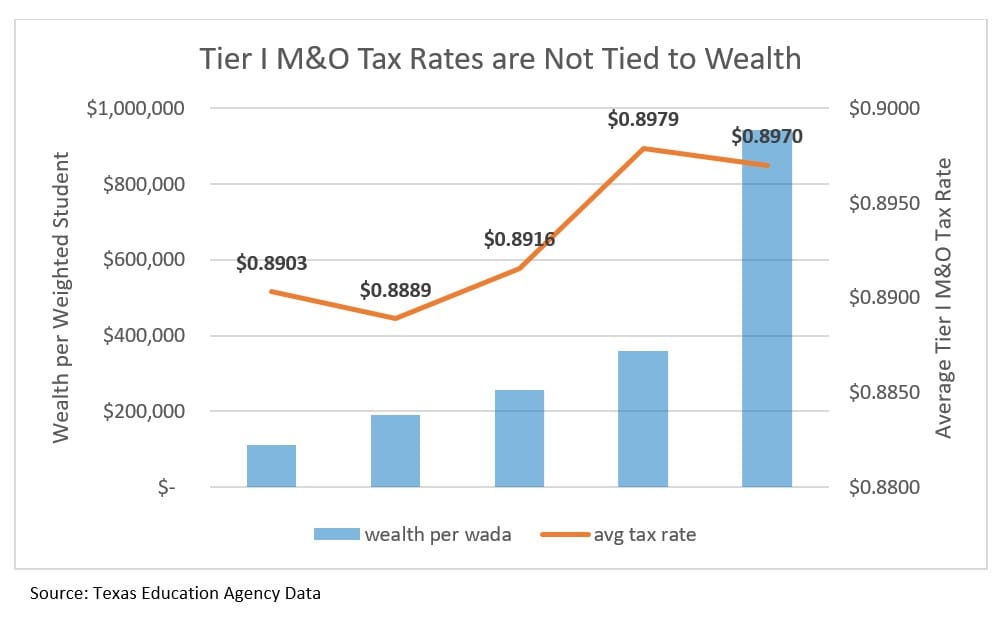

A New Division In School Finance - Every Texan

Why Are Texas Property Taxes So High Home Tax Solutions

Whats The Difference Between Income Taxes And Short-term Rental Lodging Taxes

Sanantoniogov

Viainfonet

San Antonio Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

What Is The San Antonio Sales Tax Rate - The Base Rate In Texas Is 625

Which Texas Mega-city Has Adopted The Highest Property Tax Rate

How To Get Tax Refund In Usa As Tourist For Shopping 2021

Sanantoniogov

A Texas Sales Tax Increase Would Hit Poor People The Hardest The Kinder Institute For Urban Research

What Is The San Antonio Sales Tax Rate - The Base Rate In Texas Is 625

A Texas Sales Tax Increase Would Hit Poor People The Hardest The Kinder Institute For Urban Research

Annexation

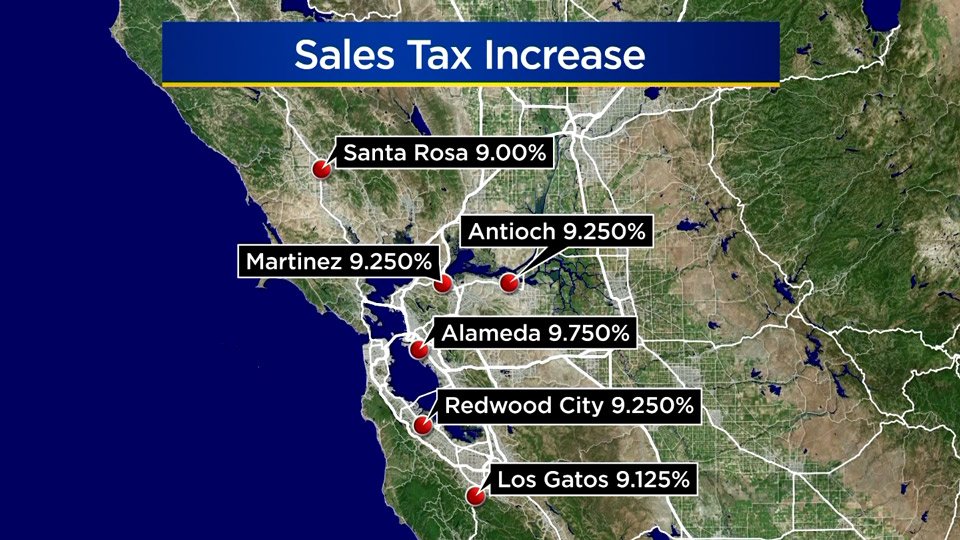

Sales Tax Rates Rise Monday Out-of-state Online Sellers Included Cbs San Francisco

Comments

Post a Comment