123 elm street • lewiston, id • 83501 • 208.555.5555 • jkendall@notmail.com. Choose a template with the colors, fonts & text sizes that are appropriate for your industry.

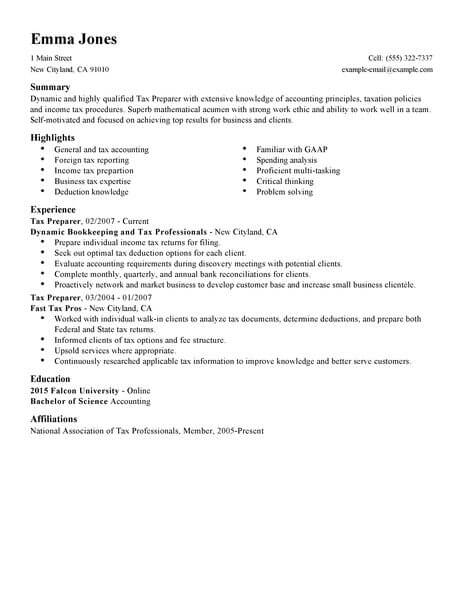

Tax Preparer Resume Example Useful Tips Myperfectresume

This handout contains resume examples that will help you get started.

Tax preparer resume sample pdf. For example, if you have a ph.d in neuroscience and a master's in the same sphere, just list your ph.d. But if you want to download in pdf format or forward directly to your employer then pay small amount and then you are on. Click the button below to make your resume in this design.

