The minimum combined 2021 sales tax rate for davis county, utah is. 84037 zip code sales tax and use tax rate | kaysville {davis county} utah.

Grocery Food

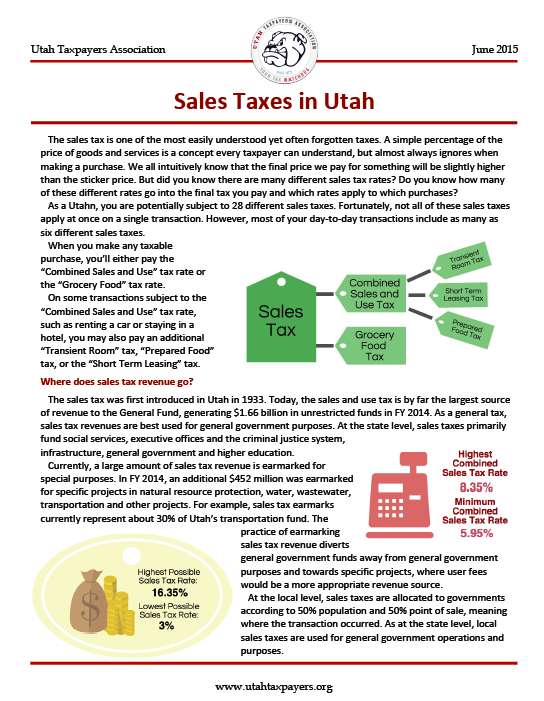

The utah state sales tax rate is currently %.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/19367952/merlin_19023.jpg)

Davis county utah sales tax rate. As income surpasses certain levels the credits phase out. The current total local sales tax rate in davis county, ut is 7.150%. The 7.25% sales tax rate in bountiful consists of 4.85% utah state sales tax, 1.8% davis county sales tax and 0.6% special tax.

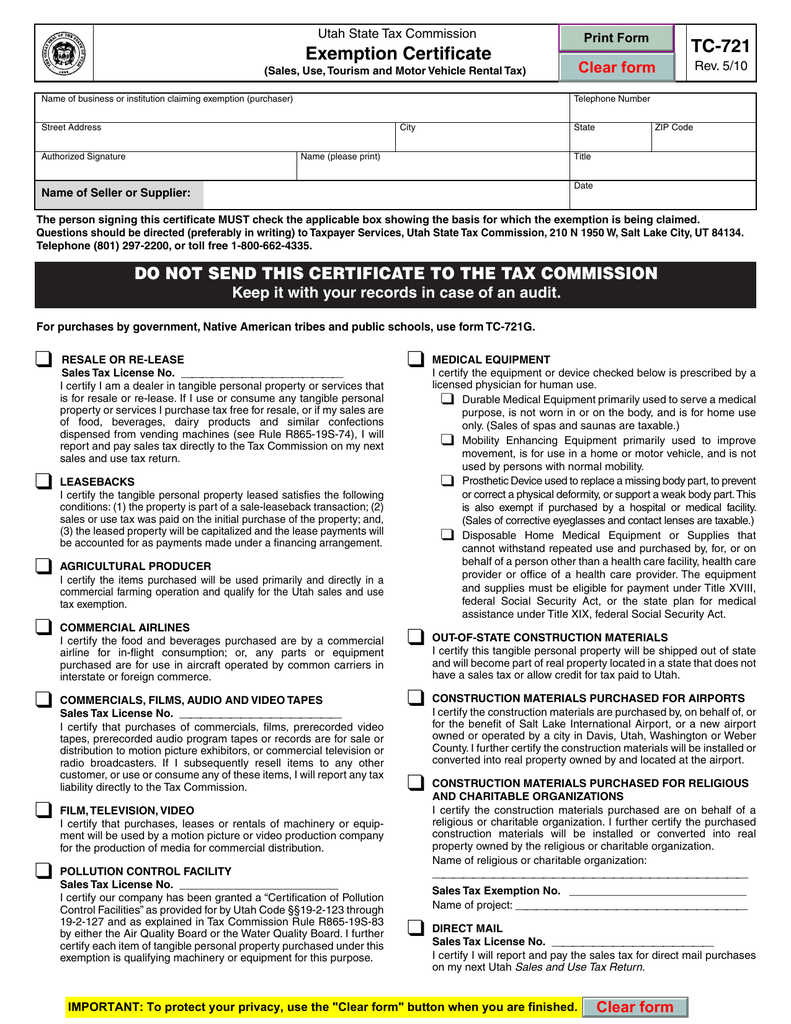

The various taxes and fees assessed by the dmv include, but are. The utah state sales tax rate is 5.95%, and the average ut sales tax after local surtaxes is 6.68%. [ 3 ] state sales tax is 4.85%.rank 34.estimated combined tax rate 7.15%, estimated county tax rate 1.80%, estimated city tax rate 0.00%, estimated special tax rate 0.50% and vendor discount 0.0131.

