It does not contain all tax laws or rules. Ustc original form 40003 y y

Sample Limited Power Of Attorney Form Power Of Attorney Form Power Of Attorney Attorneys

Printable utah state tax forms for the 2020 tax year will be based on income earned between january 1, 2020 through december 31, 2020.

Utah state tax commission forms. This form is for income earned in tax year 2020, with tax returns due in april 2021.we will update this page with a new version of the form for 2022 as soon as it. Taxformfinder provides printable pdf copies of 56 current utah income tax forms. The main utah tax forms are:

Mail utah state tax commission mail utah state tax commission returns with 210 n 1950 w all other 210 n 1950 w payments to: Due to the pandemic, the tax filing deadline to submit 2020 irs federal taxes. 34 rows previous years’ forms & pubs.

If you need help with your federal tax return, start. T 0 ustc use only address 0 4 city state zip code payment amount enclosed $ 00 make check or money order. The current tax year is 2020, and most states will release updated tax forms between january and april of 2021.

Utah has a flat state income tax of 4.95% , which is administered by the utah state tax commission. United states government or native american tribe File electronically using taxpayer access point at tap.utah.gov.

Attach completed schedule to your utah income tax return. State tax forms & filing options. (mmddyyyy) save postage & a check.

From (mmddyyyy) to (mmddyyyy) return due date: Make a copy for your records. Utah's state tax system imposes a 5% flat rate on all income and wages.

When that date falls on a weekend or holiday, filers get until the next business day to submit their state returns. Do not send this certificate to the tax commission keep it with your records in case of an audit. This helps us route your documents to the correct place.

This form is for income earned in tax year 2020, with tax returns due in april 2021.we will update this page with a new version of the form for 2022 as soon as it. To verify your identity send copies (not originals) of the following documents: Official site of the property tax division of the utah state tax commission, with information about property taxes in utah.

The utah income tax rate for tax year 2020 is 4.95%. I tax year ending i secondary taxpayer name social security no. Application for utah motor vehicle identification number.

Id verification letter send a copy of the letter you received from us requesting that you verify your identity. Resource link (click to open in new tab/window) alaska. Spouse’s first name spouse's last name y/n address.

12/11 return payment coupon primary taxpayer name social security no. Additional ut state taxes help. File online at tap.utah.gov check here if this is an amended return.

Individual income tax mail to: Name) email address phone owner’s driver’s license no. Your first name your last name spouse’s soc.

Sample Pasture Lease Agreement Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Forma Lease Agreement Lease Being A Landlord

Sample Pasture Lease Agreement Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Forma Lease Agreement Lease Being A Landlord

Fill Out Print And Use This And Thousands Of Other Free Templates At Templaterollercom Commercial Vehicle Street Legal Atv Utility Trailer

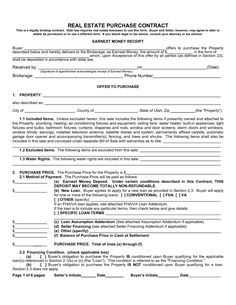

Free Purchase Agreement Form - Free Printable Documents Purchase Agreement Purchase Contract Contract

Georgia Medical Release Form Download The Free Printable Basic Blank Medical Release Form Template Or Waiver I Document Templates Doctor For Kids Doctor Names

Oklahoma Vehicle Bill Of Sale Download The Free Printable Basic Bill Of Sale Blank Form Template Or Waiver In Microsoft Bill Of Sale Template Bills Templates

Utah Quit Claim Deed Form Quites Utah Form

Are 144a Securities Private Placements Securities And Exchange Commission Accredited Investor Initial Public Offering

Spring Wreath For Front Door Deco Mesh Spring Wreath Welcome Etsy Spring Mesh Wreaths Spring Wreath Spring Deco Mesh Wreaths

Browse Our Printable Handwritten Receipt Template Receipt Template Templates Handwriting

Late Rent Notice Real Estate Forms Late Rent Notice Real Estate Forms Templates

Letsupdate-a Platform To Get All Updates Blogger Help Human Resource Development Motivational Messages

Free Minor Child Power Of Attorney Delegation Form Colorado Pdf - Power Of Attorney Form For Child Power Of Attorney Power Of Attorney Form Attorneys

Blank Weekly Bill Organizer Printable Budget Planner Budget Planner Printable Budget Planner Template

Bill Of Sale-utah State Tax Commission In 2021 State Tax Bills Bill Of Sale Template

Business Plan Templates - 43 Examples In Word Free Premium Regarding Business Plan Template Word Simple Business Plan Template Business Plan Template

Sample Pasture Lease Agreement Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Forma Lease Agreement Lease Being A Landlord

Free Purchase Agreement Form - Free Printable Documents Purchase Agreement Purchase Contract Contract

Event Management Company Event Management And Stationery On Pinterest Event Management Company Event Planning Company Event Planning Quotes

Comments

Post a Comment