For any single prize greater than $600, state lottery agencies must notify the internal revenue service (irs). They are not intended to specify the exact final tax burden, which may.

How Long After Winning The Lottery Do You Get The Money In All Lotteries

In new york city you can use the new york lottery tax calculator.

Iowa lottery tax calculator. Today, the tax rate is a little lower. Here are the 10 states with the highest taxes on lottery winnings: The payer pays the withholding tax.

After a few seconds, you will be provided with a full breakdown of the tax you are paying. Do you pay taxes on $1,000 lottery winnings? India used to tax 30.9% plus additional income tax.

In this case, calculate the adjusted noncash payment. 35% on the next $306,200. That raises your total ordinary taxable income to $140,000, with $25,000 withheld from your winnings for federal taxes.

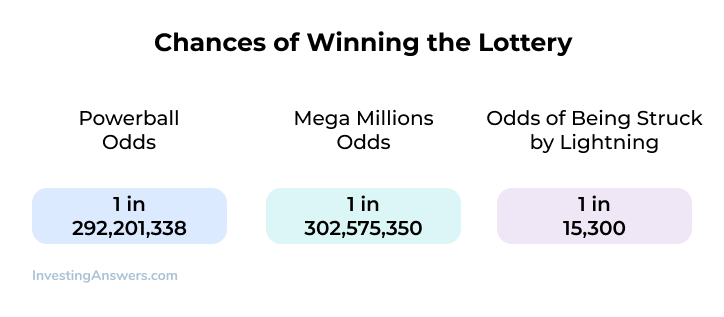

The iowa lottery does not withhold tax for prizes of $600 or less. 37% on any amount more than $510,300. So if you really want to be a mega millions winner, then this is the cheapest & easiest way to achieve your goal.

Out of the 43 states that participate in multistate lotteries, only arizona and maryland tax the winnings of people who live out of state. Noncash payment = (fmv of the noncash payment − the amount of the wager)/(1 − iowa income tax withholding percentage) noncash. This can range from 24% to 37% of your winnings.

The iowa lottery makes every effort to ensure the accuracy of the winning numbers, prize payouts and other information posted on the iowa lottery website. Income tax withheld by the us government, including income from lottery prize money. This varies across states, and can range from 0% to more than 8%.

Please note, the amounts shown are very close approximations to the amount a jackpot annuity winner would receive from the lottery every year. Federal and state tax for lottery winnings on lump sum payment in usa most of the lottery winners want a lump sum payment immediately. Suppose, you opt to win a lottery prize and received the lottery winning taxation amount in the form of an annuity payment of $60,000 in 2018.

Lottery tax calculator calculates the lump sum payments, taxes on the lottery and tries to provide accurate data to the user. Some states don’t impose an income tax while others withhold over 15 percent. Our tax calculator can be accessed and used free in any state and is great to use in the more popular gambling states like nj, nv, mi, pa, in, and co.

The table below shows the payout schedule for a jackpot of $224,000,000 for a ticket purchased in iowa, including taxes withheld. By law, prizes of more than $600 will face a 5 percent state withholding tax. Lottery number selectors, converters and calculators below is a list of calculators and selector programs available for use in picking lottery numbers for various national, regional and state lotteries.

The taxes you will have to pay in order to receive. In the event of a discrepancy, the official. For several people, gambling can mean regularly betting on sports to buying the occasional lottery ticket.

Now, on your tax return for the year 2018, you must report the lottery winning payment as your income for the year 2018. This is actually a favorable change toward the previous policy. Below the calculator, you can learn more about federal tax and the local tax rates in each participating state.

Depending on the number of your winnings, your federal tax rate could be as high as 37 percent as per the lottery tax calculation. The latest changes to the lottery law imply that you will have to pay 28% on all winnings. This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs.

*** winners living in new york city (3.876% extra) and yonkers (1.323% extra) may be subject to additional taxes. The tax calculator helps you to work out how much cash you will receive on your lotto america prize once federal and state taxes have been deducted. New york ( 8.82%) maryland ( 8.75%) new jersey ( 8.00%)

32% on the next $43,375. The official winning numbers are those selected in the respective drawings and recorded under the observation of an independent accounting firm. How do you calculate taxes on mega millions?

Buy a lottery ticket now. The table below shows a breakdown of the gross annuity value and the applicable federal and state tax for each year. Wyoming no tax on lottery winnings.

If a player wins more than $5,000, an additional 24 percent federal withholding tax will be withheld when the prize is claimed. You just need to enter details of your prize amount and where you purchased your ticket. Additional tax withheld, dependent on the state.

We have written and provided these for your. To use our georgia salary tax calculator, all you have to do is enter the necessary details and click on the calculate button. State and local tax rates vary by location.

In other words, say you make $40,000 a year and you won $100,000 in the lottery. In other words, if the winner of the powerball jackpot lives in new york city, he'd fork over a grand total of $486 million in taxes ($368 million in federal, $118 million in state and local taxes), and the net payout on the $930 million lump sum option would be only $444 million.

Pick 4 Players Win Big With Popular Ten-ten Numbers

Usa Lottery Tax Calculators Comparethelottocom

Lottery Tax Calculator Updated 2021 - Lottery N Go

Usa Lottery Tax Calculators Comparethelottocom

Why Multiple Lottery Wins Are Essential And How To Get Them Fast Winning The Lottery Lottery Win

If You Hit The 750 Million Powerball Jackpot Heres Your Tax Bill

Lottery Tax Calculator - How Lottery Winnings Are Taxed Taxact

Secrets To Winning The Lottery Revealed Wach

Best Lottery Tax Calculator Lotto Lump Sum Calculator

Saturdays Powerball Numbers Powerball Lottery Results Lottery Numbers

Scam Watch Lured By Lottery Winner On Instagram Which Conversation

Heres What To Do If You Win 500 Million Lottery

Best Lottery Tax Calculator Lotto Lump Sum Calculator

Winning Lottery Scratch Game Ticket Stock Photo - Download Image Now - Istock

Mega Millions Dc Lottery

Saturdays Powerball Numbers Powerball Lottery Results Lottery Numbers

Lottery Tax Calculator Updated 2021 - Lottery N Go

How Long After Winning The Lottery Do You Get The Money

4 Negative Effects Of Winning The Lottery You Cant Ignore

Comments

Post a Comment