A computer data center entitled to exemption under r.c. You will need to state a reason for the exemption, which would be that the item is being purchased to be used in the manufacturing of tangible personal property for sale.

Farm Bag Supply - Supplier Of Agricultural Film

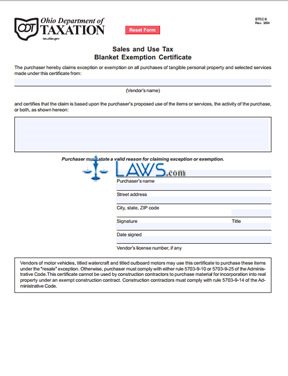

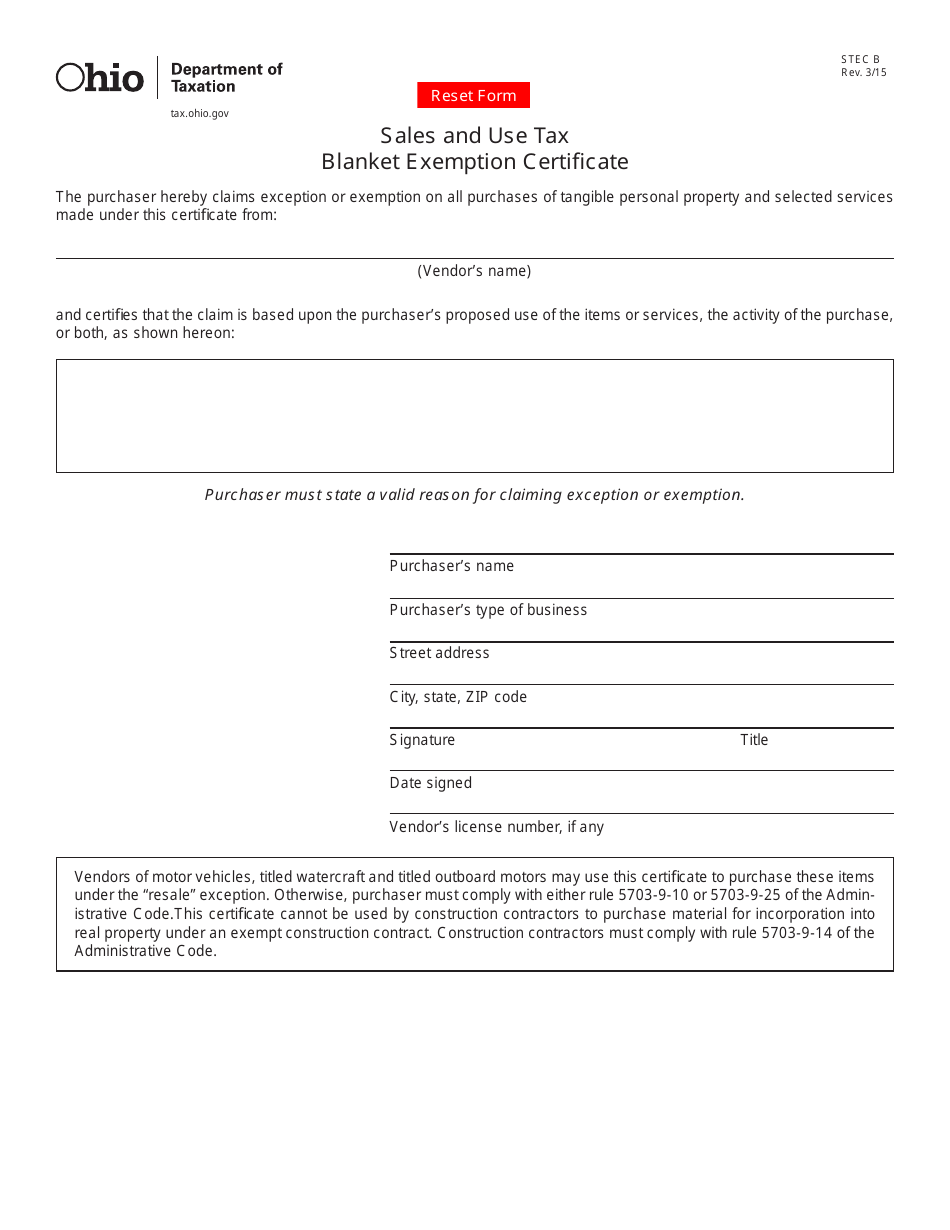