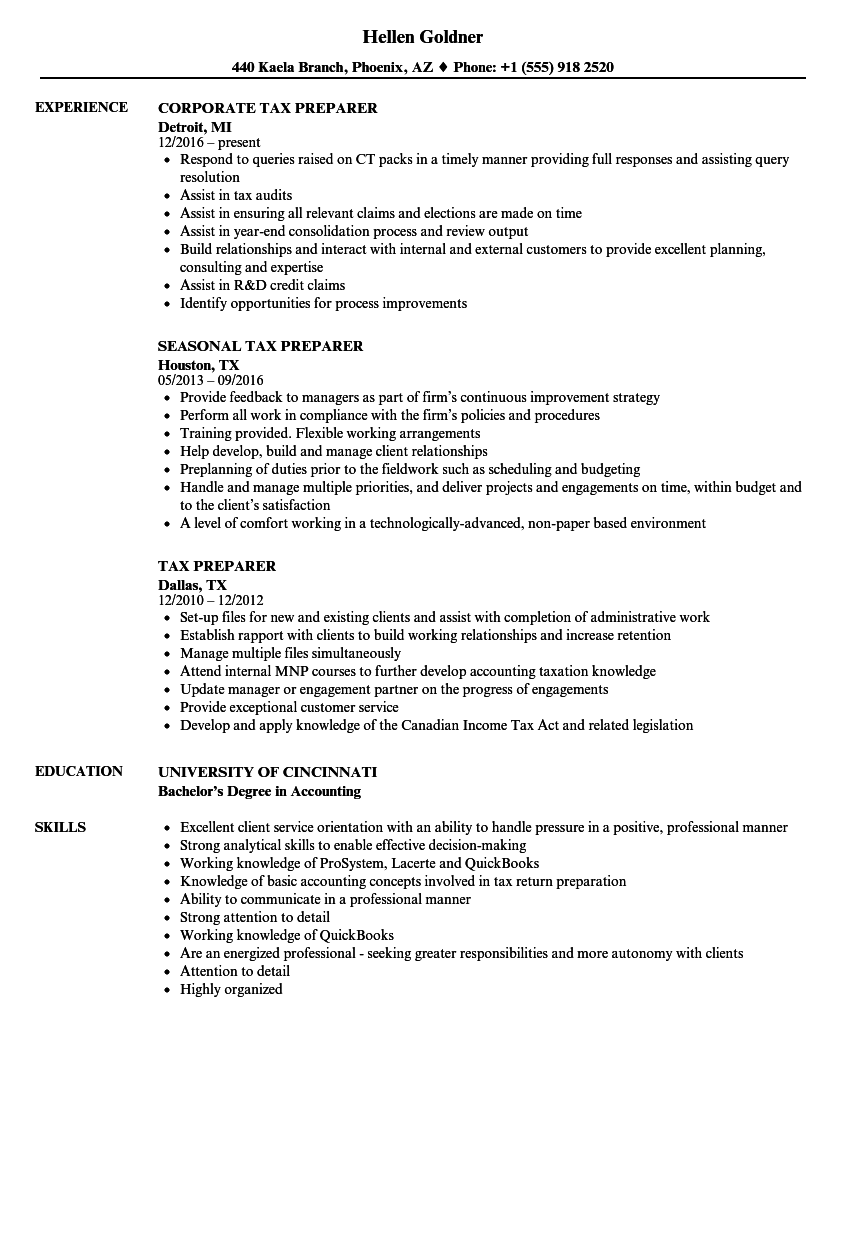

Ad answer a few questions & your resume will make itself! Accounting, accounts payable, accounts receivable. Resume sample of a tax accountant with several years of experience.

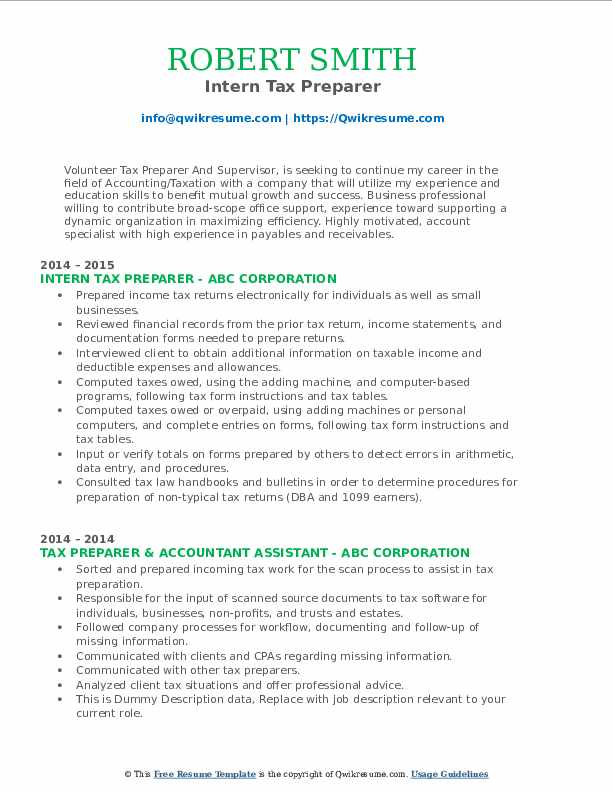

Download resume pdf build free resume. 2+ years of general tax experience (compliance and individual); Use the tax preparer resume sample given below.

