Try it now & grow your business! Quarterly if taxable sales are $4,801 to $95,999 per year (if the tax is less than $300 per month).

How To Calculate Sales Tax - Video Lesson Transcript Studycom

Create your own online store and start selling today.

Aurora co sales tax rate. Retailers are required to collect the aurora sales tax rate of 3.75% on cigarettes beginning dec. Some cities in colorado are in process signing up with the suts program. What is the sales tax rate for arapahoe county colorado?

This page does not contain all tax rates for a business location. The colorado sales tax rate is currently %. This is the total of state, county and city sales tax rates.

, co sales tax rate. The combined rate used in this calculator (8%) is the result of the colorado state rate (2.9%), the 80014's county rate (0.25%), the aurora tax rate (3.75%), and in some case, special rate (1.1%). Try it now & grow your business!

The 80010, aurora, colorado, general sales tax rate is 8.5%. The 8% sales tax rate in aurora consists of 2.9% colorado state sales tax, 0.25% adams county sales tax, 3.75% aurora tax and 1.1% special tax. Directly for your sales tax questions.

Create your own online store and start selling today. The aurora, colorado sales tax is 8.00%, consisting of 2.90% colorado state sales tax and 5.10% aurora local sales taxes.the local sales tax consists of a 0.25% county sales tax, a 3.75% city sales tax and a 1.10% special district sales tax (used to fund transportation districts, local attractions, etc). Those cities are not yet accepting sales tax returns through the suts system, but you can still see their rates and jurisdiction codes when you look up a location within their boundaries.

Cities that have not yet signed up will be shown with a red exclamation mark beside their sales tax rate. Aurora in colorado has a tax rate of 8% for 2022, this includes the colorado sales tax rate of 2.9% and local sales tax rates in aurora totaling 5.1%. This is the total of state and county sales tax rates.

The combined rate used in this calculator (8.5%) is the result of the colorado state rate (2.9%), the 80010's county rate (0.75%), the aurora tax rate (3.75%), and in some case, special rate (1.1%). Note that failure to collect the sales tax does not remove the retailer’s responsibility for payment. The colorado state sales tax rate is currently 2.9%.

Sales tax and use tax rate of zip code 80016 is located in aurora city, douglas county, colorado state. The minimum combined 2021 sales tax rate for aurora, colorado is. Annually if taxable sales are $4,800 or less per year (if.

Monthly if taxable sales are $96,000 or more per year (if the tax is more than $300 per month). This sales tax will be remitted as part of your regular city of aurora sales and use tax filing. There are a total of 223 local tax jurisdictions across the state, collecting an average local tax of 3.374%.

The aurora sales tax rate is %. The estimated 2021 sales tax rate for 80016 is. Aurora, co sales tax rate.

To find all applicable sales or use tax rates for a specific business location or local government, visit the how to look up sales & use tax rates web page. In colorado , annual sales tax revenues reached $3 billion in fiscal year 2019, which ended last june. Rate variation the 80014's tax rate may change depending of the type of purchase.

The current total local sales tax rate in aurora, co is 8.000%. Their contact information list listed below. Aurora collects a 5.6% local sales tax, the maximum local sales tax allowed under colorado law aurora has a higher sales tax than 88.6% of colorado's other cities and counties aurora colorado sales tax exemptions

Rate variation the 80010's tax rate may change depending of the type of purchase. The 2018 united states supreme court decision in south dakota v. The sales tax jurisdiction name is aurora (arapahoe co), which may refer to a local government division.

[ 5 ] state sales tax is 2.90%. This document lists the sales and use tax rates for all colorado cities, counties, and special districts. Colorado has state sales tax of 2.9% , and allows local governments to collect a local option sales tax of up to 8%.

This web page contains changes to existing sales or use tax rates. Sales & use tax rate changes effective july 1, 2021 The county sales tax rate is %.

Popular | counties | all | a b c d e f g h i j k l m n o p r s t u v. Average sales tax (with local): The minimum combined 2021 sales tax rate for arapahoe county , colorado is 3.25%.

The 80014, aurora, colorado, general sales tax rate is 8%. You can find more tax rates and allowances for aurora and colorado in the 2022 colorado tax tables. The december 2020 total local sales tax rate was also 8.000%.

County sales tax 0.25% 0.75% total combined tax rate 24.10% 24.6 0% please note that there is also a 5.0% city excise tax imposed on the average market rate of unprocessed retail marijuana that is sold or transferred from a retail marijuana cultivation facility located within.

825 Sales Tax Calculator Template Tax Printables Sales Tax Calculator

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Pengertian Dan 7 Contoh Gambar Poster Seni Budaya Poster Seni Budaya

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Sales Tax On Grocery Items - Taxjar

How Colorado Taxes Work - Auto Dealers - Dealrtax

Nationally Renowned Shopping Low Sales Tax Rates And Diverse Recreational Opportunities Make The City Of Lone Tree A Very Desirable Plac Lone Tree Tree Lonely

80016 Sales Tax Rate - Co Sales Taxes By Zip

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

How To Calculate Cannabis Taxes At Your Dispensary

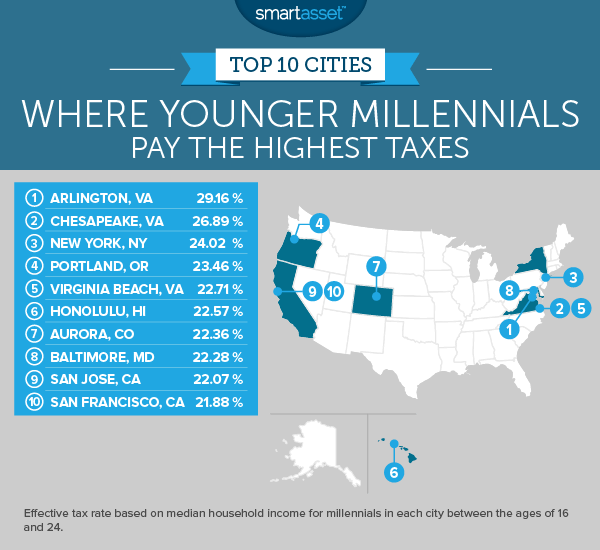

Where Millennials Pay The Highest Taxes - 2017 Edition - Smartasset

State Income Tax - Wikiwand

2

Al Habib Business Services Offering All Business Services Under One Roof Call Now 0515700513 0518313521 0515586744 032 Business Systems Business Service

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

How Colorado Taxes Work - Auto Dealers - Dealrtax

Taxes In Orem Utah Orem Sales Tax Rates And Orem Property Tax Rates - Orem Ut The Best Guide To Orem Utah

Property Tax Village Of Carol Stream Il

Comments

Post a Comment