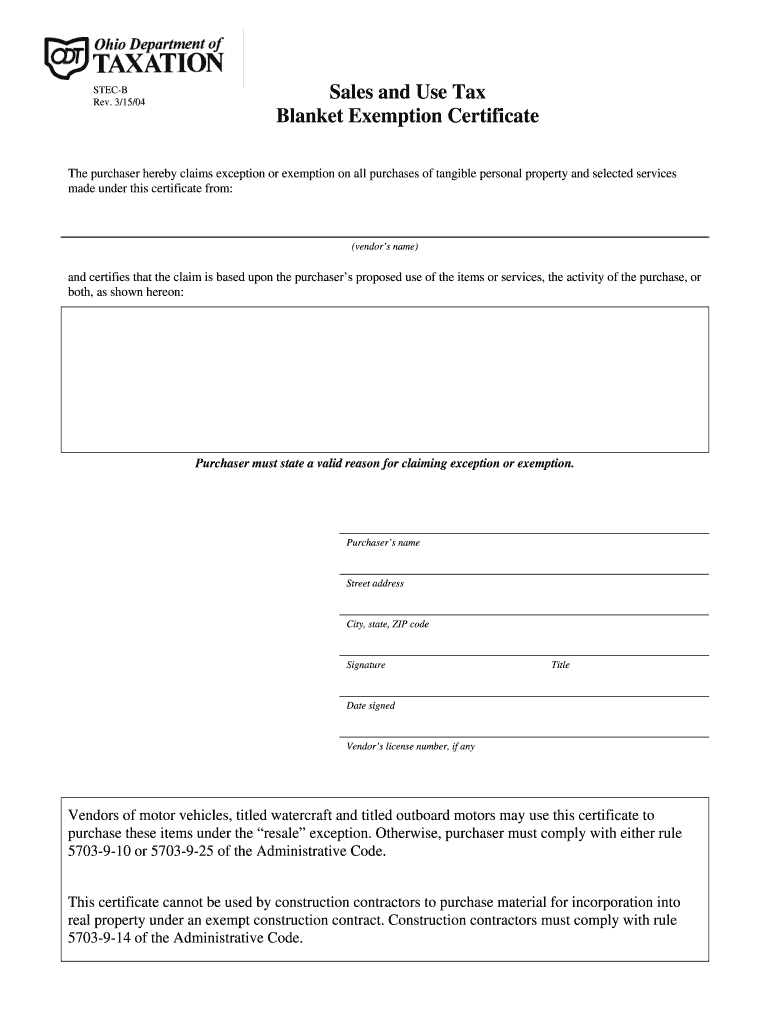

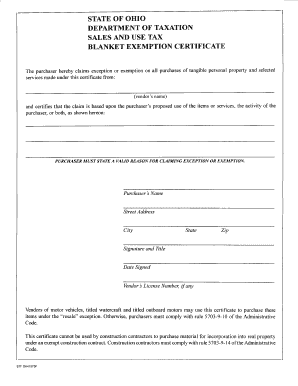

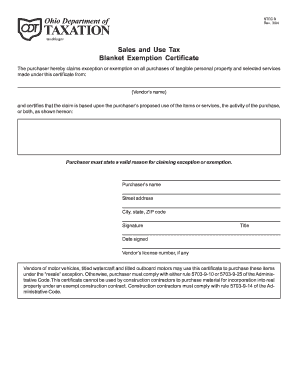

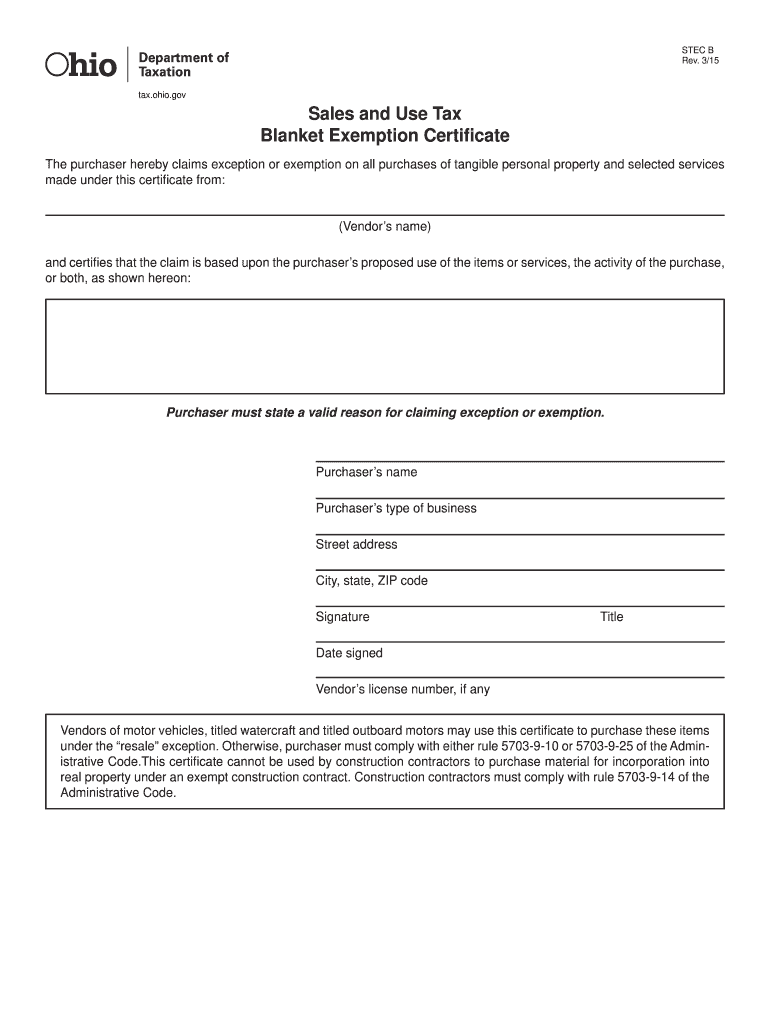

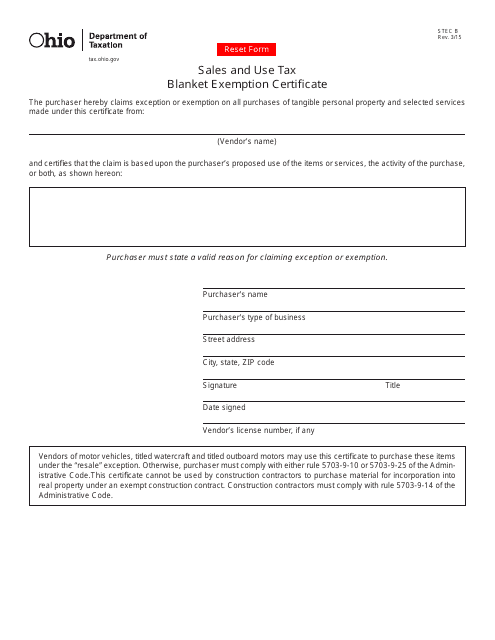

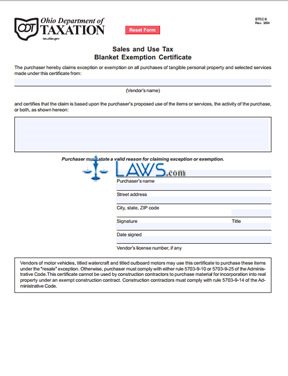

3/15 the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certificate from:

Ohio sales tax exemption form stec-b. Questions answered every 9 seconds. Ohio sales and use tax unit exemption certificate stec u step 9: 11/14 sales and use tax contractor’s exemption certifi cate identifi cation of contract:

Ohio sales and use tax unit exemption certificate stec u step 10: Submit this document to the ohio department of taxation. In the next section, provide a written explanation for the reason you are seeking this exemption.

