Get instant job matches for companies hiring now for senior tax manager jobs in sedgley. Fung corporate services group (uk) limited hiring organization:

Chartered Accountant Average Salary In London 2021 - The Complete Guide

The average salary for a senior accountant in united kingdom is £34,581.

Senior tax manager salary uk. Senior tax manager in with one to one recruitment. Ey senior manager salary the average income of a senior manager at ey is approximately $200,000 with a 192,800 base earning and $8,300 bonuses, not including the profit sharing. In other developed countries like the uk or canada, the figure is slightly above $130,000.

The base salary for tax manager ranges from $111,743 to $148,072 with the average base salary of $128,368. Senior tax manager (remote/hybrid) job description. As a senior manager, you will be required to liaise with clients, manage the completion of projects and mentor the junior staff members.

Salaries estimates are based on 78 salaries submitted anonymously to glassdoor by senior tax manager employees in london, united kingdom area. Visit payscale to research senior accountant salaries by city, experience, skill, employer and more. You would be dealing with corporate transactions and deals at all stages of the transaction cycle.

This jobot job is hosted by: Apply for senior tax manager in sedgley jobs today! Recruit uk are working on an excellent opportunity for a senior tax manager in london.

As a newly created role there is plenty of scope for development through providing advice to our existing client base as well as exposure to new client opportunities. Any from £15,000 from £20,000 from £25,000 from £30,000 from £45,000 from £55,000 other. The average salary for a tax manager is $99,348.

The average bdo salary ranges from approximately £15,969 per year for assistant to £76,476 per year for senior tax manager. Hays specialist recruitment date advertised: Salaries estimates are based on 228 salaries submitted anonymously to glassdoor by tax manager employees in london, united kingdom area.

Badenoch + clark are currently working with a highly successful organisation based in sussex to recruit a senior tax manager on a permanent basis. The total cash compensation, which includes base, and annual incentives, can vary anywhere from $120,660 to $169,372 with. Ideally for this role, you will be aca/att/cta or an international equivalent of this qualified or have a law qualification.

Whether you are planning your next career. Average bdo hourly pay ranges from approximately £14.42 per hour for plasterer to £15.00 per hour for welder. Easy apply now by clicking the apply now button and sending us your resume.

The role will suit a manager or senior manager with experience of advising fund managers on complex tax matters, who is comfortable to take the lead on a variety of projects. Any hourly daily weekly monthly yearly. Welcome to the robert half 2022 salary guide, your online resource for starting salary ranges, benefits and hiring trends for over 200 positions across administration, hr and office support, finance and accounting, legal, financial services, marketing and creative, and technology sectors.

Fung corporate services group (uk) limited salary. Corporate tax senior manager in birmingham: The average salary for senior tax manager is £91,135 per year in london, united kingdom area.

The average salary for tax manager is £64,584 per year in london, united kingdom area. Visit payscale to research tax manager salaries by city, experience, skill, employer and more. Today 3 days 7 days all days.

Strong technical knowledge of corporate tax and ideally some experience exposure to employment tax issues. Identifying and implementing approved tax strategies… company: The company advertised several vacancies, of which we would.

Closes 05 jan 2022 ref 2711340827 job role tax.

