The bbba would replace the tcja’s flat rate of 21% with a graduated rate structure. New details of a democratic plan to enact a 15% minimum corporate tax on declared income of large corporations were released tuesday by three senators.

Corporate Tax Reform In The Wake Of The Pandemic Itep

For corporations with income >$2b.

Corporate tax increase proposal. Raises about $191b per year, according to jct. The corporation tax charge and main rate for financial year 2022 will have effect from 1 april 2022 to 31 march 2023. Corporate rate by 5.5 percentage points raises by far the most revenue among all of the business tax increases proposed by ways and means.

Leaders of the world’s 20 biggest economies will endorse a us proposal for a global minimum corporate tax of 15%, draft conclusions of the. The withholding tax rate on interest and royalties is linked to the top corporate income tax rate. The graduated corporate rate would max out at 26.5% for income exceeding $5 million.

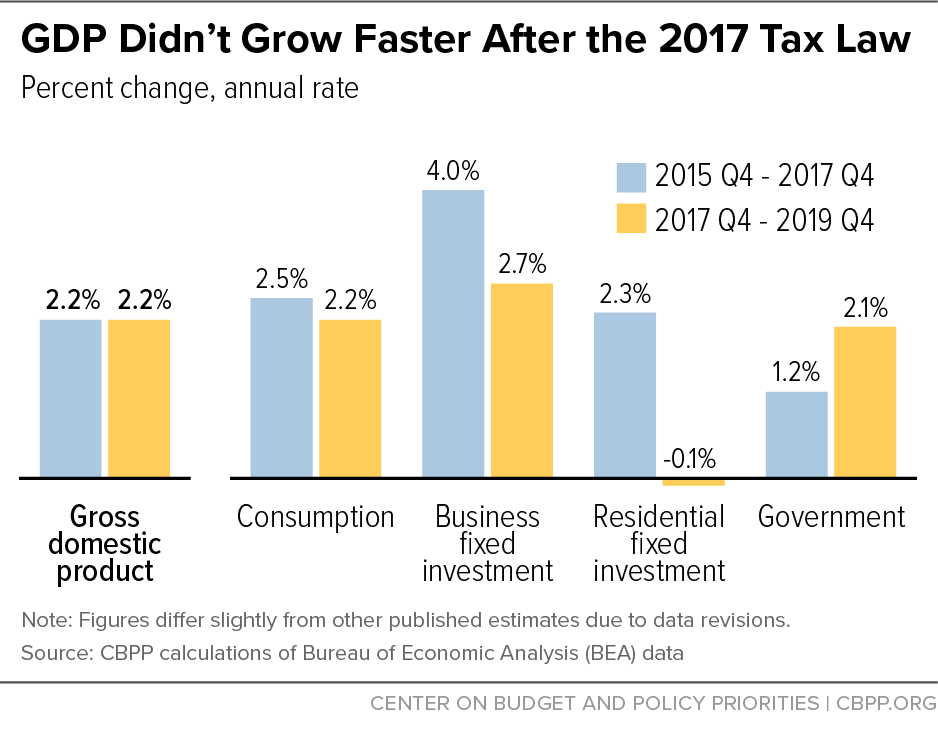

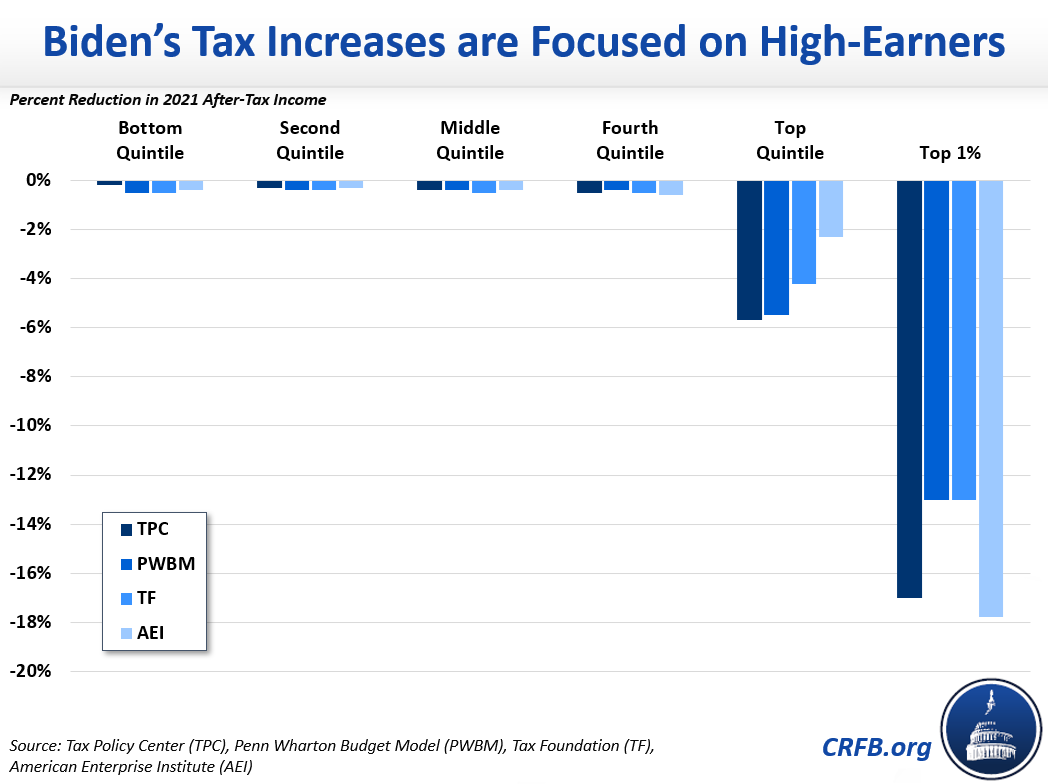

One proposal would increase the top corporate income tax rate to 25.8% (from 25%), effective 1 january 2022. In general, the combined effects of these changes would result in many households paying higher taxes in 2023 than in 2022. Rather than the 21% enjoyed by many businesses from the tax cuts & jobs act of 2017, c corporations would see a new 28% flat tax rate.

The current proposal is to create a progressive corporate income tax, similar to what is currently used to calculate personal income tax. House democrats proposed a 26.5% top corporate tax rate and 39.6% top individual rate as they try to pay for a $3.5 trillion bill. The lower income tax rate of 15% for profits up to €395,000 (as of 1 january 2022) would be maintained.