The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certificate from: 04/20 do not send this form to the streamlined sales tax governing board. Department of taxation tax.oh,o.gov sales and use tax blanket exemption certificate stec b rev.

Gov sales and use tax blanket exemption certi cate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certi cate from vendor s name and certi es that the claim is based upon the purchaser s proposed use of the items or services the activity of the. Also keep in mind that if you are. Ohio state university extension (vendor’s name)

Ad a tax advisor will answer you now! Create your esignature and click ok. Steps for filling out the ohio sales and use tax exemption certificate.

If you qualify for tax exemption under a certain category and. Download or email fillable forms, try for free now! 3/15 sales and use tax unit exemption certifi cate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from:

Send the completed form to your seller and keep a copy for your records. This certificate cannot be used by construction contractors to purchase material for incorporation into real property under an exempt construction contract. Ad a tax advisor will answer you now!

Both forms require the buyer to list their name, address, purpose for the exemption (resale), and vendor’s license number (if any). Ad access any form you need. You will need to state a reason for the exemption, which would be that the item is being purchased to be used in the manufacturing of tangible personal property for sale.

Note that if your business operates in multiple states, it is possible to file a streamlined sales and use tax agreement accepted in multiple jurisdictions. A typed, drawn or uploaded signature. Complete, edit or print your forms instantly.

Select the document you want to sign and click upload. Decide on what kind of esignature to create. You can use the blanket exemption certificate to make further purchases from the same seller without having to give a newly completed form every time.

Contractee’s (owner’s) name exact location of job/project name of job/project as it appears on contract documentation the undersigned hereby certifi es that the tangible personal property purchased under this exemption from: Questions answered every 9 seconds. Real property that is owned, or will be accepted for ownership at the time of completion, by the united states government, its agencies, the state of ohio or an ohio political subdivision;

Tion into real property in that state, would be exempt from a tax on sales levied by that state; Most sellers will want the stec b to avoid having to create additional forms for future purchases. For other ohio sales tax exemption certificates, go here.

At the top of the page, enter the name of the vendor on the line provided. Complete the form as follows:

Findlayedu

Form Stec B Download Fillable Pdf Or Fill Online Sales And Use Tax Blanket Exemption Certificate Ohio Templateroller

Meigslocalorg

Ohio Tax Exempt Form - Fill Online Printable Fillable Blank Pdffiller

2015-2021 Oh Stec B Formerly Stf Oh41575f Fill Online Printable Fillable Blank - Pdffiller

Taxohiogov

How To Fill Out Ohio Tax Exempt Form - Fill Online Printable Fillable Blank Pdffiller

Form Stec B Fillable Sales And Use Tax Blanket Exemption Certificate

Tax Exempt Form Ohio - Fill Out And Sign Printable Pdf Template Signnow

Mlk12ohus

Ohio Tax Exempt Form For Farmers - Fill Online Printable Fillable Blank Pdffiller

Tax Exempt Form Ohio - Fill Out And Sign Printable Pdf Template Signnow

Miamiohedu

How To Get A Sales Tax Exemption Certificate In Ohio - Startingyourbusinesscom

2015-2021 Oh Stec B Formerly Stf Oh41575f Fill Online Printable Fillable Blank - Pdffiller

Form Stec Mv Fillable Certificate Of Exemption Regarding Sale Of A Motor Vehicle Off-highway Motorcycle Or All-purpose Vehicle

Form Stec B Download Fillable Pdf Or Fill Online Sales And Use Tax Blanket Exemption Certificate Ohio Templateroller

Free Form Sales And Use Tax Blanket Exemption Certificate - Free Legal Forms - Lawscom

The University Of Toledo

Comments

Post a Comment