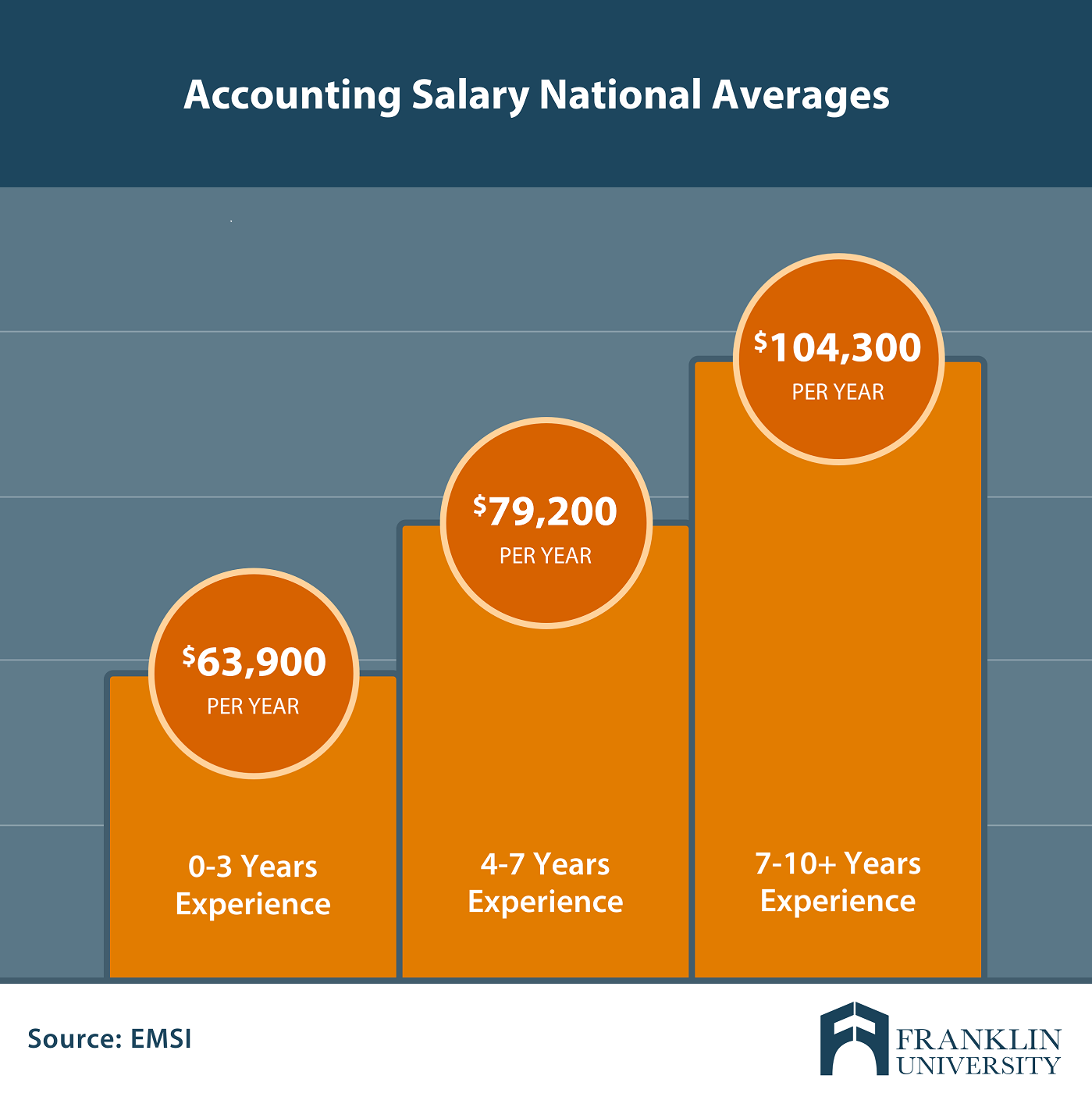

Masters Degree In Accounting Salary What Can You Expect

Accountancy Salaries In 2019 - Jobsie

Project Manager Salary Uk Apm

Personal Tax Jobs

Project Manager Salary Uk Apm

Corporate Tax Manager Jobs

Project Manager Salary Uk Apm

Personal Tax Jobs

Project Manager Salary Uk Apm

Browse Jobs Taxation Jobs