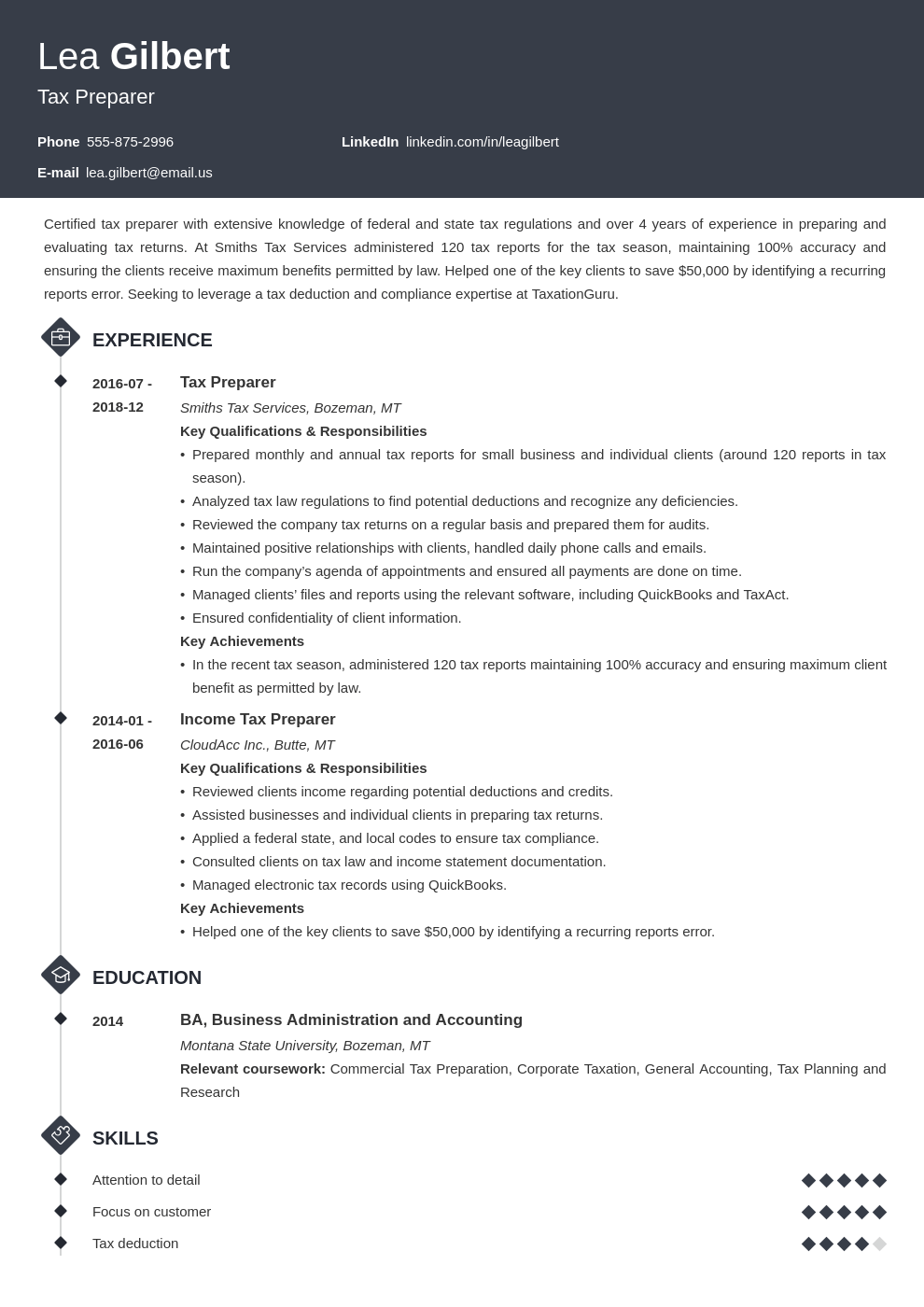

Microsoft office/suite proficient (excel, outlook, word, etc.) working knowledge of prosystem, lacerte and quickbooks. These professionals assist the clients in fulfilling their tax obligations by following federal laws as well as provide suggestions for saving money on tax, and reimbursement on overpaid taxes. The following tax preparer sample resume is created using timeline resume builder.

To become a tax preparer, you’ll need specialized training and courses, plus a compelling resume. You don’t need to be an accountant or a cpa. You need a great tax accountant resume to prove all that.

Tax accountant resume sample & guide [20+ tips] tax accountant resume sample & guide [20+ tips] you help families maximize their tax returns. Using the templates, you can rest assured that the structure and format of your tax preparer resume is top notch. Tax preparer resume sample & writing guide [20+ tips] tax preparer resume sample & writing guide [20+ tips] tax preparers make and submit accurate tax returns for individuals and small businesses.

A seasonal tax preparer is responsible for preparing income tax for companies and individuals. This resume adopts the recommended format of having a summary of qualifications followed by a section highlighting the candidate's core expertise. Ad top resume builder, build a perfect resume with ease.

