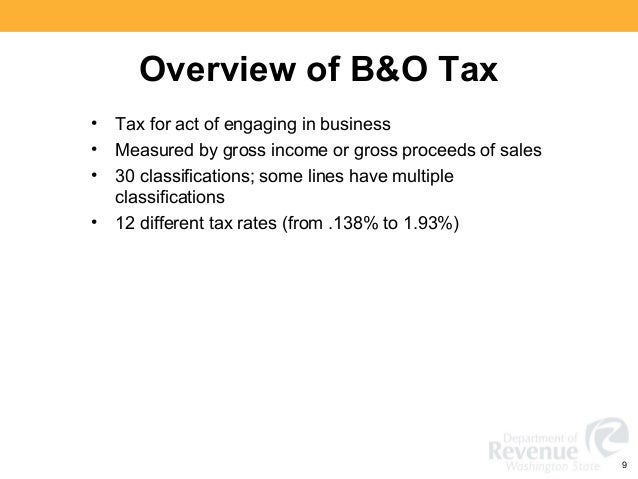

The b&o tax (short for “business & occupation tax”) is a gross receipts tax. If you operate a small professional services firm (say a consultancy) and the firm grosses $200,000 in revenue, you will owe 1.5%, or $3,000, in business and occupation taxes.

Washington State Enacts Major Tax Legislation - Bader Martin

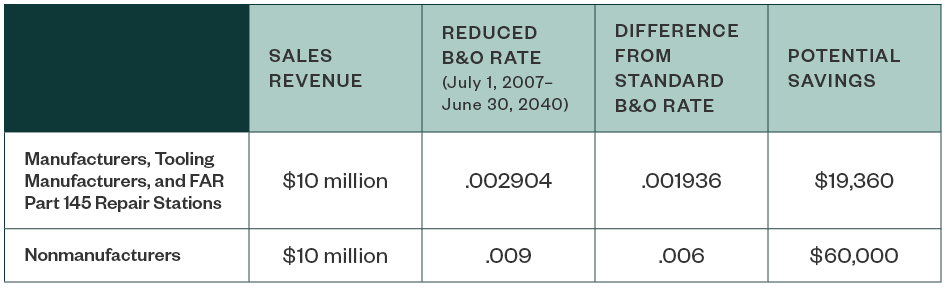

Washington, unlike many other states, does not have an income tax.

B&o tax rate washington state. Washington, unlike many other states, does not have an income tax. Washington state doesn’t have income tax like most states, but business owners do need to pay business and occupation (b&o) tax, and this is usually on a state and city level. This rate is comprised of the preferential b&o tax rate (0.2904%) and a surcharge (0.052%).

The state does not exempt marketplace facilitators from collecting and remitting sales tax, in addition to the b&o tax. Marketplace facilitators, such as amazon, typically collect sales tax at the retail sales rate, which ranges from 7% to 10.5% depending on location and industry. How do i know my b&o tax rate?

A real estate excise tax (reet) exemption for sales of standing timber (but not land) to be cut within 30 months of the sale. Currently all businesses subject to b&o tax under rcw 82.04.290(2) pay a b&o tax rate of 1.5% on gross income. The bill enacted a b&o tax surcharge on the service receipts of taxpayers primarily engaged in any combination of 43 specified business activities, effective january 1, 2020.

Beginning with business activities occurring on or after january 1, 2020, hb 2158, if enacted, would impose b&o tax surcharges — at rates of 20%, 33.33% and 66.66% —. This includes the value of products, gross proceeds of sale, or the gross income of the business. It is measured on the value of products, gross proceeds of sale, or gross income of the business.

Most washington businesses fall under the 1.5% gross receipts tax rate. This means there are no deductions from the b&o tax for labor, materials, taxes, or other costs of doing business. The washington state business and occupation tax (b&o tax) is measured on a company’s gross receipts.

Here’s a summary of the tax changes. It is measured on the value of products, gross proceeds of sale, or gross income of the business. Also, effective january 1, 2020, an additional 1.2% b&o tax is imposed on the income of specified financial institutions that are subject to service and other activities b&o tax.

(click here to see the department of revenue’s current list of business and occupation tax rates.) example: Your last step is to simply multiply your washington gross receipts for the taxing period (usually a month) by your b&o tax rate. The additional.3% is referred to as “workforce education surcharge”.