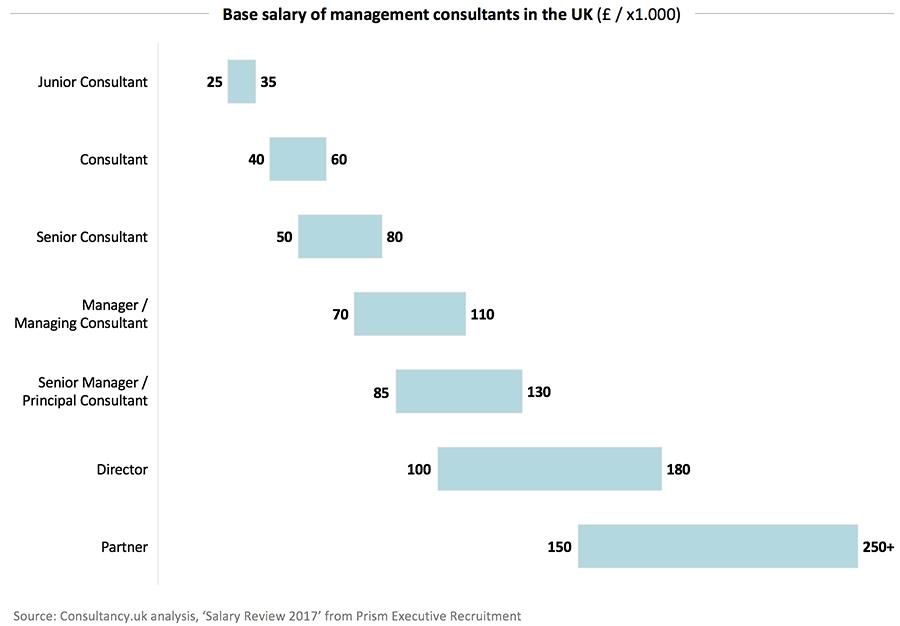

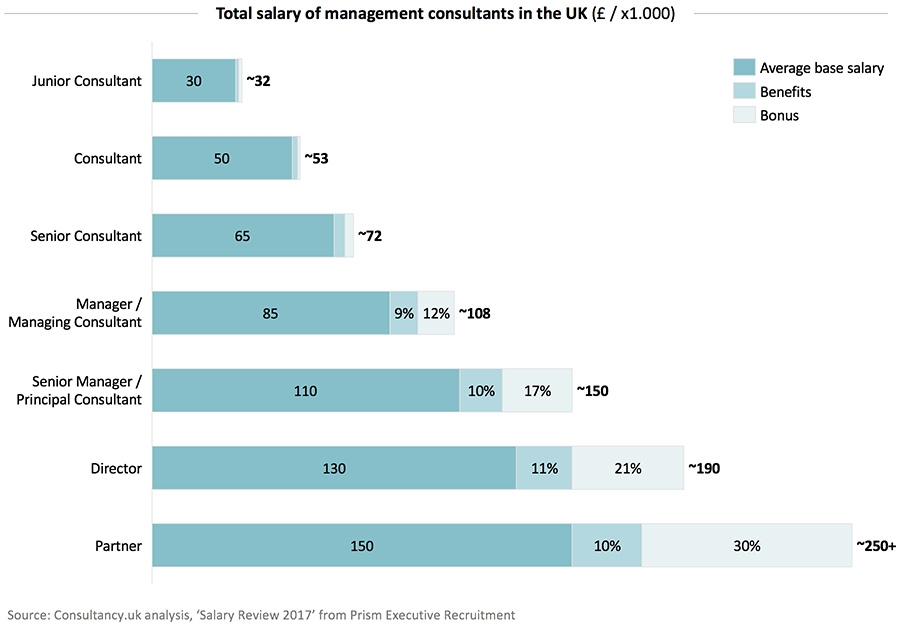

Base Salary And Total Remuneration Of Consultants In The Uk

Chartered Accountant Average Salary In London 2021 - The Complete Guide

The Salary Of Consultants In The Uk Consulting Industry

Personal Tax Jobs

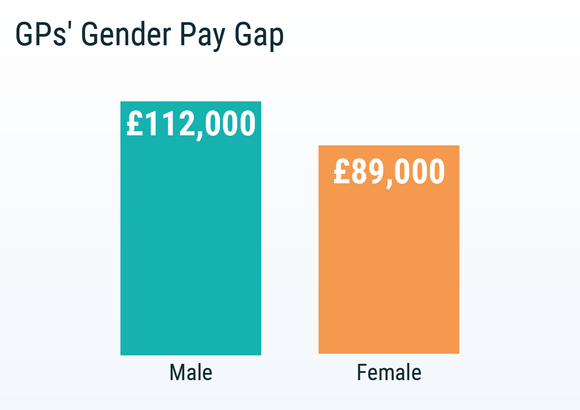