The corporate tax rate would begin at 18% on income up to $400,000, increase to 21% on income between $400,000 and $5mm, and then be taxed at 26.5% on amounts in excess of $5mm. In addition, one of the major tax increases in the bill, the corporate minimum tax on book income, isn’t scheduled to take effect until 2023. Biden says will raise about $1t, and that it will still be much lower than the 35% in 2017.

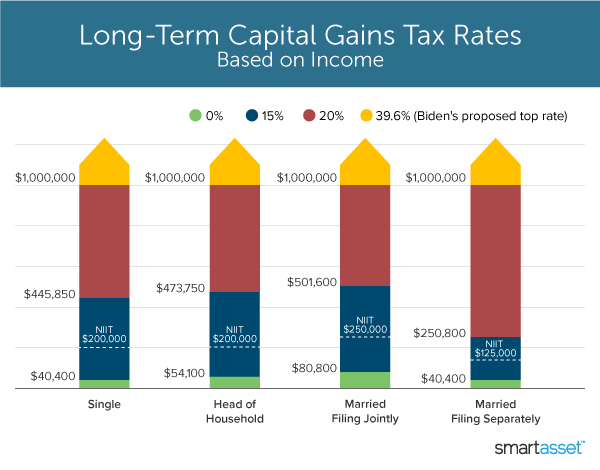

The first $400,000 of income would be subject to an 18% rate, with the 21% rate retained for income between $400,000 and $5 million. 39.6% capital gains rate for incomes over $1m. A compromise proposal to raise it to 25% now also appears to be unlikely.

President biden's administration has made a proposal to increase the corporate tax rate. Revenue effects corporate tax rate The proposal would have an effect on the measurement of the existing deferred tax assets and liabilities that are expected to reverse in fy 2022 and onwards.

The biden plan proposes raising the corporate tax rate from 21% to 28%. 15% minimum tax based on book income. A recent bipartisan infrastructure deal did not include a.

The 2022 tax plan proposes to increase the “headline” corporate income tax rate from 25% to 25.8% for fiscal year (fy) 2022 and onwards. What you need to know. Cryptocurrency, tobacco among areas targeted to raise revenue watch:

The plan is one of a number of corporate tax provisions intended to help pay for the biden administration’s $1.85 trillion in proposed spending on. House democrats are reportedly set to propose raising the corporate tax. The increase in the corporate income tax from 21 percent to 28 percent and the 15 percent minimum book tax on corporations make up a majority of the economic impact of biden’s tax proposals.