Make a copy of this resume sample at no cost or modify it in any way using our online resume builder. Ransom 4070 green avenue san francisco, ca, 94107 phone no: For cover letter help, see our tax preparer cover letter tax preparer resume sample.

Get invited for more job interviews and get inspiration for your new resume with this expertly drafted cpa tax accountant resume sample. The job description entails identifying potential tax credits and liabilities and completing the filing of returns in a timely manner. You perform due diligence on behalf of enterprises.

Ad answer a few questions & your resume will make itself! To engaged in a career that will allow for progress in terms of skills/expertise, and innovation through exposure to new ideas for personal/professional growth, as well as growth of the company. The experience section of the resume sample identifies the candidate’s achievements at each position she held.

We’ve compiled several resume examples for tax preparers below. A candidate seeking advanced tax preparer employment. Tax preparer resume examples & samples.

We offer to you these 32+ accountant resume samples to help you get the job for accounting positions. If you’ve been working for a few years and have a few solid positions to show, put your education after your tax preparer experience. As a tax preparer at white umbrella tax professionals, she achieved “a 98% customer satisfaction rating or.

1 + year of experience as a tax associate. Successfully advised, informed and filed tax returns for a number of clients including enterprises and small businesses to ensure timely filing and compliance of tax regulations. Cpa tax accountant resume sample.

Tax preparer job seeking tips. Skilled in accumulating, analyzing, and processing the financial accounting data in. As long as you have the necessary training, competencies, and.

Tax accountants work with public accounting firms, companies, or as a freelancer and help clients in filing their tax returns. An accountant resume is indeed one of the most important documents that an applicant should have when applying in the field of accounting. Ad top resume builder, build a perfect resume with ease.

Make sure to make education a priority on your tax preparer resume.