Exemptions, deductions, or other exceptions may apply in certain circumstances. The applicable b&o tax rate is 0.3424%. Effective january 1, 2020, specified business will pay b&o tax at a rate of 1.8% on their taxable washington revenue, while select advance computing businesses with annual worldwide revenues between $25 billion and $100 billion will pay b&o tax at a rate of 2%.

Tax rates may apply to businesses categories other than those above. Once you know whether or not you have washington b&o tax nexus, and which receipts count as washington receipts, you’re largely past the difficult part. For taxpayers subject to the surcharge, the service and other activities b&o tax rate was effectively increased from 1.5% to 1.8%.

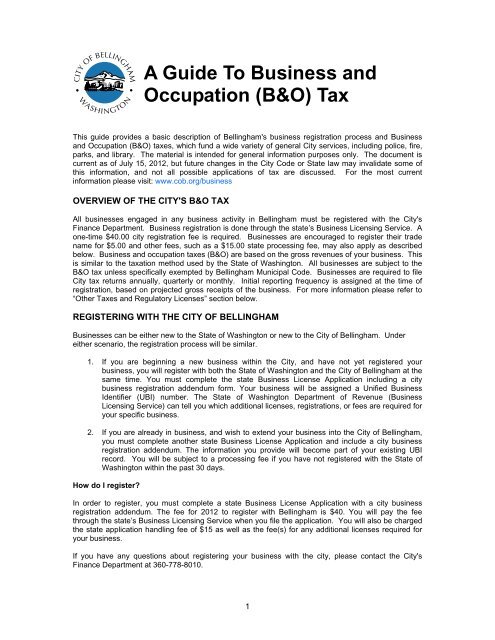

Business and occupation (b&o) services tax (hb 2158). And some businesses pay lower rates. ***for manufacturing gross reciepts over $8 billion, the b&o rate drops to 0.00025.

Thresholds are subject to change. The preference is scheduled to expire july 1, 2024. The state b&o tax is a gross receipts tax.

Washington’s b&o tax is calculated on the gross income from activities. Washington state b&o tax is based on the gross income from business activities. This results in an effective “service and other activities” b&o tax rate of 2.72%, as advanced computing businesses are subject to the regular “service and other activities” b&o tax rate of 1.5%.

B & o tax rates when paying the b & o tax to the department of revenue, you declare your income in different categories. Businesses pay a washington b&o tax rate depending on their classification. For more information on the workforce education investment surcharge, visit the washington dor webpage.

Contact the city finance department for more information.

Business Occupation Tax Bainbridge Island Wa - Official Website

Why Our Bo Tax Is Unfair Rseattlewa

Retail Combo Businesses How To Make Your Annual Report To The Wa Dor For Excise Taxes Seattle Business Apothecary Resource Center For Self-employed Women

A History Of Washington States Tax Code All In For Washington

2

Washington State Sales Use And Bo Tax Workshop

Bo Tax - City Of Bellingham

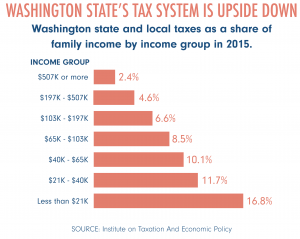

Am I Taxed Too Much Understanding The Impacts Of Fiscal Policy - Washington State Wire

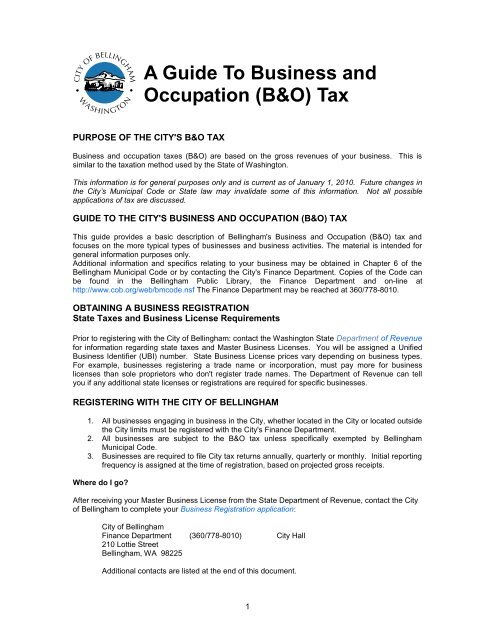

Business And Occupation Bo Tax Washington State And City Of Bellingham

A Guide To Business And Occupation Tax - City Of Bellingham Wa

Washington Revises Service Business Surcharge Grant Thornton

Washington Aerospace Tax Incentives

State Tax Structure Workgroup Seeks Input For Possible Changes To Washington Tax System Clarkcountytodaycom