Auditor's office (room 102) 61 south main street. In 2008 utah moved away from the tiered tax structure to a 'single rate' of 5%. After calculating the flat tax amount, the tax payer maybe able to reduce the amount by applying credits.

You can print a 7.25% sales tax table here. Sales tax and use tax rate of zip code 84037 is located in kaysville city, davis county, utah state.tax risk level: Utah has state sales tax of 4.85% , and allows.

There is no applicable city tax. There is no applicable city tax. What is the sales tax rate in davis county?

Local tax rates in utah range from 0% to 4%, making the sales tax range in utah 4.7% to 8.7%. Utah has a higher state sales tax than 53.8% of states Davis county, utah has a maximum sales tax rate of 7.25% and an approximate population of 235,141.

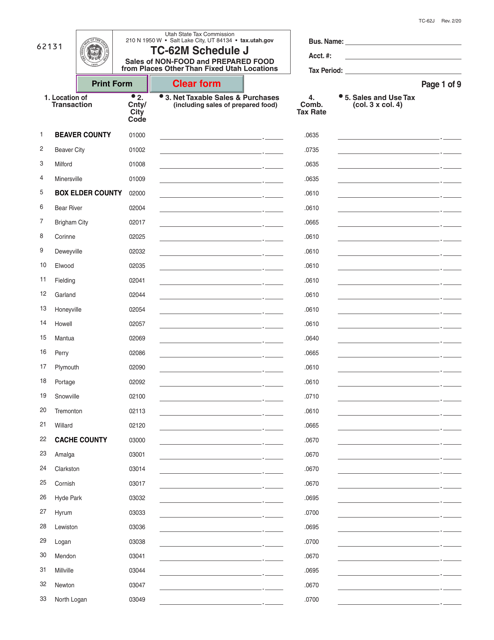

Utah sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a. The amount you need to pay at the time of vehicle registration varies depending on vehicle type, fuel type, county, and other factors. 89 rows the combined sales and use tax rates chart shows taxes due on all transactions subject to.

Find your utah combined state and local tax rate. This is the total of state and county sales tax rates. The base state sales tax rate in utah is 4.85%.

, ut sales tax rate. Any income that is earned or derived from utah falls under a state income tax. Sales tax rates in davis county are determined by nine different tax jurisdictions, layton, clearfield, syracuse, bountiful, kaysville, farmington, centerville, woods cross and north salt lake.

Utah has 340 special sales tax jurisdictions with local sales taxes in addition to the state sales tax; Davis county admin building 61 south main street (room 105) farmington, utah 84025 mailing address davis county treasurer p.o. The davis county sales tax rate is %.

262 rows average sales tax (with local): Counties and cities can charge an additional local sales tax of up to 2.4%, for a maximum possible combined sales tax of 8.35%;

Utah Sales Tax Rates By City County 2021

Utah Income Tax Calculator - Smartasset

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/19367952/merlin_19023.jpg)

Latest Tax Reform Plan Subjects Fewer Services To Utah Sales Taxes - Deseret News

2

Utah State Hospital Operational Policy And Procedure Manual

Form Tc-62m Schedule J Download Fillable Pdf Or Fill Online Sales Of Non-food And Prepared Food From Places Other Than Fixed Utah Locations Utah Templateroller

Utah County Map

Form Tc-810 Fillable Exemption Of Utah Safety And Emission Requirements For Vehicles Not In Utah

2

Lehi Woman Feels Flag Change Dishonors Utah History - Lehi Free Press

Utah Sales Tax On Cars Everything You Need To Know

Tc-721 Exemption Certificate Manualzz

Tc-40 Instructions - Utah State Tax Commission - Utahgov

Sales Taxes In Utah

![]()

Utah Llc - How To Start An Llc In Utah Truic

Utah Use Tax

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/65681588/80a93c6104.0.jpeg)

Latest Tax Reform Plan Subjects Fewer Services To Utah Sales Taxes - Deseret News

2

Utah Property Taxes Utah State Tax Commission

Comments

Post a Comment