The formula is fairly simple. The combined rate used in this calculator (6.5%) is the result of the florida state rate (6%), the 32824's county rate (0.5%).

How To Calculate Sales Tax Backwards From Total

Following is the reverse sales tax formula on how to calculate reverse tax.

Reverse sales tax calculator florida. To calculate the sales tax, plus any applicable surtax, due on alcoholic beverage sales: There are times when you may want to find out the original price of the items you’ve purchased before tax. Input the 'final price including tax' (price plus tax added on).

Divide your sales receipts by 1 plus the sales tax percentage. Formula to calculate sales tax backwards from total. Here is how the total is calculated before sales tax:

Enter the applicable sales tax percentage for the location where you are making the purchase. You will need to input the following: How to calculate sales tax.

That entry would be.0775 for the percentage. Divide the sales tax percentage by 100 (or move the decimal point two places to the left) to get the decimal equivalent of the rate. Amount without sales tax * gst rate = gst amount.

Gst calculator (good and service tax) reverse sales tax formula. Enter the sales tax percentage. • divide the total receipts from charges for the sales of alcoholic beverages by the tax rate divisor for the county where the business is located to compute gross sales

Fast and easy 2021 sales tax tool for businesses and people from 34243, sarasota, united states. Please, check the value of 'sales tax' in other sources to ensure that it is the correct value. How 2021 sales taxes are calculated for zip code 32824.

The combined rate used in this calculator (7%) is the result of the florida state rate (6%), the 33157's county rate (1%). Reverse sales tax calculator of florida for 2019 q3 reverse calculation of the general sales taxes of florida state for 2019 q3 amount after taxes sales tax rate(s) 6% 6.5% 7% 7.5% 8% 8.5% amount of taxes amount before taxes Amount without sales tax * qst rate = qst amount.

We can not guarantee its accuracy. Reverse sales tax calculator for 34243 sarasota, florida, united states in 2021 Sales taxprice before taxprice after tax$0$250$500$750$1,000$1,250.

Where fp is the final price; So if the tax rate were 7.375%, the decimal equivalent would be.07375. Reverse sales tax calculator of panama city calculation of the general sales taxes of the city panama city, florida for 2021 amount after taxes sales tax rate(s) 7% amount of.

Input the 'tax rate (%)'. Reverse sales tax calculator (remove tax) ? The 32824, orlando, florida, general sales tax rate is 6.5%.

For instance, in palm springs, california, the total sales tax percentage, including state, county and local taxes, is 7 and 3/4 percent. Sales tax calculator | reverse sales tax calculator. You are able to use our florida state tax calculator to calculate your total tax costs in the tax year 2021/22.

If you know the total sales price, and the sales tax percentage, it will calculate the base price before taxes and. Enter either the sales tax amount in dollars (such as 10 for $10) or the sales tax rate (such as 8.5 for 8.5%0. See also the reverse sales tax calculator (remove tax) on this page.

Free online 2021 reverse sales tax calculator for 34243, sarasota. Op with sales tax = [op × (tax rate in decimal form + 1)] The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim.

Pre tax price of product = sale price (post tax price) / (1 + tax rate) have you checked california sales calculator? The following formula can be used to calculate the original price of an item given the sales tax % and the final price of the item. Instead of using the reverse sales tax calculator, you can compute this manually.

This script calculates the 'before tax price' and the 'tax value' being charged. Divide your sales receipts by 1 plus the sales tax percentage. Amount with sales tax / (1+ (gst and qst rate combined/100)) or 1.14975 = amount without sales tax.

St is the sales tax (%) Our calculator has been specially developed in order to provide the users of the calculator with not only how. Enter the final price or amount.

We can not guarantee its accuracy. Reverse sales tax computation formula. How 2021 sales taxes are calculated for zip code 33157.

Reverse sales tax calculator of tampa calculation of the general sales taxes of the city tampa, florida for 2021 amount after taxes sales tax rate(s). The 33157, miami, florida, general sales tax rate is 7%. Sales tax amount or rate:

Please, check the value of sales tax in other sources to ensure that it is the correct value. In case you are interested in doing the calculation manually, here is how to calculate sales tax: Our calculator has recently been updated to include both the latest federal tax rates, along with the latest state tax rates.