Increasing Bo Taxes On This Years Legislative Agenda

2

Wa Dor Combined Excise Tax Return 2020-2021 - Fill Out Tax Template Online Us Legal Forms

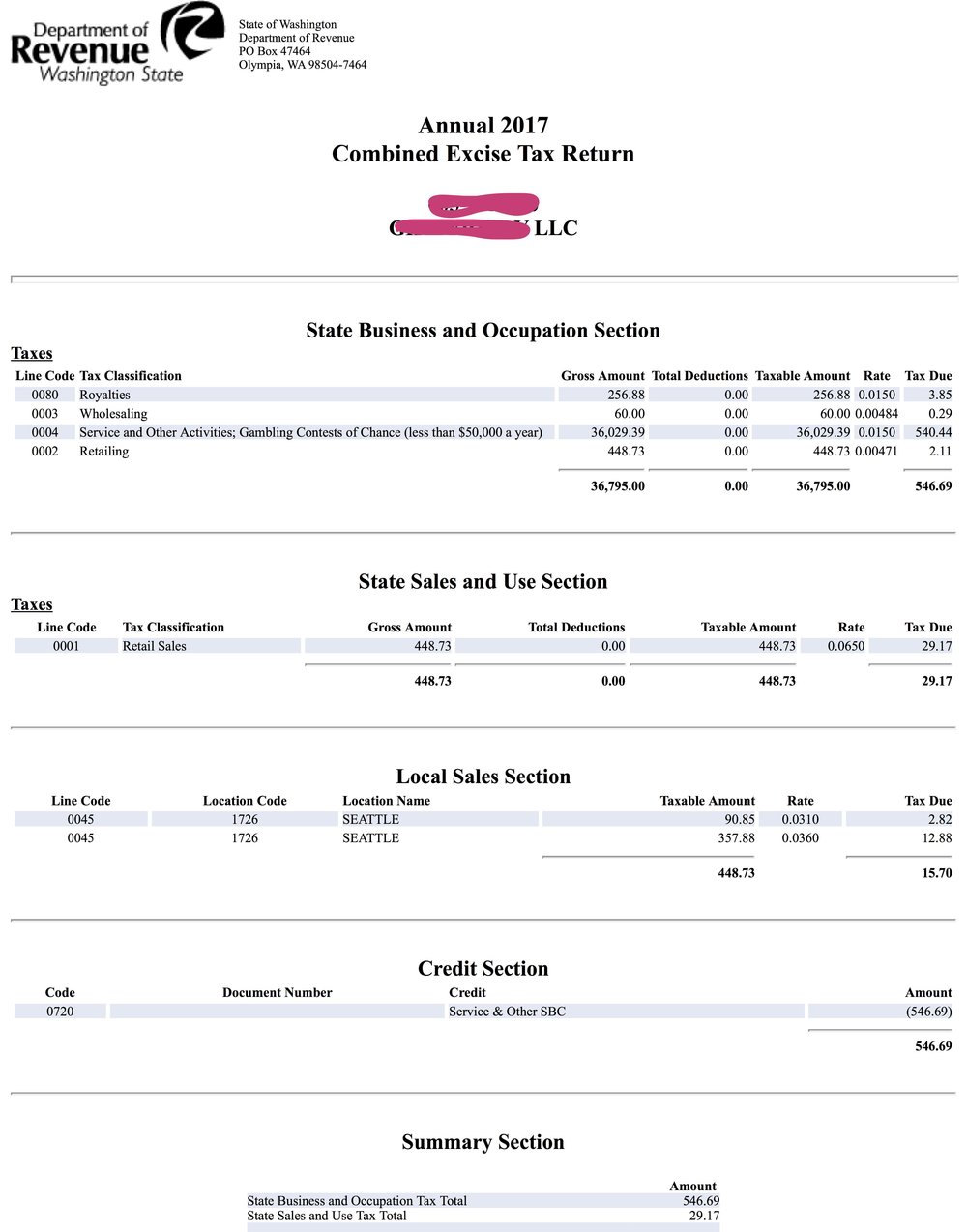

Tax Filing Example Washington Department Of Revenue

Business Taxes In Washington Remain Well Above Us Average - Opportunity Washington

How Washington Rideshare And Delivery Drivers File State Taxes - Rideshare Dashboard

Comments

Post a Comment