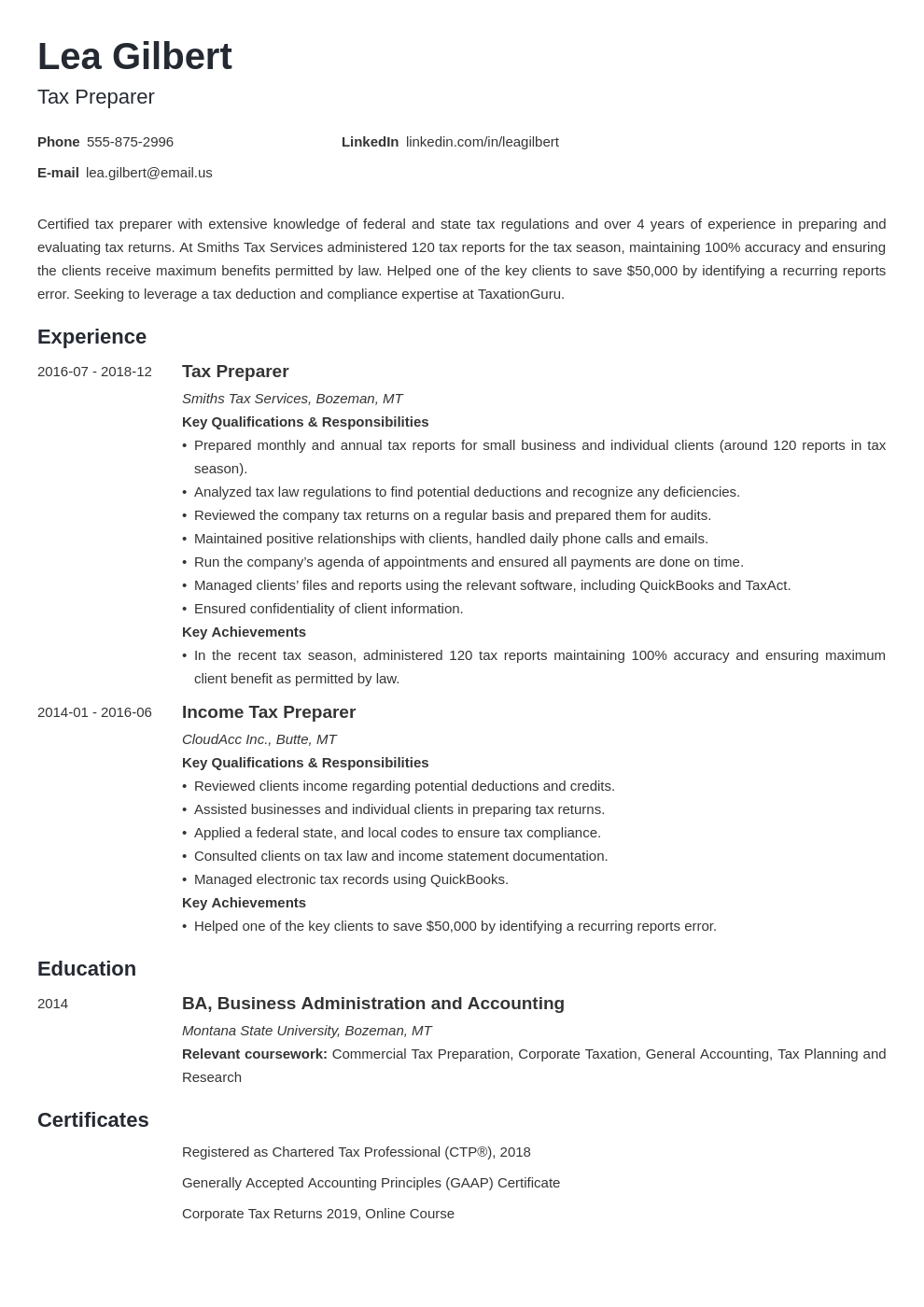

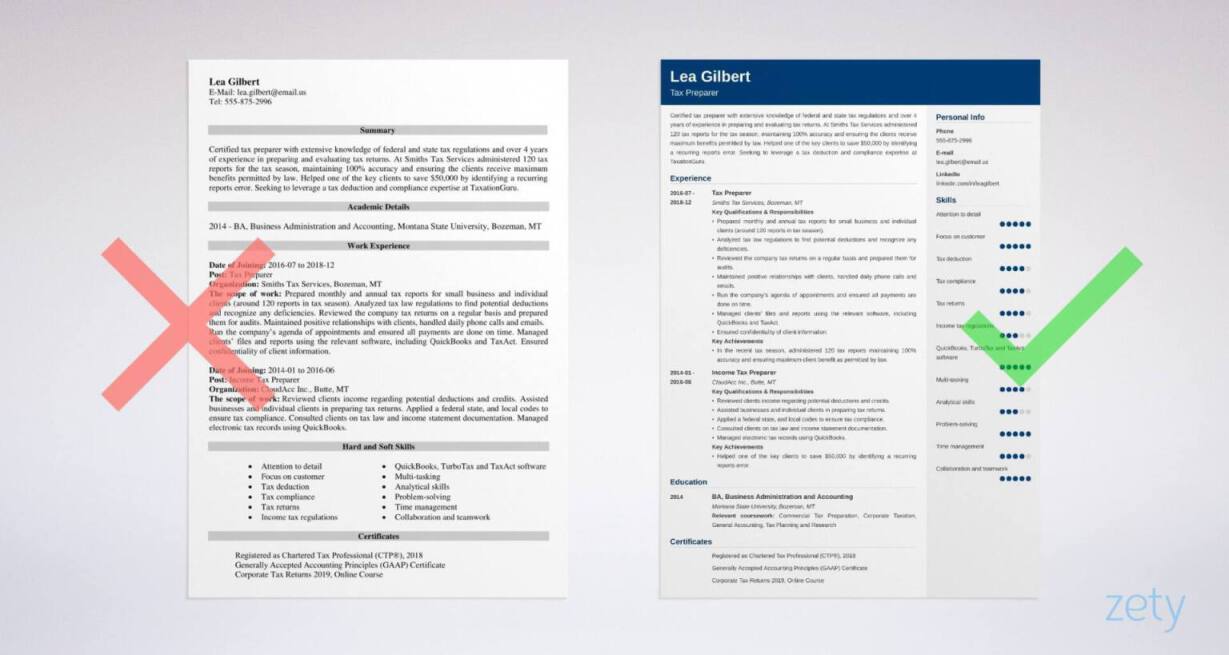

Tax Preparer Resume Sample Writing Guide 20 Tips

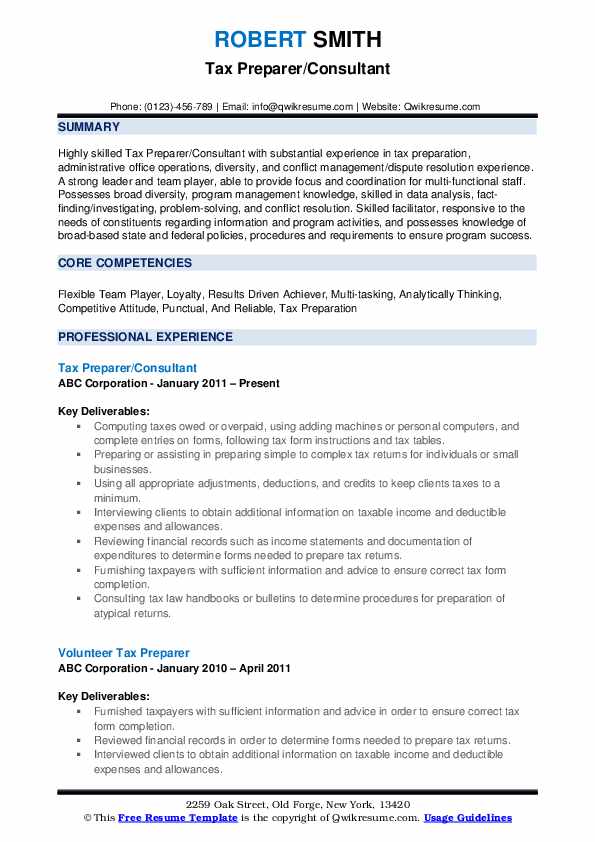

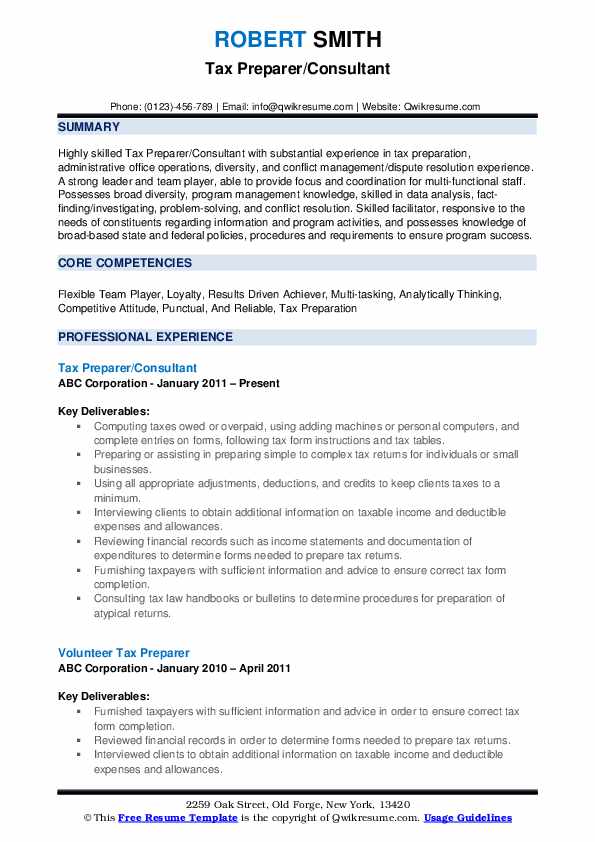

Tax Preparer Resume Samples Qwikresume

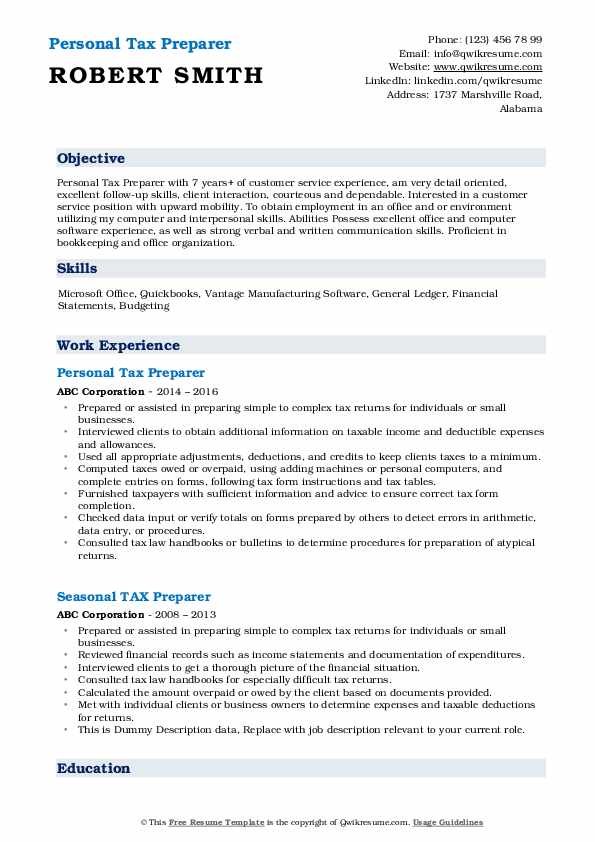

Seasonal Tax Preparer Resume November 2021

Tax Preparer Resume Samples Qwikresume

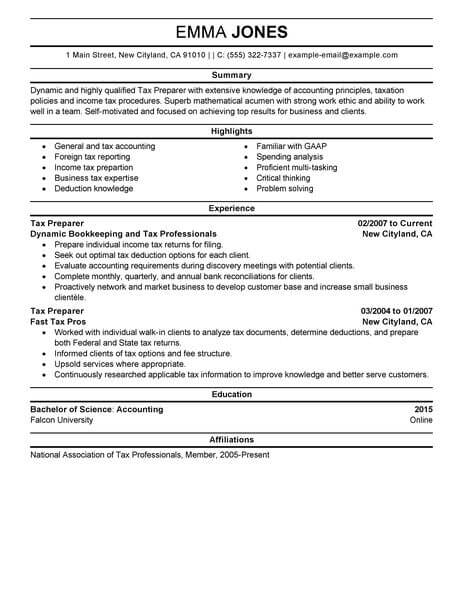

Professional Tax Preparer Resume Examples Finance Livecareer

Tax Preparer Resume Sample - Resumecompass

Tax Preparer Resume Samples Qwikresume

Tax Preparer Resume Example Useful Tips Myperfectresume Recipe Resume Examples Good Resume Examples Professional Resume Writing Service

Professional Tax Preparer Resume Examples Finance Livecareer

Tax Preparer Resume Sample Writing Guide 20 Tips

Tax Preparer Resume Example Useful Tips Myperfectresume

Tax Preparer Resume Samples Velvet Jobs

![]()

Tax Preparer Resume Sample Writing Guide 20 Tips

Tax Preparer Resume Samples Qwikresume

Tax Preparer Resume Samples Qwikresume

Tax Preparer Resume Sample Writing Guide 20 Tips

Tax Preparer Resume Samples Qwikresume

Professional Tax Preparer Resume Examples Skills Objective Summary Cakeresume

Seasonal Tax Preparer Resume Samples Qwikresume

Comments

Post a Comment