Input the 'before tax price' (price without tax added on). The second script is the reverse of the first. Input the 'tax rate' (%).

To find the original price of an item, you need this formula: In this formula, we assume that you already know the sales tax percentage.

Reverse Sales Tax Calculator - 100 Free - Calculatorsio

Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Reverse Sales Tax Calculator - 100 Free - Calculatorsio

How To Calculate Florida Sales Tax On A Car Squeeze

How To Pay Sales Tax For Small Business 6-step Guide Chart

How To Calculate Sales Tax In Excel - Tutorial - Youtube

Sales Tax Calculator For Purchase Plus Tax Or Tax-included Price

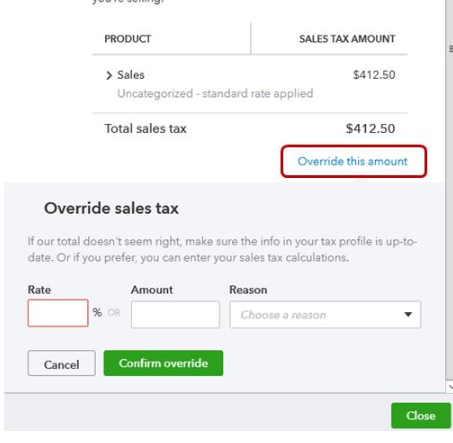

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Florida Sales Tax Calculator Reverse Sales Dremployee

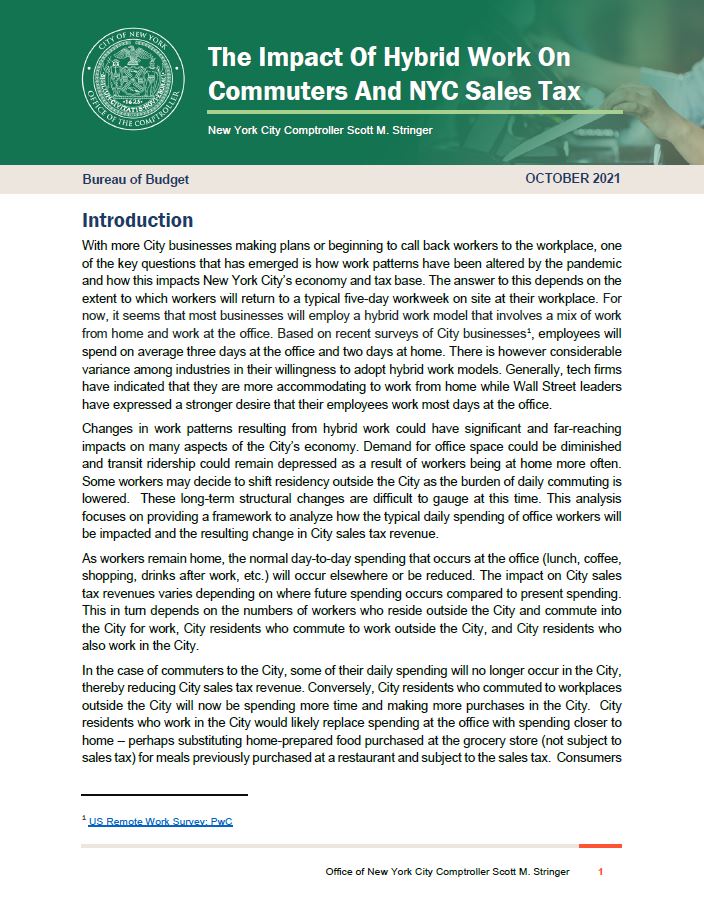

The Impact Of Hybrid Work On Commuters And Nyc Sales Tax Office Of The New York City Comptroller Scott M Stringer

Sales Tax Calculator

Sales Tax Calculator

How To Calculate Sales Tax Backwards From Total

Florida Business Owner Pleads Guilty To Tax Evasion Faces Federal Prison

Sales Tax Api Taxjar

Reverse Sales Tax Calculator De-calculator - Accounting Portal

1031 Exchange Calculator With Answers To 16 Faqs Internal Revenue Code Simplified

Kentucky Sales Tax Calculator Reverse Sales Dremployee

Us Sales Tax Calculator Reverse Sales Dremployee

Comments

Post a Comment