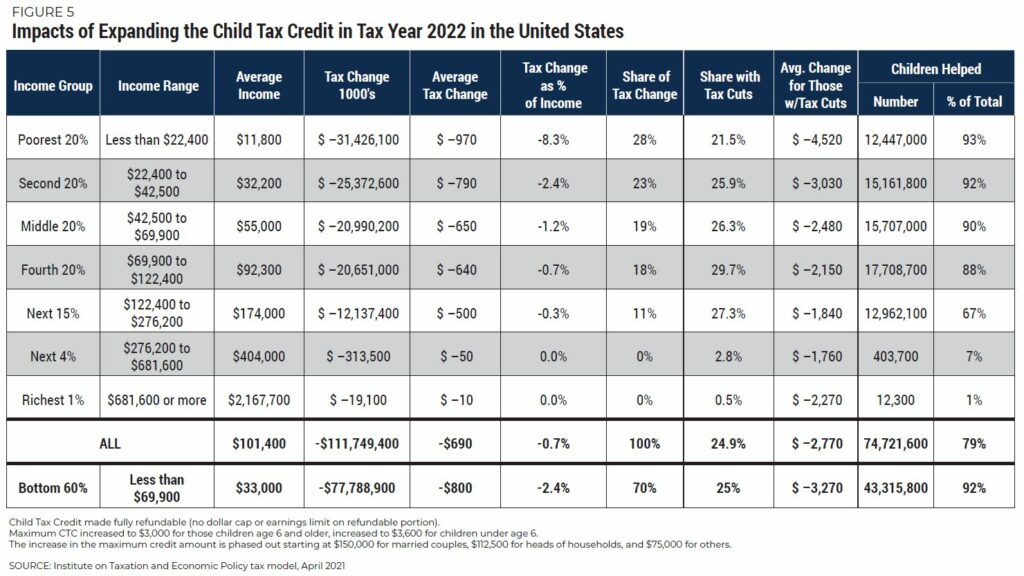

Tpc allocates corporate taxes to households, as investors and workers.

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

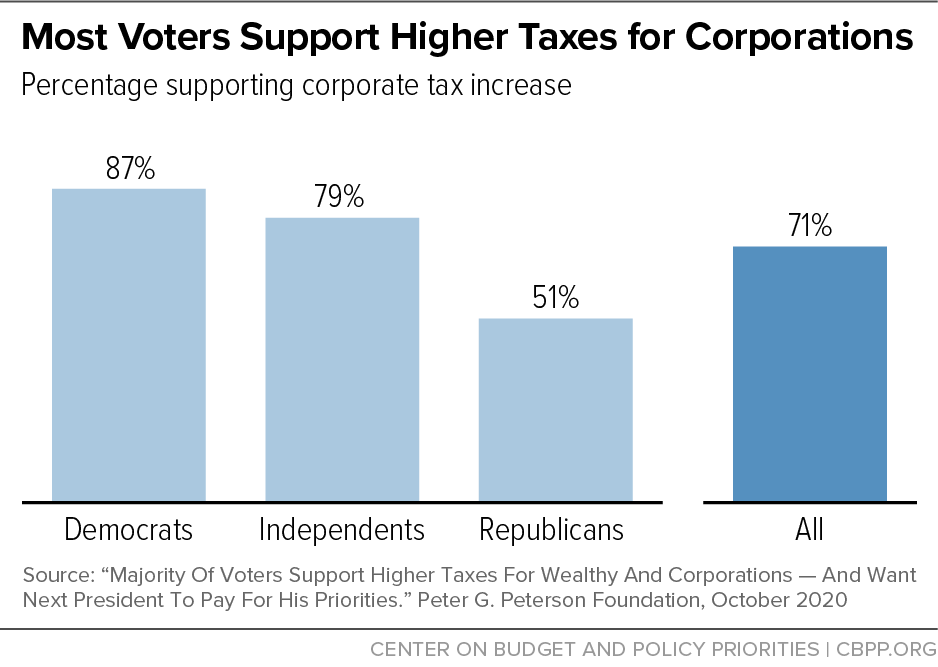

Corporate Lobbying Campaign Against Biden Tax Proposals Is Inaccurate Unpersuasive Center On Budget And Policy Priorities

Whats In Bidens Capital Gains Tax Plan - Smartasset

Corporate Lobbying Campaign Against Biden Tax Proposals Is Inaccurate Unpersuasive Center On Budget And Policy Priorities

National And State-by-state Estimates Of President Bidens Campaign Proposals For Revenue Itep