Uk Doctors Salary And Satisfaction Report 2019

Corporate Tax Manager Jobs

Base Salary And Total Remuneration Of Consultants In The Uk

Chartered Accountant Average Salary In London 2021 - The Complete Guide

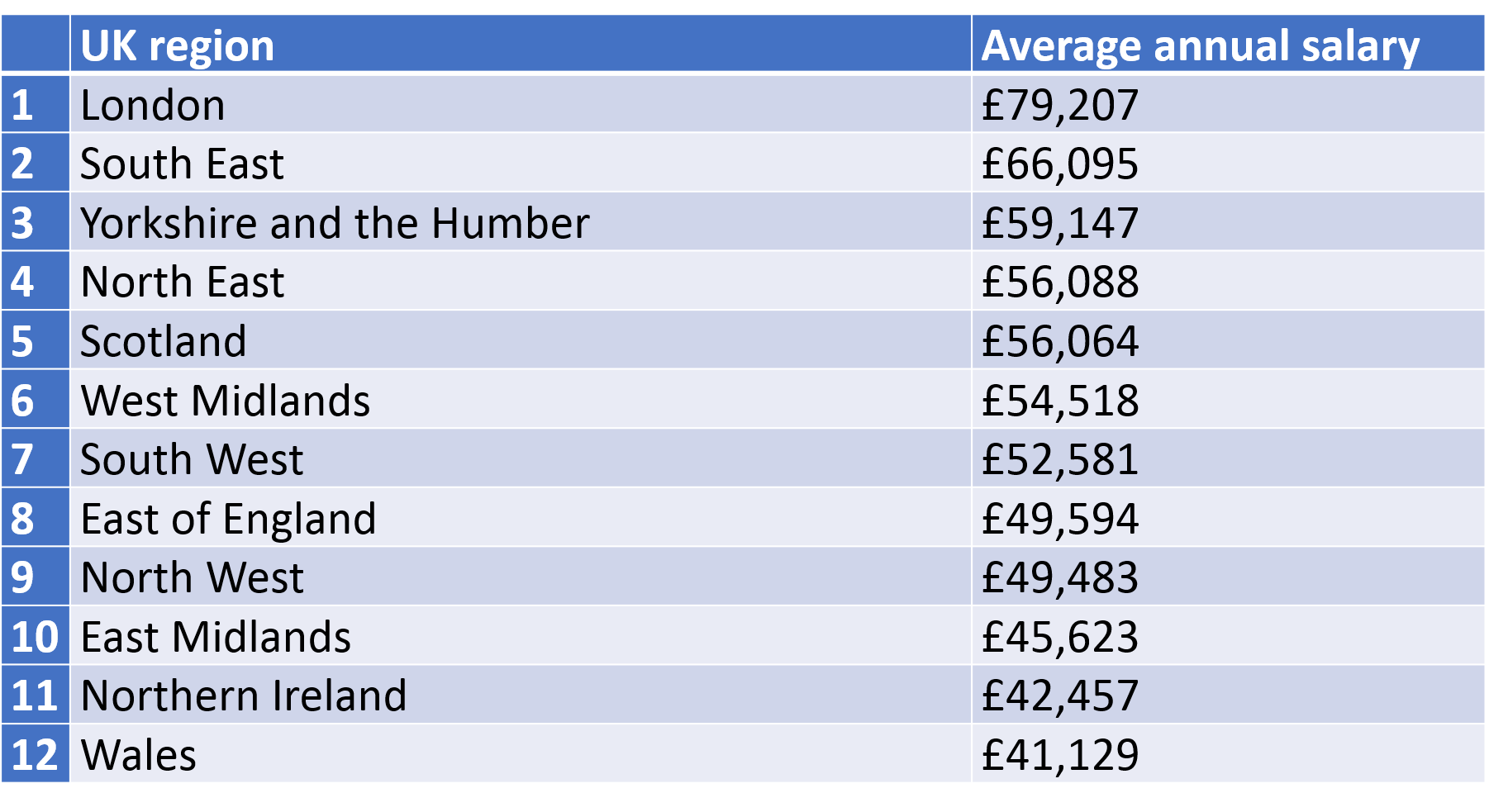

Which Uk Regions Pay The Highest Salaries In Accounting - Accountancy Age

Comments

Post a Comment