Taxing The Rich Econofact

Corporate Lobbying Campaign Against Biden Tax Proposals Is Inaccurate Unpersuasive Center On Budget And Policy Priorities

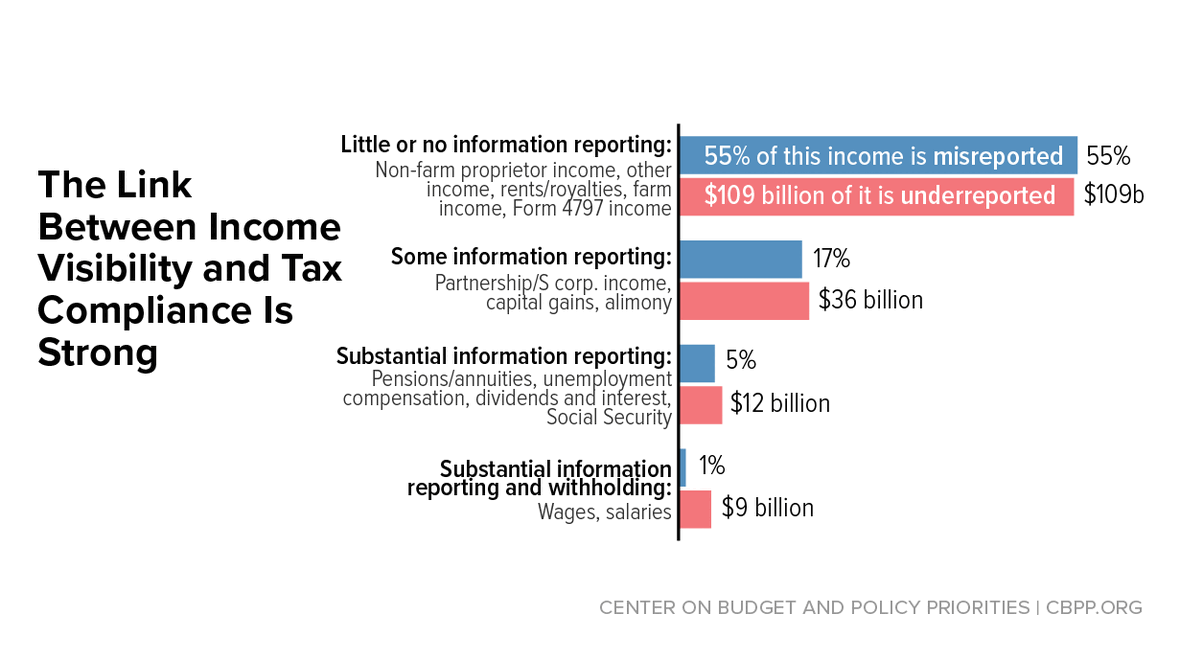

Build Back Better Requires Highest-income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

Trumps Proposed Payroll Tax Elimination Itep

Factchecking Tax Claims In The 2020 Election Committee For A Responsible Federal Budget

House Democrats Tax On Corporate Income Third-highest In Oecd

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Us Offers New Plan In Global Corporate Tax Talks Financial Times

House Democrats Propose Tax Increases In 35 Trillion Budget Bill

National And State-by-state Estimates Of President Bidens Campaign Proposals For Revenue Itep

Corporate Tax Reform In The Wake Of The Pandemic Itep

Factchecking Tax Claims In The 2020 Election Committee For A Responsible Federal Budget

House Democrats Set To Propose Corporate Tax Rate Of 265 - Bloomberg

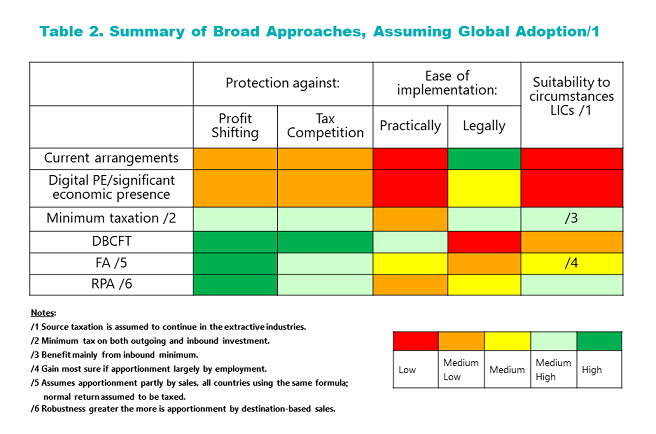

Presentation Of Imf Paper Corporate Taxation In The Global Economy

Comments

Post a Comment